Hong Kong Bitcoin, Ether ETFs wipe 2 weeks of inflow in a single day

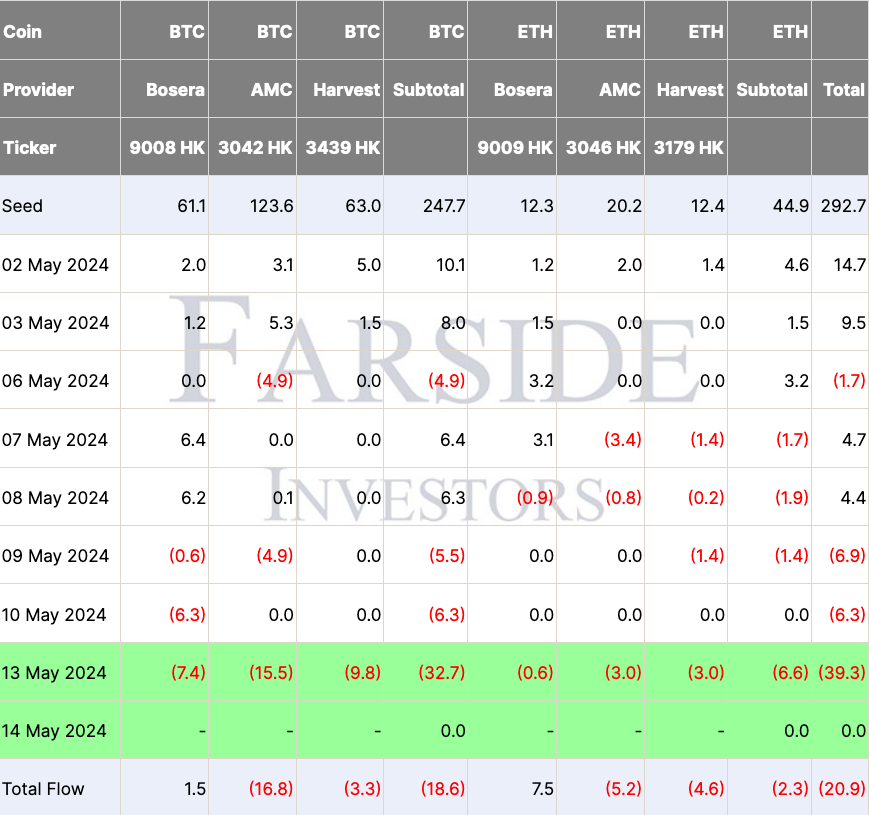

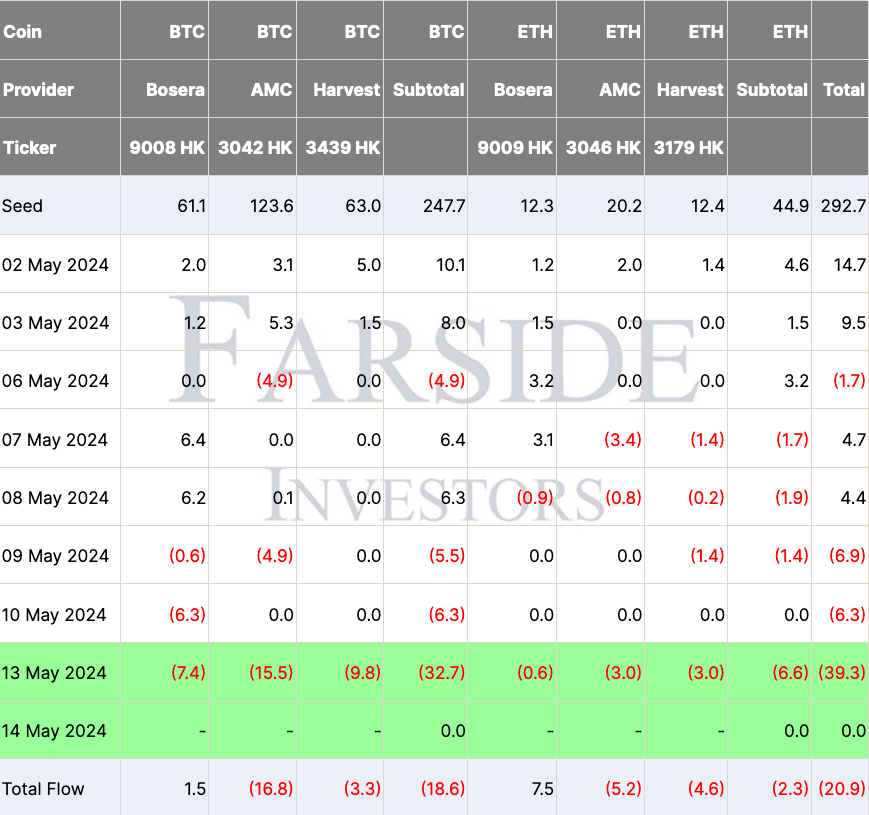

Net outflows for Hong Kong’s crypto ETFs reached a record $39 million on Monday with bleeding felt across all six funds.

