Riot Platforms proposes $950M buyout for Bitfarms amid CEO dispute

The hostile offer comes after a private offer to the board was rejected in April.

Bitcoin miner Riot Platforms has announced an offer to buy Bitfarms at a significant premium over its share price. Riot made an offer to its smaller Canadian competitor’s board on April 22 and is publicizing its intentions after that offer was rebuffed.

Colorado-based Riot is already Bitfarms’ largest shareholder, with a 9.25% stake. It has now offered combined cash and common stock to shareholders that would represent about $950 million in equity value, or a 24% premium over Bitfarms’ one-month volume-weighted average share price as of May 24, 2024. Bitfarms shareholders would own about 17% of the combined company.

Riot said in a statement that the offer “would provide Bitfarms’ shareholders with […] potential for future value creation through participation in a financially and commercially stronger company with a well-defined strategy, led by an established and proven management team.”

Related: Public Bitcoin miners secured $2B in financing ahead of halving

Bitfarms’ management is in transition as it seeks a new CEO. The company announced its search in a March 25 statement, where then-CEO and president Geoffrey Morphy expressed his “every confidence that the management team will be successful in achieving our 2024 growth targets.” Bitfarms originally intended to keep Morphy on board while it sought his replacement.

On May 10, Morphy sued the company for breach of contract, wrongful dismissal and damages, demanding $27 million. Bitfarms fired him on May 13 and appointed chairman and co-founder Nicolas Bonta to act in his place. Riot said:

“New allegations in a lawsuit brought by Bitfarms’ recently terminated CEO, if accurate, raise serious questions about whether certain directors are committed to acting in the best interests of all shareholders.”

Riot went on to specify co-founders Bonta and Emiliano Grodzki as the directors in question. It said it would requisition a special Bitfarms shareholders meeting after the company’s May 31 Annual General and Special Meeting to “add new, well-qualified and independent directors to the Bitfarms Board.”

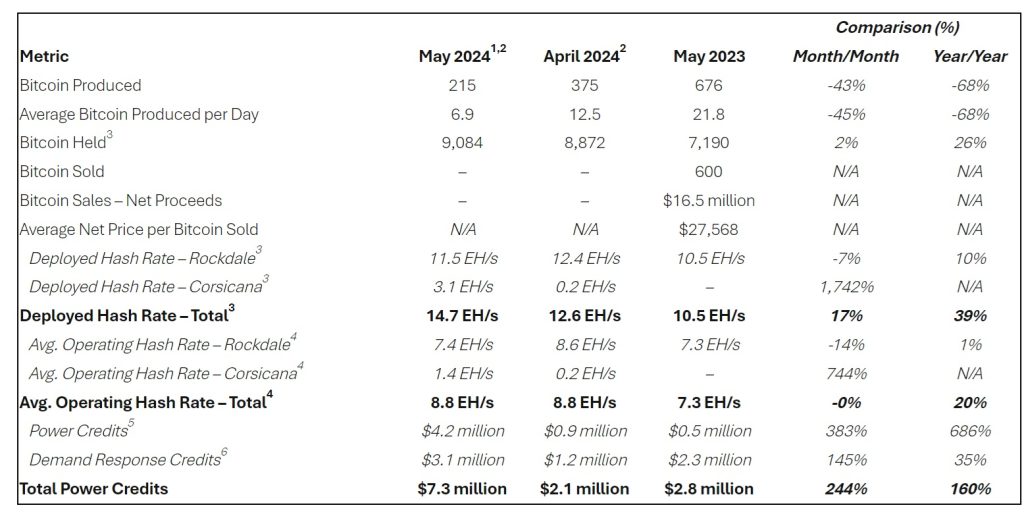

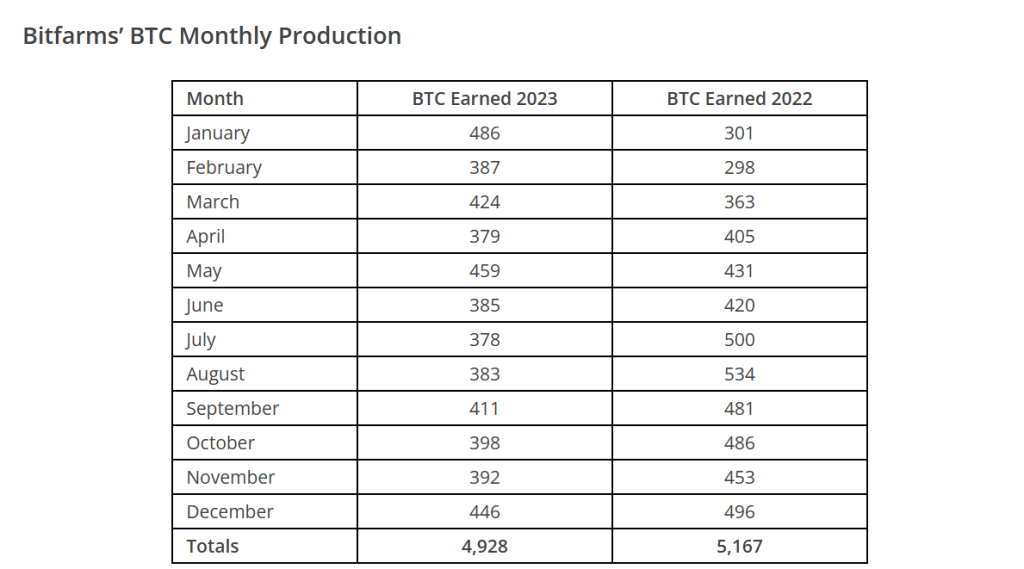

Bitfarms showed disappointing earnings year-on-year in 2023. It began a costly technical upgrade in preparation for the Bitcoin (BTC) halving. Analysts expected Bitfarms to perform well after the halving. However, its April earnings dropped 29% from the previous year. Riot generated a 131% increase in net income in the first quarter of 2024 to reach $211 million. It has not released financial information since then.

According to Riot, a combined company would have the largest capacity of any publicly listed Bitcoin miner, with “approximately 1 GW of current power capacity and 19.6 EH/s of current self-mining capacity, with up to 1.5 GW of power capacity and 52 EH/s of self-mining capacity by year-end.”

Bitfarms did not respond to a Cointelegraph request for comment by the time of publication.

Responses