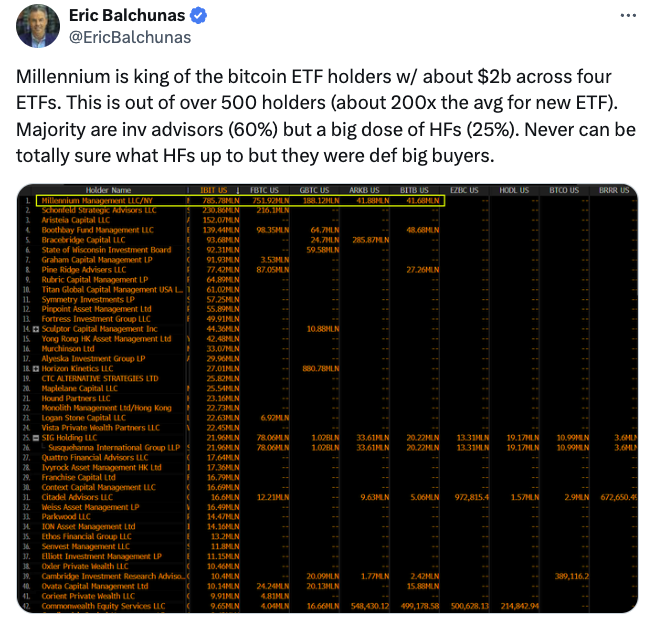

Over 600 firms reveal billions in combined investment in Bitcoin ETFs

Millennium Management is the largest Bitcoin ETF investor with a $1.9 billion investment.

Over the past week, more than 600 firms have revealed significant investments in the spot Bitcoin ETF in their latest 13F filings with the United States Securities and Exchange Commission (SEC).

Cryptocurrency asset management firm Bitwise’s chief investment officer believes that by the end of the May 15 deadline, nearly 700 professional companies will have invested $5 billion in the spot Bitcoin (BTC) ETF. Per the filing data on May 9, 563 professional investment firms reported owning $3.5 billion worth of Bitcoin ETFs.

Among them are Morgan Stanley, JPMorgan, Wells Fargo, UBS, BNP Paribas, Royale Bank of Canada and hedge funds like Millennium Management and Schonfeld Strategic Advisors,

Millennium Management is the largest BTC ETF investor with a $1.9 billion investment. Millennium invested $844.2 million in BlackRock’s IBIT, $806.7 million in Fidelity’s FBTC, $202 million in Grayscale’s GBTC, $45.0 million in Ark’s ARKB, and $44.7 million in Bitwise’s BITB.

Schonfeld Strategic Advisors, a hedge fund with $13 billion asset under management, was the second largest spot BTC ETF investors with a $248 million investment in IBIT and a $231.8 million investment in FBTC, totaling $479 million.

Boothbay Fund Management, a hedge fund manager based in New York, declared a $377 million exposure to spot Bitcoin ETFs, including $149.8 million in IBIT, $105.5 million in FBTC, $69.5 million in GBTC, and $52.3 million in BITB.

Pine Ridge Advisers, a New York-based advisory firm, announced a $205.8 million investment in spot Bitcoin ETFs, which included $83.2 million in BlackRock’s IBIT, $93.4 million in Fidelity’s FBTC, and $29.3 million in Bitwise’s BITB.

Morgan Stanley revealed a $269.9 million investment, all in Grayscale’s GBTC, making it one of the largest GBTC holders. Aristeia Capital Llc, an alternative asset manager, revealed a $163.4 million investment in IBIT.

Responses