Luxor and Bitnomial launch Bitcoin mining derivatives product

The new crypto derivatives product allows investors to speculate on future hashrates and hashprices.

Bitcoin (BTC) mining firm Luxor Technology Corporation and Bitnomial Inc. have launched a Bitcoin mining derivative product on Bitnomial’s United States derivatives exchange.

On May 28, Bitnomial announced the launch of Hashrate Futures, a derivative futures contract for trading the computing power of the Bitcoin blockchain.

Bitnomial claimed the product, trading under the ticker HUP, offers a way for miners to hedge their revenue and for investors to gain exposure to the Bitcoin mining hash rate.

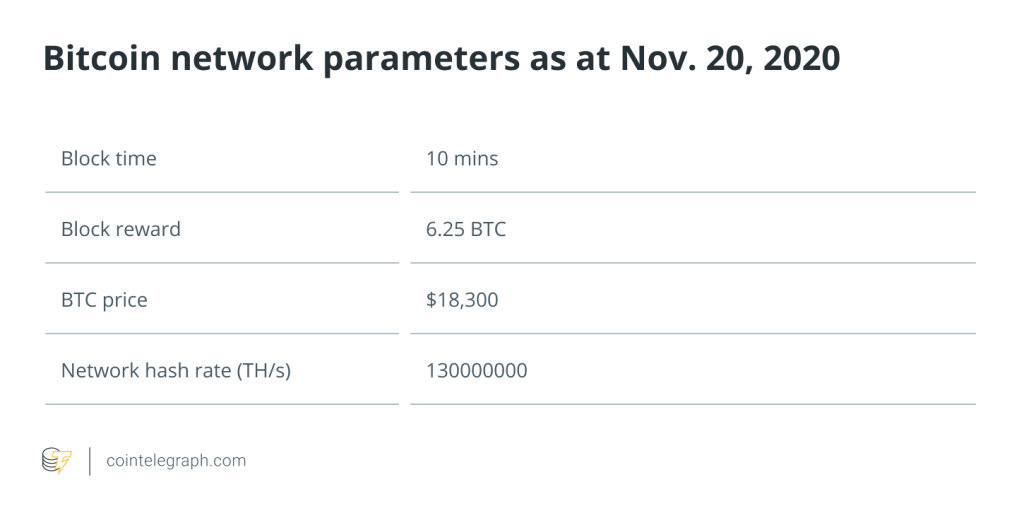

A futures contract is a financial derivative where two parties agree to buy and sell a financial asset at a future date for an agreed-upon price.

This product trades hash rate — Bitcoin’s computing power — and is priced according to “hashprice,” Luxor’s measure of Bitcoin mining revenue potential.

Hashrate Futures contracts have a 1 petahash (PH) size for monthly durations and use Luxor’s Bitcoin Hashprice Index as the reference rate for settlement.

Luxor also offers non-deliverable Hashrate Forwards which are over-the-counter products and do not settle on an exchange regulated by the Commodity Futures Trading Commission.

Bitnomial founder and CEO Luke Hoersten explained Hashrate Futures are fungible with the firm’s physical Bitcoin Futures, “enabling Hashrate to Bitcoin Futures spreads.”

“These spreads allow participants to take returns in either USD or BTC, or isolate hash rate risk from Bitcoin price risk,” he added.

Related: Bitcoin mining revenue hits post-halving yearly low

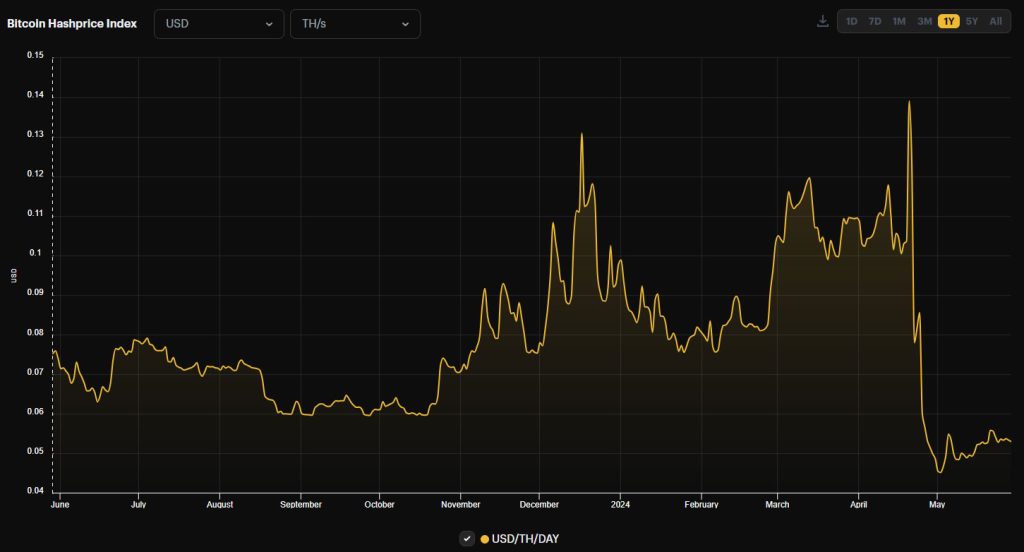

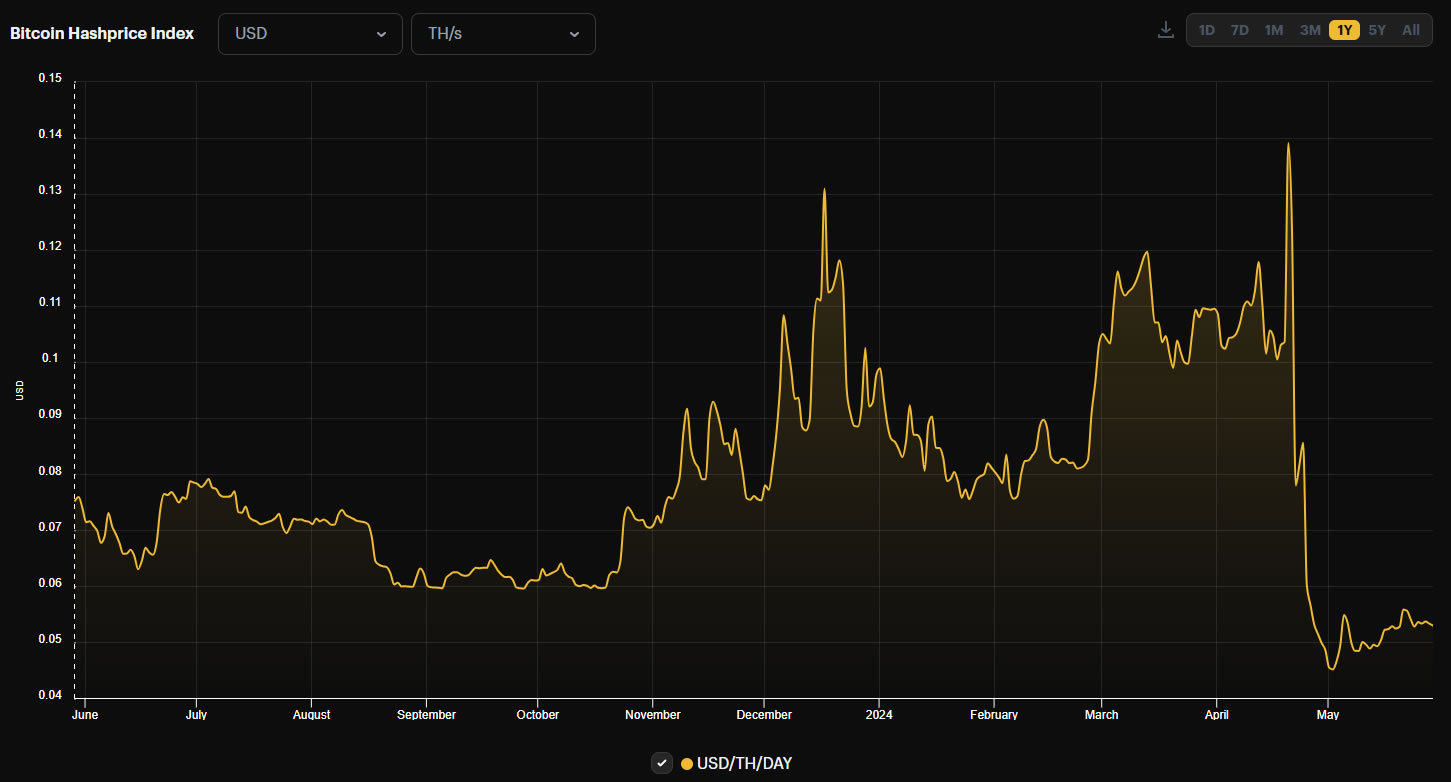

Hashprice is a term coined by Luxor that refers to the expected value of 1 TH/s of hashing power per day. It quantifies how much a miner can expect to earn from a specific quantity of hash rate.

The current hashprice is $0.053 per terahash per second per day, according to HashRateIndex.

It spiked around the halving event on April 20 to $0.140 but slumped afterward when the block rewards were cut in half.

Hashprice is down 46% since the beginning of 2024 making it even harder for miners to generate a profit from their proof-of-work activities.

Responses