US shutdowns lead to global decline in Bitcoin ATMs

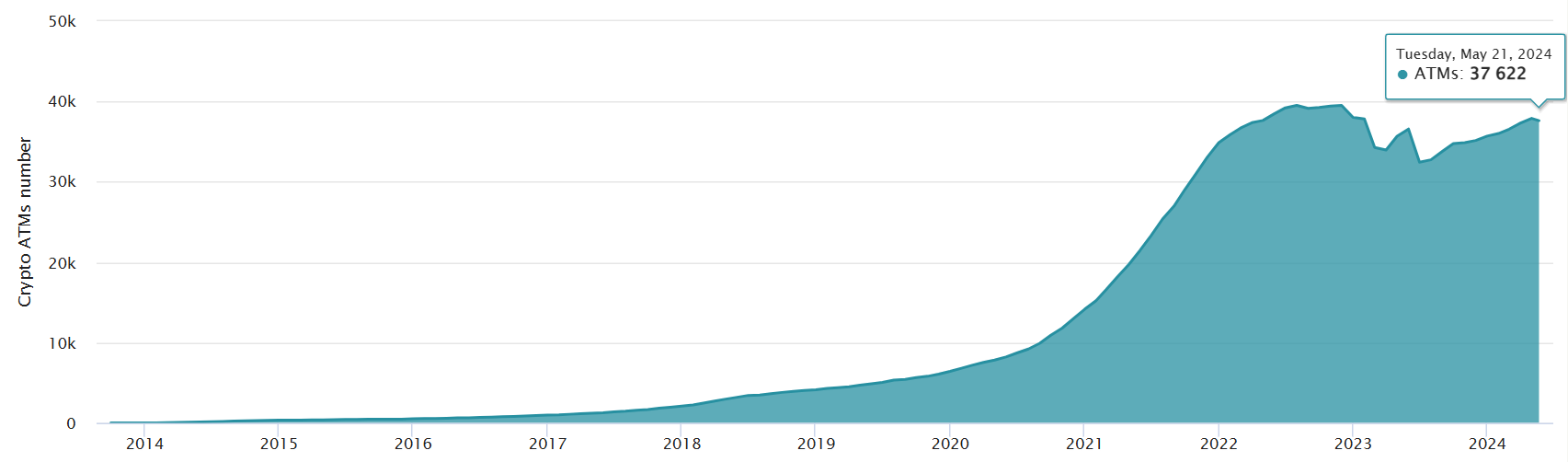

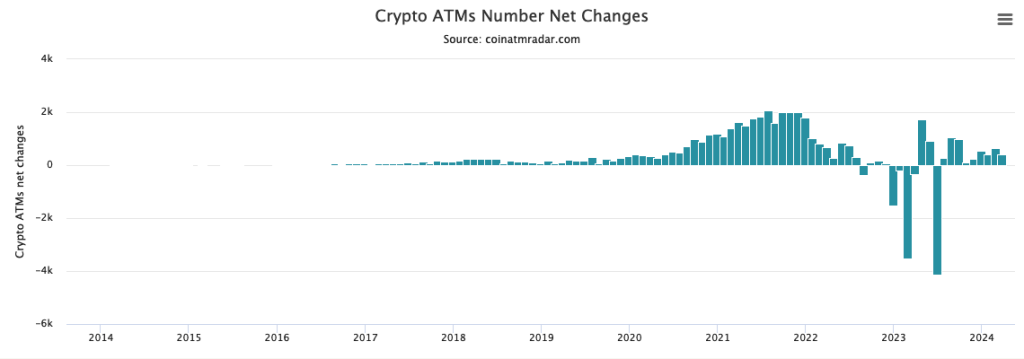

Countries worldwide contributed heavily to the month-on-month increase in Bitcoin ATMs throughout 2024, collectively coming close to reclaiming the 38,000 mark.

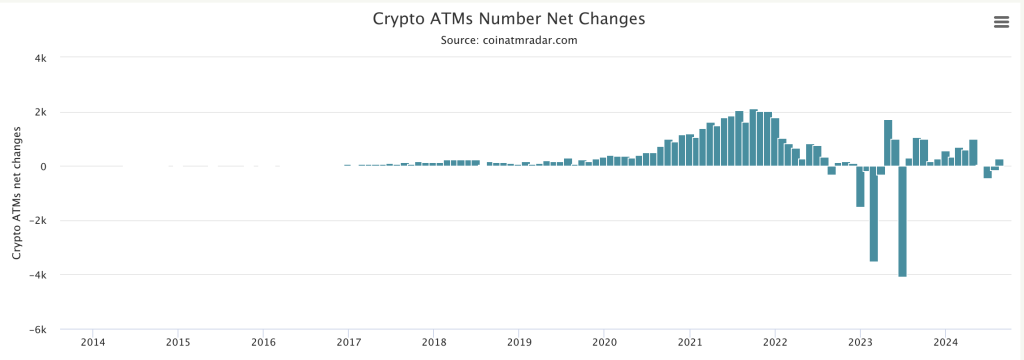

For the first time in 10 months, the number of active Bitcoin ATMs worldwide has decreased since July 2023.

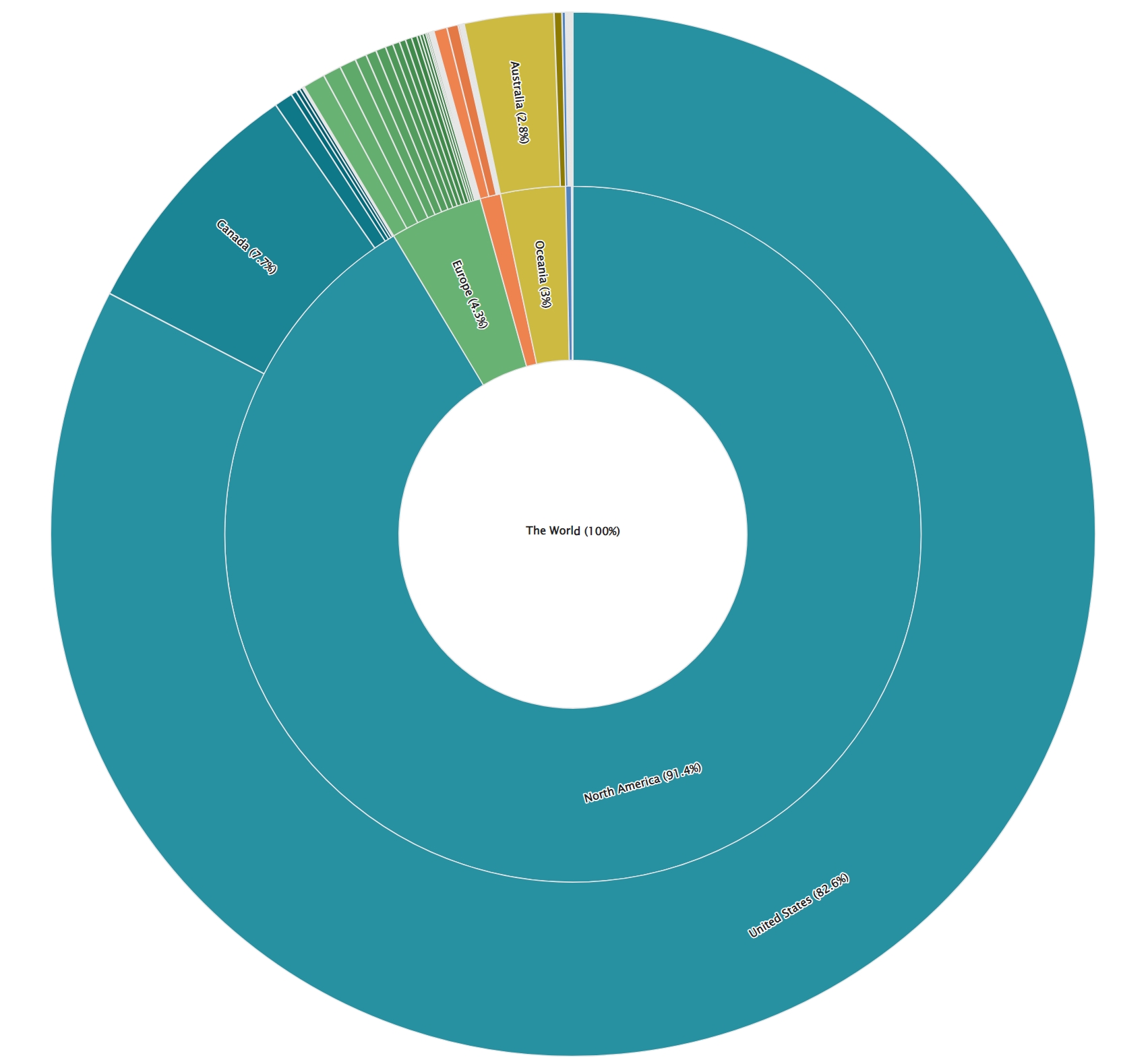

The United States and Canada represent together represent 91.4% of the total Bitcoin (BTC) ATM network, each hosting 31,089 (82.6%) and 2,909 (7.7%) machines respectively.

Countries worldwide significantly contributed to the month-on-month increase in Bitcoin ATMs throughout 2024, nearly reclaiming the 38,000 mark that had been lost in January 2023.

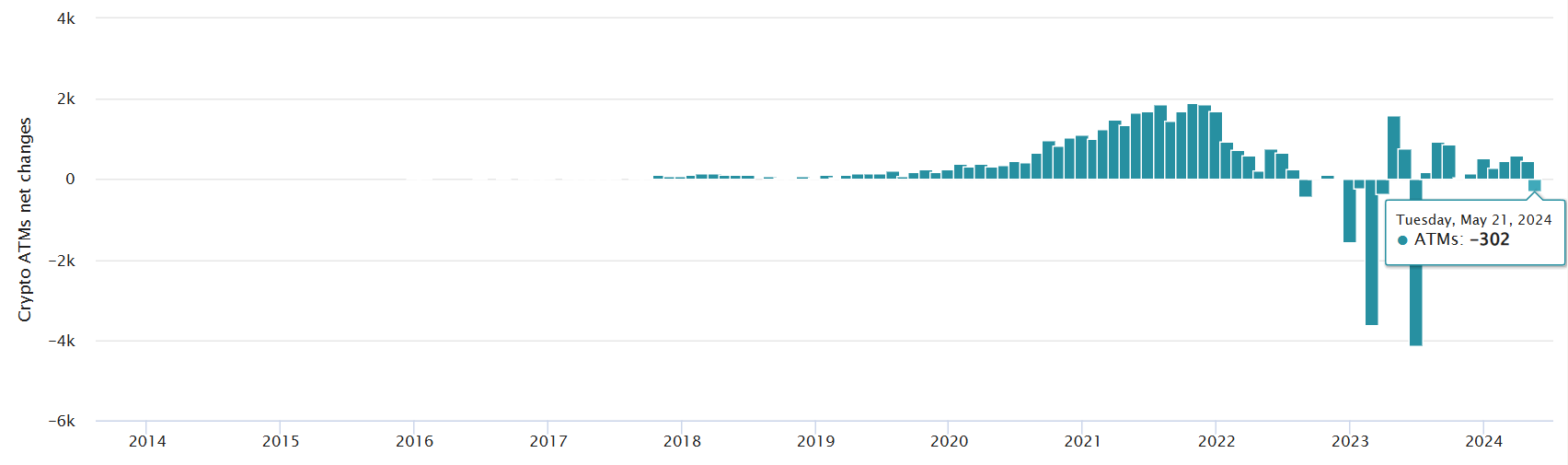

However, the 10-month-long global crypto ATM growth streak broke after over 300 ATMs went offline in May 2024. As of May 21, the U.S. market lost 302 Bitcoin ATMs during the month, while 28 machines went offline in Canada.

However, the addition of new Bitcoin ATMs in Australia, Switzerland, and Europe has reduced the net decline in crypto ATMs to 280 as of the current date.

Law enforcement agencies in the U.S. actively pursue and shut down Bitcoin ATMs frequently used for extortion and scams. However, the reasons behind the recent sharp decline in their numbers remain unclear.

Australia hosts the third-largest network of active Bitcoin ATMs after the U.S. and Canada, with 1,041 (2.8%) machines.

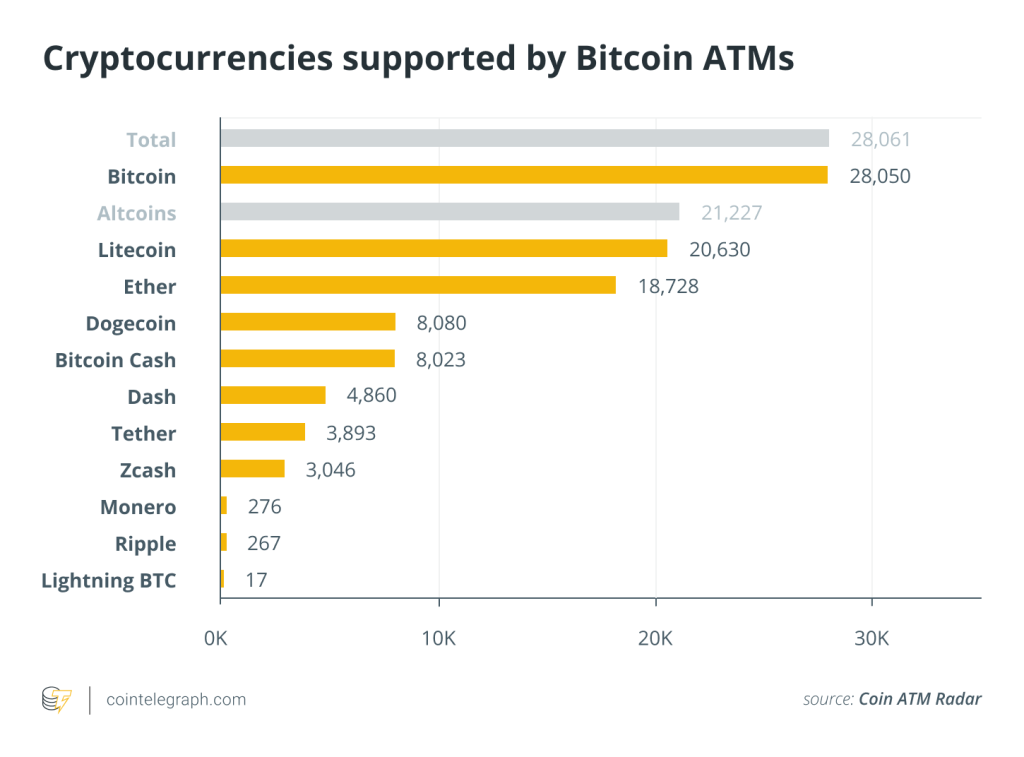

Read Cointelegraph’s crypto guide to learn more about using Bitcoin ATMs (teller machines).

Related: Australia joins 1,000+ Bitcoin ATM club alongside US, Canada

Bitcoin Depot, the biggest ATM operator in the U.S., recorded steady earnings in 2024. There was no correlation between its revenues and the price of Bitcoin historically, the firm stated in its 10-K annual report filed on April 15.

“Based on our own user surveys, a majority of our users use our products and services for non-speculative purposes, including money transfers, international remittances, and online purchases, among others,” Bitcoin Depot wrote.

According to the ATM operator, the lack of correlation between Bitcoin Depot’s revenues and the BTC price comes partly from the nature of the services provided.

Responses