3 signs hint that Bitcoin price is nearing a bottom

The result of today’s Federal Reserve minutes, Bitcoin miners’ robustness and increasing stablecoin demand in China could be signs that BTC has bottomed.

Bitcoin (BTC) price crashed between April 30 and May 1, with its price decreasing by 11.5% to $56,522. This downturn triggered $172 million in leveraged long position liquidations, which is notably low given that BTC futures open interest was at $28.9 billion before the price crash. Consequently, it would be simplistic to assume that bulls were taken by surprise.

Uncertainty should drop after the Fed minutes publish

Some analysts believe that investors are in a holding pattern until Jerome Powell, Chair of the United States Federal Reserve (Fed), concludes his speech following the two-day monetary council meeting on May 1. Although it is widely expected that the Fed will maintain interest rates at 5.25%, there is considerable skepticism regarding the U.S. Treasury Department’s ability to finance the government’s budget.

On April 30, the yield on the U.S. Treasury 2-year note climbed to its highest level in five months, reaching 5.06%, as investors sought higher returns to offset increased risk following the announcement of a $1.07 trillion deficit for the first half of 2024. Since the Fed’s rate hikes throughout 2023, interest expenses on the deficit have risen by 23% in the first half of 2024 and are projected to continue to rise as long as rates remain elevated.

Bitcoin is not alone in facing declines; the worsening macroeconomic conditions have made investors more risk-averse. The Russell 2000 Index (RTY), which tracks mid and small-cap U.S.-listed companies, fell by 8.2% over the last 30 days, wiping out gains from the previous two months. Similarly, WTI oil prices have dropped 8.3% since April 5, when they reached a five-month peak of $87.91.

A key indication that Bitcoin’s price correction may be reaching a bottom stems from the traditional markets, following a series of robust first-quarter corporate earnings reports from major companies such as Amazon, Microsoft, Google, Netflix, TSMC, Samsung, Coca-Cola, Morgan Stanley, Citigroup, HSBC and Barclays. A temporary recovery in the stock market shifts investor focus away from Bitcoin and other risk-on assets, although traders may seek alternatives if the Fed decides to maintain higher rates for an extended period.

Bitcoin miner capitulation FUD and strong crypto influx in China

Bitcoin miners are under significant strain after the April 20 halving, which reduced their rewards by 50% to 3.125 BTC per block. Ki Young Ju, CEO of CryptoQuant, mentioned that estimates of miners’ outflows to exchanges show no signs of capitulation “for now”. Young Ju added that if the Bitcoin price downtrend “stretches into a weeks-long spell, big miners are at risk of having to liquidate a bunch of Bitcoin.”

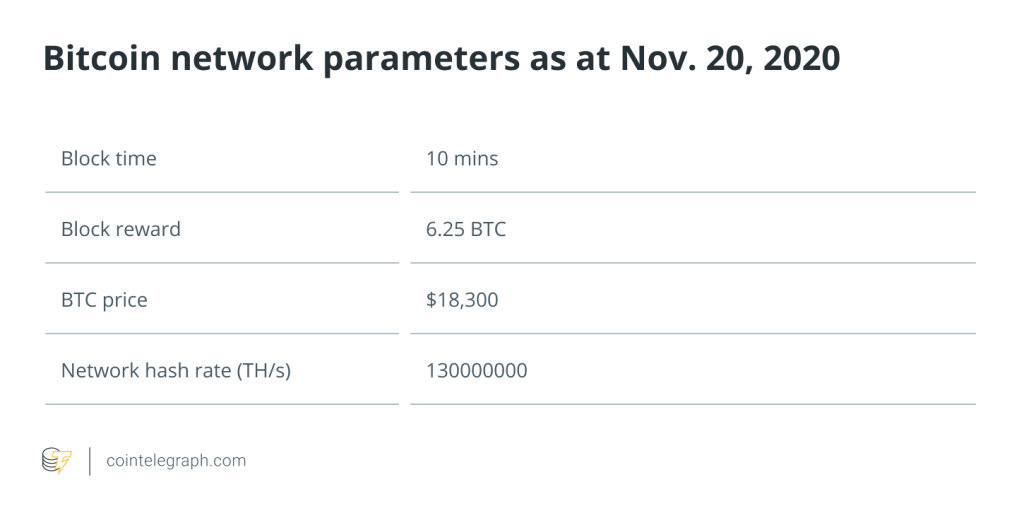

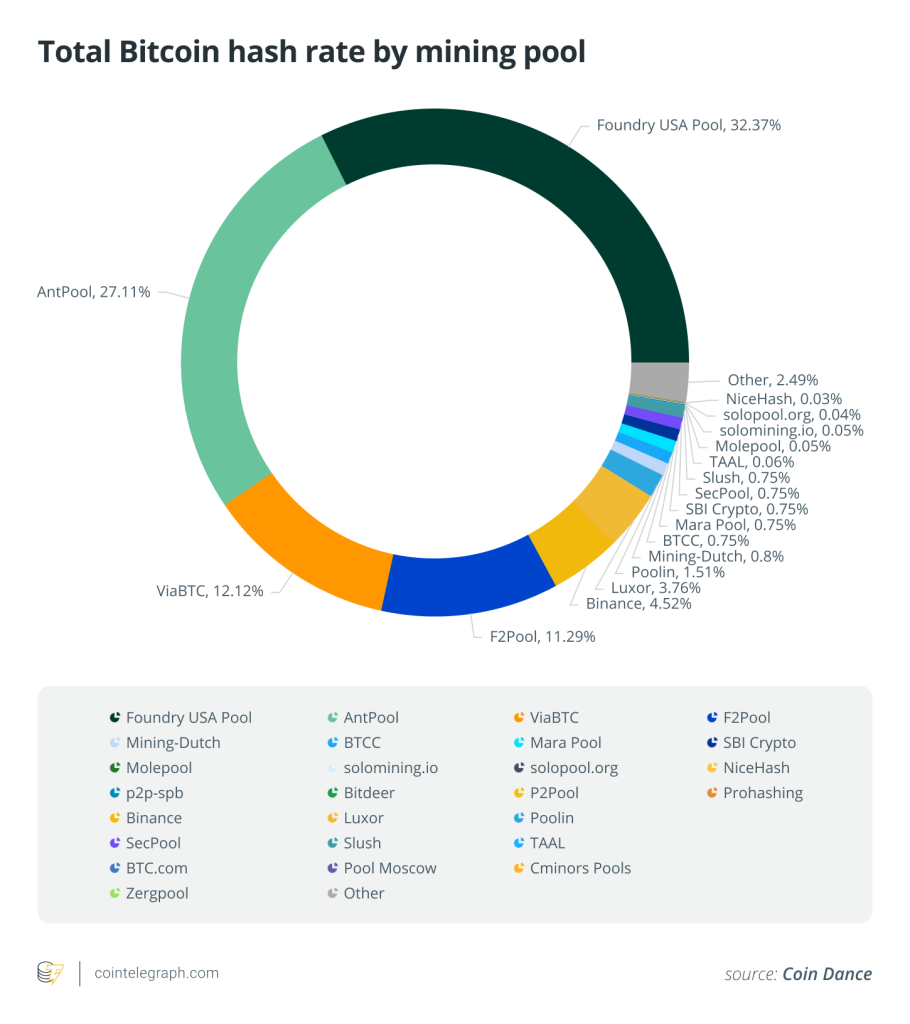

Thus, another sign that Bitcoin’s downturn may be nearing its end is the steadfastness of miners, who remain reluctant to sell despite a 57% drop in the Hashrate Index, as reported by Luxor Technology. This metric assesses the daily expected return of one terahash of hashing power, factoring in network difficulty, Bitcoin’s price, and transaction fees.

