Bitcoin price to ‘sustain’ $265K level once boring consolidation ends — Analysts

Analysts forecast a Bitcoin run to $265,000, but it could take longer than investors expect.

Bitcoin (BTC) price could continue its uptrend and triple its market capitalization, propelling its price above $260,000, according to founder and CEO of on-chain and market analytics firm CryptoQuant Ki Young Ju.

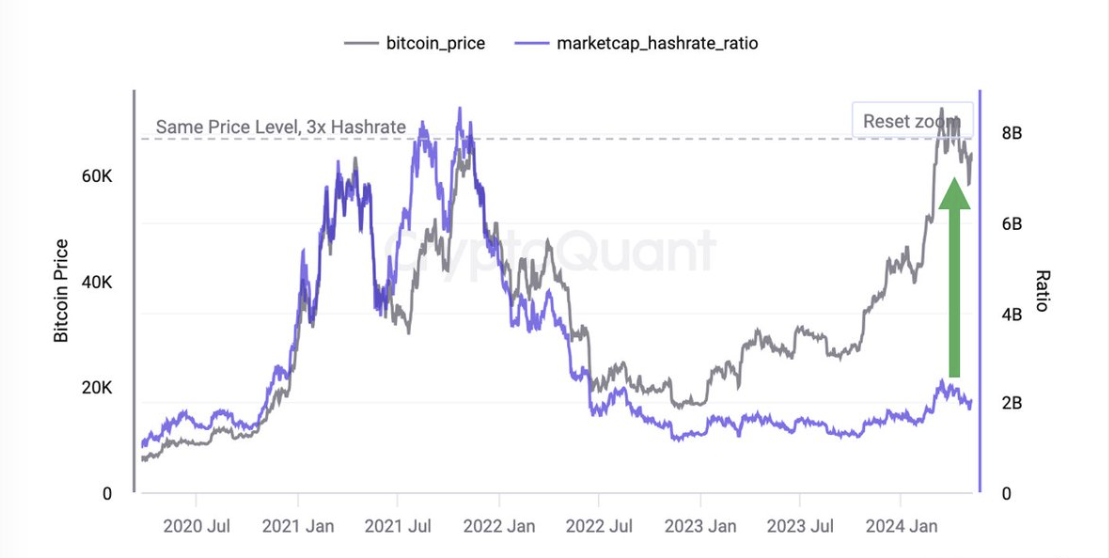

“Bitcoin network fundamentals could support a market cap three times its current size compared to the last cyclical top,” Young Ju explained in a May 8 post on X.

Young Ju was referring to a chart comparing BTC’s price and the associated hash rate to market cap ratio, highlighting the crypto’s ongoing volatility and the resilience of the Bitcoin network.

The chart reveals that Bitcoin’s hash rate to market cap ratio has increased significantly in 2024, which suggests a possible increase in market activity and investor interest.

The hash rate to market cap ratio assesses the growth of mining activity relative to the market capitalization.

If this ratio continues to grow, Young Ju declares it could “potentially sustain” Bitcoin’s price to $265,000.

In response, analyst and trader Crypto Ceaser pointed out that Young Ju’s views aligned with their analysis, which showed that BTC had formed a large cup-and-handle pattern on the weekly chart.

The setup forms when an asset in a bullish trend retraces twice, first in a wide, shallow move forming the cup and then in a smaller dip forming the handle. The cup-and-handle pattern is a bullish continuation pattern that usually forms during a price consolidation period.

If confirmed, the chart projected a BTC rally toward the technical target of the governing chart pattern at $273,693.

“Whilst this target is particularly high, it is a legitimate target and technically a diminished return (measured from low to high).”

Crypto Caesar explained that BTC’s price is currently in a “critical area”, consolidating below its all-time highs.

He added,

“If Bitcoin can start to trend above ATH’s this summer, then I anticipate a strong rally to the upside and potentially a shorter cycle.”

