Bitcoin bottomed at $56K? BTC price chart hints at breakout within days

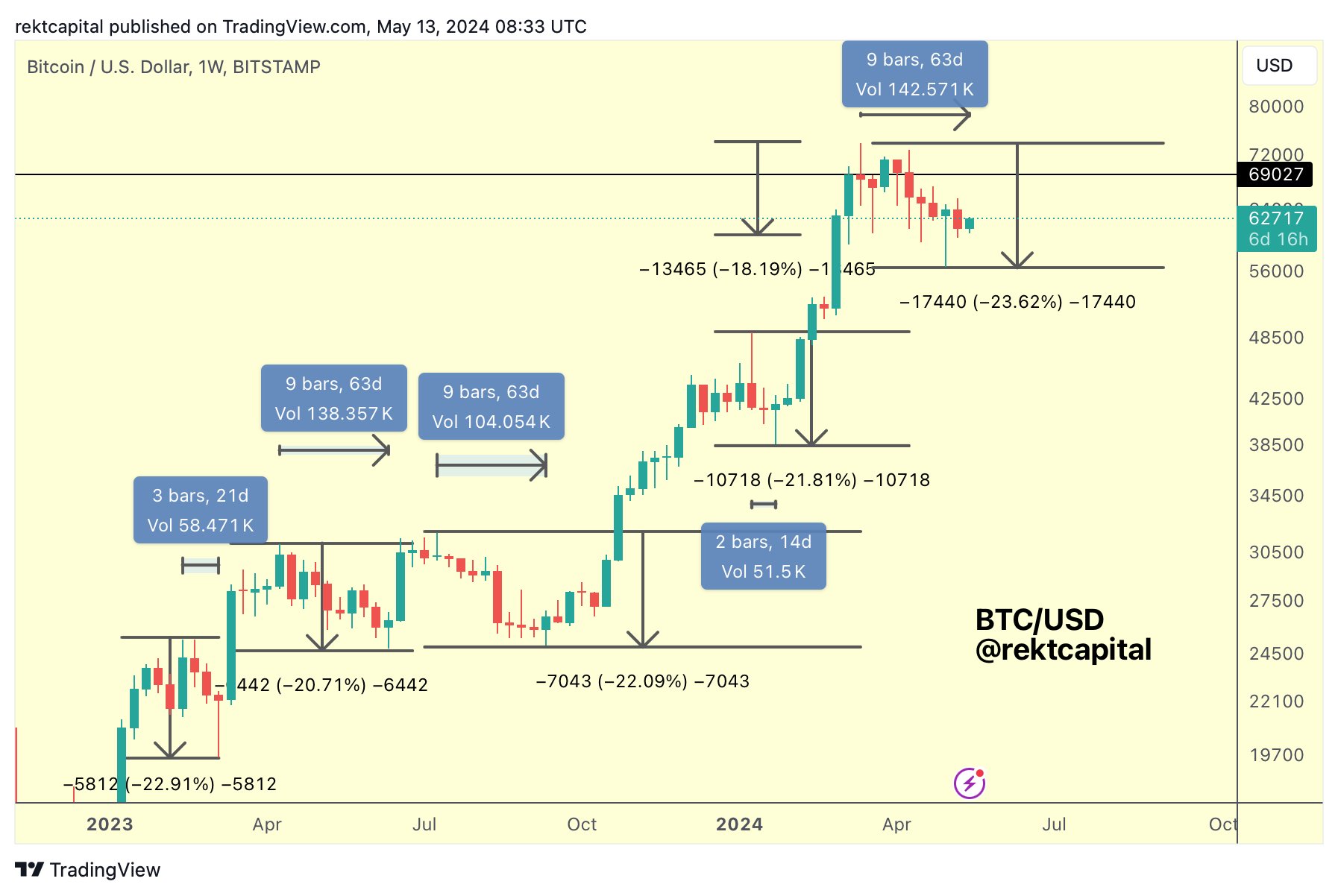

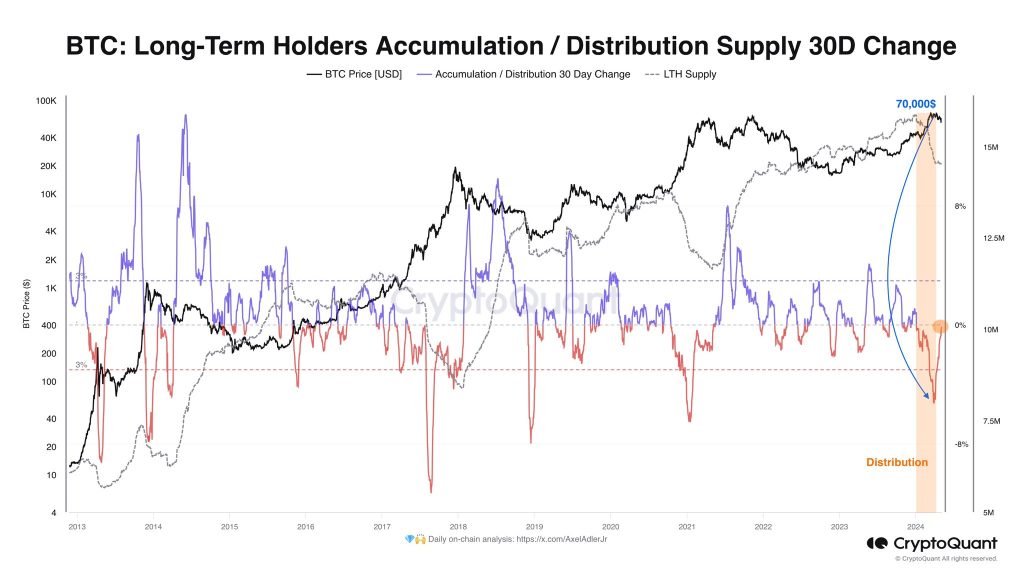

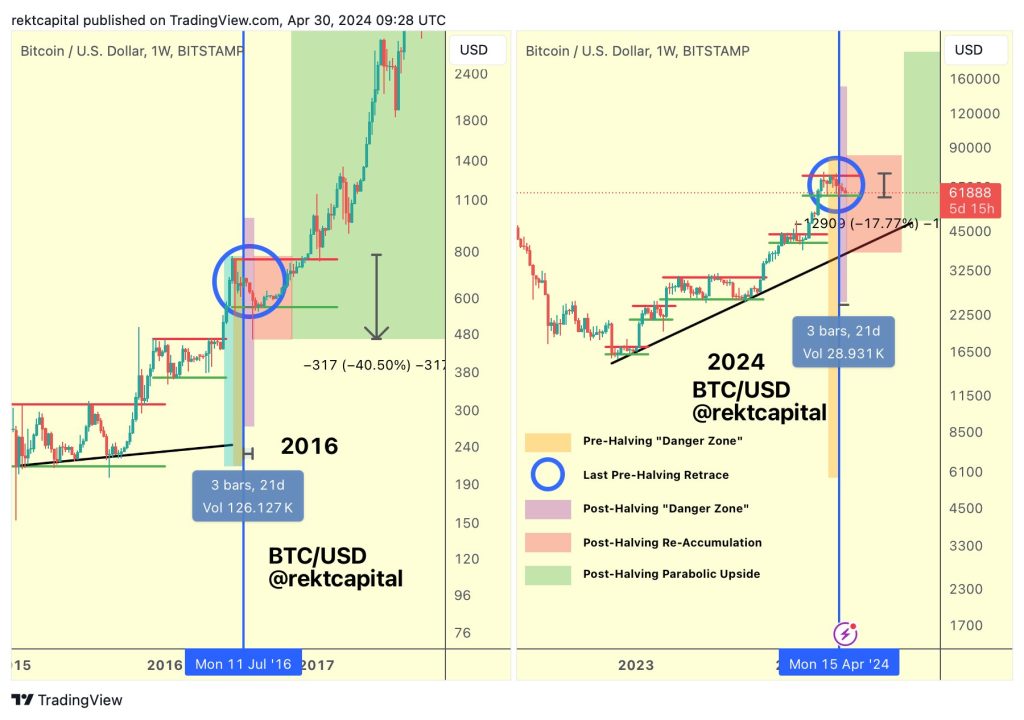

Adding to the bullish technical formation, Bitcoin’s distribution ‘danger zone’ has officially ended, according to popular analyst Rekt Capital.

A popular Bitcoin chart formation suggests that Bitcoin’s (BTC) price could break out from its current range. However, this week’s macroeconomic news could also significantly impact the price. Can Bitcoin break out to the upside?

Is a Bitcoin breakout imminent?

On the four-hour chart, Bitcoin price printed an inverse head and shoulders pattern, a formation used by technical analysts to predict the reversal of a previous downtrend.

Based on the technical formation, Bitcoin could rally to the upside if a break above the trendline occurs, according to a May 13 X post from crypto investor Quinten Francois, who wrote:

“Inverse head and shoulders pattern spotted on the $BTC chart. Not the most beautiful iH&S I’ve ever seen, but I’ll take it. Different ways to draw the neckline too, but this way makes the most sense to me. Break the neckline for further price recovery!”

Bitcoin has nearly reset some key technical indicators, including the moving average convergence/divergence (MACD), an indicator used to gauge changes in the strength and direction of an asset. This could mean more upward momentum according to pseudonymous crypto analyst Jelle, who wrote in a May 13 X post:

“Bitcoin has nearly completed a full reset. Back to the 100-day EMA, a bullish MACD cross (below the zero line) — and the first higher low in a long time. It’s looking good.”

Over on the daily chart, Bitcoin’s relative strength index (RSI) stood at 49, up from 33 on May 1, suggesting that BTC price is currently at fair value. The RSI is a popular momentum indicator used to measure whether an asset is oversold or overbought based on the magnitude of recent price changes.

In line with the previous prediction, pseudonymous crypto trader Mags also expects a price breakout, based on key technical indicators, according to a chart shared in a May 13 X post with his 74,200 followers:

Despite the bullish chart formation, the sentiment around Bitcoin is still in a precarious situation. Particularly, this week’s macroeconomic developments, especially the Consumer Price Index (CPI) on May 14, could significantly impact its short-term price trajectory, according to Matt Bell, the CEO of Turbofish. Bell told Cointelegraph:

“While the 4-hour chart hints at a potential trend reversal with the Inverse Head and Shoulders formation, it’s crucial to note that Bitcoin’s price action is tightly bound within a narrow trading range… Factors like United States macro data and insights from Jerome Powell, chair of the Federal Reserve, could introduce a new wave of volatility to the crypto market.”

Related: Did XRP price just bottom against Bitcoin?

Bitcoin at $56K marked local bottom: analyst

Bitcoin’s retrace to $56,000 has likely marked the local price bottom, according to popular crypto analyst Rekt Capital, who wrote in a May 13 X post:

“If $56,000 was not the bottom then this current pullback will have officially equaled the longest retrace in this cycle at 63 days. History however suggests that this current pullback ended at $56,000 and 47 days.”

What’s more, Bitcoin’s distribution danger zone ended on May 6, as Bitcoin rose above the $65,000 mark.

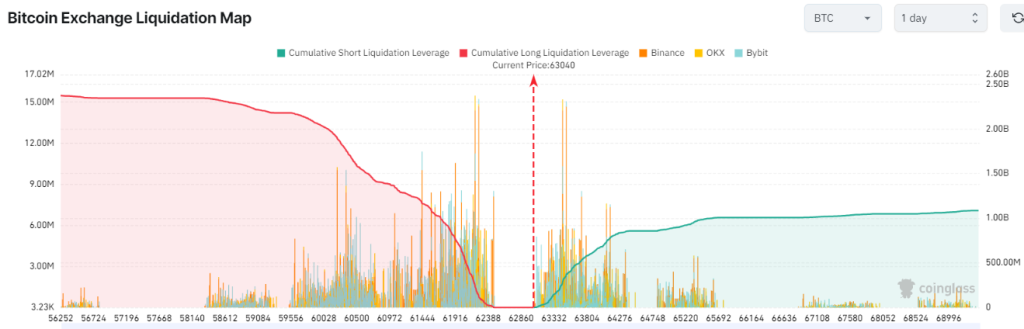

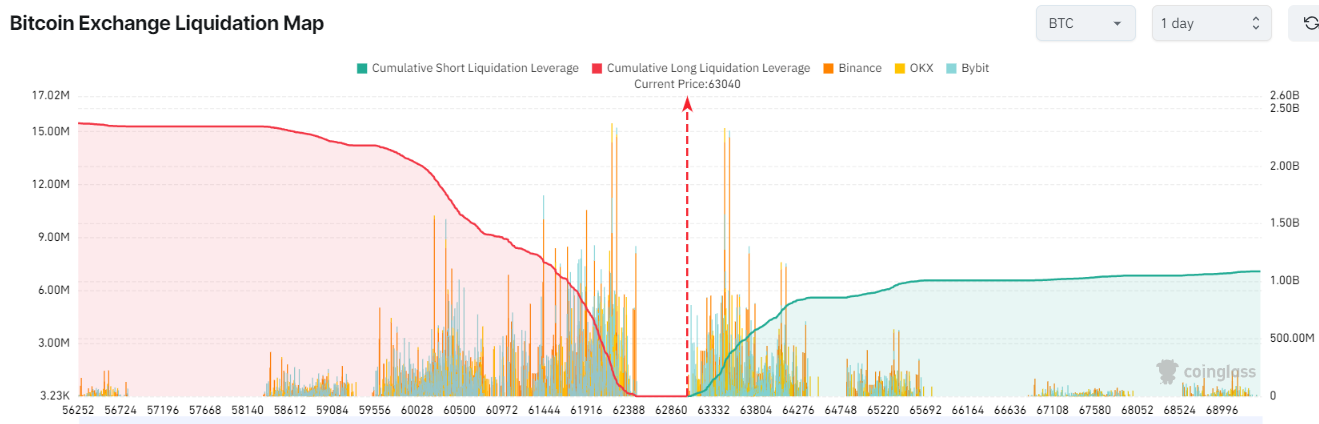

However, Bitcoin faces significant resistance around the $63,500 and $63,700. A move above $63,700 would liquidate over $516 million worth of cumulative leveraged short positions, according to Coinglass data.

Related: Bitcoin enters ‘new era’ as whales scoop up over 47K BTC during price pullback

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses