The reasons Bitcoin price is down 11% since the halving

Bitcoin’s current price action is “hardly a surprise” given the extraordinary bullish action leading up to the fourth halving.

The Bitcoin (BTC) price has sharply declined over the past few days, which might have triggered some concerns from those who thought Bitcoin would surge after its fourth halving.

The price of Bitcoin has dropped 11% since the fourth Bitcoin halving, which occurred on April 20, at 12:09 am UTC.

On the halving date, Bitcoin traded around $64,000. In the immediate aftermath of halving, Bitcoin saw a short rally, topping above $67,000 on April 22. But since then, Bitcoin has been gradually selling off, tumbling below $57,000 on May 1, according to CoinGecko data.

At the time of writing, Bitcoin is trading at $57,362, down around 7% over the past 24 hours and more than 17% over the past 30 days.

The sharp decline of the Bitcoin price post-halving might have surprised someone who expected BTC to start rising in the aftermath of halving in line with some of the previous halving-linked cycles.

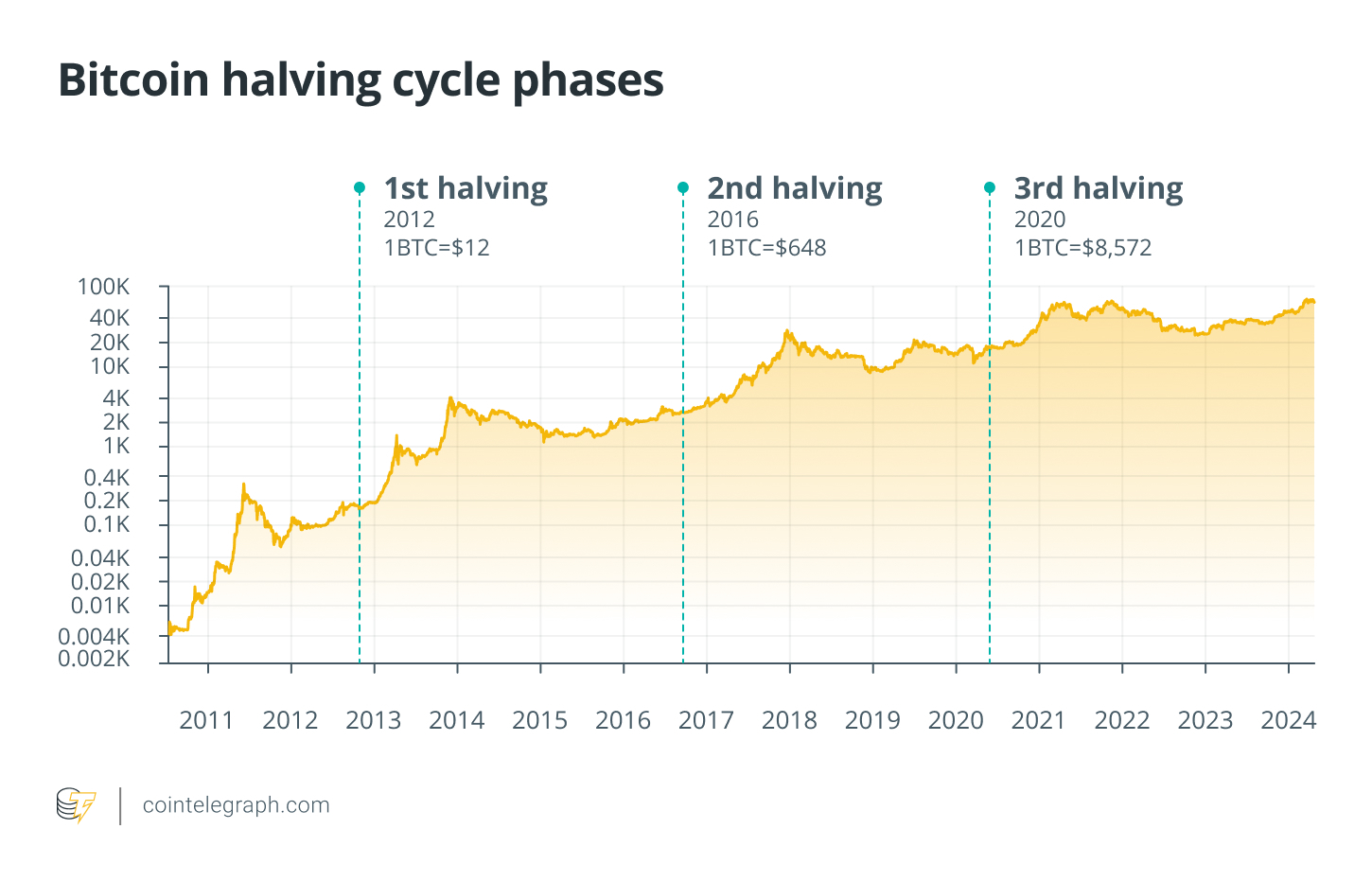

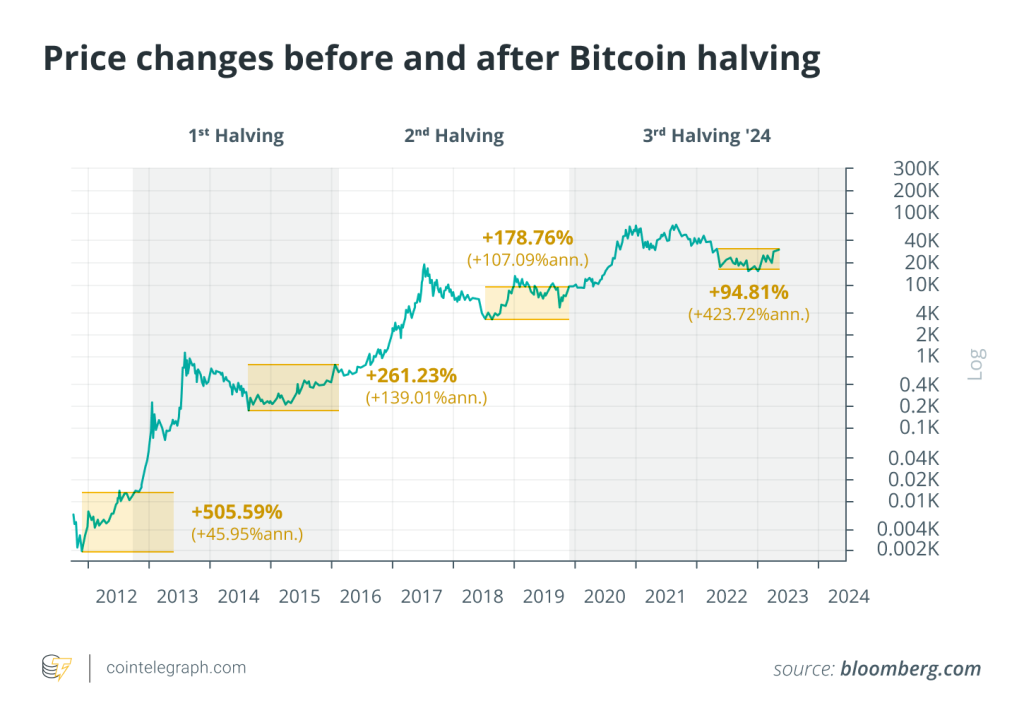

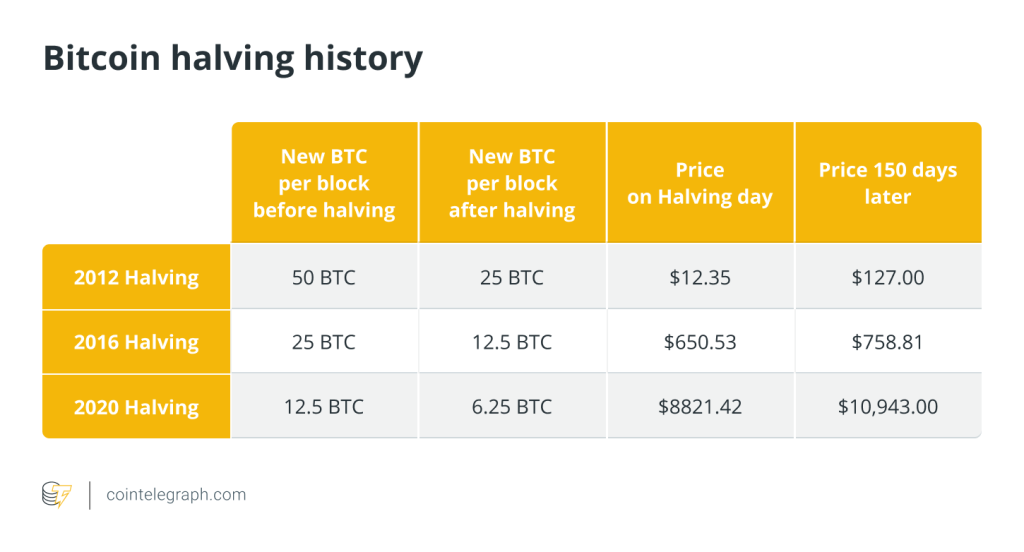

As previously mentioned, Bitcoin halvings have been historically associated with post-halving rallies, usually coming in about a year or more. For example, Bitcoin skyrocketed about 3,000% in 17 months after halving in 2016, reaching a milestone of $20,000 in December 2017.

