Grayscale Bitcoin ETF nullifies $66.9M inflows in 2 days

Grayscale’s Bitcoin ETF saw substantial investment outflows that surpassed the $66.9 million it had attracted just a few days earlier.

The rare inflows to Grayscale’s spot Bitcoin exchange-traded fund (ETF) dried up within two days as outflows returned.

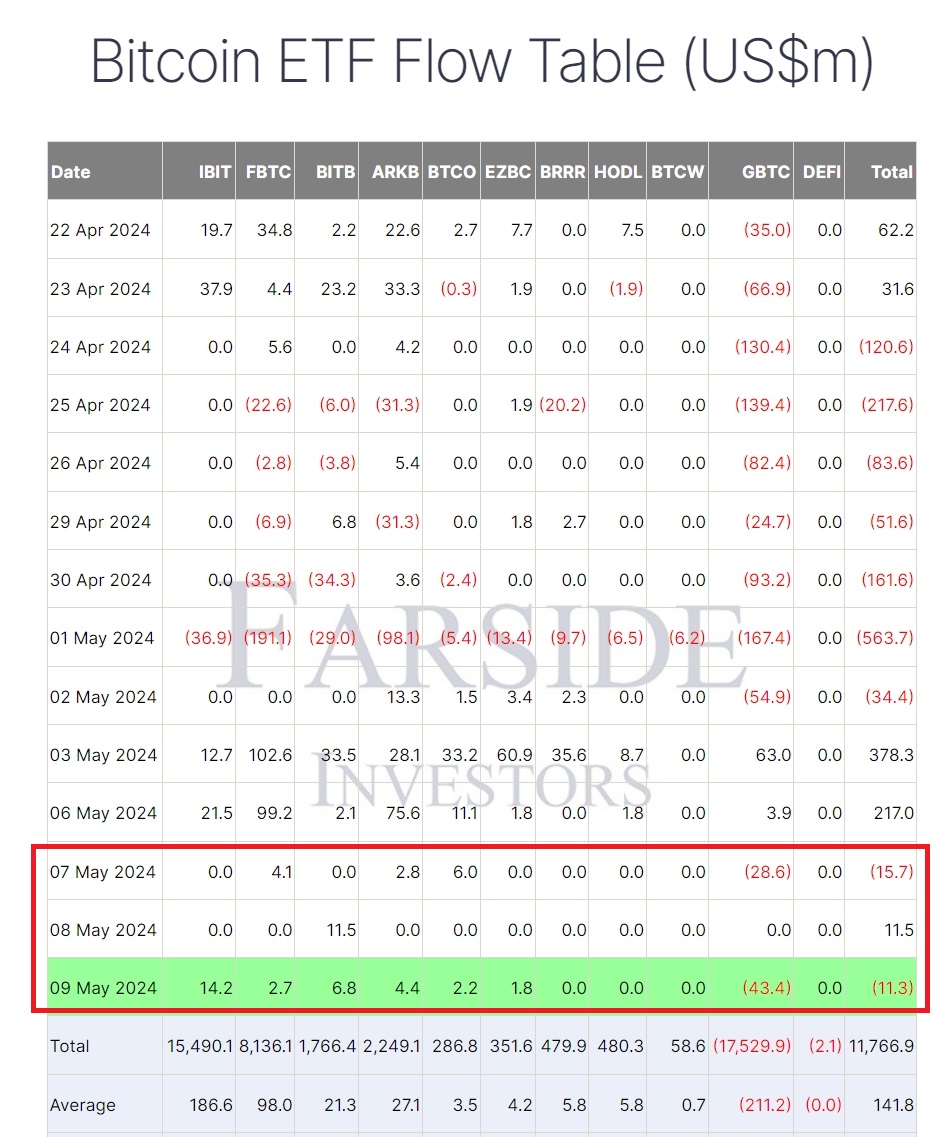

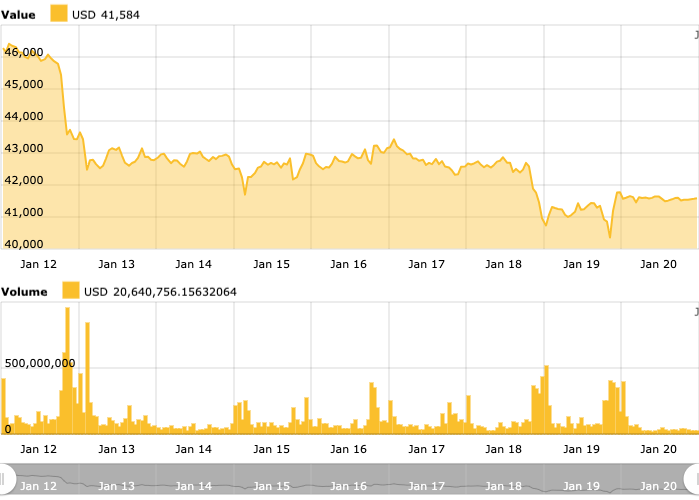

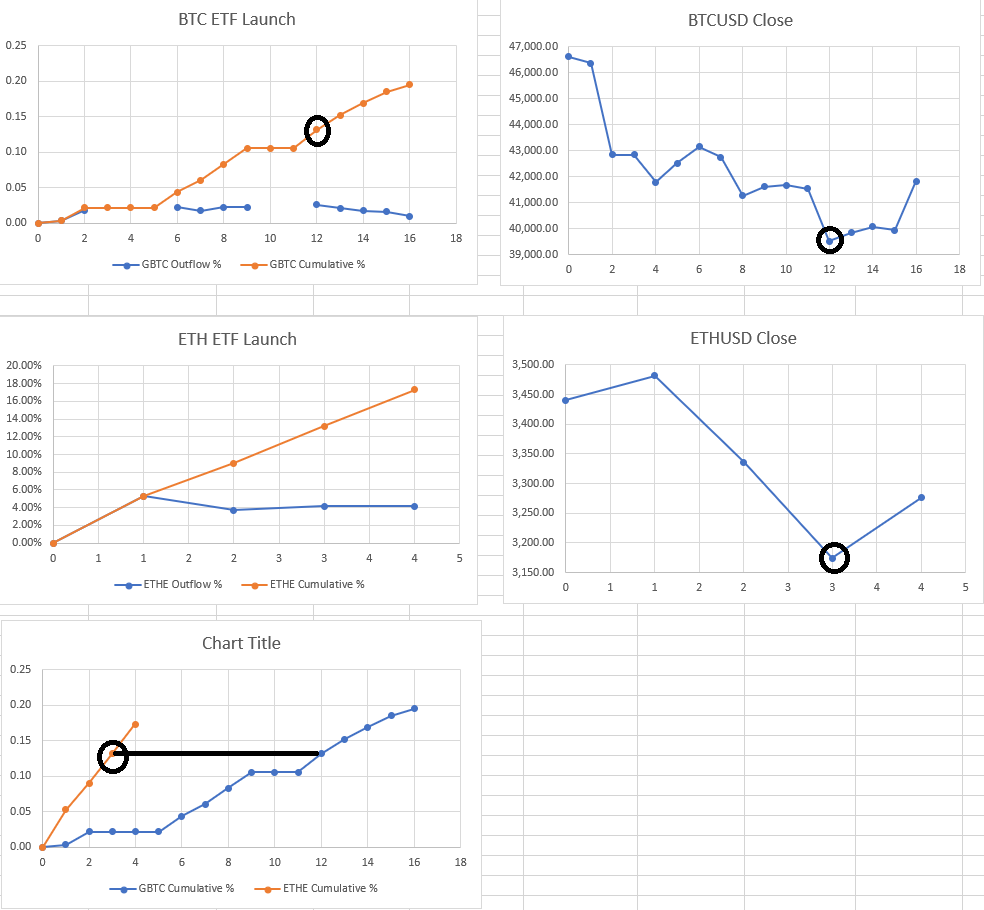

The Grayscale Bitcoin Trust (GBTC) ETF recorded inflows worth $66.9 million in May after bleeding over $17.5 billion in 78 days straight since its Jan. 11 launch. The investments came in on May 3 and 6, each day attracting $63 million and $3.9 million, respectively.

However, the inflow trend has failed to maintain momentum since.

GBTC recorded outflows worth $28.6 million and $43.4 million on May 7 and 9, respectively — undoing the investments it had recently brought in. On both days, Grayscale was the only spot Bitcoin (BTC) ETF issuer to report outflows.

The rest of the nine Bitcoin ETFs approved by the United States Securities and Exchange Commission (SEC) recorded positive or no investments during the timeframe.

On average, the Grayscale Bitcoin Trust has lost $211 million daily since its launch. However, inflows to the other ETFs have kept the net balance at a positive $11.7 billion.

All Bitcoin ETF issuers, except GBTC, have positive inflow balances. Out of the lot, BlackRock’s iShares Bitcoin Trust attracted the highest investments, racking up nearly $15.5 billion to date.

Other prominent issuers include Fidelity’s Wise Origin Bitcoin Fund, Bitwise Bitcoin ETF and Cathie Wood’s ARK 21Shares Bitcoin ETF, which currently sport net inflows of $8.1 billion, $1.7 billion and $2.2, respectively.

Related: Grayscale Bitcoin ETF takes the slow train to recoup $17.4B outflows

Speaking exclusively to Cointelegraph at Paris Blockchain Week in April, VanEck CEO Jan VanEck said the retail sector brings in 90% of Bitcoin ETF inflows. “You’ve had some Bitcoin whales and some other institutions move some assets in, but they were already exposed to Bitcoin,” he said.

However, VanEck anticipated the arrival of some major institutional investments from banks and traditional firms by May.

Responses