BTC trades at 'deep discount' after halving — 5 things to know in Bitcoin this week

Bitcoin has a new countdown after the halving as the days of a sub-$100,000 BTC price are "numbered," new analysis suggests.

Bitcoin (BTC) begins the first week of its new halving epoch in fighting form as bulls inch closer toward $70,000.

BTC price action is potentially finding its feet again after a successful halving begins the latest chapter, or epoch, in Bitcoin’s history.

After a week of volatility and breakdowns to six-week lows, Bitcoin has certainly tested traders’ resolve — has the market put the worst behind it?

Analysts are toying with some familiar forces. Halvings tend to see BTC price downside before a dramatic recovery, but this tends to play out over many months, not days or weeks.

This cycle, however, has been one of many firsts — notably a new all-time high for BTC/USD before the halving event itself takes place.

Anything could thus be possible in 2024 as miners adjust to the new reality and Bitcoin continues to navigate a fragile geopolitical and macroeconomic landscape.

Cointelegraph takes a closer look at the key issues on the radar for Bitcoin market participants going forward in the weekly digest of BTC price triggers to look out for.

Liquidity keeps lid on Bitcoin’s post-halving rebound

After an uneventful weekly close, BTC/USD soon upped the stakes with a push beyond $66,000 — its highest levels since April 15.

Currently circling the $66,000 mark, per data from Cointelegraph Markets Pro and TradingView, the pair is a major focus for traders ahead of the week’s first Wall Street open.

Last week was characterized by selling during United States trading hours.

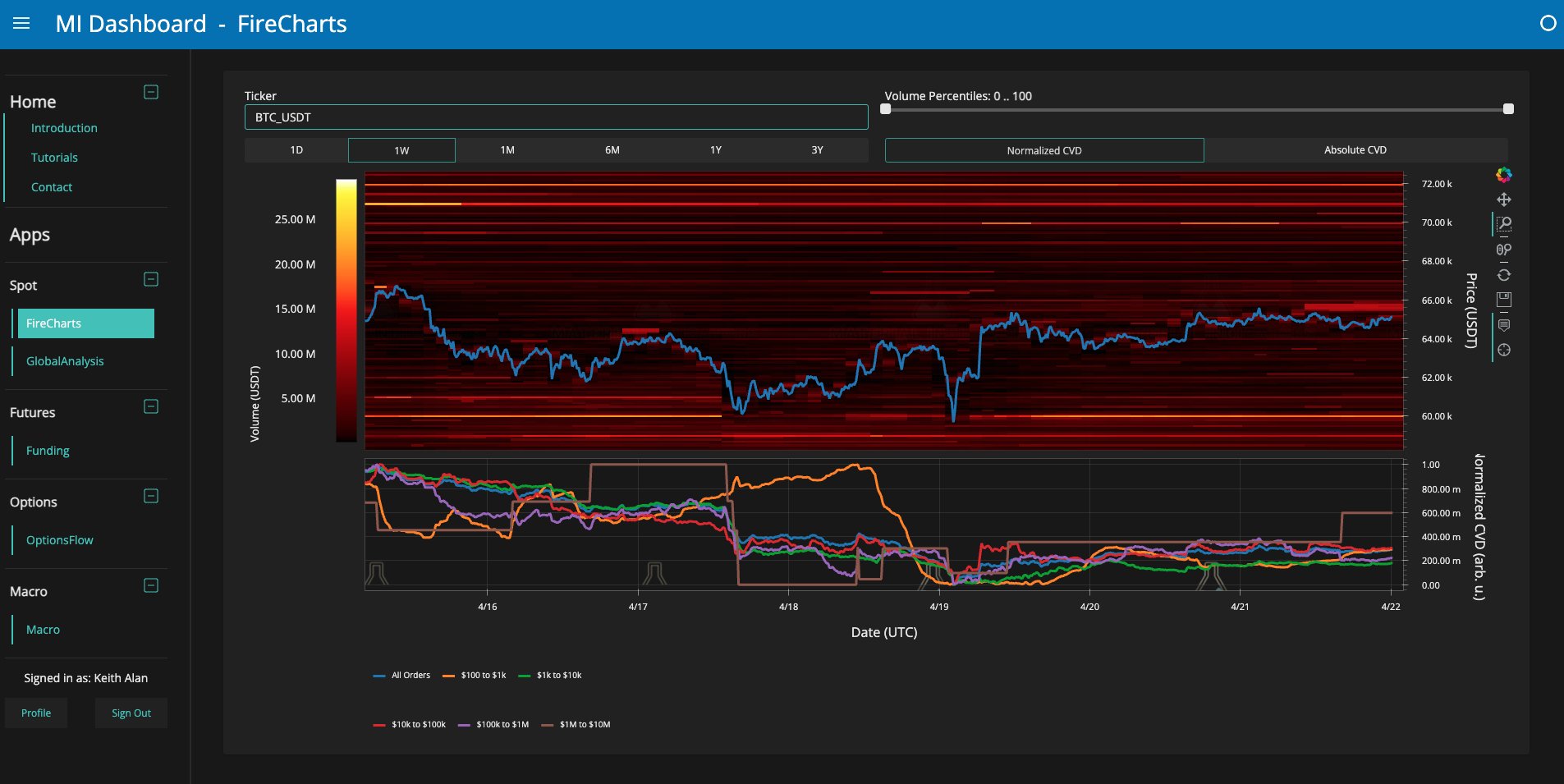

Analyzing the current order book setup, Keith Alan, co-founder of trading resource Material Indicators, eyed a large block of ask liquidity immediately above spot price.

“Seems like this fat block of BTC ask liquidity may have been put in place to prevent a Green W close,” he suggested in a post on X (formerly Twitter).

“I’m speculating about the possibility that one of THE 10 #BTCETF institutions put that up to keep price from running back to the $70k range before TradFi markets open and they have a chance to buy a dip.”

Alan noted that this liquidity was not supplied while Wall Street was absent.

“In fact, it may be the reason they didn’t dump it on the weekend. After all, there’s no benefit for them if they can’t buy,” he reasoned.

“Expecting some volatility on Monday.”