Hong Kong’s Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs) posted the largest-ever net outflow on Monday, May 13 — wiping all gains they’ve made since launching under two weeks ago.

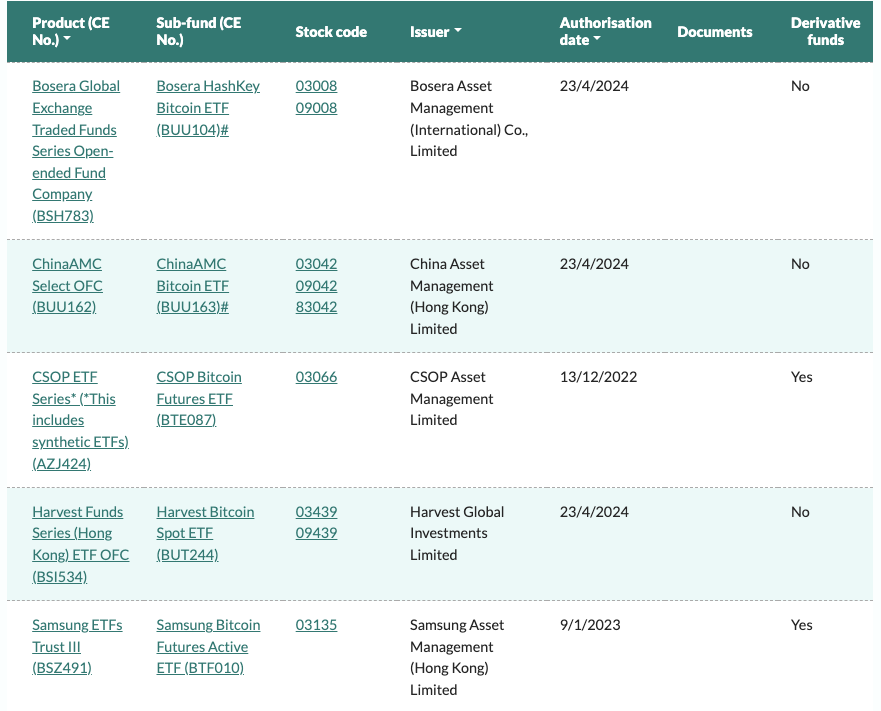

Bosera, ChinaAMC and Harvest Global’s spot Bitcoin ETF funds posted net outflows of $32.7 million, with ChinaAMC’s Bitcoin fund coming in as the biggest loser on the day with $15.5 million in outflows, according to Farside Investors data.

Meanwhile, spot Ether ETFs from the same issuers saw total joint net outflows of $6.6 million. Harvest Global and ChinaAMC tied for most outflows with $3 million each.

As of Monday, all funds since their April 30 trading launch have together seen $20.9 million in total outflows, outpacing the $18.4 million in total inflows accrued as of Friday, May 10.

Monday’s outflows also mark the third trading day in a row where Hong Kong’s crypto ETFs posted net outflows, with $52.5 million in total being pulled from the funds since May 9.

It’s also the first time Harvest Global’s Bitcoin ETF saw outflows, which totaled $9.8 million.

Related: Hong Kong spot Bitcoin and Ether ETFs struggle to gain traction

It comes as BTC traded below $61,000 over the weekend in what many believe is part of a post-halving slump.

Bitcoin mining rewards were cut by 50% on April 20 — a scarcity mechanism coded into the blockchain that typically sees Bitcoin’s price fall in the weeks after as the market absorbs the new issuance schedule.

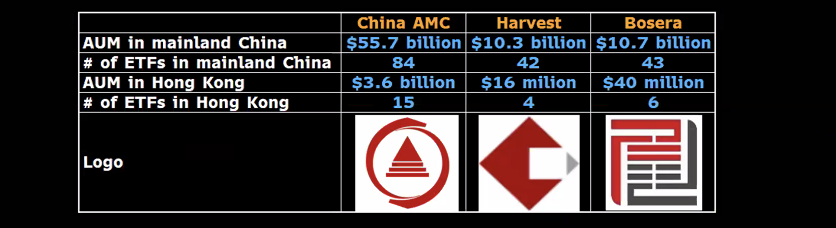

The region’s crypto ETF market is significantly smaller in both funds offered and assets under management compared to the United States.

The United States 11 spot Bitcoin ETFs have over $50 billion in assets under management. Hong Kong’s ETFs have $179.2 million, split between an 88.5% share for Bitcoin ETFs with the remaining space left for Ether ETFs, per SoSoValue.

Responses