The Runes protocol will ignite a new season for Bitcoin after the halving

The Runes protocol will launch when Bitcoin’s halving takes place, and a wave of new tokens will ignite a new season for the world’s largest blockchain.

The 2024 halving is a major event in the cryptocurrency world. This year, however, the Runes protocol — and the hunt for the epic satoshi, the first satoshi of the halving block — will begin on the same day, and that could be an even more significant event in Bitcoin’s (BTC) history.

The second phase of Bitcoin

The Ordinals protocol launched in December 2022 and brought an unprecedented cultural movement to the world’s largest blockchain. It is often referred to as “The second phase of Bitcoin.” Ordinals allowed users to begin putting things such as images, audio and code files on the Bitcoin blockchain.

After that successful launch, developer Casey Rodarmor introduced the concept of the Runes token protocol, which is designed to facilitate the creation of fungible tokens on the Bitcoin network.

Related: China has a Trojan Horse in US Bitcoin mining infrastructure

The Runes token protocol is set to activate when the halving occurs. A battle for block space will begin where players will compete with each other to see who can issue the first tokens and the best token names, followed by a battle to see who can be the first to buy these tokens.

BREAKING: The Largest Bitcoin Mining Company by Hashrate is now an Ordinals Company

They will be isolating the Epic Sat at the halving if they win the block and distributing profits to pool members

The real question: Will they re-org to win & Pre-Etch the first 1,000 Runes? pic.twitter.com/7kv6OpNQVc

— trevor.btc (@TO) April 17, 2024

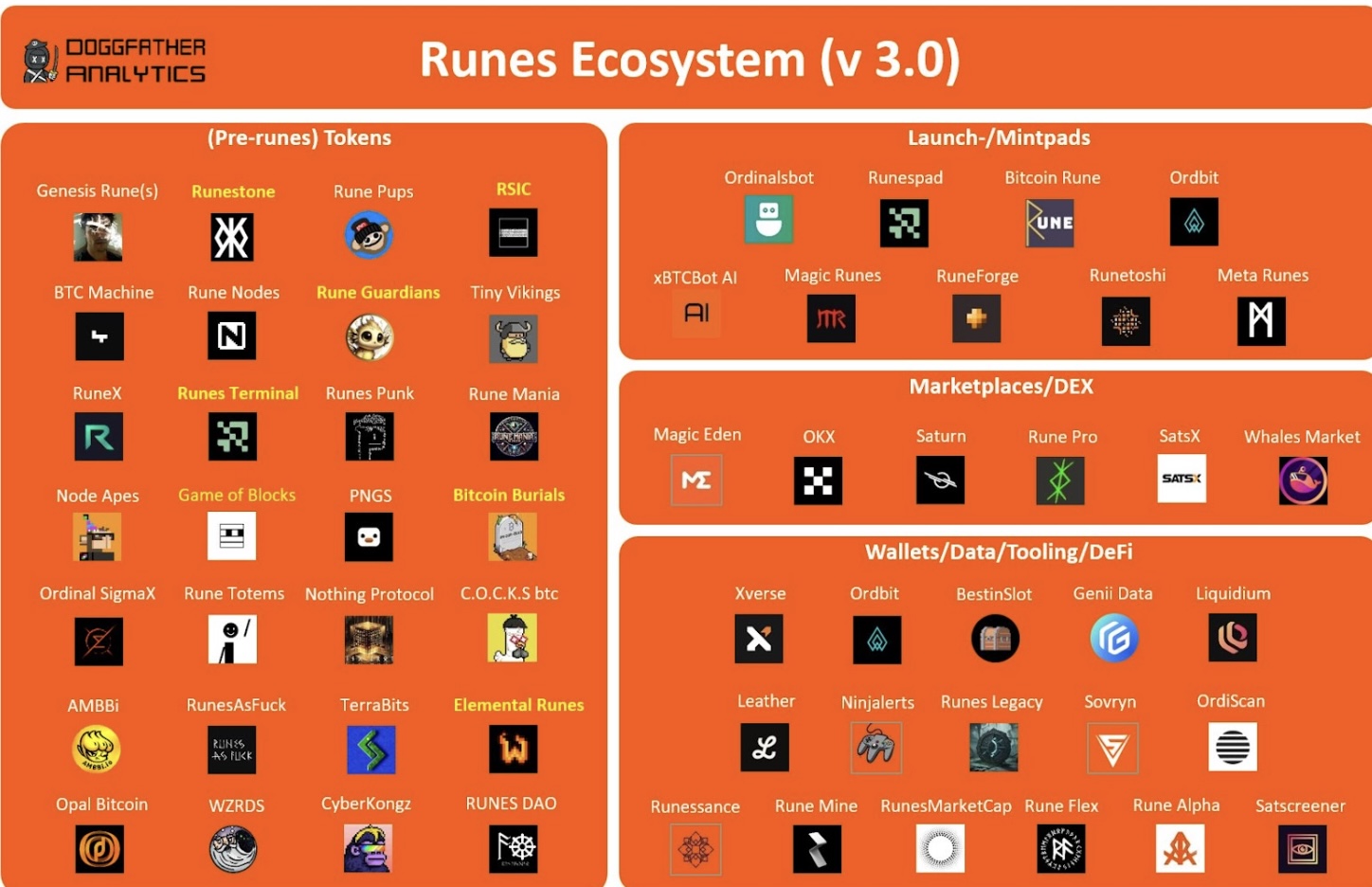

Exchanges around the world are already preparing to list the main tokens that will launch with the Runes protocol. Marketplaces and DEXes — such as Magic Eden and OKX, respectively — have already announced that they will support tokens created from the Runes protocol starting on day one.

The historical significance of the Runes and Ordinals protocols

Unlike blockchains such as Ethereum (ETH) and Solana (SOL) — which are known as platforms for application development and environments for issuing and exchanging other assets — Bitcoin has historically been perceived as an asset with no special purpose.

Since Ordinals launched, for the first time in history, thousands of people have been using the Bitcoin network every day to acquire assets priced in Bitcoin. In just over a year, more than $3 billion has already been moved through these Ordinals assets, involving nearly 600,000 unique wallets and 2.5 million on-chain transactions.

$1.5 trillion asset manager Franklin Templeton: ORDINALS DRIVING 'RENAISSANCE' IN BITCOIN INNOVATIONhttps://t.co/M2Stt8EQa6 https://t.co/VHaGcdfC3Z

— Lugui Tillier (@lugui_tillier) April 13, 2024

The Ordinals protocol has culturally impacted Bitcoin in a way not seen in years, leading the market to denote this period as “the second phase of Bitcoin,” characterized by a rebirth of accelerated innovation around the world’s largest blockchain.

I'm sure there's a lot of work needed to mature it, but it's wild how fast the Bitcoin L2 ecosystem is growing https://t.co/fi0hnpJxiH

— Mustafa Al-Bassam (@musalbas) April 16, 2024

With the new interest in navigating and building on Bitcoin, products such as wallets, nodes, unspent transaction output (UTXO) managers and even the mempool have improved.Discussions around decentralized finance (DeFi) and Bitcoin’s layer-2 solutions are more intense than eve drawing considerable attention from venture capitalists.

Related: Bitcoin is evolving into a multiasset network

The Ordinals protocol ignited a new flame in Bitcoin, and the Runes protocol represents the next phase.

Who’s going to win the $1 million satoshi?

The halving block itself will be the most contested and lucrative block in history. In addition to this retail competition for block spaces, there will also be a duel among miners. One player who mines the halving block will collect a satoshi classified as “Epic,” with an estimated value of more than $1 million.

BREAKING: The Largest Bitcoin Mining Company by Hashrate is now an Ordinals Company

They will be isolating the Epic Sat at the halving if they win the block and distributing profits to pool members

The real question: Will they re-org to win & Pre-Etch the first 1,000 Runes? pic.twitter.com/7kv6OpNQVc

— trevor.btc (@TO) April 17, 2024

Additionally, in anticipation of Bitcoin network congestion, some projects are creating solutions to scale trading on the Runes protocol. In the past, a bridge that enabled the exchange of Bitcoin assets on Solana was successful. Now, platforms more aligned with Bitcoin are emerging — such as RuneChain, a Bitcoin layer-2 focused on Runes.