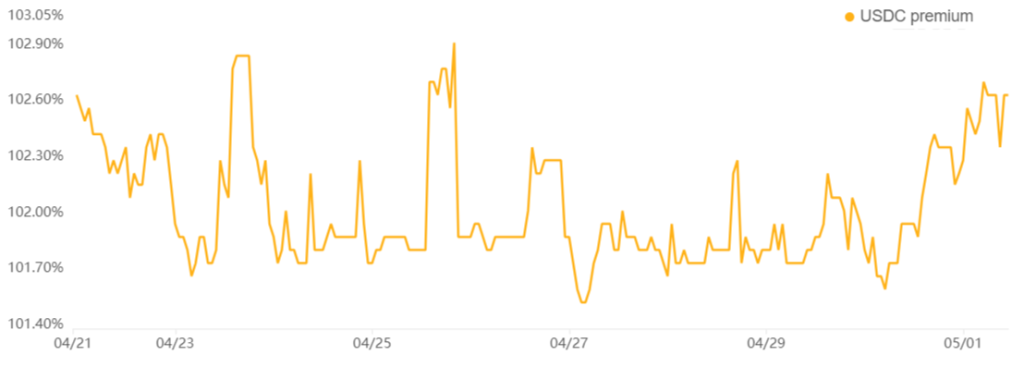

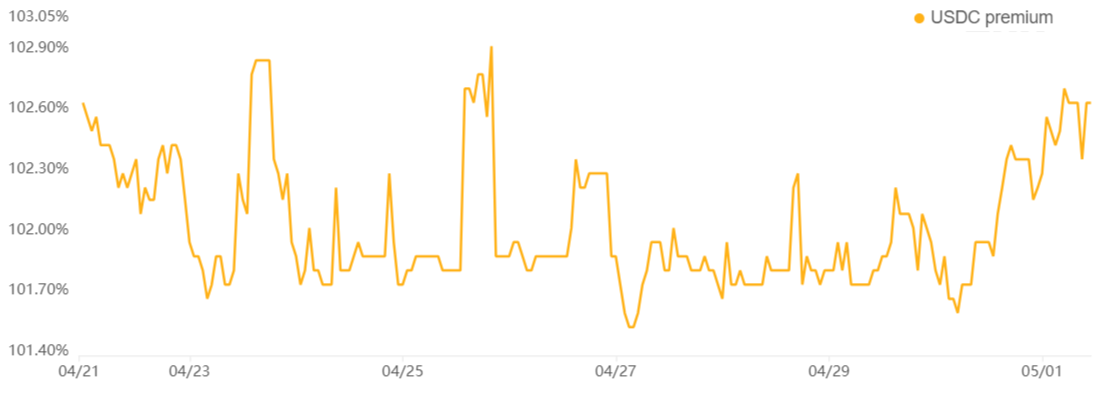

To understand the broader sentiment in the cryptocurrency market, examining the demand for stablecoins in China, particularly for USD Coin (USDC), can be enlightening. The premium on USDC transactions over the official U.S. dollar rate offers insight into retail investors’ activities, indicating whether they are moving into or out of cryptocurrency markets.

Related: The reasons Bitcoin price is down 11% since the halving

On May 1, the premium for USDC in China increased to 2.7%, signifying a robust demand for converting the Chinese Yuan (CNY), into USDC. This sustained interest points to a positive sentiment towards cryptocurrencies in China, bolstering an optimistic outlook for Bitcoin, which recently saw a 20% decline in price over three weeks.

However, despite potential improvements in market sentiment following the Federal Reserve’s notes and the realization that fears of miner capitulation are, thus far, unfounded, the situation in U.S. markets shows a different trend. Specifically, net outflows from U.S.-listed spot exchange-traded funds (ETFs) amounted to $635 million in the past five trading days.

Such findings suggest that investment flows are crucial in determining Bitcoin’s price movements, with no certainty that the $56,500 support level will hold.

Responses