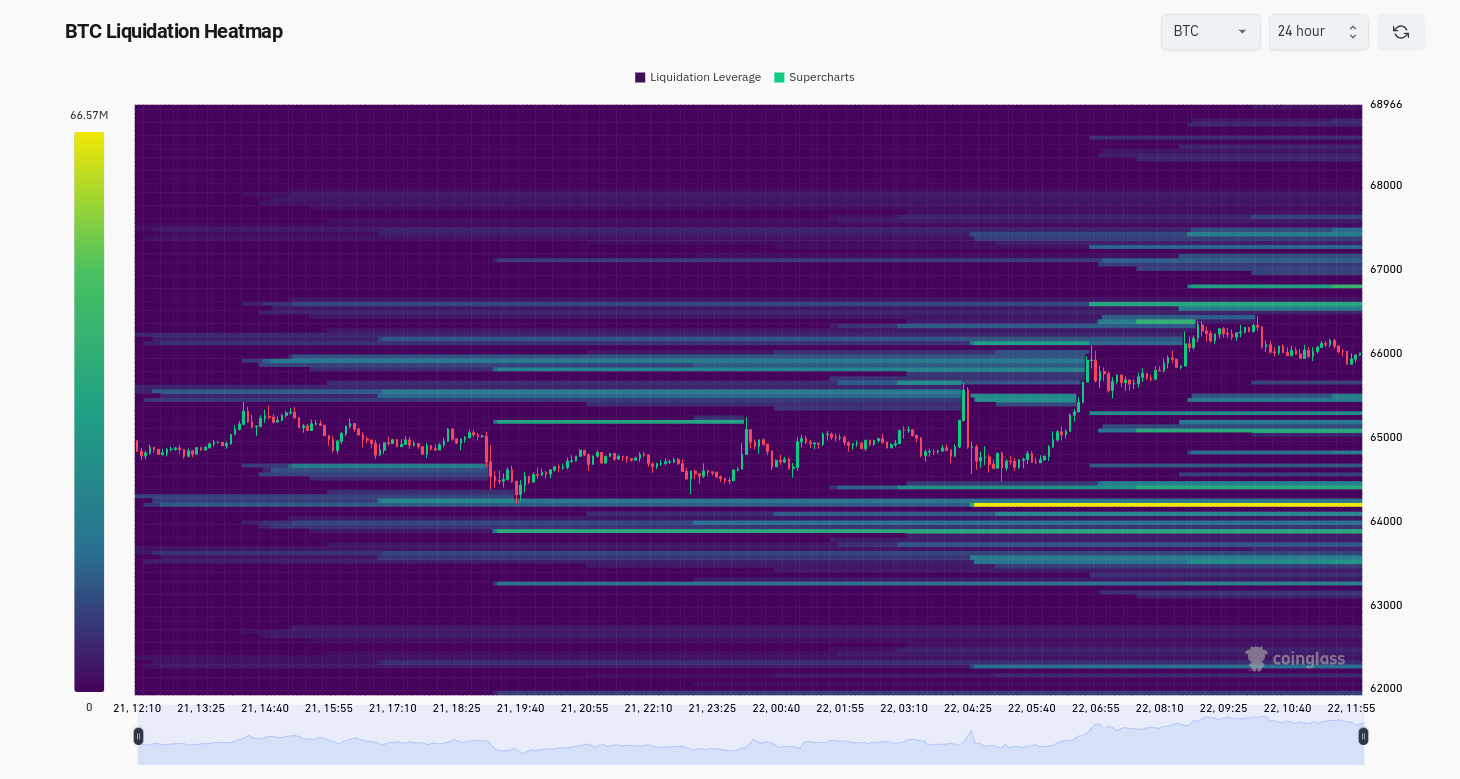

The latest order book data from monitoring resource CoinGlass shows Bitcoin eating through some of the liquidity at the time of writing, with the majority stacked around $66,600.

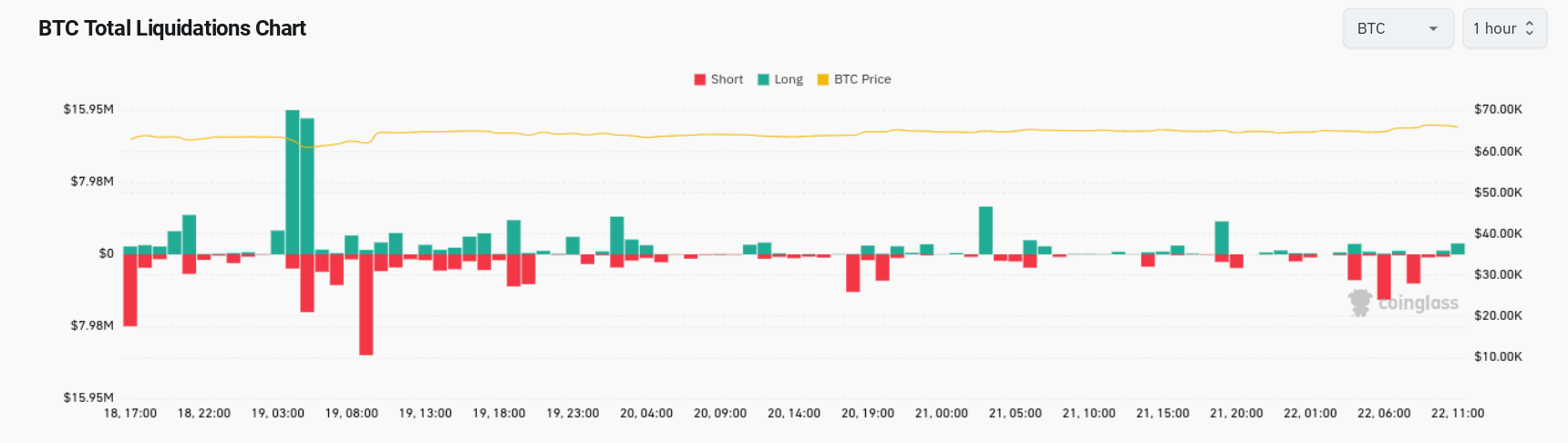

CoinGlass also shows that despite running to weekly highs, BTC/USD did not liquidate large numbers of short positions, totaling a mere $17 million over the past 24 hours.

Continuing, popular trader Skew described the weekly close, which came in at $65,000, as “pretty good.”

“Early week trend will be important for risk & BTC,” he told X followers in his latest Bitcoin update.

“$65K – $66K area has been relatively sticky for HTF trend. 4H trend will lead into higher timeframe confirmations I think today, so that’s essentially what I am focused on.”

Analysis eyes BTC price range before “parabolic upside”

With the block subsidy halving now complete, market participants are considering how Bitcoin will react going forward — and whether it will set a new paradigm compared with previous halvings.

Chief among them is popular trader and analyst Rekt Capital.

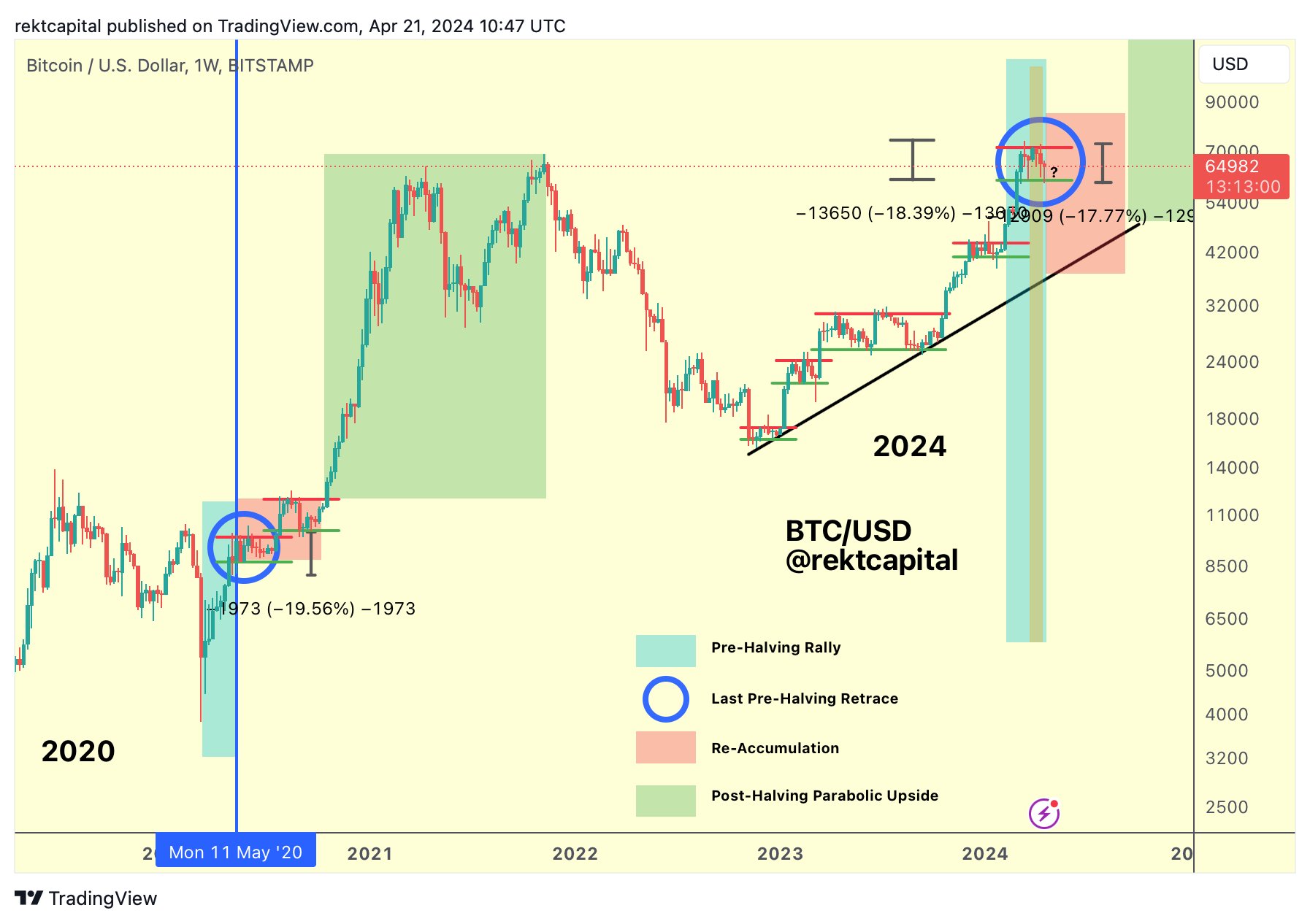

For months, analysis has flagged various BTC price “phases” common to Bitcoin’s previous two halvings.

As Cointelegraph reported, Bitcoin has adhered to these this year — at least to an extent — while also setting new records such as posting an all-time high before the halving, not after it.

Currently, Rekt Capital suggests BTC/USD is in a “re-accumulation phase” consisting of consolidation around the halving.

While this would explain recent price reticence, he now argues that the re-accumulation range could act as a perfect springboard for long-term gains.

“What if Bitcoin has already revealed the top and bottom of its Post-Halving Re-Accumulation Range?” he queried on April 21.

“Then the prices within this range would be the best we will be able to get before Bitcoin is finally ready Post-Halving Parabolic Upside.”

Another post reinforced this theory. Bitcoin, having given investors a “buy the dip” opportunity last week, should repeat it while staying within the current range over the coming weeks.

“Any BTC downside in the Pre-Halving period represented bargain-buying opportunities,” Rekt Capital wrote.

“Going forward, this upcoming several week consolidation will represent a bargain-buying opportunity.”

PCE week greets a hawkish Fed

Adding to the volatility catalysts this week is a familiar face in the form of U.S. macroeconomic data prints.

These are set to include Q1 gross domestic product (GDP) and jobless claims, all leading up to the March print of the Personal Consumption Expenditures (PCE) Index on April 26.

The latter is known to be the Federal Reserve’s preferred inflation measure, and should thus be closely watched as economic policy hangs in the balance between hawkish and dovish.

Risk assets continue to look for hints that interest rates will come down sooner rather than later, while recent language employed by Fed officials has favored a “higher for longer” approach.

In an unusual development, central banks in Europe and the United Kingdom are poised to begin a rate-cut cycle before the Fed.

“Will PCE inflation data show another increase in inflation?” trading resource The Kobeissi Letter queried in part of an X thread summarizing the week’s major macro events.

“All eyes will be on PCE inflation data this week, the Fed’s preferred inflation metric.”

Kobeissi further noted a sharp decline in sentiment among U.S. equities. The classic yardstick for this, the Fear & Greed Index, has shifted from “greed” to “extreme fear” in a matter of days.

Bitcoin’s correlation to equities could thus return as a topic of conversation.

Bitcoin transaction fees: “Higher for longer?”

Bitcoin’s transaction fees have made the headlines for the wrong reasons since the halving, at one point passing a near record $200.

Thanks to the Runes phenomenon, Bitcoin miners have seen bumper earnings despite the 50% reduction in block subsidy.

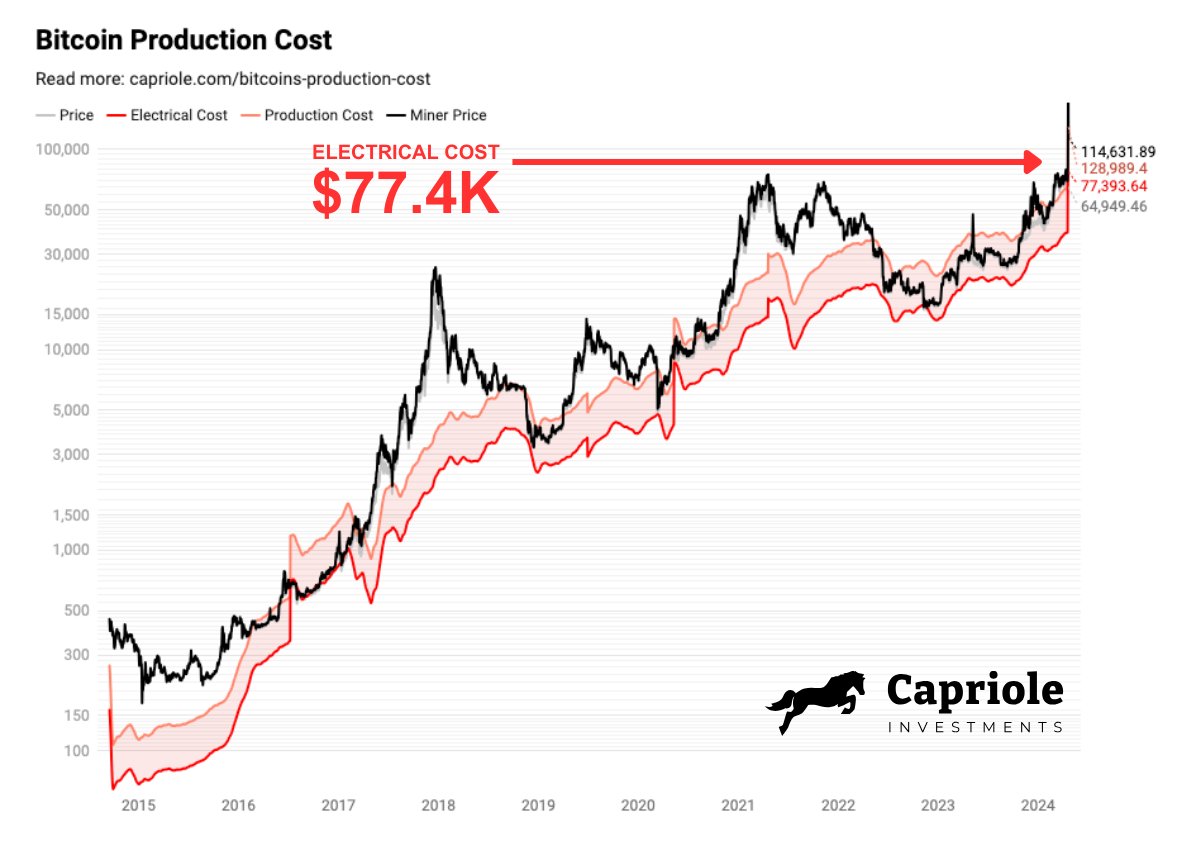

Examining the status quo, Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, concluded that the new halving epoch represents a seismic shift for Bitcoin as a whole.

“Welcome to a new paradigm,” he summarized on X on April 22.

Edwards explains that Bitcoin electrical cost — the “raw” cost of electricity per mined block — is now higher than spot price at over $77,000.

“Bitcoin Miner Price hit $244K on Saturday! This is the block reward + fees per Bitcoin mined. It boomed as transaction fees hit $230+ (about 4X the prior ATH of $68 set in 2021),” he wrote.

“This means Bitcoin is trading at a DEEP DISCOUNT.”

Edwards notes that BTC/USD trading beneath its electrical cost is extremely rare and never lasts long before redressing the balance. This comes from a combination of BTC price upside, unprofitable miners shutting down and fees remaining higher than before.

“Expecting a bit of all three,” he forecast.

“Bitcoin’s days under $100K are numbered.”

