Bitcoin mining difficulty risks biggest dip since 2022 as BTC price eyes $60K

Bitcoin may still be trading above $60,000, but network fundamentals are already showing the strain as BTC price gains fail to materialize.

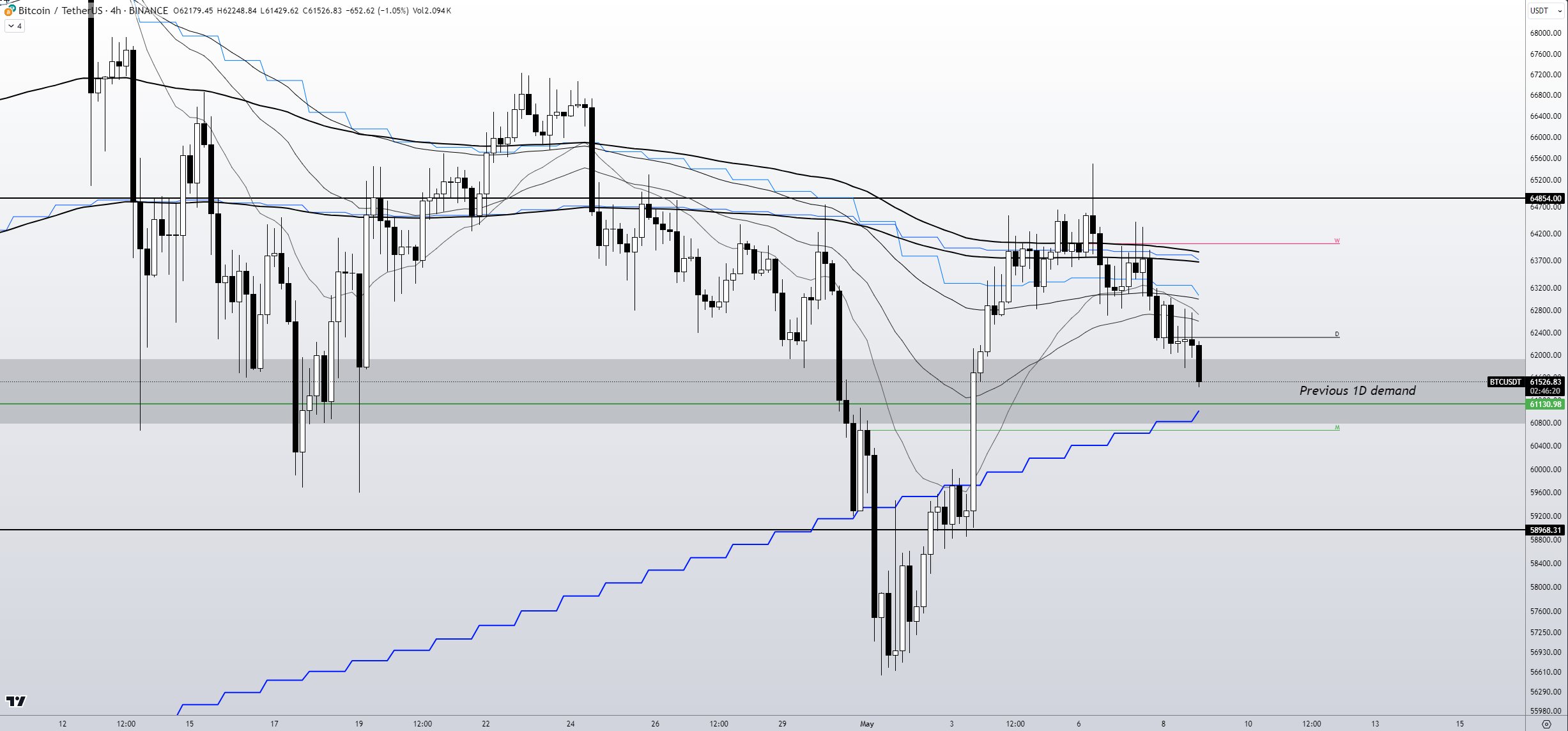

Bitcoin (BTC) threatened a $61,000 breakdown on May 9 as familiar trendlines got a fresh support test.

BTC price keeps up pressure on bull market support

Data from Cointelegraph Markets Pro and TradingView followed BTC price moves as it slowly ground lower to erase a week’s upside.

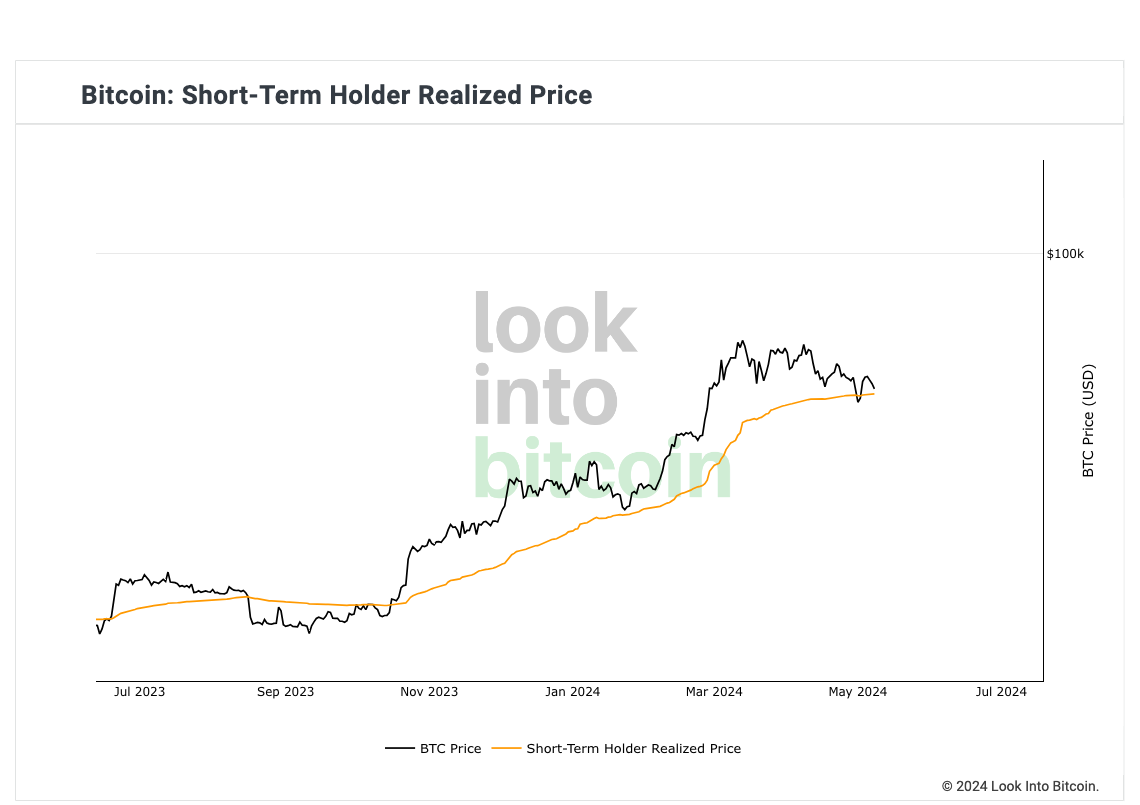

While taking order book liquidity via low-timeframe volatility, BTC/USD lacked upside impetus overall, and now, the 100-day simple moving average (SMA) and short-term holder realized price (STH-RP) were back on the radar.

As Cointelegraph reported, these are classic bull market support levels, with last week’s brief dip to $56,500 not violating them for long.

The 100-day SMA and STH-RP — the latter referring to the aggregate cost basis of Bitcoin speculators — stood at $61,200 and $60,100, respectively, at the time of writing.

In his latest commentary on X, popular trader Skew described the 100-day SMA and the monthly open at $60,600 as “pretty important” on high timeframes.

“There is some 100BTC bids stacked here but need to see evidence of absorption of sellers to get strong confluence of demand,” he wrote overnight.

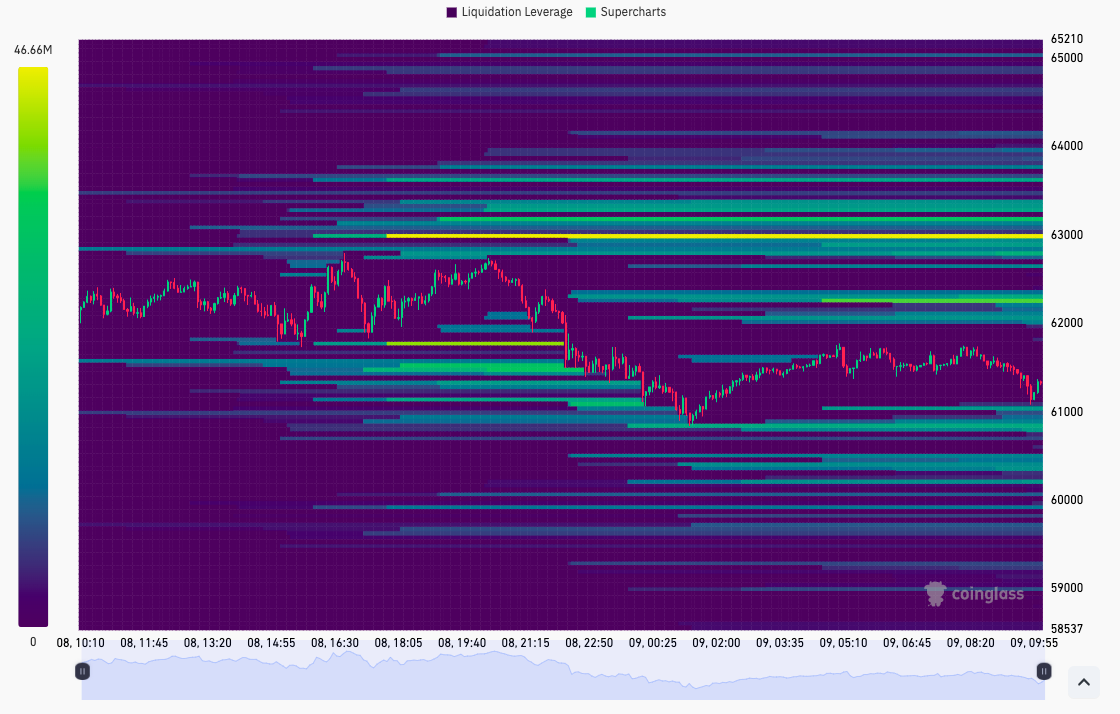

Data from monitoring resource CoinGlass confirmed a cloud of bid liquidity just below $61,000, with Bitcoin still to challenge this on the day.

“Clearly here someone is walking price lower while trying to draw in liquidity to sell on bounces,” Skew summarized previously.

“Keeping an eye on this because eventually someone will take the other side (bid) & test this ask liquidity.”

Bitcoin mining hash rate, difficulty retreat

The latest BTC price moves meanwhile took their toll on network fundamentals.

Related: Bitcoin exchange inflows drop to 10-year lows after $74K all-time highs

Bitcoin mining difficulty was about to drop by 5.5% at the time of writing, per data from BTC.com — its largest single downward adjustment since the end of the 2022 bear market. At the time, BTC/USD traded at under $20,000.

Difficulty is currently at all-time highs of 83.23 trillion.

Discussing the current landscape on X, mining analysis account Pennyether noted that hash rate was already headed lower.

“Hashrate looks to be dropping. But, what matters for miners is the difficulty, not the network hashrate. Miners will not mine more bitcoin per EH/s until difficulty gets adjusted downward, and this happens every 2016 blocks (~14d),” it wrote on May 8.

“Assuming we get a -7% adjustment, that puts the ‘difficulty hashrate’ at around 585 EH/s. Referring to my post-halving prediction, this is still above my estimate of 560 EH/s given the current hashprice of $50.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses