State of Wisconsin reports $164M investments in spot Bitcoin ETFs

The entity responsible for managing assets in the state’s pension system reported it held millions of shares of the BlackRock iShares Bitcoin Trust and Grayscale Bitcoin Trust.

The State of Wisconsin Investment Board (SWIB) reported investments in spot Bitcoin (BTC) exchange-traded funds offered by Grayscale and BlackRock.

In a May 14 filing with the U.S. Securities and Exchange Commission (SEC), the government entity responsible for managing Wisconsin state trust funds disclosed it held more than 2.4 million shares in the BlackRock iShares Bitcoin Trust (IBIT) and more than a million shares of Grayscale Bitcoin Trust (GBTC), worth roughly $100 million and $64 million, respectively. The filing suggested that the Wisconsin Retirement System could have exposure to crypto investments through the two asset management firms.

The SWIB reported that it managed more than $156 billion in assets as of December 2023, with roughly 48% going into public equity investments. Other investments included shares of stock in Coinbase, MicroStrategy and Cleanspark. The SEC added that observers should not assume that the information provided by the state entity was “accurate and complete.”

“Normally you don’t get these big fish institutions in the 13Fs for a year or so (when the ETF gets more liquidity) but as we’ve seen these are no ordinary launches,” said Bloomberg ETF analyst Eric Balchunas in a May 14 X post. “Good sign, expect more, as institutions tend to move in herds.”

Related: Bitcoin returns “too significant to ignore” for world’s retirement plans

The SEC filing followed similar reports from major banks, including Wells Fargo and JPMorgan Chase, who disclosed less than $1 million combined in spot BTC ETFs. Susquehanna International Group reported it purchased more than $1 billion worth of shares of the spot crypto ETFs in the first quarter of 2024. The investments were comprised of shares of GBTC, IBIT, Fidelity Wise Origin Bitcoin Fund (FBTC), ProShares Bitcoin Strategy ETF (BITO) and Bitwise Bitcoin ETF.

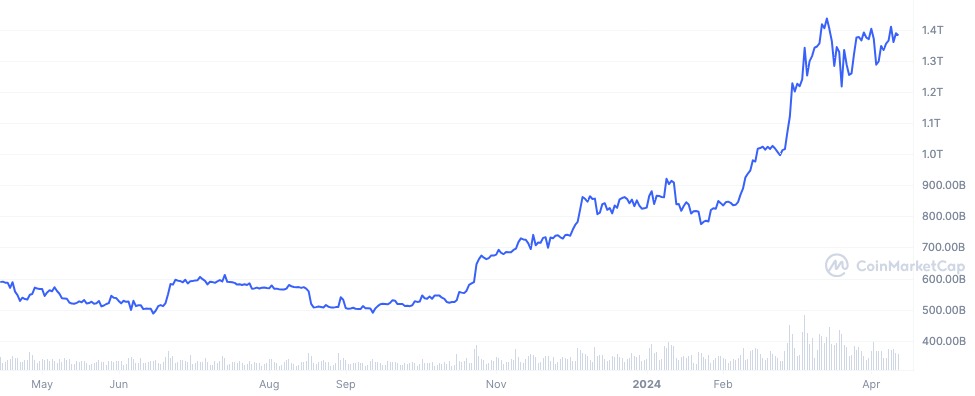

The SEC approved the listing and trading of spot Bitcoin ETFs on U.S. exchanges in January. Many experts expect the commission to decide whether to approve a spot Ether (ETH) exchange-traded fund by May 23, when the final deadline for an application from asset manager VanEck approaches.

Responses