Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

Analysts from investing banking firm Benchmark initiated coverage on Hut 8, issuing a “buy” rating and setting a $12 target for the firm’s share price.

United States Bitcoin (BTC) miner Hut 8’s plans to expand its self-mining operations and its scope of diversified revenue streams will make it more competitive in a post-halving world, according to investing banking firm Benchmark.

In an April 22 research note viewed by Cointelegraph, Benchmark senior analyst Mark Palmer explained that the “new HUT” — a firm borne out of a merger between the “old HUT” and US Bitcoin Corporation — boasted a “diversified business model” with multiple revenue streams.

Benchmark initiated coverage of Hut 8 stock and set a $12 price target — a near 30% increase from its current share price of $9.22, per TradingView data.

Hut 8’s current self-mining hash rate of 5.4 exahash per second (EH/S) remains far below that of self-mining category leader Marathon Digital which has a deployed rate of 27.8 EH/s, but despite this, Palmer said he expects this gap to close over time.

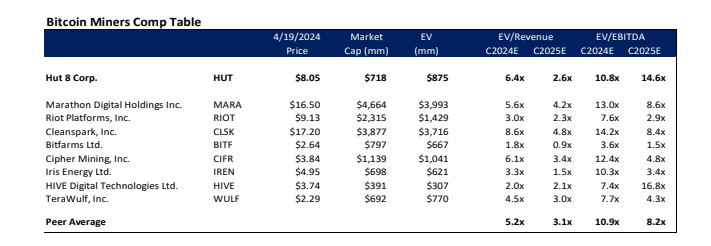

“Hut trades at a discount to its Bitcoin mining peers that we expect to shrink as the company executes on its self-mining expansion plans.”

Palmer looked to Hut 8’s multiple revenue streams, which include self-mining, cloud computing, high-performance computing, and artificial intelligence services, as justification for his price target.

Related: Biden is asking Congress to kill the American Bitcoin mining industry

“We believe the diversity of Hut 8’s platform will benefit it over the long-term, as its revenue streams outside of self-mining position it to weather severe downturns in Bitcoin’s price better than most of its listed peers, in our view,” Palmer said.

Additionally, Palmer explained that Hut 8 touts an enterprise value-to-revenue multiple of 2.6 which is slightly below that of the 3.1 average of its publicly traded Bitcoin mining peers including, Marathon Digital, Riot Platforms, and several others.

While Palmer conceded that Hut 8 still needs to upgrade its hash rate he said its 9,102 Bitcoin held on reserve provided it with a “sizable liquidity cushion” as well as an ability to capture upside moves if the price of BTC were to rally significantly in the coming months.

On Feb. 7, Hut 8 announced a leadership shakeup, with former CEO Jamie Leverton being replaced by Asher Genoot, the then-president and sitting member of the company’s board of directors.

The management re-structure came just weeks after short-selling firm JCapital published a report claiming that Hut 8 was in “legal trouble” and warned investors in the Florida-based Bitcoin miner of “upcoming pump and dump.”

Hut 8 slammed the share seller report as a “deliberate attempt to spread misinformation,” claiming it was filled with inaccurate information and misrepresented data.

Responses