Real-world tokenization can drive homeownership — Quarter Homes CEO

Current 30-year fixed mortgage rates in the United States are close to 7%, as younger individuals struggle to purchase property.

Homeownership, once an attainable dream in much of the developed world, is quickly becoming a distant fantasy for younger generations as the price of residential real estate soars and interest rates are driven to relative highs in an effort to quell inflation.

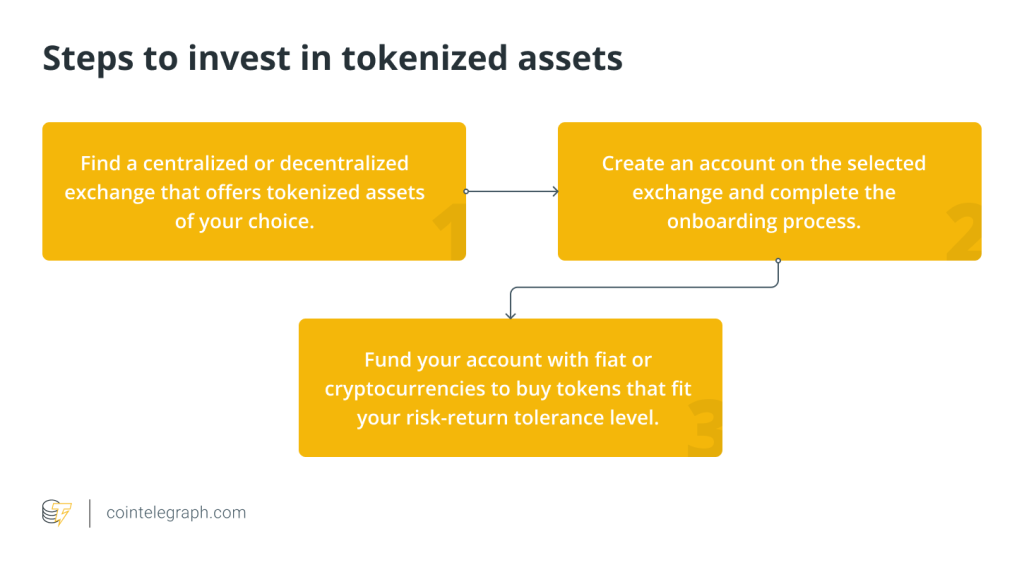

Cointelegraph sat down with Shannon Diesch, CEO of Quarter Homes — a company offering tokenized alternatives to debt-based mortgage financing — to get the lowdown on how real-world asset tokenization can foster home ownership.

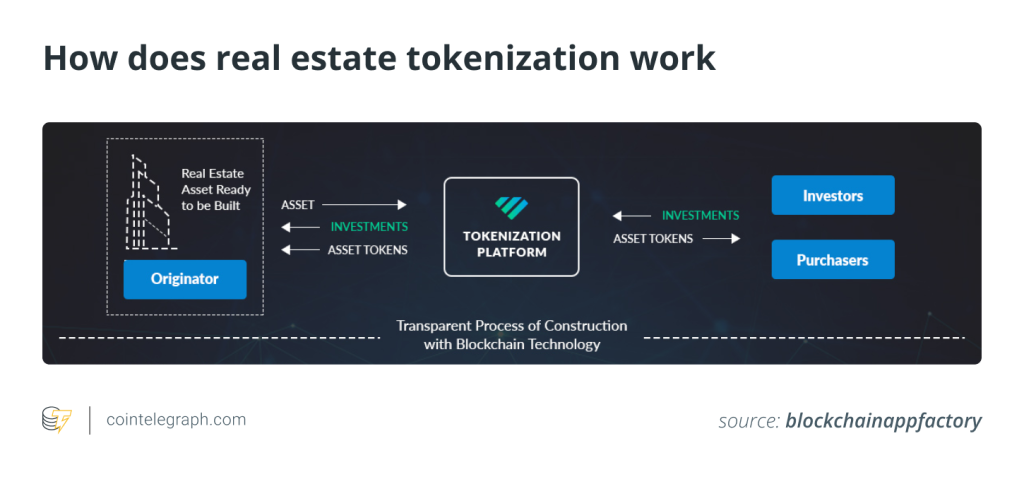

The CEO explained that tokenizing residential real estate introduces a new equity-based model for home financing that brings together real estate investors and aspiring homeowners as equity partners in the transaction, a stark contrast from the current creditor-debtor relationship characteristic of home mortgages.

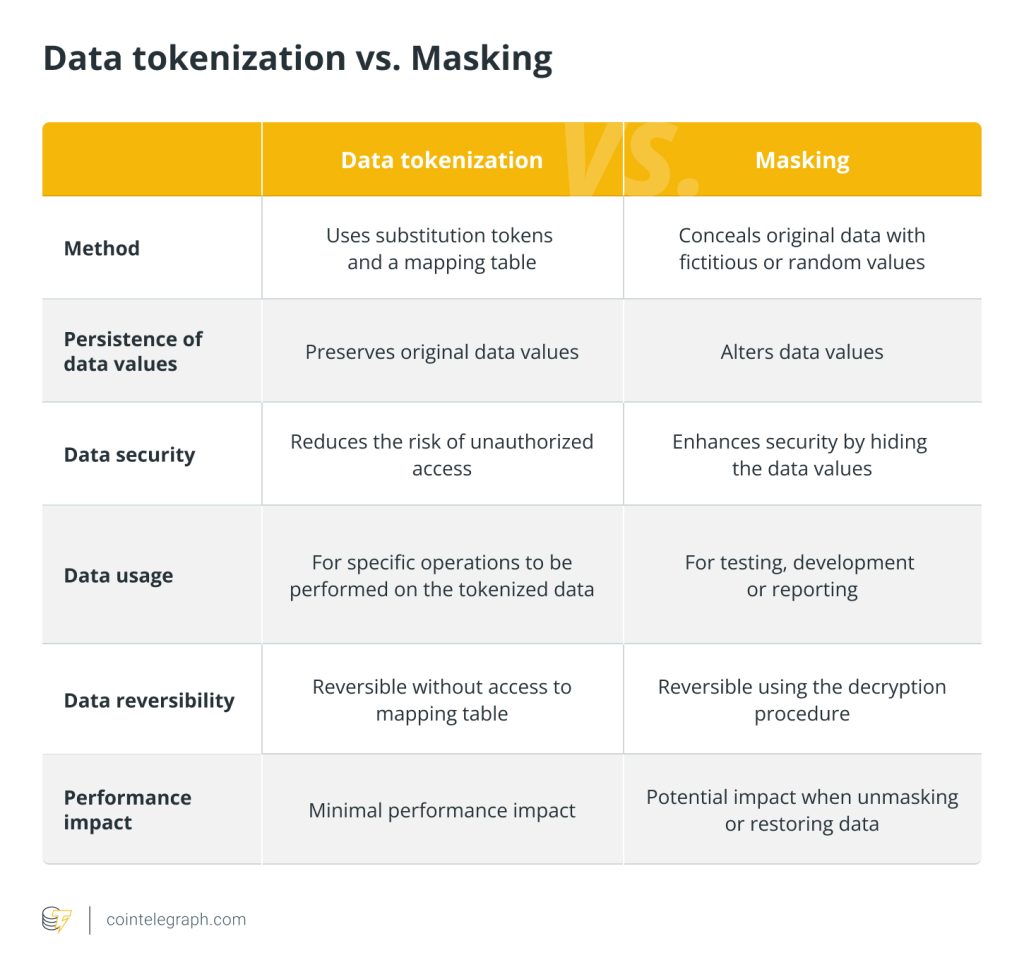

This works by assigning fractionalized equity rights via tokens to both the investor and the homeowner, allowing both parties to share in the appreciation of the underlying asset and realize their equity gains by simply selling their tokens.

In this model, investors can capitalize on both the appreciation of the property and monthly cash flows from the homeowners. Diesch then remarked on the lower barrier to entry tokenized real estate provides to potential homeowners:

“Retail investors can’t buy investment properties very easily — it’s expensive. They have to save up for a down payment, all those things, and so it’s really just opening that opportunity up to folks that don’t currently have access to that type of investment.”

Moreover, tokenization provides an alternative to current equity tapping solutions such as home equity lines of credit and other private equity refinancing, which are often out of reach for many individuals or are predatory, according to Diesch.

Related: Real-world assets evolve finance by tokenizing everything, says Kinto co-founder

Investors benefit, too

On the investor side, tokenizing residential real estate gives investors an alternative avenue for property investment that removes the headaches of rental agreements and property management, the Quarter Homes CEO told Cointelegraph.

Additionally, by connecting investors directly with aspiring homeowners, costly intermediaries such as banks and Wall Street are removed from the transaction, bringing significant savings to both the investor and the homeowner.

Blockchain changing the real estate game

In 2023, Ralf Kubli of the Casper Association pitched a similar idea of tokenizing mortgages to provide much-needed transparency for the home mortgage industry to avoid another 2008-style financial crisis.

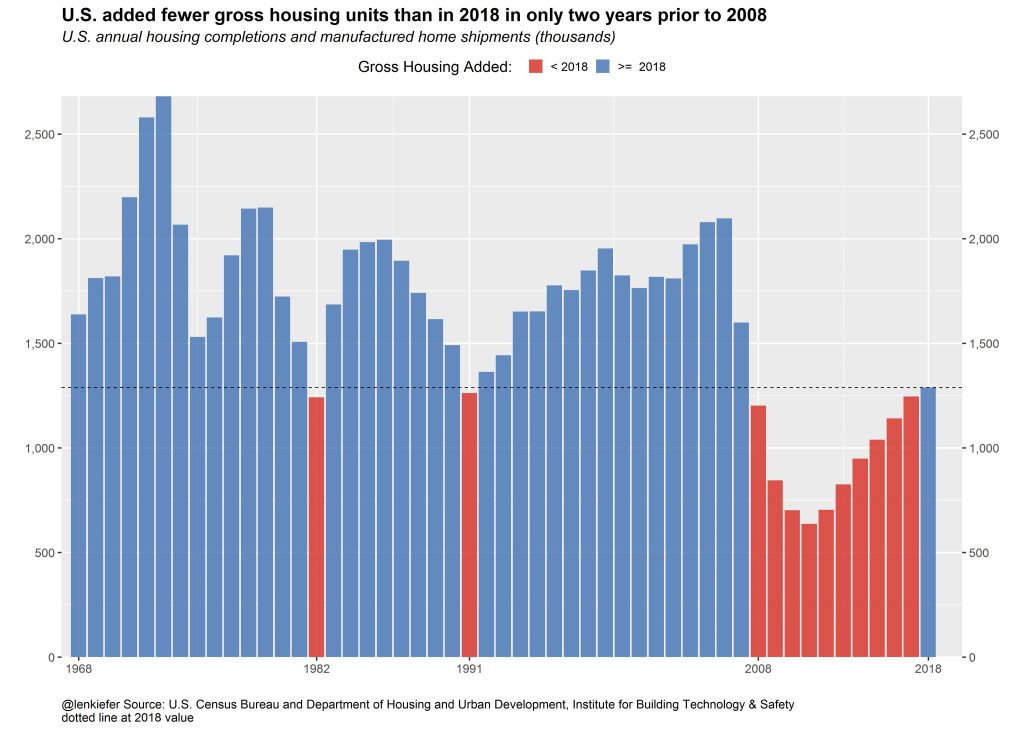

The Home Construction Collective is also leveraging real-world asset tokenization to use blockchain-based crowd-funding mechanisms to build residential homes, which the organization claims are deliberately undersupplied to the market, pricing first-time homebuyers out.

On the commercial real estate side, Hilton Hotels and Resorts recently issued tokenized debt to build a hotel in El Salvador. Investors must invest a minimum of $1,000 into the project to receive tokens that are exchangeable on the Bitcoin layer-2 Liquid Network.

Magazine: Crypto-Sec: Evolve Bank suffers data breach, Turbo Toad enthusiast loses $3.6K

Responses