Stablecoins on Bitcoin coming soon, says Lightning Labs CEO

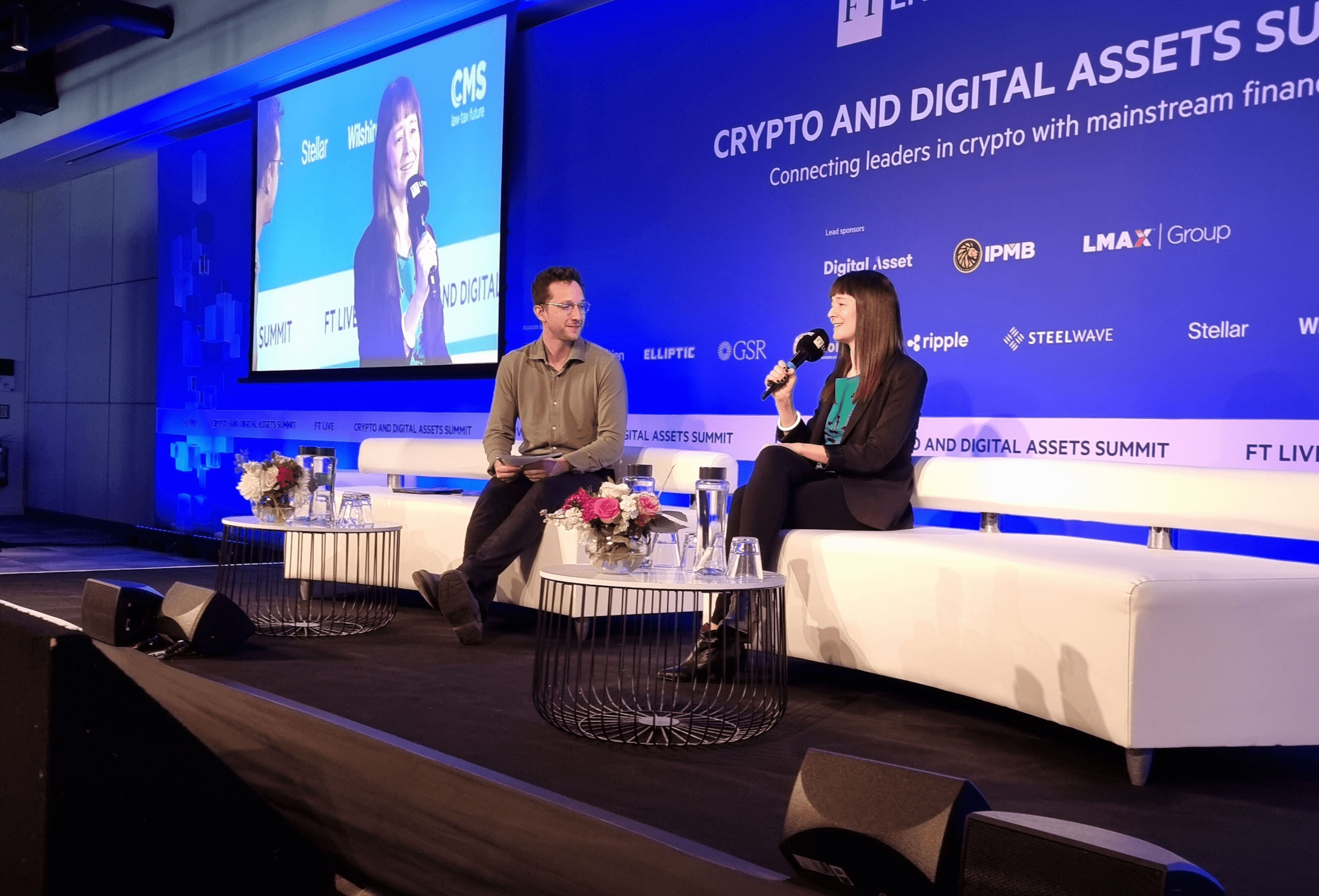

Elizabeth Stark unpacked the basics of Bitcoin Lightning at FT Live’s Crypto summit and teased a new development on Bitcoin’s leading layer 2.

Stablecoins running on Bitcoin are edging closer to reality through new functionality built by Lightning Labs using the network’s Taproot upgrade implemented in late 2021.

Elizabeth Stark, CEO of Lightning Labs, unpacked the latest development from the Bitcoin development firm at FT Live’s Crypto and Digital Assets summit in London.

The firm’s co-founder also gave an eloquent explainer of Bitcoin and the Lightning Network to an audience of traditional finance players.

Lightning Labs’ Taproot Assets protocol is building functionality to bring stablecoins and tokenized assets to Bitcoin. According to Stark, developers have made significant headway toward this goal, culminating in the testing of transactions on Lightning:

“We released an early part of the code in October and recently demoed the first-ever transaction on Lightning of an asset. The idea is to have crypto dollars and stablecoins on the Bitcoin blockchain.”

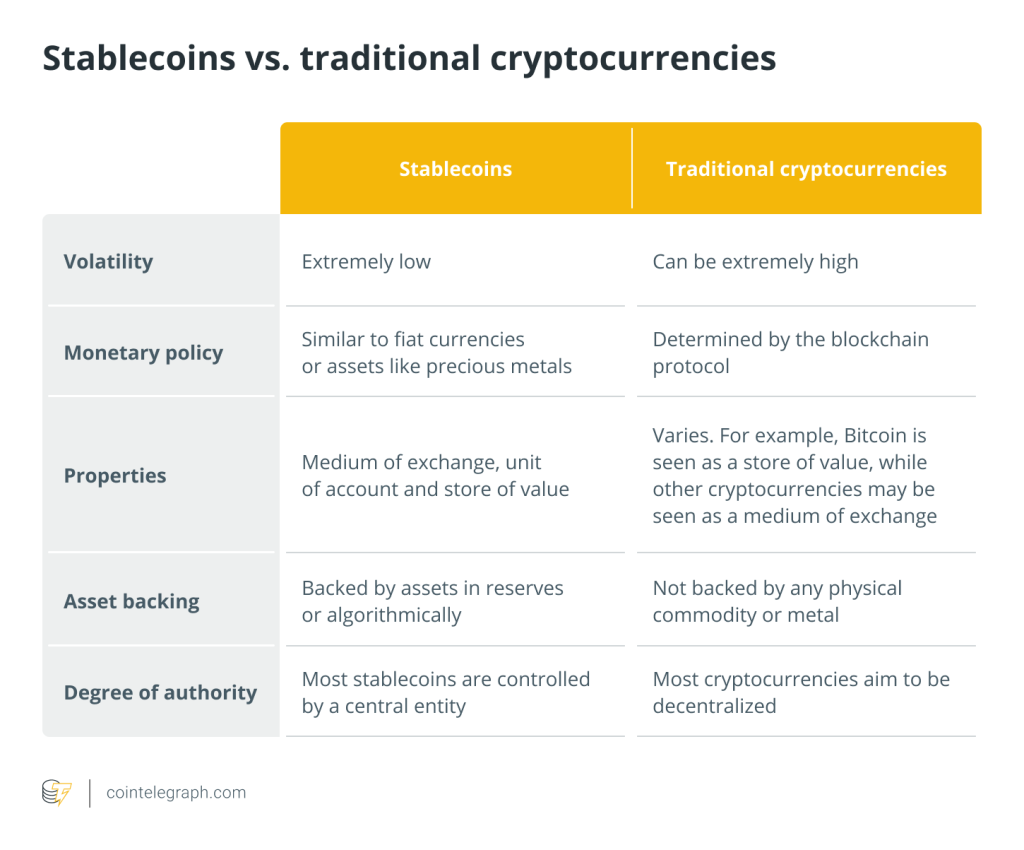

Stark added that traditionally, these digital assets have operated on other blockchains that have suffered from high fees and other issues. She argues that Bitcoin’s network is perhaps best placed to facilitate the use of stablecoins because it “is the most secure and decentralized” blockchain.

Bitcoin and stablecoins value as a store of value

Stark went on to discuss the merits of Bitcoin (BTC) and stablecoins as a store of value, especially in nations grappling with inflation issues and devaluing fiat currencies.

The Lightning Labs CEO said stablecoin adoption has grown dramatically since the COVID-19 pandemic, with users largely being based in emerging markets.

“The stickiest users have been those looking for a stable store of value. In some cases, they’re using Bitcoin. In other cases, they’re using stablecoins, and in some cases, it’s a combination of both,” Stark explained.

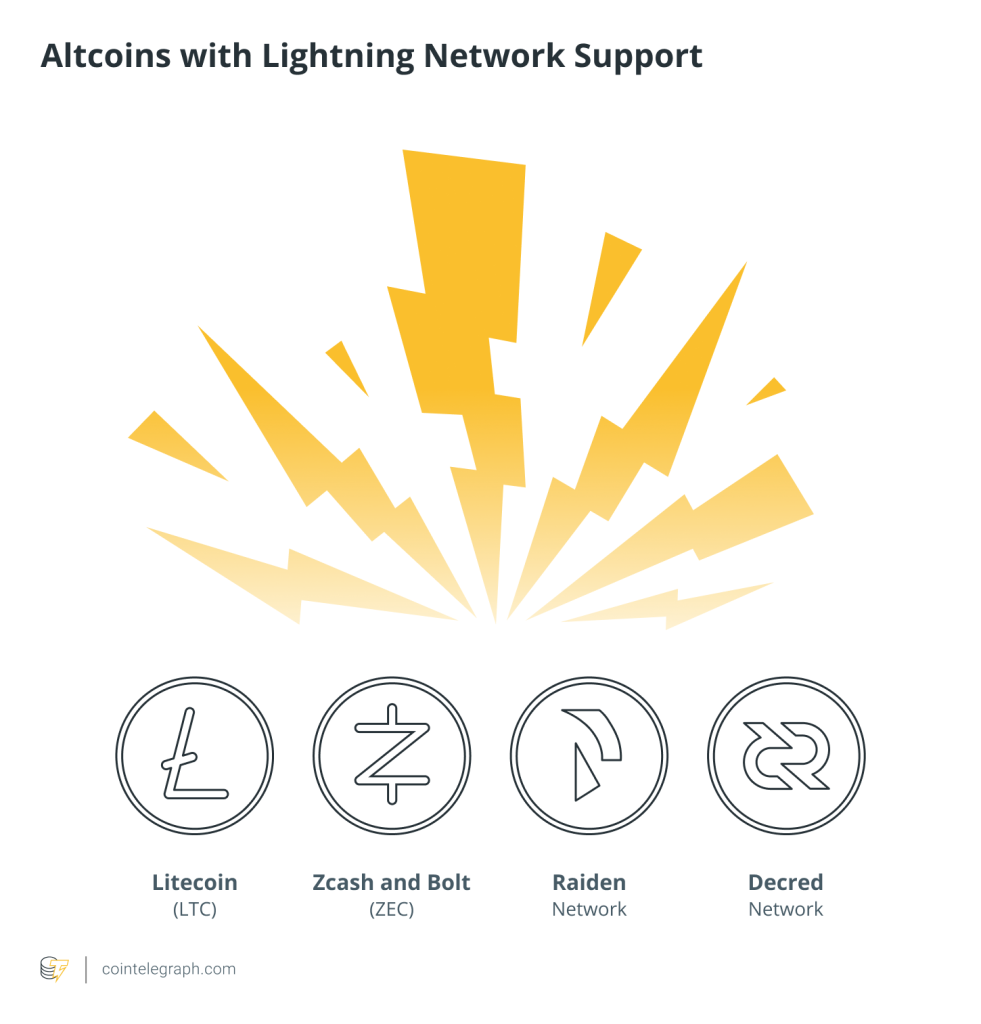

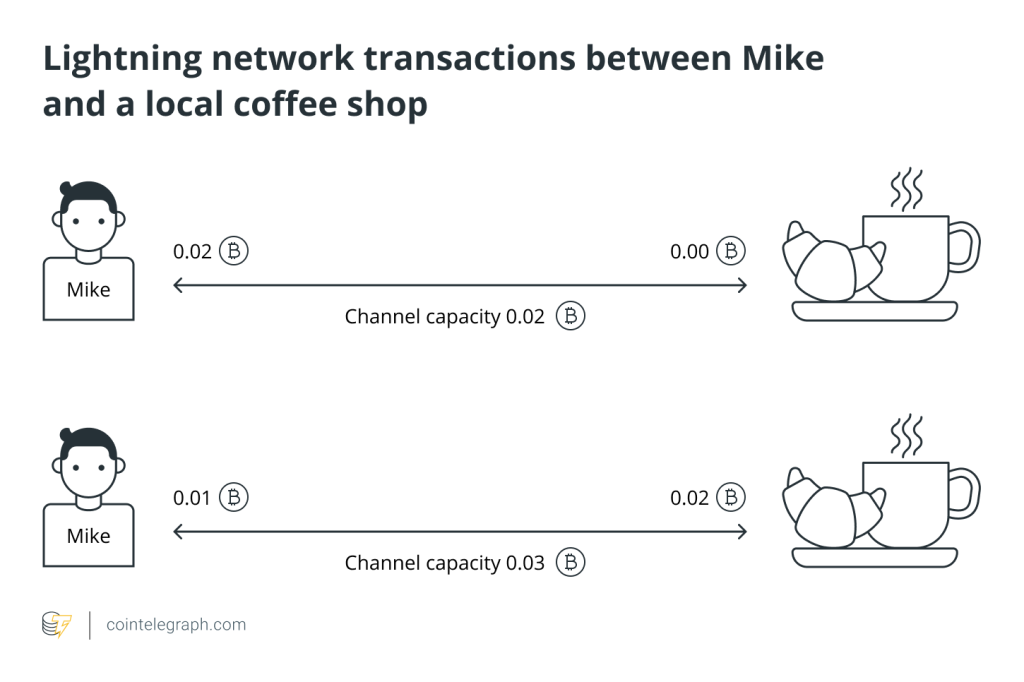

Related: What is the Bitcoin Lightning Network, and how does it work?

The two largest stablecoin players, Tether (USDT) and Circle (USDC), hold more United States Treasury bonds combined than major nations like Germany and South Korea. Stark said this is an intriguing fact given that end users don’t benefit from the interest from holding stablecoins.

For those in countries grappling with hyperinflation or precarious economic environments, the choice of holding a stablecoin is driven by the need for a store of value.

Lightning-powered stablecoins will be superior

Given the significant growth in value of the stablecoin market, Stark said there is a need for the infrastructure to enable the issuance of stablecoins and real world assets on the Bitcoin blockchain.

“That’s why we’re building this protocol, this technology right now. We’re not issuing assets, we’re building the rails. Asset issuers will use our technology to issue real-world tokenized assets,” Stark explained.

Related: Coinbase integrates Lightning Network for Bitcoin transactions

The CEO added that financial institutions could issue gold assets, stablecoins and other fiat-backed assets on Bitcoin and then transact over the Lightning Network.

Perhaps most telling was the relative cost compared to other blockchains and conventional traditional finance systems which Stark highlighted:

“If you look at Visa where fees in the U.S. can be upward of 3%, or even or 1% the fees, transacting with stablecoins on Lightning can be dramatically lower, a cent or less than that.”

Stark added that this could competitively enable people to transact globally at far lower rates than through traditional networks.

Responses