Grayscale launches investment fund for AVAX token

It joins Grayscale’s suite of more than 20 crypto investment products.

Asset manager Grayscale Investments launched a new investment fund for Avalanche’s native token, AVAX, according to an Aug. 22 announcement.

The Grayscale Avalanche Trust “offers investors the opportunity to gain exposure to Avalanche (AVAX), a three-chain smart contract platform designed to simultaneously optimize for scalability, network security, and decentralization,” Grayscale said.

Avalanche is a layer-1 blockchain network with a focus on facilitating real-world asset (RWA) tokenization, which involves converting tangible assets, such as real estate, commodities, or fine art, into digital on-chain tokens. On Aug. 22, Franklin Templeton expanded its blockchain-integrated money market fund to Avalanche.

Related: Franklin Templeton expands blockchain fund to Avalanche network

Grayscale’s Avalanche Trust allows investors to participate in Avalanche’s “advancement of RWA tokenization” including “[t]hrough its key strategic partnerships and unique, multi-chain structure,” Rayhaneh Sharif-Askary, Grayscale’s head of product and research, said in a statement.

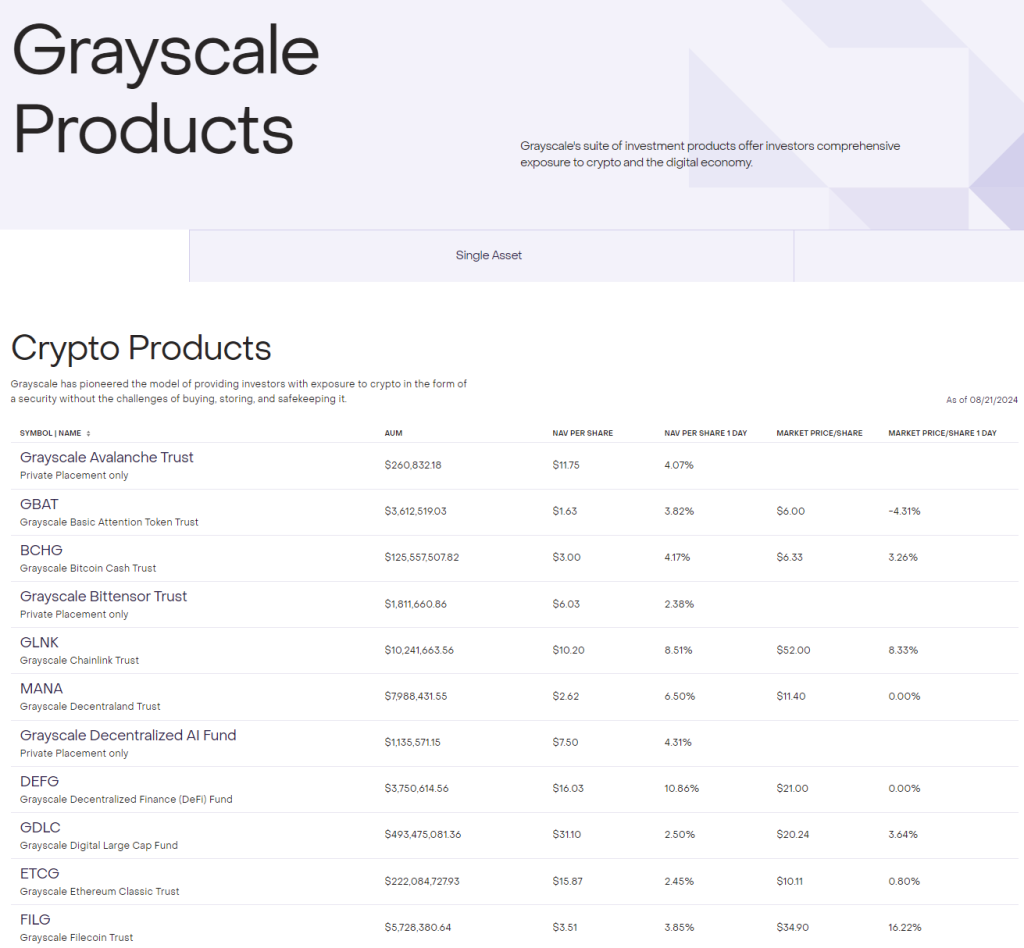

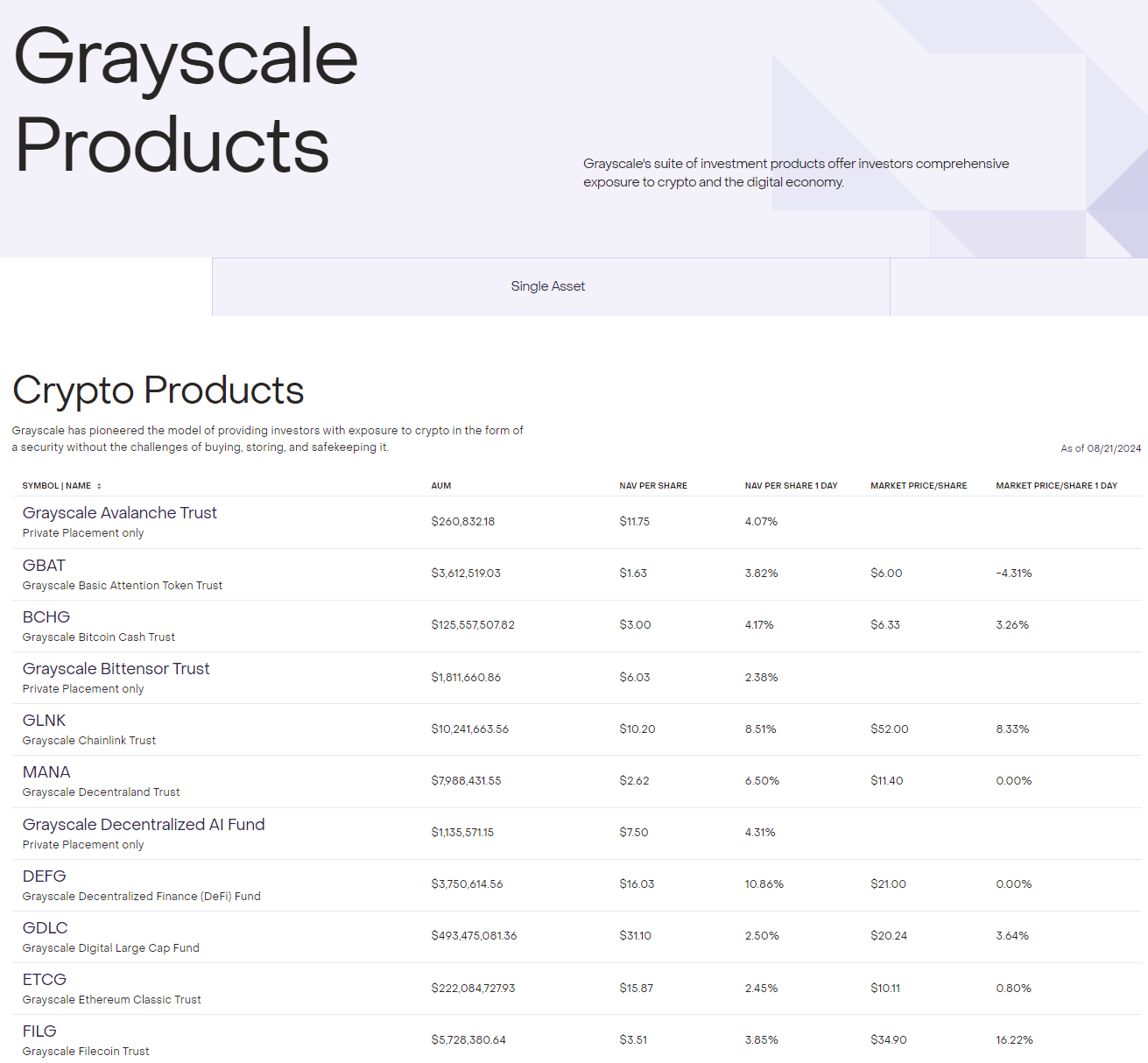

Grayscale has a suite of more than 20 investment products. Source: Grayscale

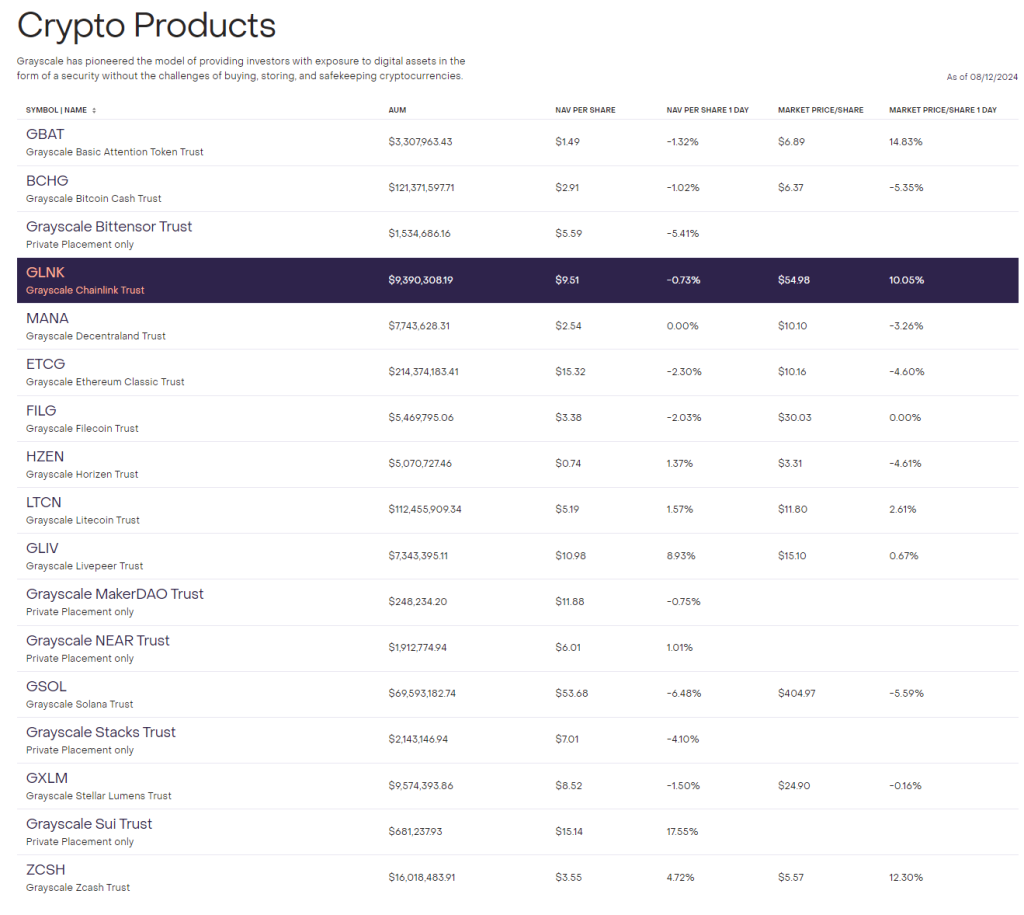

The fund — which is not exchange-traded and is only available to qualified investors — adds to Grayscale’s suite of more than 20 crypto investment products. On Aug. 13., Grayscale launched a trust to invest in MakerDAO’s MKR token. On Aug. 7, Grayscale launched two other trusts to invest in Bittensor’s and Sui’s native protocol tokens.

Grayscale is the world’s largest crypto fund manager, with upward of $25 billion in assets under management (AUM). It is best known for its Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs), including Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE).

Grayscale also operates private single-asset funds for other protocol tokens, such as Basic Attention Token (BAT) and Chainlink (LINK).

During an Aug. 12 webinar, Dave LaValle, Grayscale’s global head of ETFs, predicted that the market for cryptocurrency ETFs will expand to encompass new types of digital assets and diversified crypto indexes.

“We’re going to see a number of more single-asset products, and then also certainly some index-based and diversified products,” LaValle said.

Magazine: 11 critical moments in Ethereum’s history that made it the No.2 blockchain

Responses