Users are also becoming more educated about Bitcoin as the market prepares for the arrival of the first tokens created with the Runes protocol. Likewise, thousands of people have started running Bitcoin nodes and are educating themselves about UTXOs to gain an advantage during these token launches.

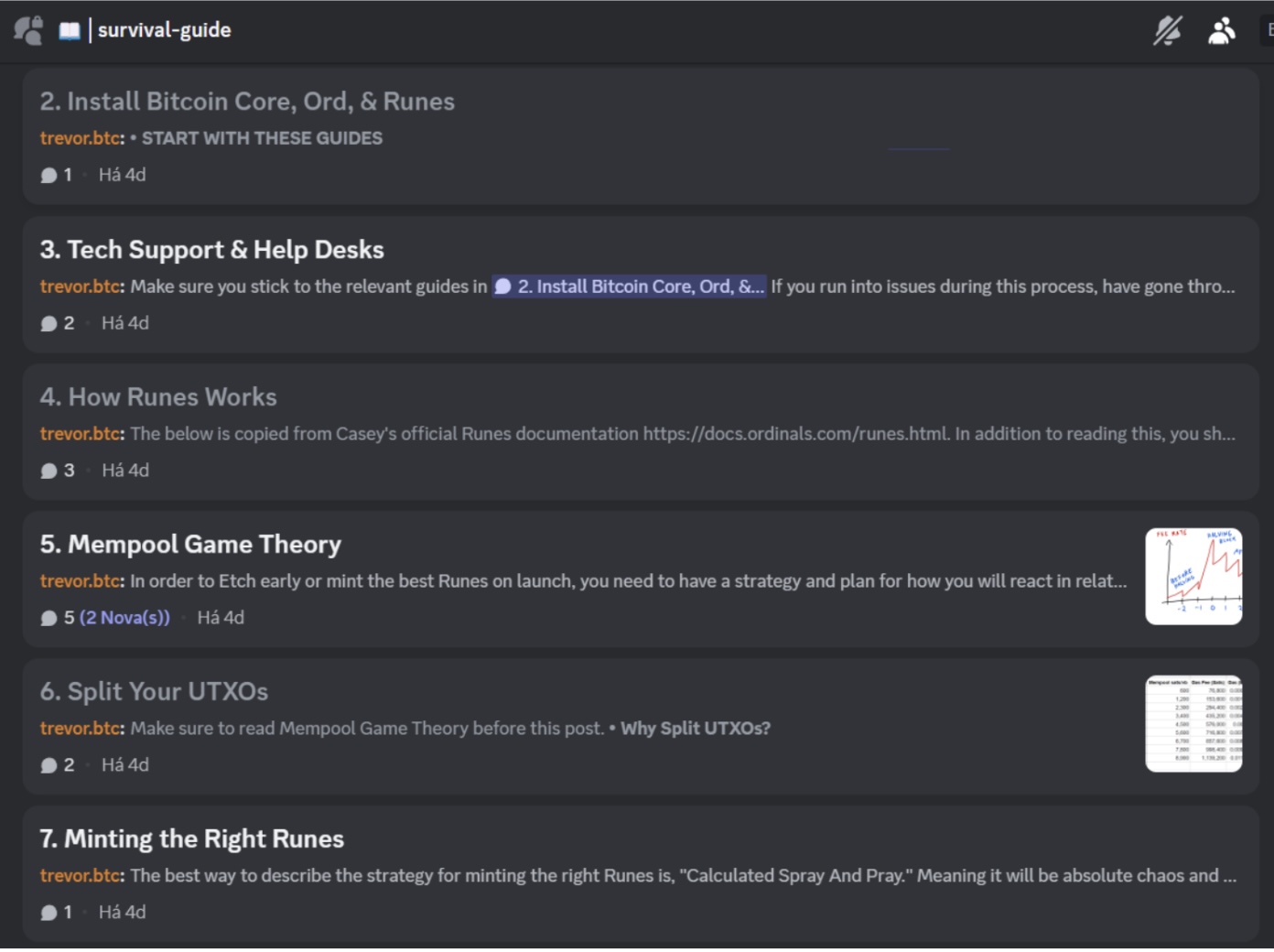

NFT communities like the Pizza Ninjas are have made significant efforts to educate their holders on these topics. The Ninjas created a complete survival guide for Runes — and offer 24/7 help desks in English and Chinese — for their holders.