Crypto “greed” returns after open interest wipeout

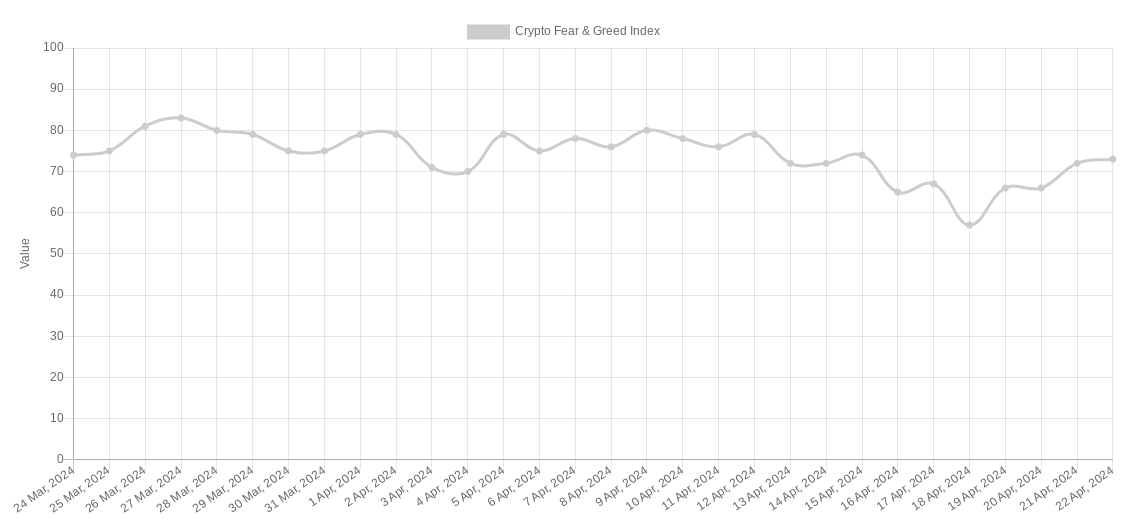

While stocks enter a period of cold feet, crypto sentiment has gone the opposite way.

Related: BlackRock Bitcoin ETF hits 69 days of inflows on ‘4/20’ halving day

The Crypto Fear & Greed Index — the crypto counterpart of the stocks sentiment gauge — currently sits just below the “extreme geed” zone at 73/100.

Just days ago on April 18, the Index measured 57/100, indicating greed having been practically flushed from the radar.