However, the ongoing cycle has been very different from the past in terms of Bitcoin halving characteristics. One such difference is that Bitcoin experienced an extraordinary bull run before the fourth halving, reaching a new all-time high right before the halving event. Such a price trajectory has never been seen before in the history of Bitcoin.

“What’s unique about this latest Bitcoin halving is the incredible bull run and price action leading up to it. Even considering this recent pullback, Bitcoin has still been up 35% since the start of the year,” Quantum Economics founder Mati Greenspan told Cointelegraph.

Greenspan noted that the current drop in the price of BTC was somewhat expected in the context of a decline in the stock market and economic circumstances, stating:

“Considering the expectation of yet another Fed pivot and what’s happening in the stock market, Bitcoin’s current price action is hardly a surprise. We’ll be a lot smarter about that later today, though.”

Some crypto analysts have previously predicted that Bitcoin will drop following the fourth halving. In March 2024, Bitcoin analysts from JPMorgan predicted that Bitcoin could drop toward $42,000 after the halving.

Related: BlackRock’s Bitcoin ETF daily inflow on halt for 4 days

According to 10x Research CEO and head analyst Markus Thielen, Bitcoin may fall to $52,000 following the halving. The analyst believes that the primary driver for the recent Bitcoin rally was the inflow of funds into Bitcoin exchange-traded funds, which has dramatically slowed down in the past month.

According to some analysts, including investment researcher Lyn Alden, there are many more reasons than just the halving and U.S. Bitcoin ETFs for Bitcoin to surge to new highs in 2024.

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in

Responses