Bitcoin distribution 'danger zone' over, analysts say

Bitcoin’s post-halving "danger zone" is over as Bitcoin establishes a firm footing above the $60,000 re-accumulation range, new analysis suggests.

Bitcoin’s (BTC) price rose above the $65,000 mark on May 6 as analysts argue that the post-halving “danger zone” may be over with more BTC upside on the way.

Bitcoin out of the post-halving ‘danger zone’ – analyst

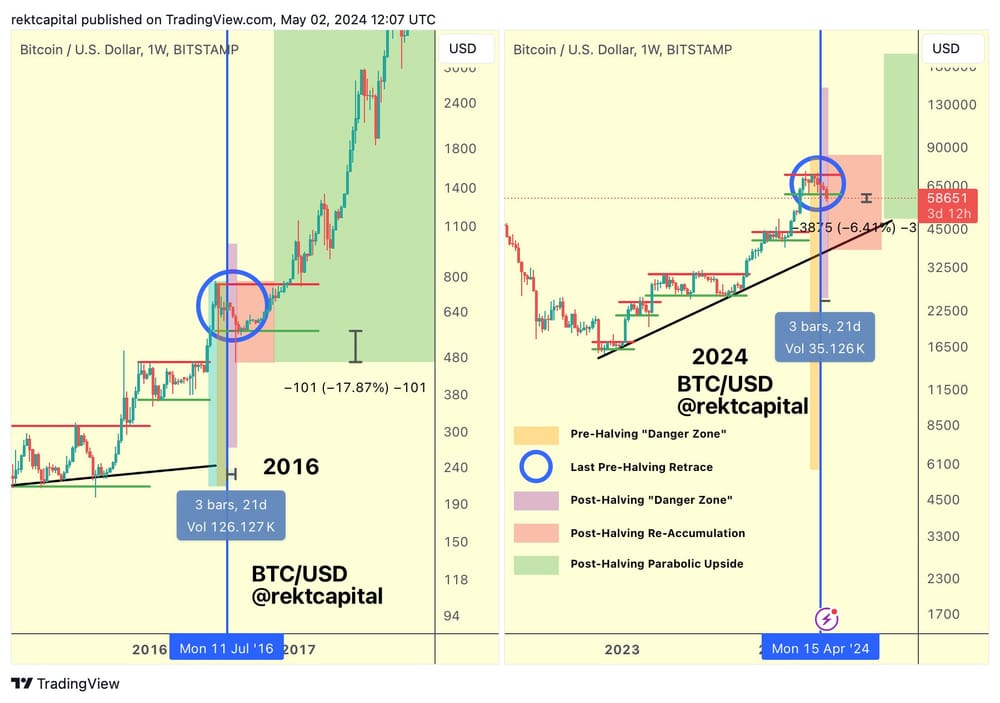

Bitcoin’s post-halving “danger zone” is a three-week window after the halving, historically associated with downside volatility occurring below the re-accumulation range.

With Bitcoin rising above the current re-accumulation range of approximately $60,000, the post-halving danger zone may be over, according to popular crypto analyst Rekt Capital. He wrote in a May 6 post:

“Time-wise the post-Halving “Danger Zone” will continue for the remainder of this week, to see out its third final week in this post-Halving window. However, price-wise the anticipated effect has already occurred.”

During the 2016 bull cycle, Bitcoin produced an 11% downside wick 21 days after the halving, which marked the beginning of the price reversal, noted Rekt Capital in a May 6 X post:

“History did repeat because in this cycle Bitcoin produced a -6% downside wick below its respective Range Low in the 15 days after the Halving. Bitcoin has since rebounded strongly to the upside… The Bitcoin Post-Halving “Danger Zone” is over.”

