2 key Bitcoin indicators have ‘cooled off’ — Why it could be bullish

The Bitcoin funding rate and 3-month annualized basis rates are moving to levels that signal to traders it may just be the “calm before the storm.”

Two key Bitcoin (BTC) trading indicators — funding rate and 3-month annualized basis rate — could suggest the price is on track to go upwards soon, according to a crypto analyst.

“Looks like we’re consolidating before the next leg up,” Reflexivity Research co-founder Will Clemente wrote in a May 7 post on X, explaining that both Bitcoin’s funding rate and Basis rate have “cooled off” after briefly reaching negative readings.

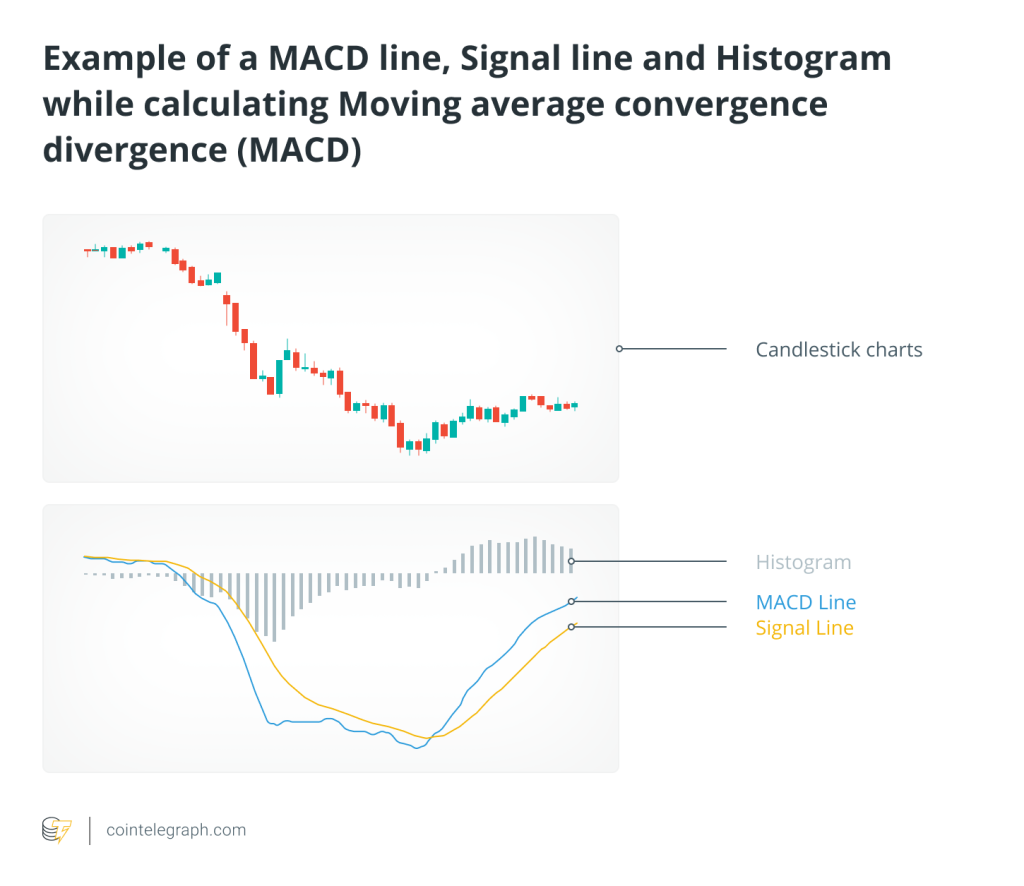

Bitcoin’s funding rate is often used to track overall trader sentiment for the cryptocurrency market. Exchanges use this rate to balance out traders entering long positions with those opting for short positions to mitigate the risk of overexposure.

When long-position traders take more dominant positions, the funding rate turns positive, indicating their confidence in Bitcoin’s price increasing.

At the time of writing, the OI-weighted funding rate is 0.0091%, having recovered from a negative rate of -0.0050% on May 4, as per CoinGlass data.

“Sounds like the calm before the storm,” said pseudonymous crypto commentator Crypto Empire.

“The Bitcoin funding rates still remaining this low, while Bitcoin is bouncing makes me feel extremely bullish,” echoed pseudonymous crypto trader Mister Crypto to their 98,000 X followers.

The shift in the funding rate over the four-day period was also mirrored by a slight increase in Bitcoin’s price, which rose 1.11% to $62,361, as per CoinMarketCap data.

Related: Bitcoin trader flags key levels as BTC price attacks $64K liquidity

However, liquidation data contradicts this, suggesting that futures traders are still leaning bearish and anticipate a near-term price drop.

A 3.5% rise in price to the key $65,000 level could liquidate $1.36 billion in short positions, meanwhile, a 3.5% drop to $60,500 in contrast would only wipe out $650 million in long positions.

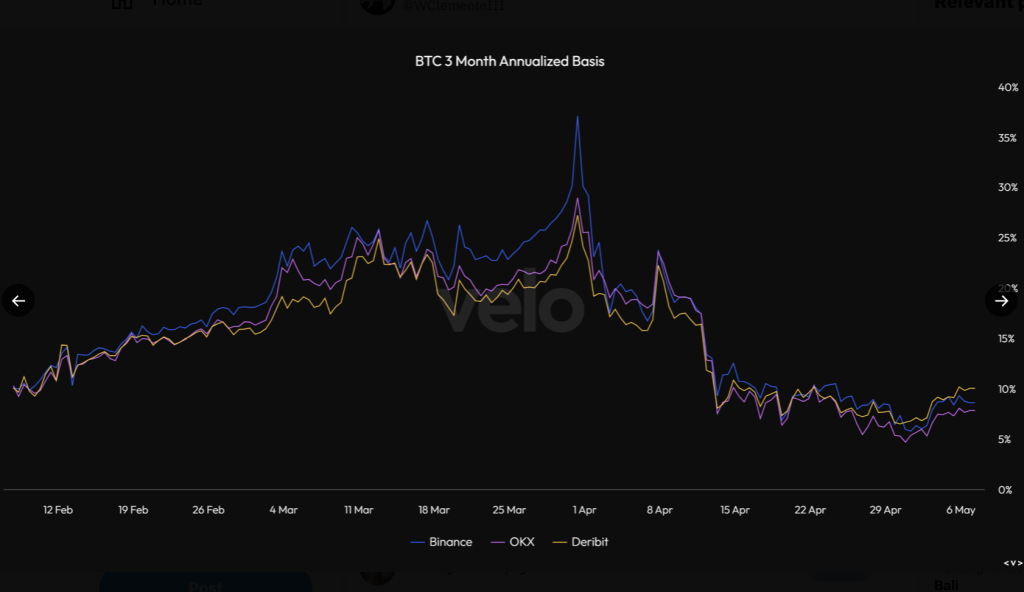

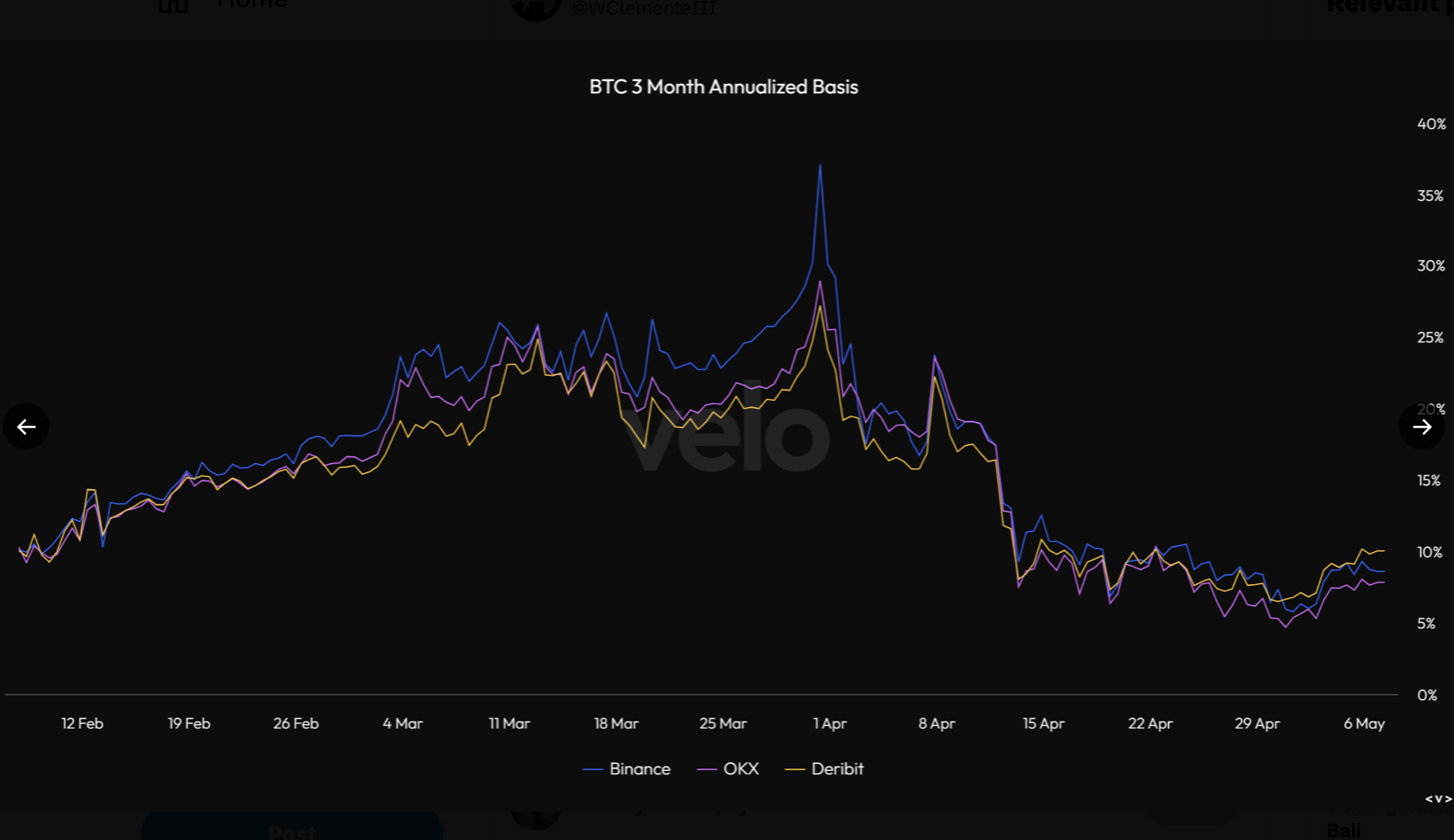

Meanwhile, some traders also note that Bitcoin’s annualized basis rate has increased to the higher end of the 5-10% neutral range on major exchanges such as Binance, OKX, and Deribit.

The annualized basis rate is a way to measure the cost difference between a Bitcoin futures contract and the actual price of Bitcoin.

Traders often view rates above 10% as a neutral-to-bullish signal.

Responses