Bitcoin Runes reclaims dominance over BTC transactions

Runes made a recovery to account for the lion’s share of transactions over the Bitcoin network.

Bitcoin Runes has regained its top position within the Bitcoin network by surpassing the original Bitcoin (BTC), Ordinals, and BRC-20 in terms of daily transactions.

The Runes protocol launched on April 20 — coinciding with the fourth Bitcoin halving — to increase efficiency on BRC-20, an experimental standard for fungible tokens on the Bitcoin blockchain.

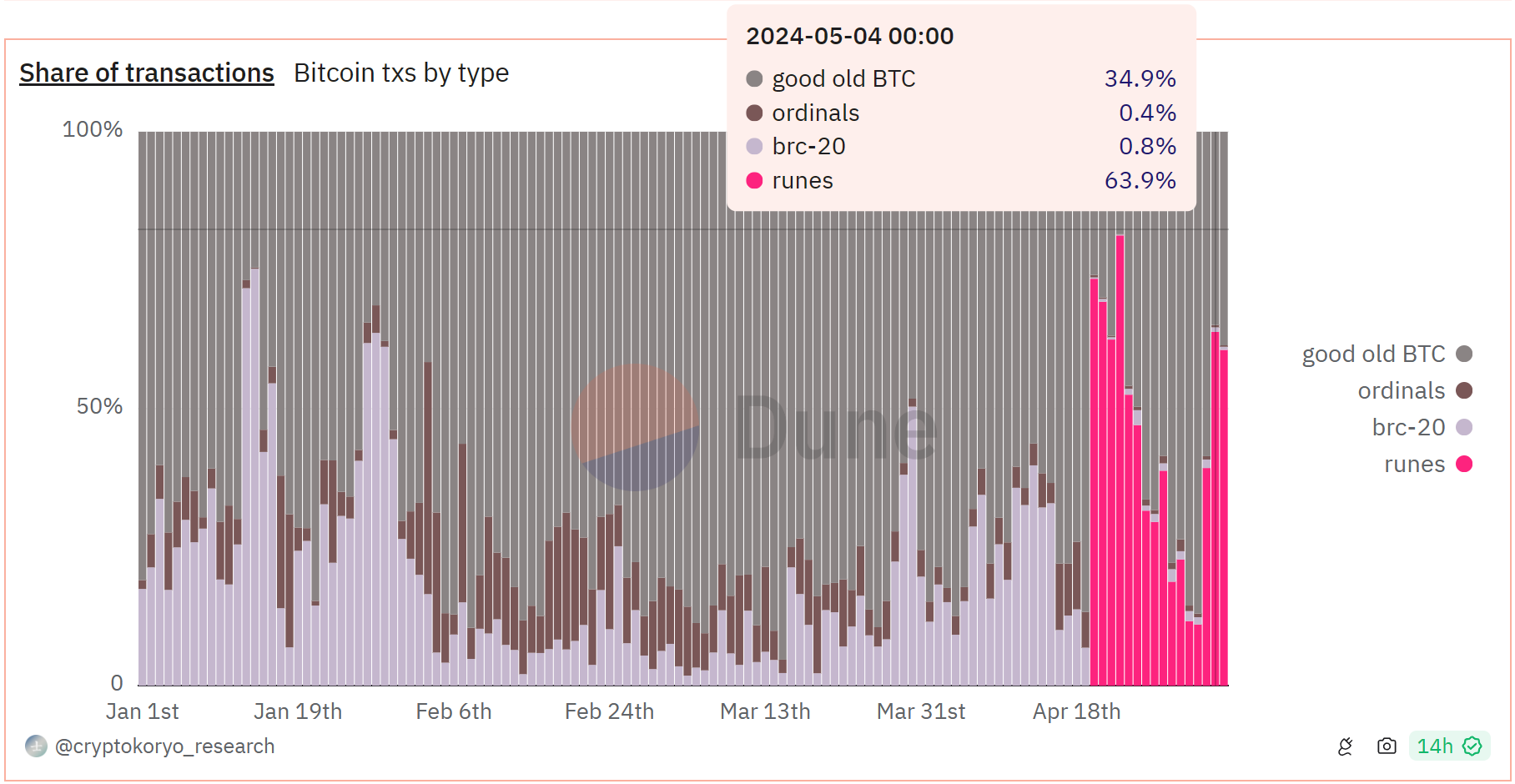

Data from Dune Analytics shows that Runes-related transactions made up a majority of the transactions on the Bitcoin network until April 24.

Runes claimed the highest transaction share, 81.3%, on April 23, pushing BTC’s transaction share down to 18.15% and Ordinals and BRC-20 transactions at 0.1% each. However, Runes transactions dwindled consistently over the next nine days until March 2.

As shown above, Runes began to make a recovery from March 3. In the following days, on March 4 and 5, Runes regained its transaction share over 60%.

Related: Solo Bitcoin miner wins the 3.125 BTC lottery, solving valid block

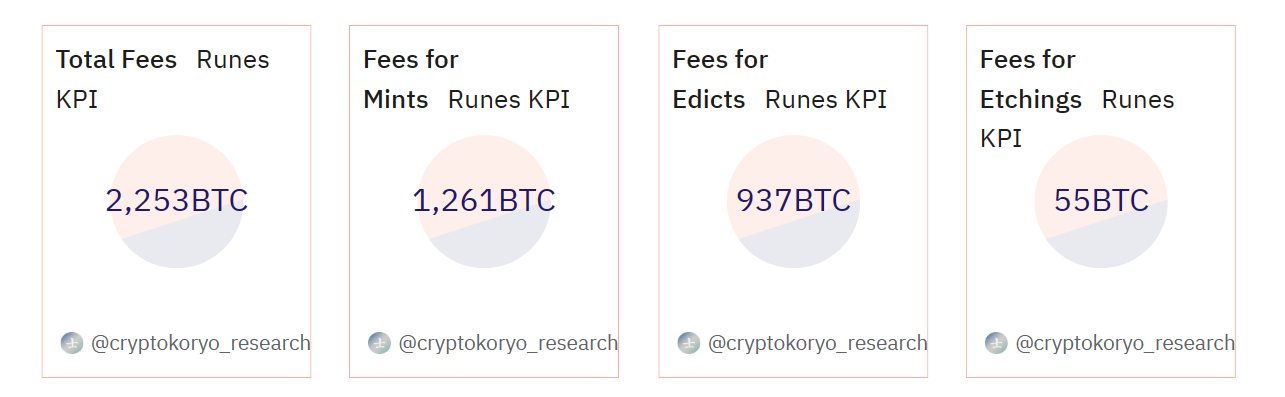

While the rapid increase in the number of transactions inadvertently increases the network fees, it often works in the favor of Bitcoin miners. The Runes protocol racked up 2,253 BTC in fees for the mining community in 16 days.

The mining community welcomes rising fees as their earnings dropped significantly following the Bitcoin halving. In May, total revenue for Bitcoin miners dropped to under $30 million per day.

Total value in United States dollars of Coinbase block rewards and transaction fees paid to miners. Source: blockchain.com

To maintain profitability, miners have resorted to upgrading their current technology stack with highly efficient mining rigs to reduce operating costs and improve performance and profitability.

Bitcoin mining firm Bitfarms allotted $240 million for its upgrade which would eventually triple its hash rate to 21 exahashes per second (EH/s). Additionally, Bitfarms sold nearly all the Bitcoin it mined over the past two months as it continues to reinvest into growing its mining fleet.

Responses