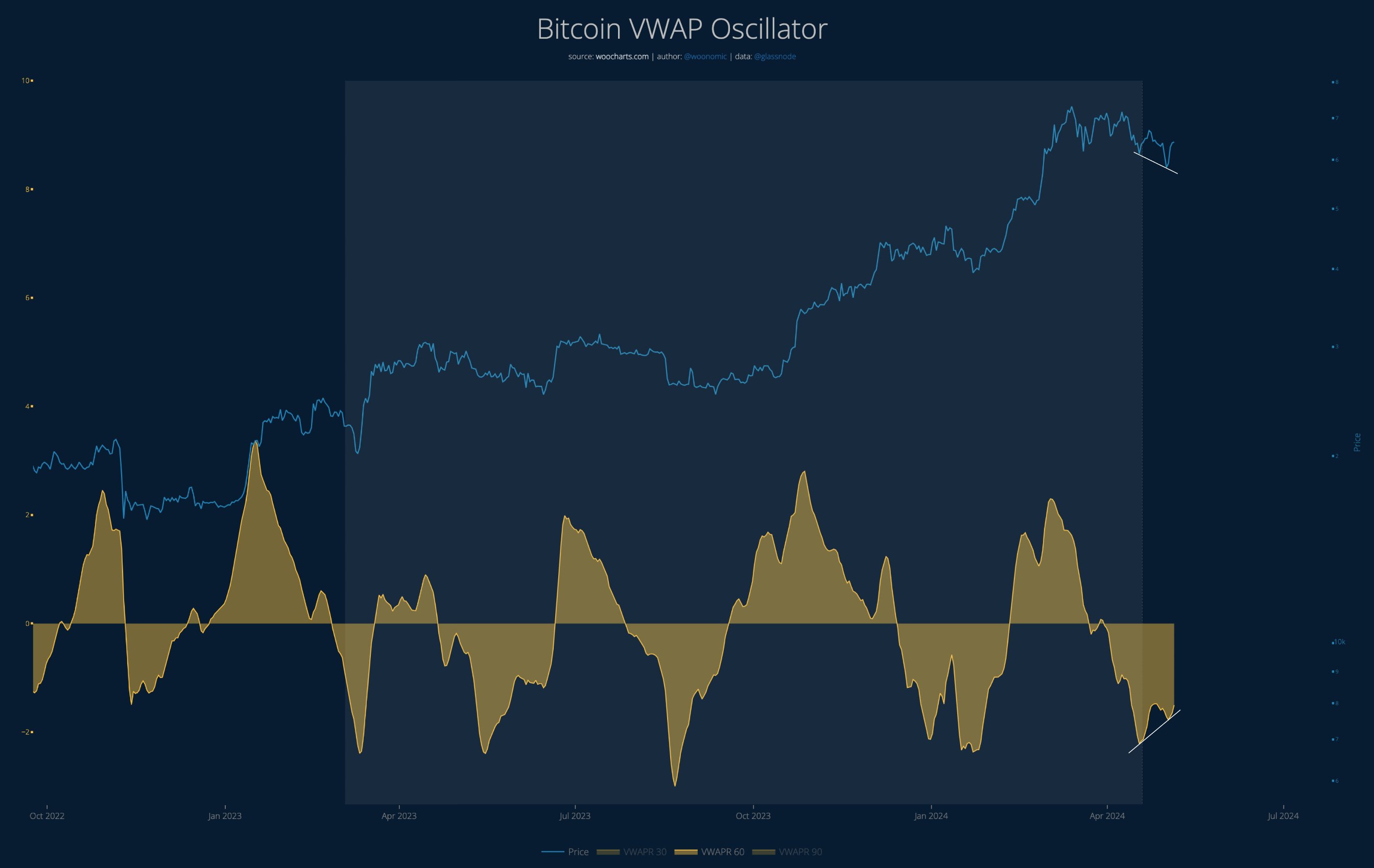

Meanwhile, Bitcoin analyst Willy Woo also expects higher BTC prices based on the Volume-Weighted Average Price (VWAP), a popular oscillator used by traders to determine the average asset price based on price action and volume.

Woo wrote in a May 6 X post:

“Seems like a good setup for BTC to reach escape velocity. Bull divergence with lots of room to run.”

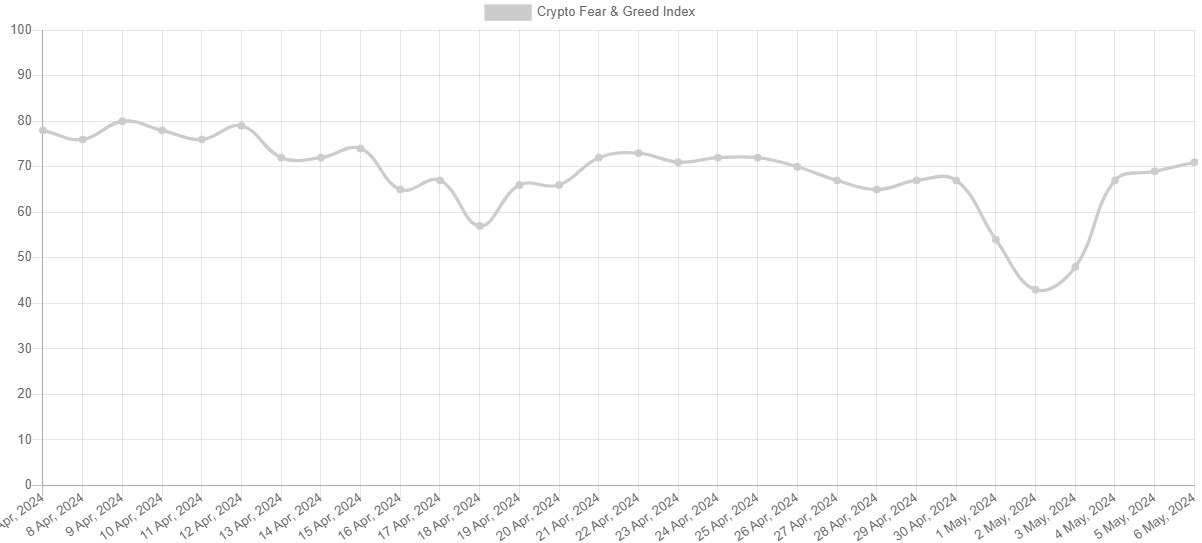

Further showcasing a change in investor sentiment, the Crypto Fear & Greed Index rose to 71/100, signaling “greed,” up from 43/100, or “fear,” on May 2.

Are Bitcoin’s long-term holders done selling?