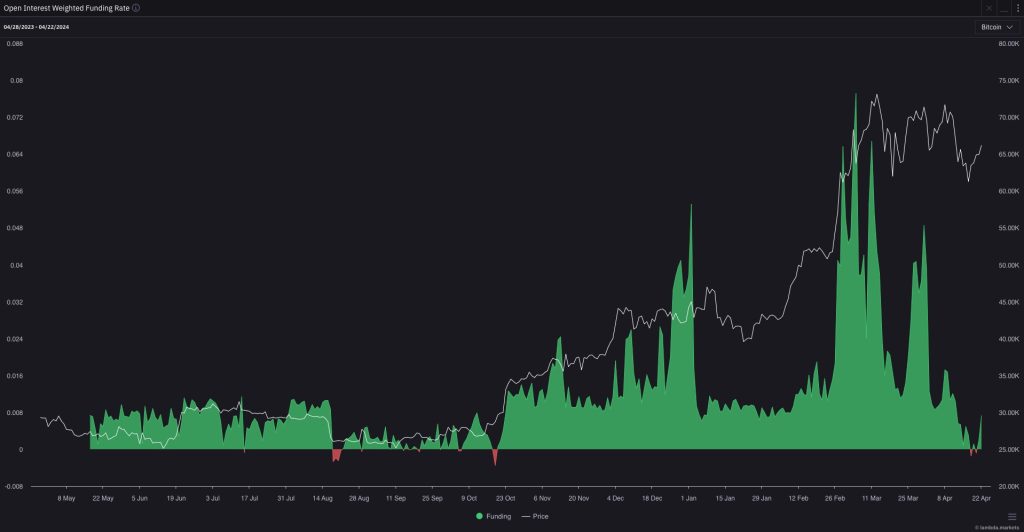

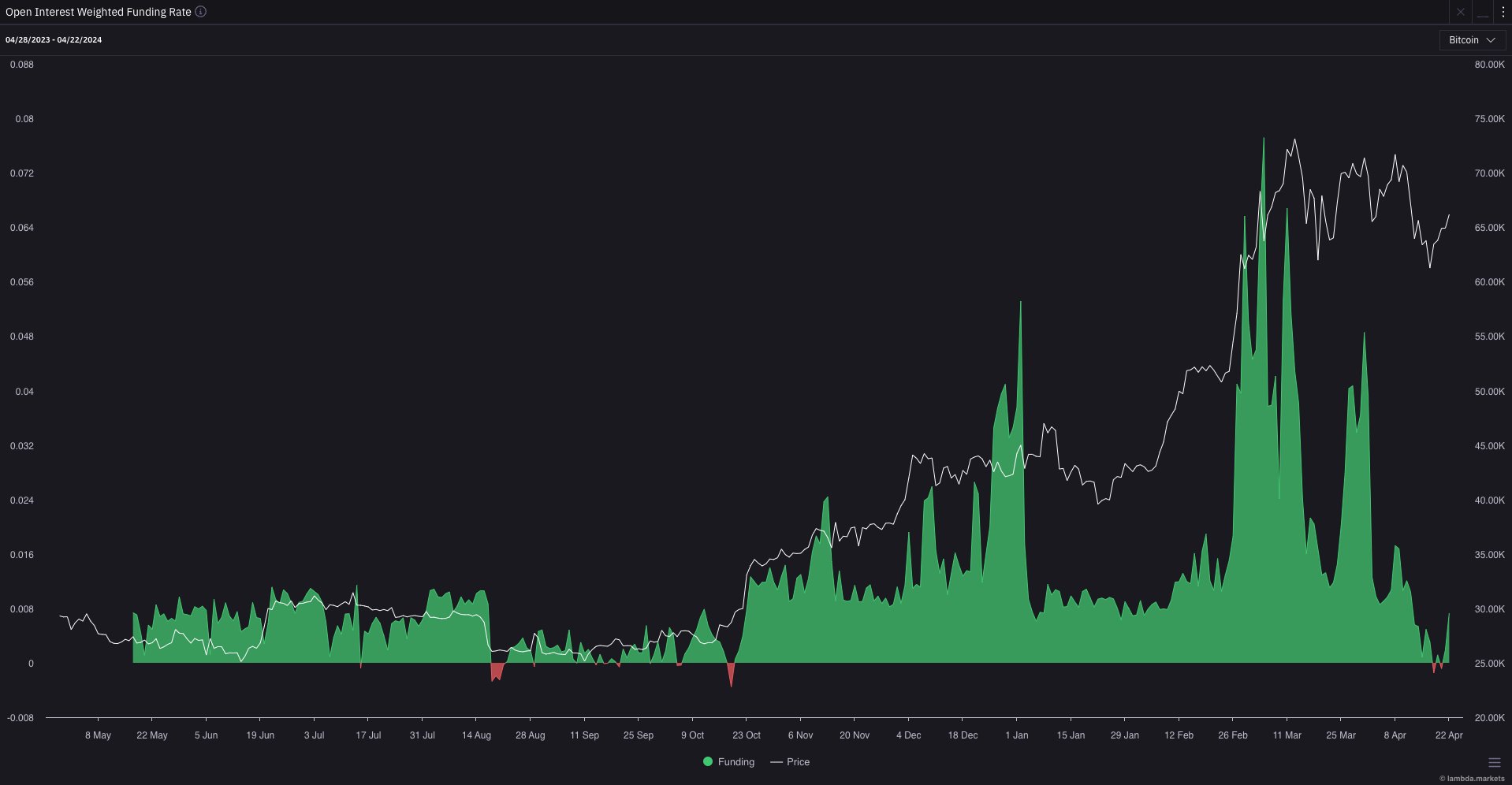

This accompanied not only a BTC price retracement but also a reset across exchanges in the form of steep declines in funding rates and open interest.

This, financial commentator Tedtalksmacro writes on April 22, could have last consequences, which enable a broader market rebound.

“The market has gifted us with a beautiful reset in trader positioning for Bitcoin,” he predicted.

“OI weighted funding turned negative for the first time since October 2023… That was before Bitcoin ran from 27k to 46k without any meaningful dip.”

An accompanying chart shows just how much the landscape has changed since Bitcoin hit its latest all-time high of $73,800 in mid-March.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses