Bitcoin futures open interest reaches a 16-month high: $70,000 granted?

BTC derivatives show moderate bullishness, paving the way for further gains above $70,000.

The Bitcoin (BTC) price has downtrended since it tested $70,300 on May 27, and is currently near $67,500, a 4% drop in two days. However, the $66,000 support has been holding firm since May 17, providing some reassurance to the bulls who are not yet alarmed by this correction.

The potentially concerning data comes from Bitcoin derivatives markets, as the number of BTC equivalent leverage bets, known as open interest, rose to a 16-month high on May 29.

Investors move away from fixed-income positions, favoring Bitcoin’s performance

Macro trends have influenced Bitcoin’s performance as the S&P 500 is currently just 1.2% below its all-time high of 5,342 from May 23, indicating a robust stock market. Additionally, the 5-year Treasury yield has increased to 4.63% from 4.34% two weeks ago, suggesting that traders are moving away from fixed-income positions.

This shift was particularly notable following weak demand at a Treasury Department auction on May 28, which pushed the benchmark yield to levels that stock investors may find concerning.

On May 29, the aggregate Bitcoin futures open interest reached 516k BTC, the highest since January 2023 and a 6% increase over the past week.

Chicago Mercantile Exchange (CME) leads the market with a 30% share, followed by Binance with 22%, and Bybit with 15%. This substantial open interest, equivalent to $34.8 billion, is a double-edged sword for the market.

The high open interest can indicate a bullish sentiment, as it shows a strong appetite for Bitcoin futures. However, if bulls rely excessively on leverage, a typical 10% market correction could trigger cascading liquidations, exacerbating the price drop. Notably, Bitcoin’s price has shown resilience since regulatory pressures in the United States have eased.

Positive regulatory developments include the approval of a spot Ethereum (ETH) exchange-traded fund, the Senate’s vote to repeal the Securities and Exchange Commission’s proposed SAB 121 accounting rule, and Congress passing the FIT 21 reform, allowing most crypto to be treated as commodities and regulated by the Commodity Futures Trading Commission. These factors collectively favor Bitcoin bulls.

Bitcoin futures reflect moderate optimism

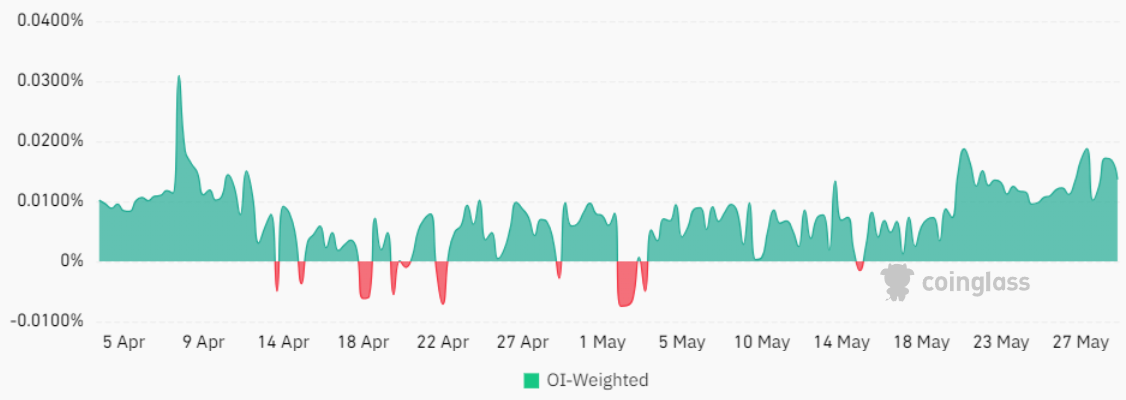

Perpetual contracts do not have an expiry date, unlike traditional monthly futures. They are designed to closely track the underlying asset’s price using a funding rate mechanism. When the funding rate is positive, long (buy) position holders pay short (sell) position holders, and vice versa.

Currently, the funding rate for perpetual futures is at 0.35% per week, indicating a modest cost for leverage. This rate can spike to 2.4% per week in times of high optimism, reflecting increased demand for leverage.

The basis rate, or futures premium, is another critical metric. Typically, in a healthy market, the basis rate for Bitcoin futures ranges from 5% to 10% annually. This premium exists because futures contracts have a settlement date in the future, and traders are willing to pay more to lock in prices.

The 3-month futures premium is at 14%, which is above the neutral range but not excessively high. It indicates that there is still room for additional leverage without immediate risk of cascading liquidations.

Related: Bitcoin ‘diamond hands’ cut selling by nearly 50% at $73.8K — Research

A rally above $70,000 is possible, but will not necessarily driven by futures markets

While the growth in Bitcoin futures open interest could raise concerns about potential liquidations in a market correction, the overall indicators suggest that the market is in a healthy state.

The resilience of Bitcoin’s price amid easing regulatory pressures, combined with a relatively low funding rate and a moderate futures premium, implies that there is no immediate reason to fear the increase in open interest. Instead, it likely signals a higher institutional appetite for Bitcoin, pointing towards a potentially bullish outlook in the near term.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses