Grayscale spot Bitcoin ETF ‘halves’ before BTC halving

GBTC, the biggest spot Bitcoin ETF, has “halved” since the trading launch in January, but rivals like BlackRock’s IBIT have added more than 10,000%.

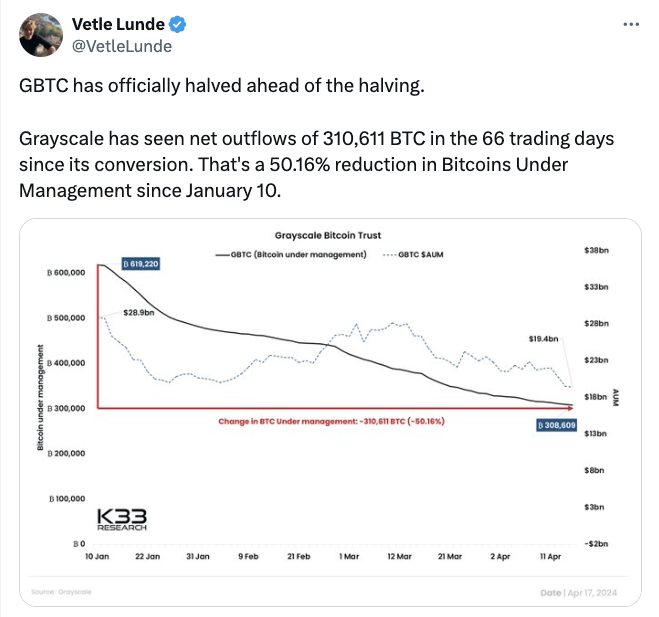

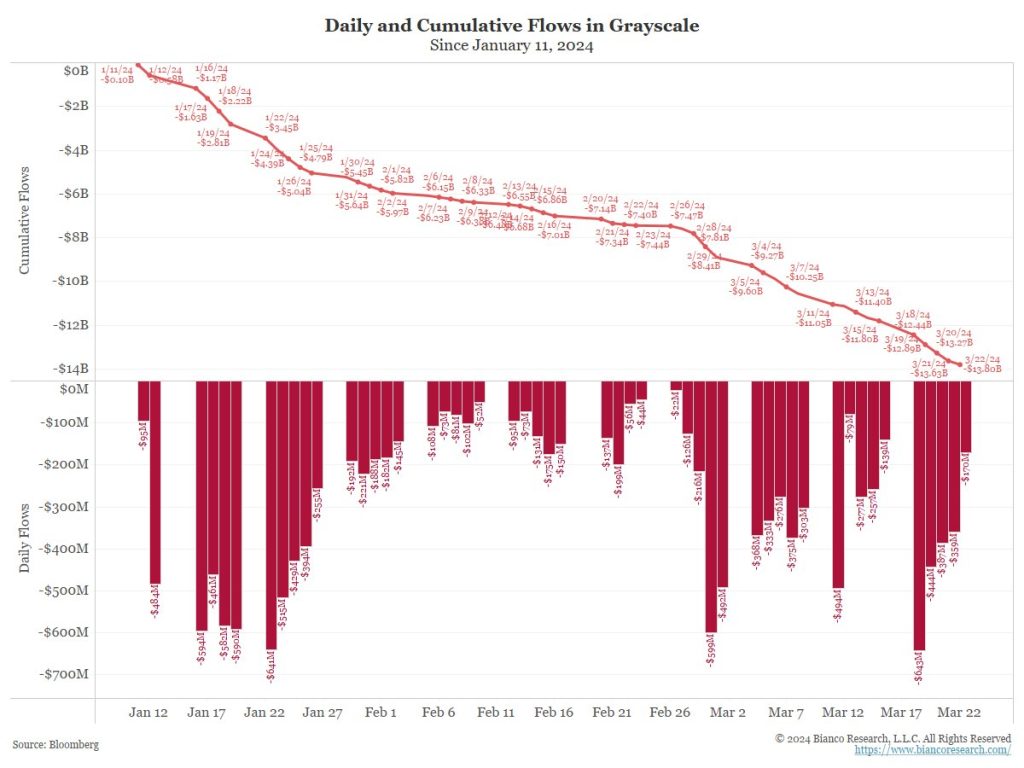

Major Bitcoin (BTC) investor Grayscale Investments has seen its spot BTC exchange-traded fund (ETF) holdings drop 50% ahead of the anticipated Bitcoin halving event.

