Bitcoin in 42-day ‘boredom zone’ — traders debate next move

Bitcoin’s price has sat in the "boredom zone" for over a month, leaving traders guessing about a potential surge or retracement.

Bitcoin (BTC) has now spent 42 days in the “boredom zone,” and crypto traders are divided over whether it is consolidating for another surge or facing a 20% pullback toward crucial support levels.

“We have now spent 42 days in the low volatility and boredom zone,” pseudonymous crypto trader CryptoCon declared in a May 30 X post, explaining a lack of volatility in Bitcoin’s price is the main sign of “boredom in the market.”

Bitcoin is currently trading at $67,680, just 6.7% higher than its price 42 days ago, according to data from CoinMarketCap.

Apart from two occasions breaking outside its support and resistance levels, at $58,253, and reaching $71,443, Bitcoin has mainly traded within a narrow range throughout the period.

Pseudonymous crypto trader Willy Woo believes that Bitcoin’s extended consolidation is a positive sign that its price hasn’t peaked yet, forecasting that it only has “more room to run before topping out,” in a May 29 X post.

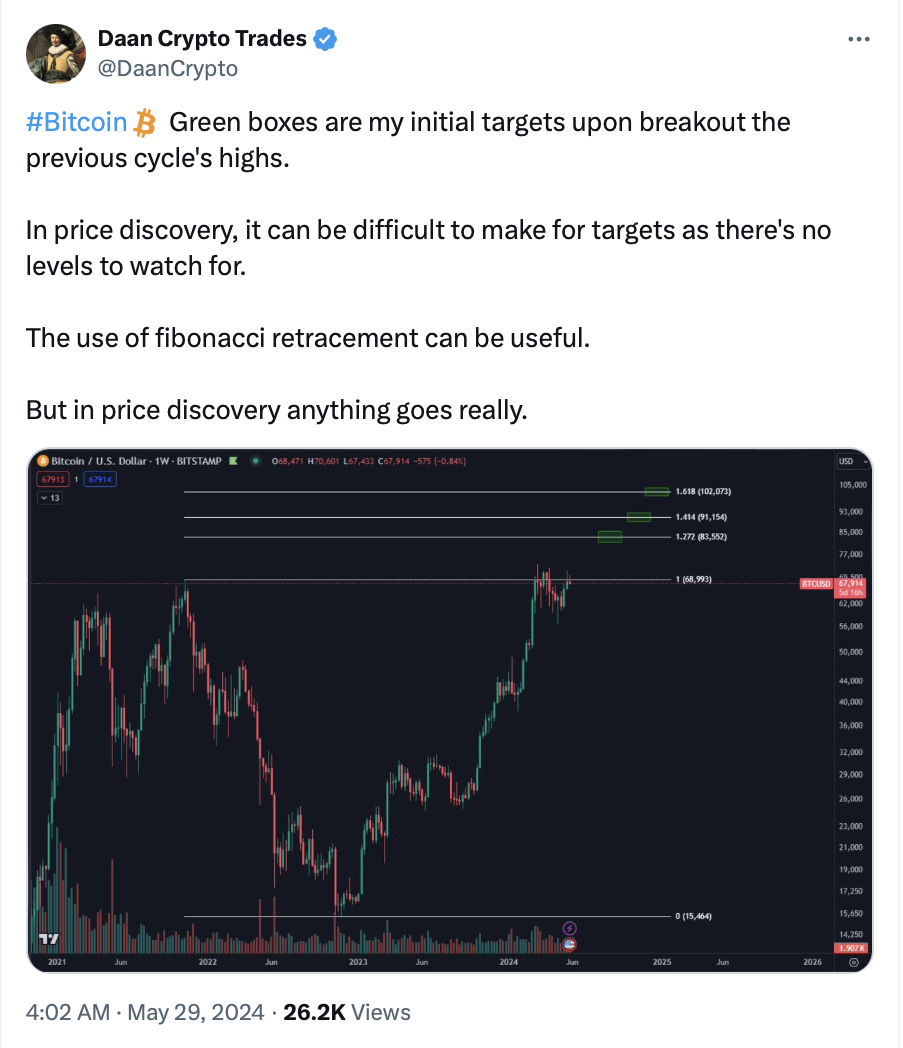

Pseudonymous crypto trader Daan Crypto Trades believes Bitcoin is currently in the price discovery phase, where “anything goes really.”

“In price discovery, it can be difficult to make targets as there are no levels to watch for,” Daan Crypto Trades argued in a May 29 X post.

He argued that once it breaks through its current all-time highs of $73,679, it could reach $102,073 before the years-end.

However, crypto traders using different indicators are not as hopeful of what comes next.

Founder of Cane Island Alternative Advisors Timothy Peterson pointed out that Bitcoin’s price may drop to somewhere around $54,190 based on the Bitcoin Price to Metcalfe Value — an indicator that suggests the value of Bitcoin is proportional to the square of the number of users or participants in the Bitcoin network.

Related: Bitcoin futures open interest reaches a 16-month high: $70,000 granted?

“This is Bitcoin’s Price to Metcalfe Value. When the ratio is >100% it has always predicted a bear market of -20% or more. This week, it hit 102%. There is a 2/3 chance of a -20% decline in 6 months,” Peterson explained.

“Odds are high that Bitcoin will drop to the low 50s sometime in the next 180 days,” he added.

Responses