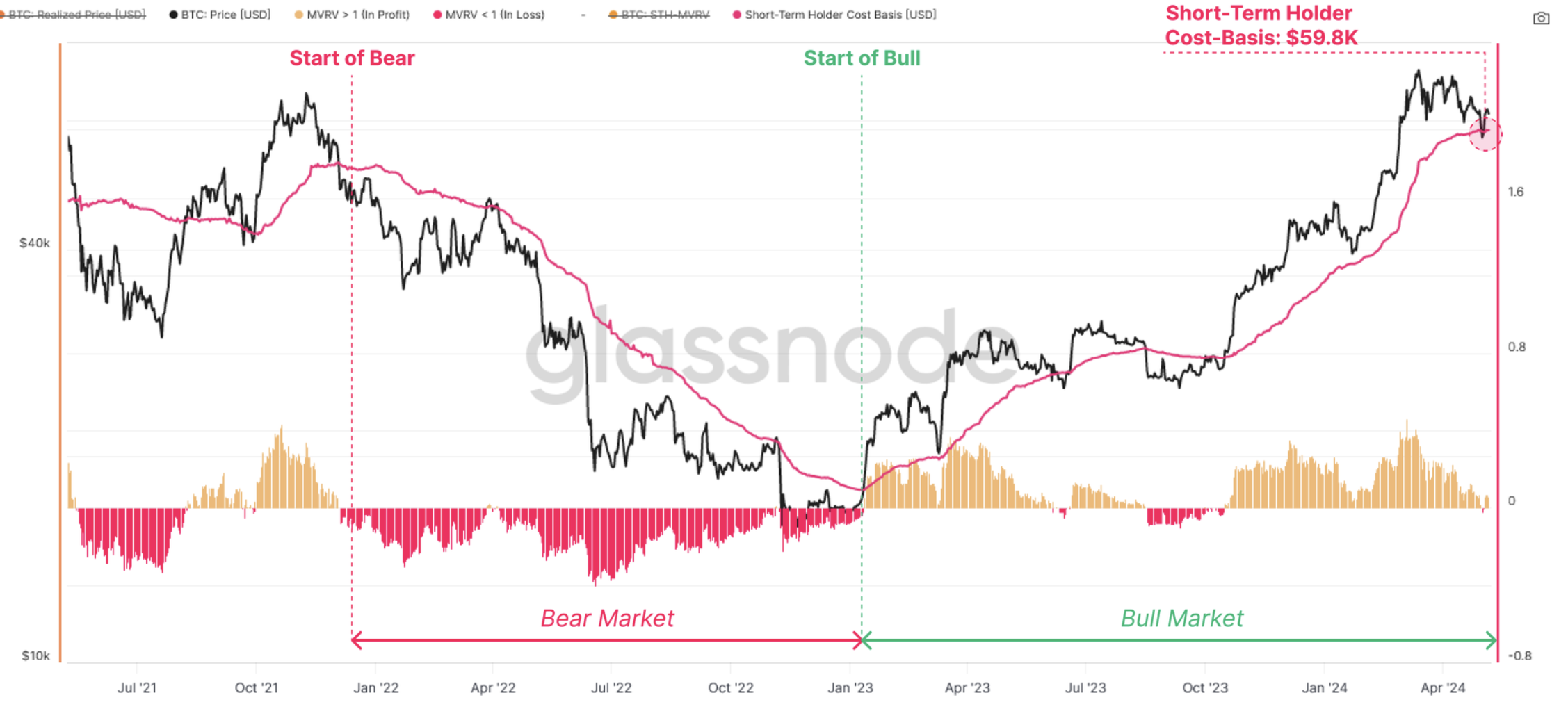

Although it is crucial that Bitcoin holds above its short-term holder price of $59,500 to “maintain its bullish trend,” pseudonymous crypto analyst and co-founder of CMCC Crest Willy Woo told his 1.1 million X followers on May 3.

Glassnode analysts said in a May 7 report that the average short-term holder acquisition price has always acted as a stiff barrier during bearish trends and provided strong support during bullish trends.

“This thesis has held up so far this week, with the Bitcoin market correcting down below the STH-Cost Basis at $59.8k, where it found support and rallied higher.”

Meanwhile, some traders believe that Bitcoin has to produce a decisive daily candlestick close above the 50-day simple moving average (SMA) to remain bullish.

Crypto influencer Lark Davis shared this sentiment, saying, “We want to now have a breakout and produce a strong daily candle close above the 50-day SMA on the chart here.”

Related: BTC price clings to $62K as Bitcoin bulls suffer post-halving ‘boredom’

“BTC is currently in the process of breaking the trendline of Pennant and the 50 Daily SMA,” added Negentropic, an X account authored by the co-founders of Glassnode.

“When level 65-66K is broken, BTC will move on first to 73.5K and then 76.5K and chances are that we will see 85.2K before the summer.”

Bitcoin’s volatility is cooling off slightly as “price has been consolidating in this current range,” pseudonymous crypto trader Daan Crypto Traders told his X followers in a May 8 post, adding, “It’s still at relatively low levels compared to last cycle. Likely to see that change as time goes on and price leaves this range.”

Responses