$8.2B in Bitcoin and Ether options expire, here’s how it could impact the markets

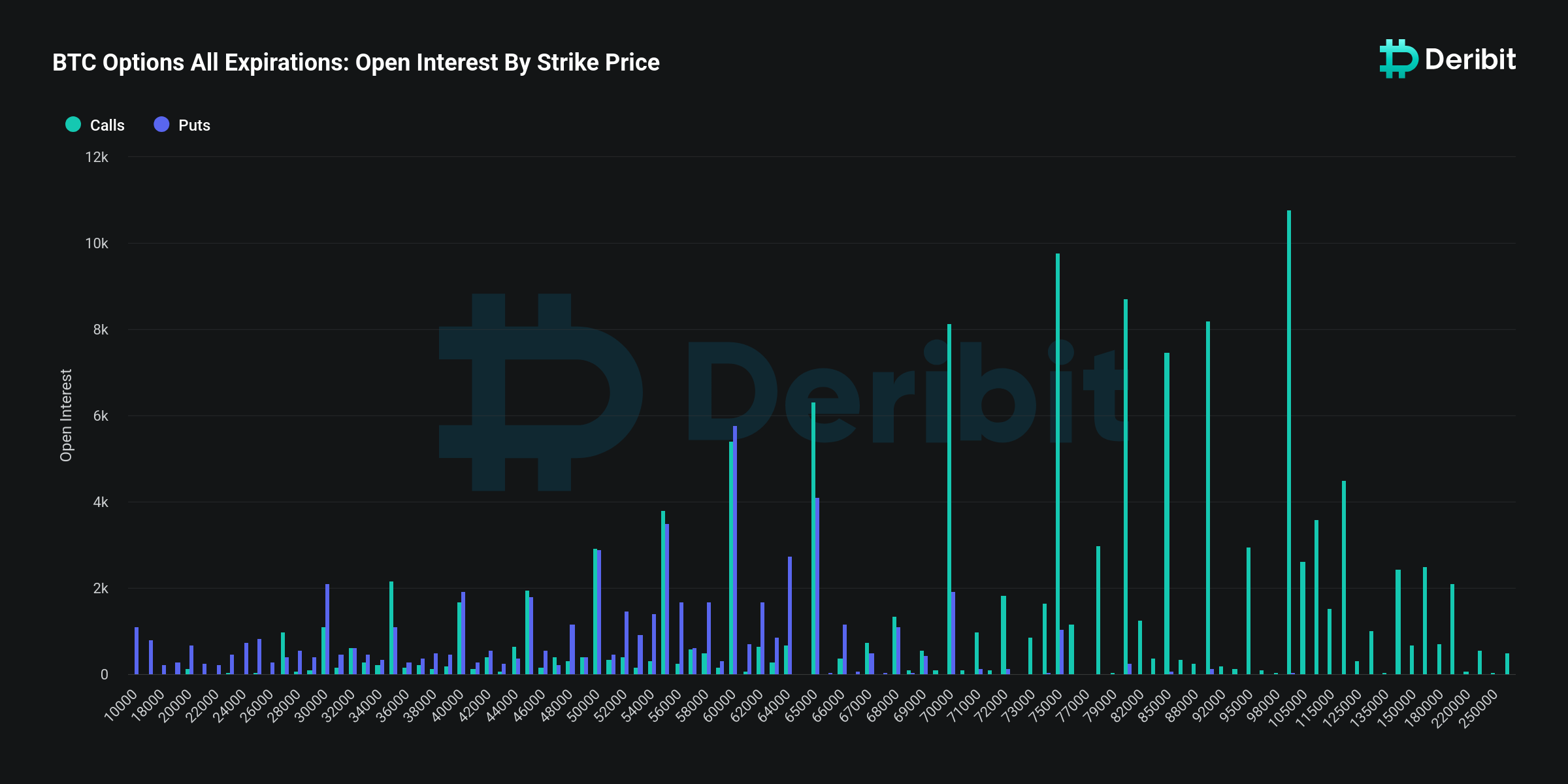

The total OI notional value for all outstanding BTC options contracts is $19 billion.

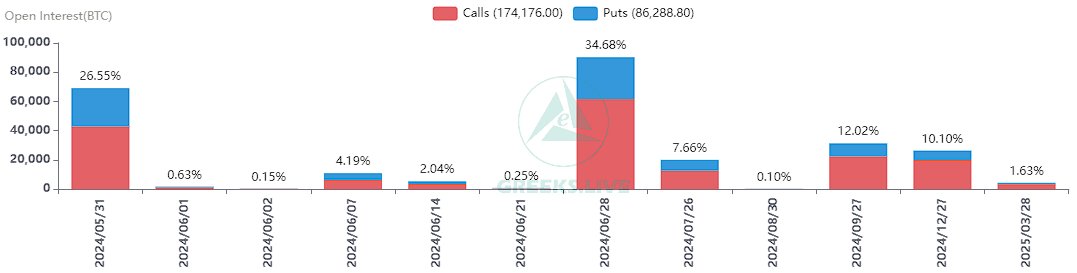

On May 31, 69,000 Bitcoin options worth $4.7 billion and 920,000 Ether options worth $3.5 billion expire. The expiry of crypto options contracts is historically linked to price volatility in the crypto market.

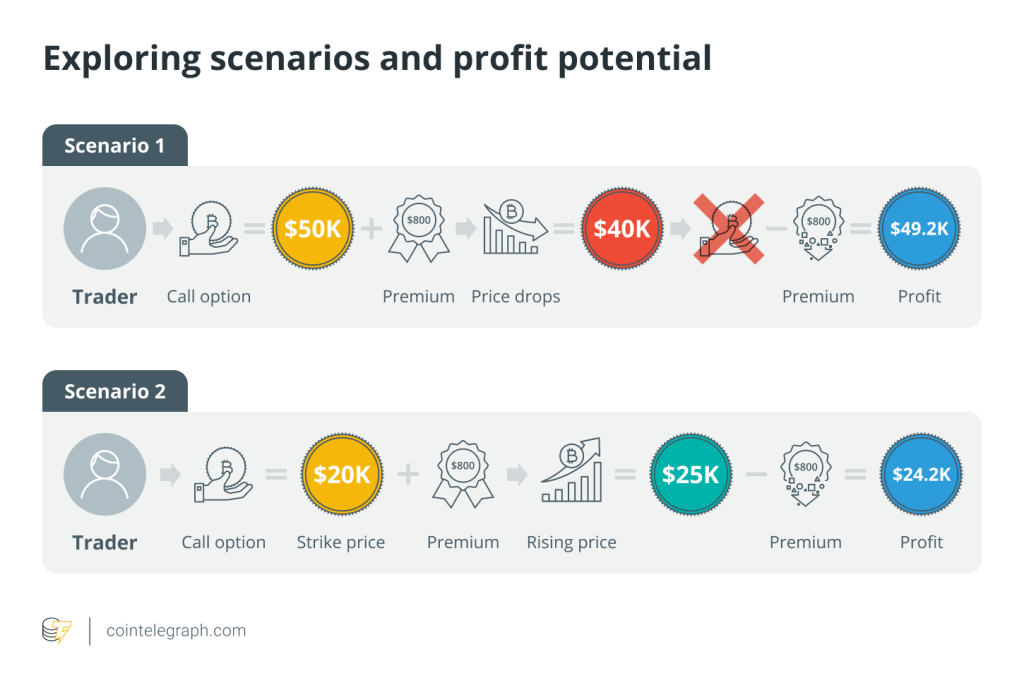

According to the Derbit data, the put/call ratio for the expired Bitcoin (BTC) options is 0.61. This means more calls (or long contracts) are expiring than puts (or shorts). On the other hand, Ether (ETH) options had a put/call ratio of 0.46.

The put/call ratio (PCR) is a technical indicator that reflects trader market sentiment. A PCR below 0.7 is considered a strong bullish sentiment, while a PCR above 1 is considered a strong bearish sentiment.

Max pain for Bitcoin at $66,000, ETH at $3,300

The maximum pain point at which most losses will be made by the leverage traders for Bitcoin is $66,000. For ETH, the max pain point is $3,300. BTC is currently trading at $68,210, $2,000 above the pain point, and ETH is trading at $3,738, more than $400 above its pain point.

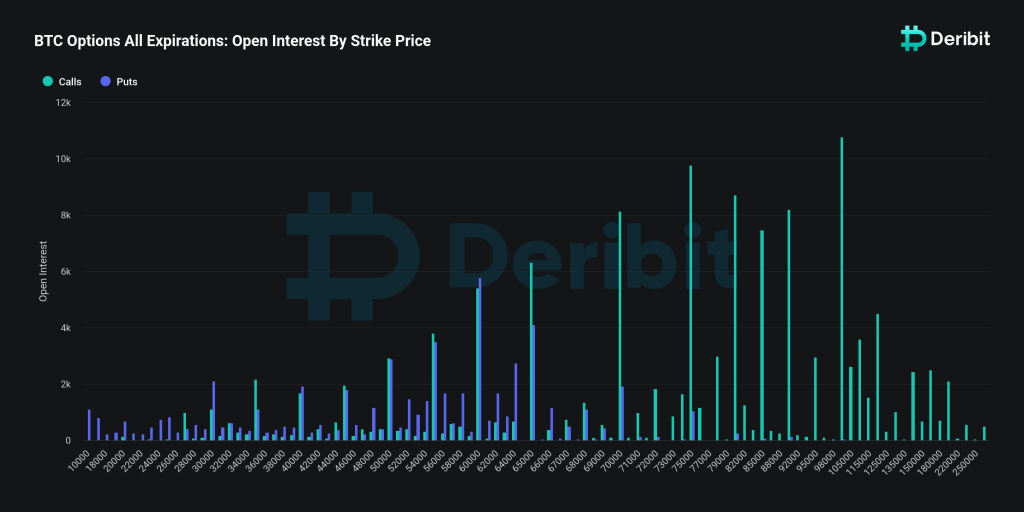

Millions in open interest (OI) are in long positions with strike prices at $70,000, $75,000, $80,000, and even $100,000. Open interest refers to the total number of outstanding derivative contracts that have not been settled.

A few traders have placed long positions on Bitcoin with a target price of $100,000. With $886 million in open interest (OI) at this strike price, the number of long positions appears significant. The total notional value of all outstanding BTC options contracts amounts to $19 billion.

Related: Bitcoin price reclaims $70K as Coinbase BTC supply hits 9-year low

Post-spot ETH approval hangover

The spot ETH ETF approval by the Securities and Exchange Commission (SEC) in May was a significant and bullish event for the crypto market. ETH prices rose 20% in May in anticipation of the approval. However, the SEC only approved the 19b-4 filing, thus delaying the actual listing for trading.

Since the ETH ETF approval, the crypto market has shown a bearish sideways movement, with ETH stuck below $4,000 and BTC below the $70,000 price barrier. Currently, the crypto market is experiencing bearish momentum, correcting from the bullish surge of the past two weeks.

Magazine: Godzilla vs. Kong — SEC faces fierce battle against crypto’s legal firepower

Responses