Bitcoin holdings in the Grayscale Bitcoin Trust ETF (GBTC) shrunk by one-half from 619,220 BTC on the first day of trading on Jan. 11.

According to GBTC data, the spot Bitcoin ETF held 309,871 BTC on its 66th day of trading on April 16, down 50% of the amount since the trading debut. At the time of writing, the amount is worth $19.7 billion.

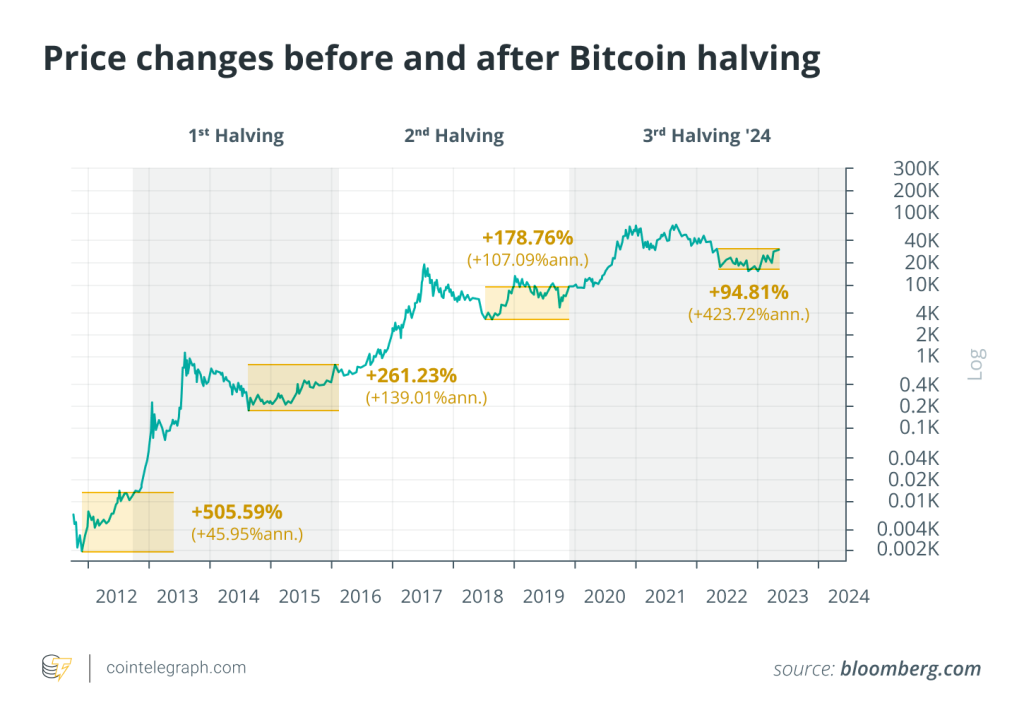

The GBTC “halving” came just two days before the much anticipated Bitcoin halving, which will reduce the mining reward by 50% from 6.25 BTC to 3.125 BTC.