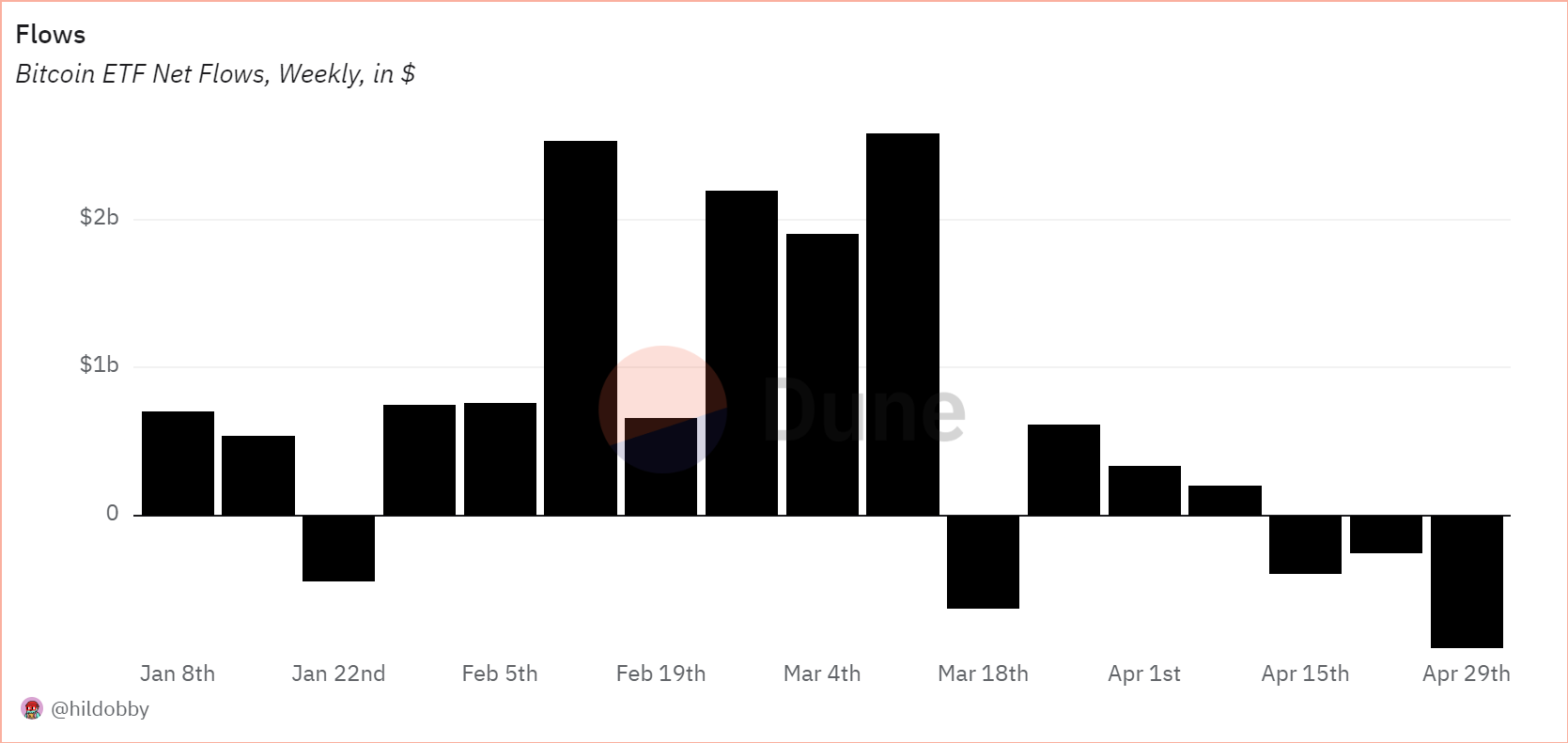

Outflows from the 11 United States spot Bitcoin exchange-traded funds (ETFs) have contributed to Bitcoin’s correction. The U.S. ETFs recorded their highest week of outflows since launch, with nearly $900 million in net cumulative outflows over the past week, according to Dune data.

Related: Bitcoin enters ‘new era’ as whales scoop up over 47K BTC during price pullback

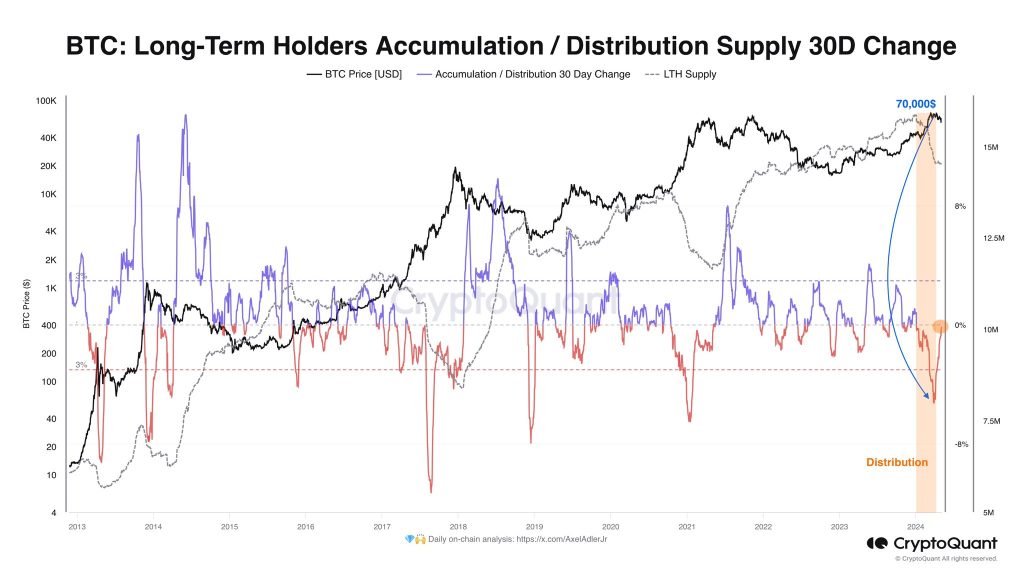

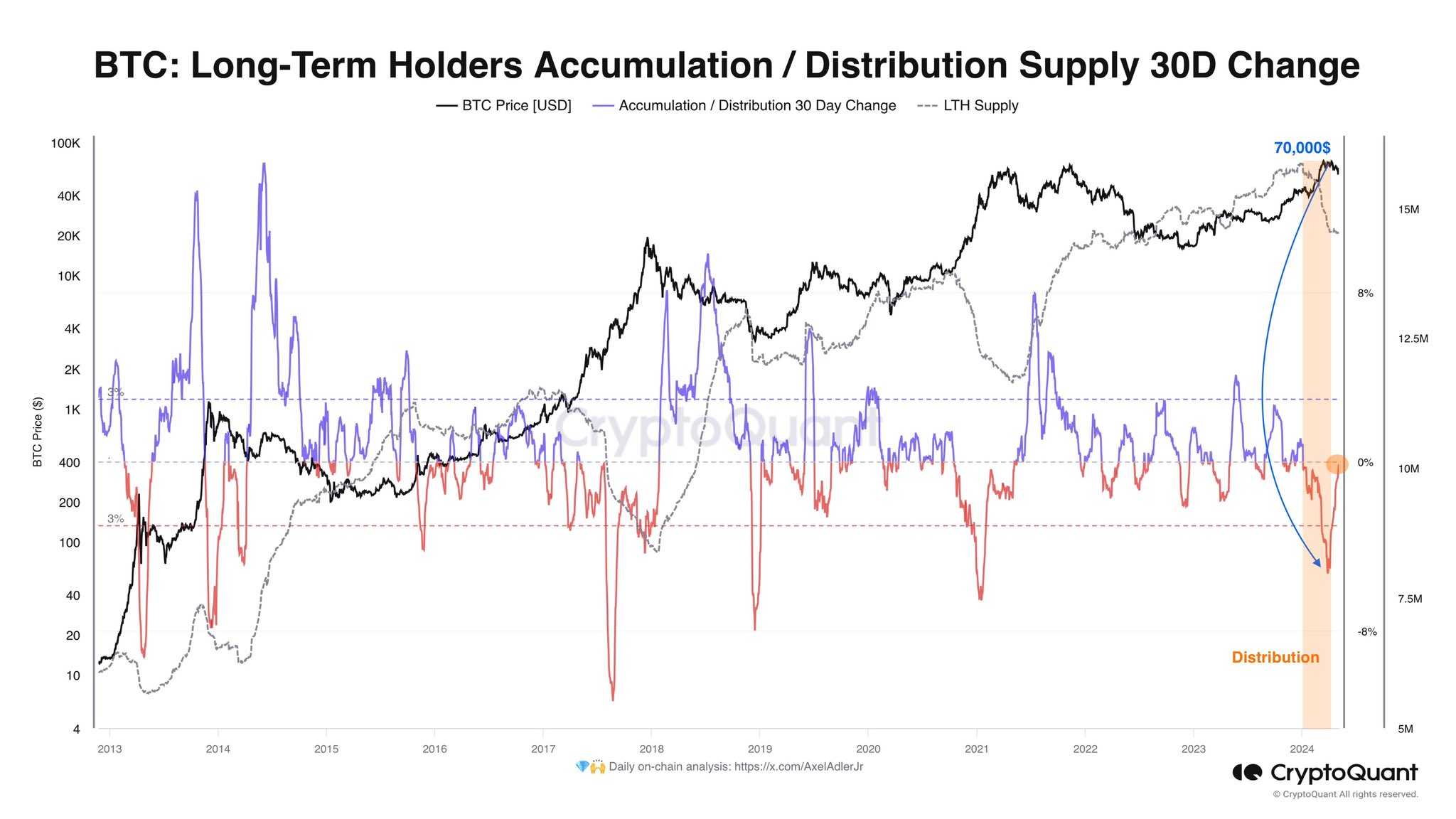

Interestingly, data suggests that long-term holders (LTH) at the $70,000 price have finished selling to new investors. Thus, a new active accumulation phase could be starting, according to CryptoQuant author Axel Adler Jr’s May 6 X post.

This can significantly reduce Bitcoin’s sell pressure, paving the way toward a gradual climb to new highs, according to Eitan Katz, the founder of Kima, a decentralized money transfer protocol. Katz told Cointelegraph:

“The completion of distribution by long-term holders at the $70,000 mark could indeed alleviate some sell pressure in the market. This scenario might contribute to a more stable environment and provide new investors with a clearer path for growth.”

However, Bitcoin could remain subdued in the short-term, due to concerns over inflation and dampened expectations for rate cuts, according to Mithil Thakore, the CEO of Velar, a Bitcoin-native liquidity protocol. Thakore told Cointelegraph:

“Last week’s decision by the Federal Reserve to maintain interest rates at two-decade highs, while signaling potential future reductions, adds complexity to the market landscape. Considering these factors, short-term consolidation below the previous all-time high is conceivable.”

After the current short-term consolidation, Thakore expects Bitcoin price to reach $100,000 before the end of 2024. He said:

“The latter part of 2024 holds promise for Bitcoin. Anticipated interest rate reductions, renewed demand in ETFs, and advancements in Bitcoin Layer 2 solutions may fuel a resurgence, potentially propelling Bitcoin to new all-time highs and the coveted $100,000 milestone.”

Related: ‘Mr. 100’ buys the Bitcoin dip for the first time since halving — Is the BTC bottom in?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses