Core Scientific sees revenue surge in 1Q24 after emerging from bankruptcy

Bitcoin miner Core Scientific has posted $150 million in revenue from digital asset mining in the first quarter of 2024, boosting its gross margin to 46% from 26% in the previous year.

Bitcoin miner firm Core Scientific posted improved financial results for the first quarter since emerging from bankruptcy.

The company reported a total revenue of $179.3 million, marking an increase of $58.6 million over the same period in 2023.

Net income for the quarter reached $210.7 million, an increase from the net loss of $0.4 million reported for the first quarter of 2023. This rise in net income was primarily driven by gains from obligations totaling $143.8 million and a decrease in Chapter 11 financing expenses, said the company.

Revenue from digital asset mining reached $150 million, while hosting revenue contributed $29.3 million, according to Core Scientific. Digital asset mining revenue in excess of mining costs stood at $68.4 million, reflecting a 46% gross margin — compared to $25.4 million and a 26% gross margin in the same period of the previous year.

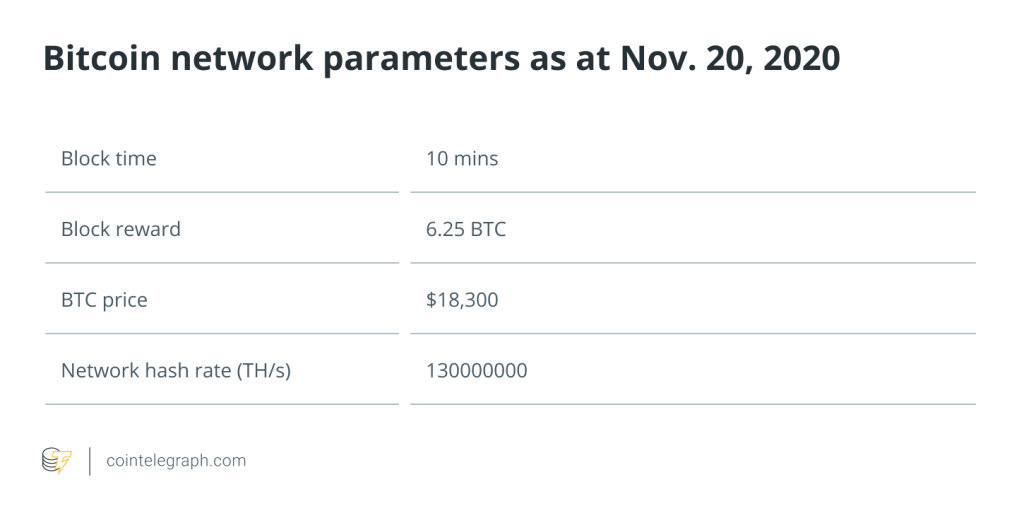

The overall revenue from mining increased due to higher Bitcoin prices and Core’s mining capacity. According to the company, mining revenue was driven by a 134% increase in the price of Bitcoin and a 20% increase in the company’s self-mining hash rate, which offset a 34% reduction in the amount of Bitcoin received due to a 73% rise in the global hash rate.

Hosting revenue in excess of hosting costs was $9.3 million, representing a 32% gross margin, compared to $6.4 million and a 28% gross margin in the first quarter of the previous year. The higher hosting revenue was primarily attributed to onboarding new digital asset mining clients, which drove a $6.7 million increase in hosting revenue. Operating expenses for the quarter totaled $16.9 million, down from $24.2 million in the same period last year.

“We now believe our infrastructure is well positioned to take advantage of the enormous demand for power and infrastructure required for high-performance computing, and we see this as the next major growth opportunity for our business,” said Core Scientific’s CEO Adam Sullivan during an earnings call.

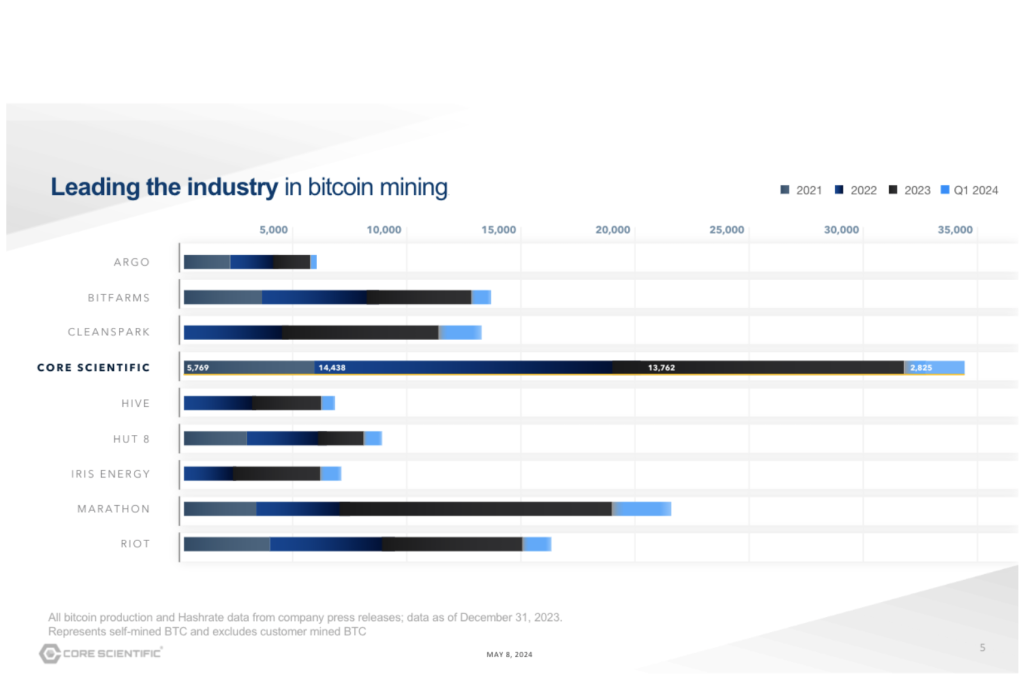

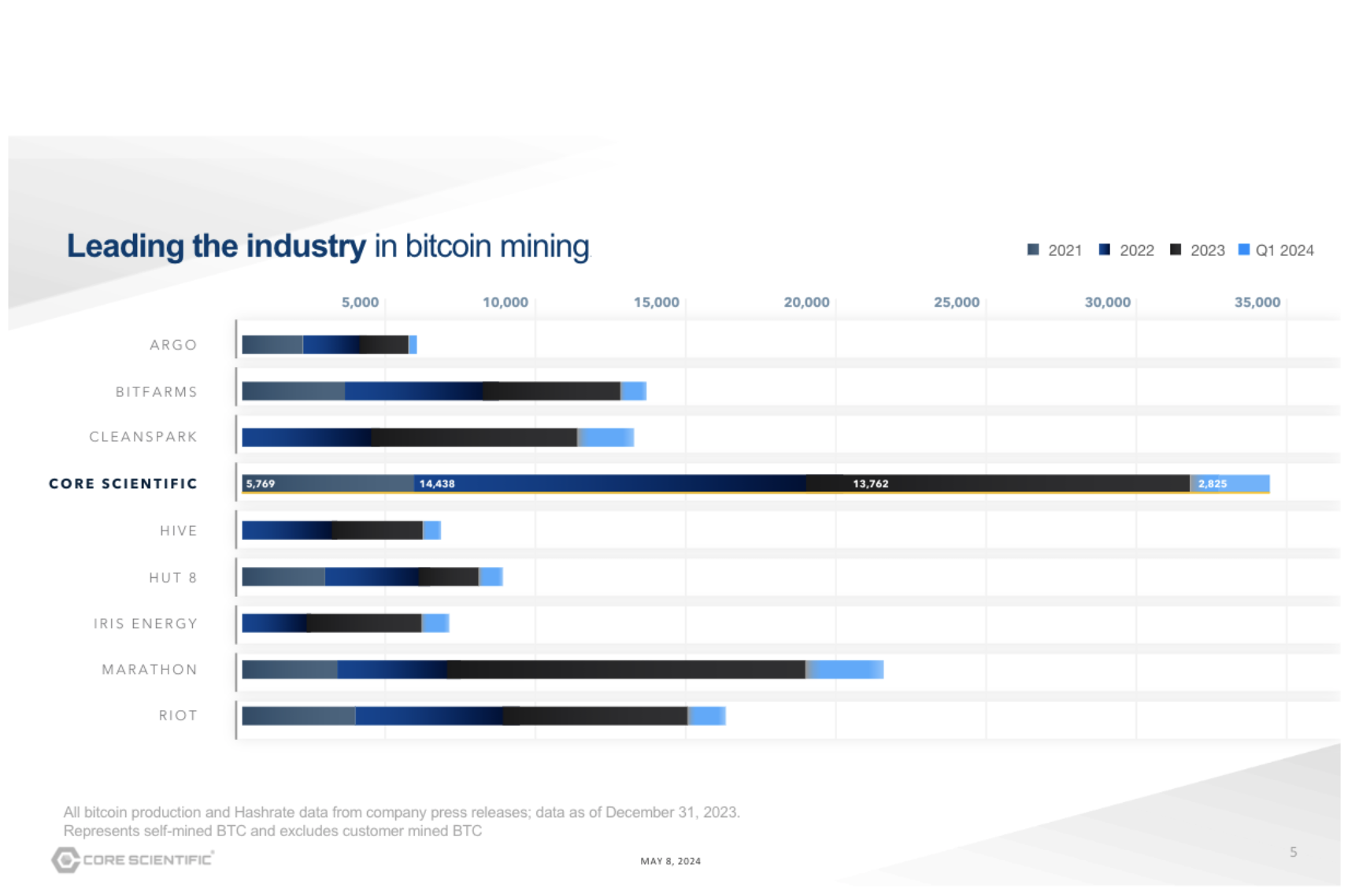

During the fiscal first quarter of 2024, Core Scientific produced 2,825 self-mined Bitcoin, reportedly more than any other publicly listed miner in North America. The company owns approximately 745 megawatts of infrastructure that generated a total hash rate of 25.5 EH/s, comprising 19.3 EH/s from self-mining and 6.2 EH/s from hosting operations during the quarter.

Following the Bitcoin halving event — which cuts miners’ revenue by half — Core is planning strategic mining equipment purchases at lower prices. According to Sullivan:

“We are waiting to make countercyclical miner purchases to take advantage of improved pricing. After the recent halving, we are already seeing that dynamic take shape, with post-purchase pricing lower than pre-purchase.”

Core Scientific received court approval to emerge from bankruptcy and relist its shares on the Nasdaq on Jan. 16, putting an end to a 13-month restructuring process.

Responses