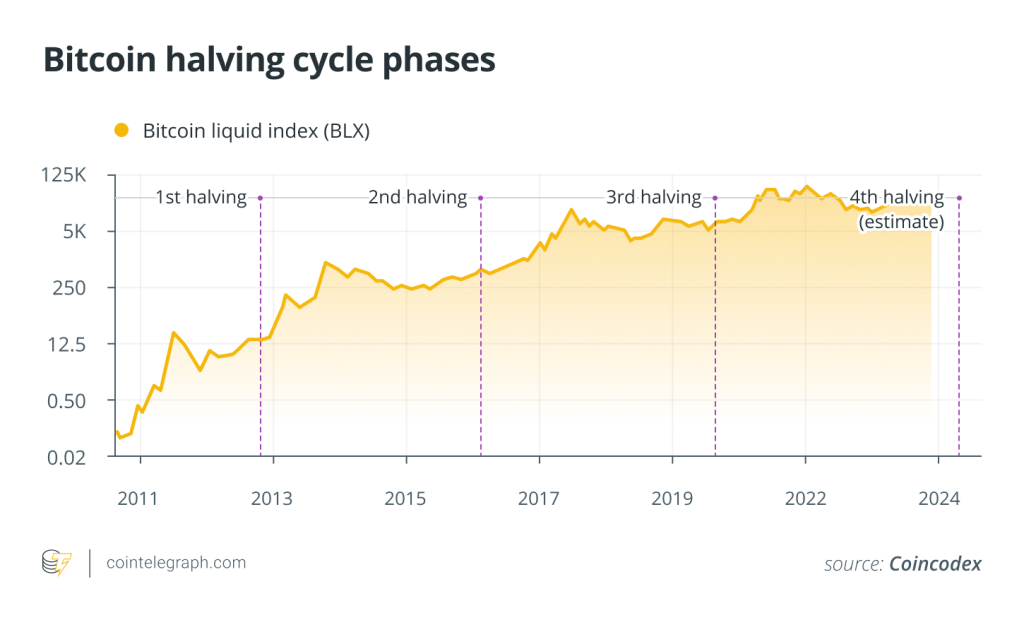

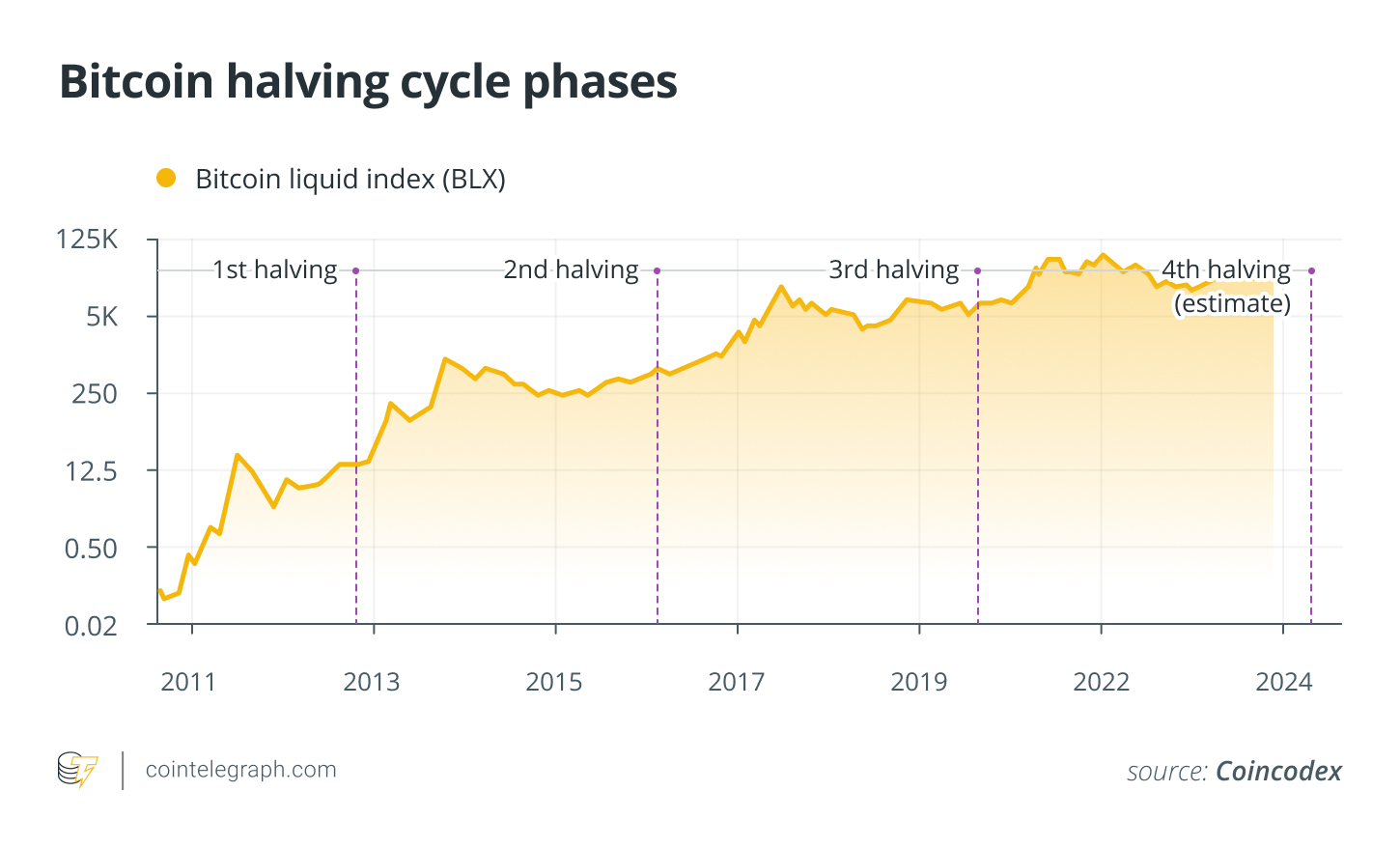

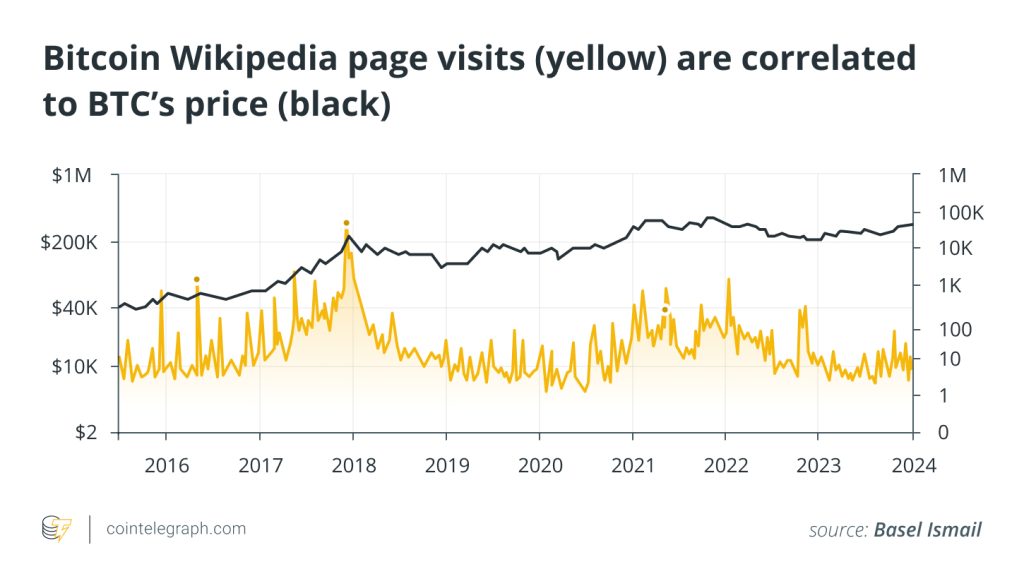

Occurring once every four years, or once in 210,000 blocks, the Bitcoin halving is a major event, often tied to subsequent rallies in the crypto market.

The two events do not correlate but make for another coincidence in the chronology of Bitcoin-related occurrences.

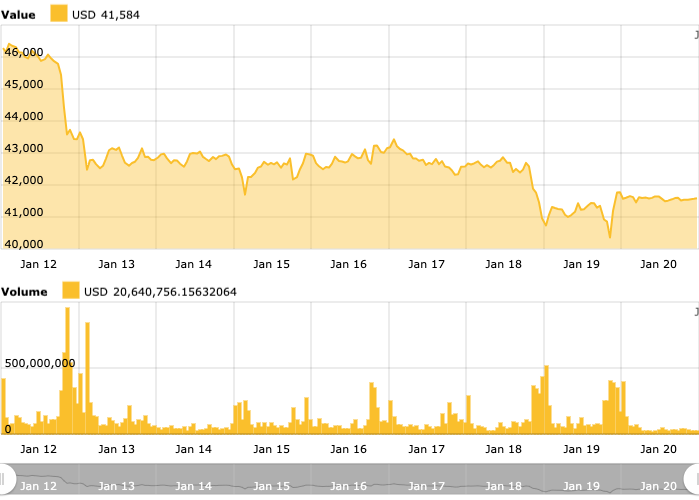

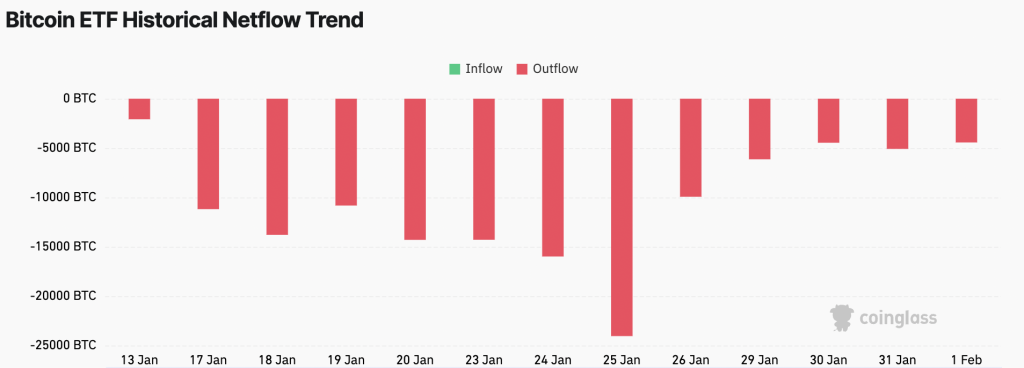

GBTC has been experiencing a massive sell-off since the first day of trading, significantly impacting the Bitcoin price.

The outflows have been largely attributed to high trading fees as GBTC had the biggest fees of the 10 spot Bitcoin ETFs in the United States — 1.5% at the trading start. The majority of Bitcoin ETFs were lowering their fees to increase competitiveness, setting trading commissions between 0.2% and 0.4%.

Related: GBTC fees will drop when Bitcoin ETFs ‘start to mature’ — Grayscale CEO

GBTC’s biggest rival, BlackRock’s iShares Bitcoin Trust (IBIT), offered a 0.25% fee at the trading start, not including a 0.12% discount for the first $5 billion of traded assets during the waiver period.

BlackRock’s spot Bitcoin ETF has attracted a lot of inflows, with holdings surging more than 10,000% from just 2,621 BTC on the trading debut to 272,548 BTC on April 16. BlackRock’s IBIT is now 13% far from reaching GBTC holdings.

Despite the rapid growth, IBIT has failed to absorb GBTC outflows of 309,349 BTC. However, with eight other issuers, the spot Bitcoin ETF providers have accumulated around 224,552 BTC, excluding GBTC, since the trading launch.

As of April 16, 2024, the 10 spot Bitcoin ETFs collectively held around 862,162 BTC, worth $54.7 billion.

Responses