Moreover, the market has been experiencing a “pre-Runes season.” Some Runes-standard tokens have already been “pre-distributed” through airdrops to Bitcoin NFT holders. Each collection employs its own distribution model: Some took snapshots of NFT holders and will distribute tokens after the halving, while others will distribute tokens based on the duration that users have held their NFTs. (The longer an NFT has been held, the more tokens a user will receive.

Runestone is an example of an NFT collection that will conduct a one-time snapshot. RSIC is an example of a collection that will distribute tokens based on the length of time an NFT has been held.

The second option that users have to capitalize on the trend is to purchase BRC-20 tokens — WZRD and PUPS, for example — that will migrate from the BRC-20 standard to the Runes standard.

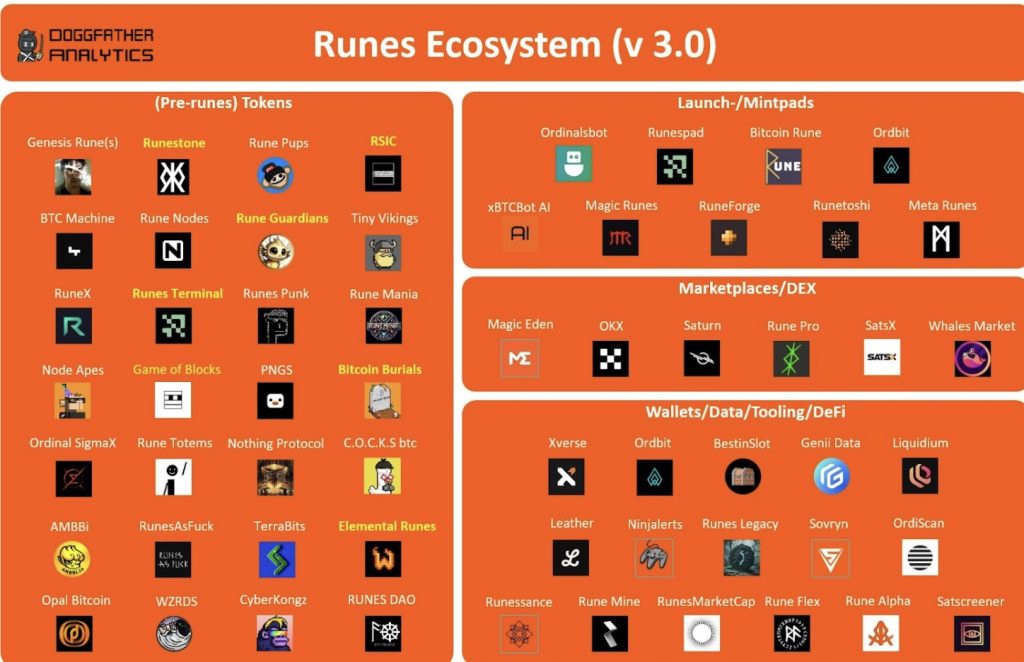

The table below segments all the developments related to pre-Runes projects, marketplaces and launchpads, that are set to launch.

Bitcoin’s second season is approaching one of its most climactic moments. Runes tokens will become historic, loved, hated, transformative, frightening, necessary, exhausting, and everything imaginable at the same time. But they will happen, and nothing will stop them. Welcome to season two!

Lugui Tillier is a guest author for Cointelegraph and the business development director of Lumx, a Web3 studio in Rio de Janeiro that counts BTG Pactual Bank, the largest investment bank in Latin America, among its investors.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses