Uncovering the halving’s impact on Bitcoin’s inflation rate and store of value proposition

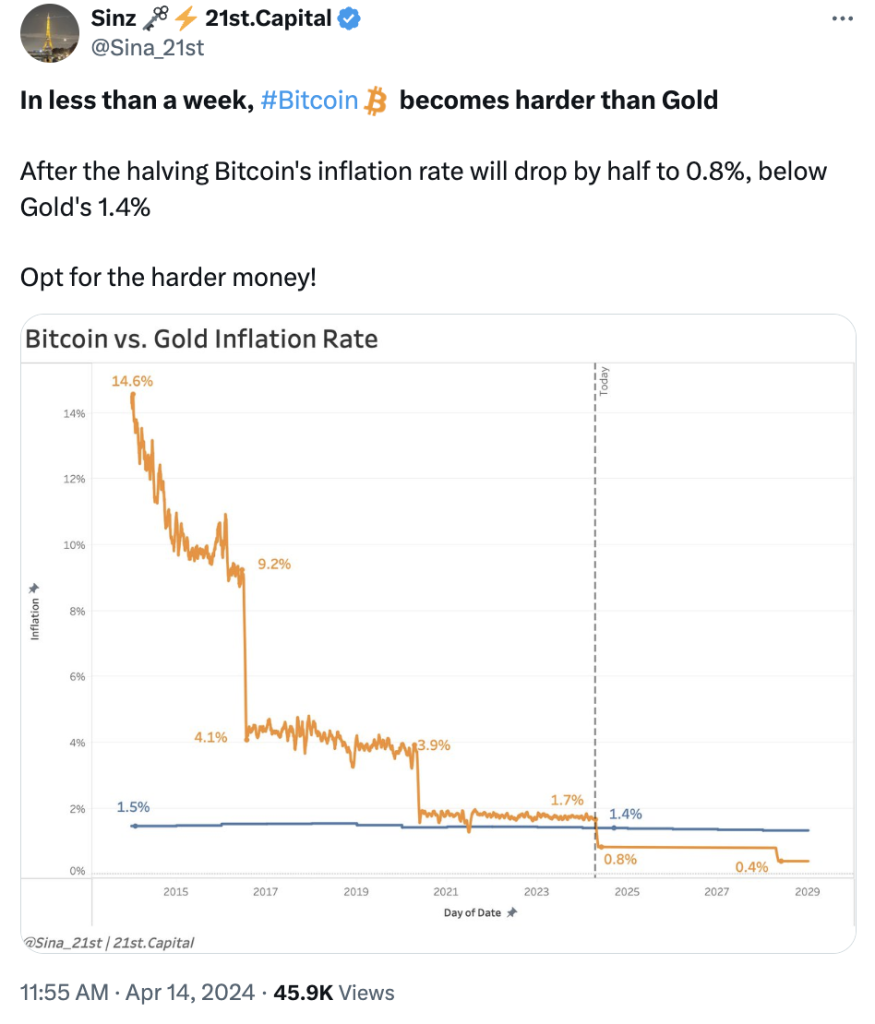

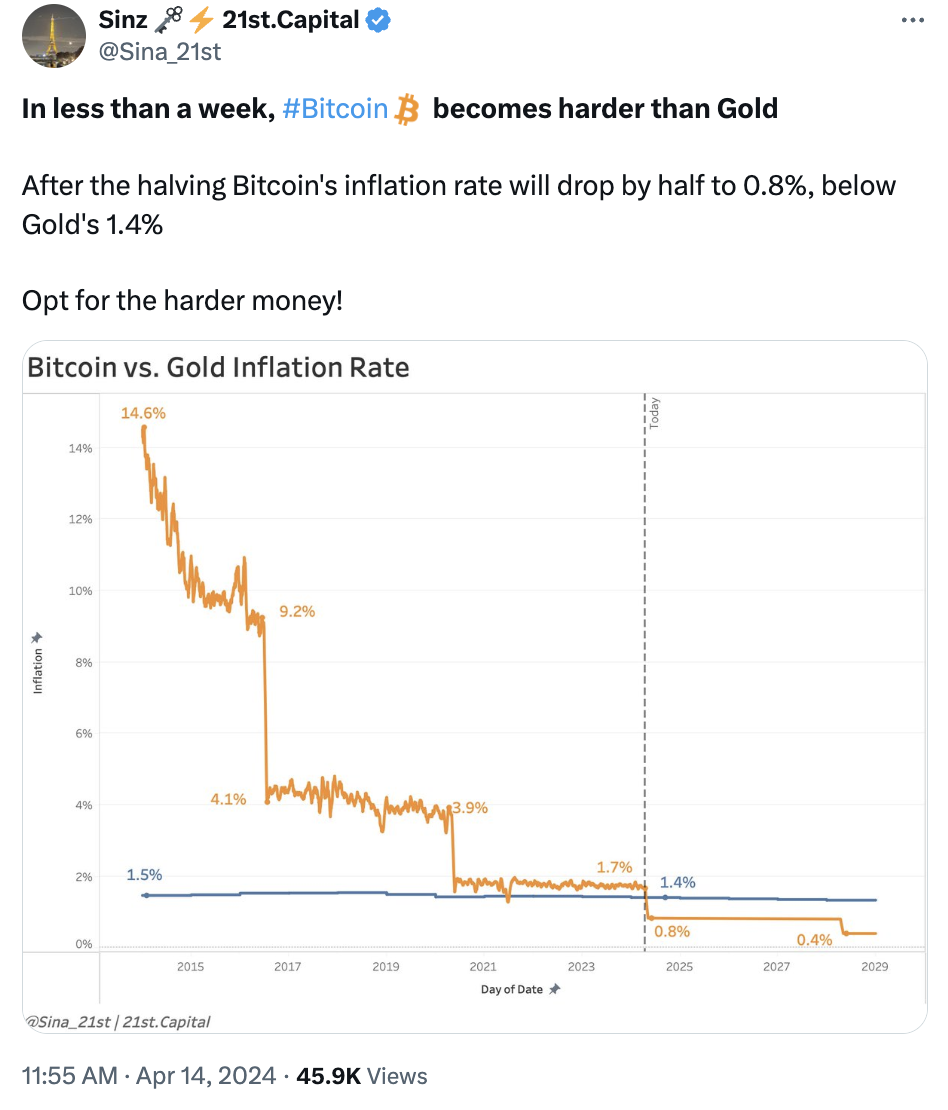

Many analysts are looking at how the cryptocurrency’s inflation rate will compare to gold’s after the halving, expected on April 19.

With the Bitcoin (BTC) blockchain halving expected to occur within four days, many analysts have suggested that the event could affect the cryptocurrency’s status as a store of value.

At the time of publication, roughly 630 blocks were left to mine before the Bitcoin halving occurred, placing the monumental event in the crypto space on April 19. In 2024, the BTC price reached an all-time high of more than $73,000, the United States Securities and Exchange Commission approved the listing and trading of Bitcoin spot exchange-traded funds on exchanges, and the crypto asset has continued to show volatility in its price.

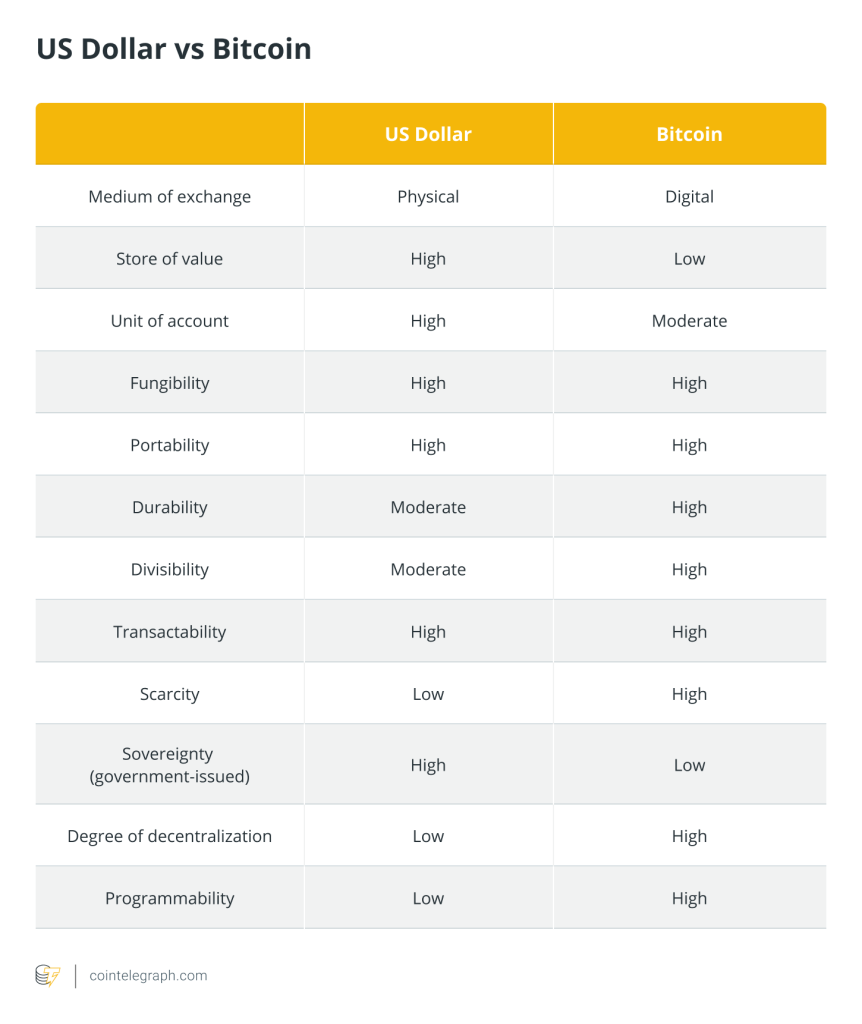

Many crypto users and financial analysts claim that Bitcoin could be an effective hedge against inflation as countries’ central banks, including the United States Federal Reserve, devalue fiat currency by printing money. In contrast, there is a fixed supply of 21 million BTC, roughly 19.7 million of which have already been mined.

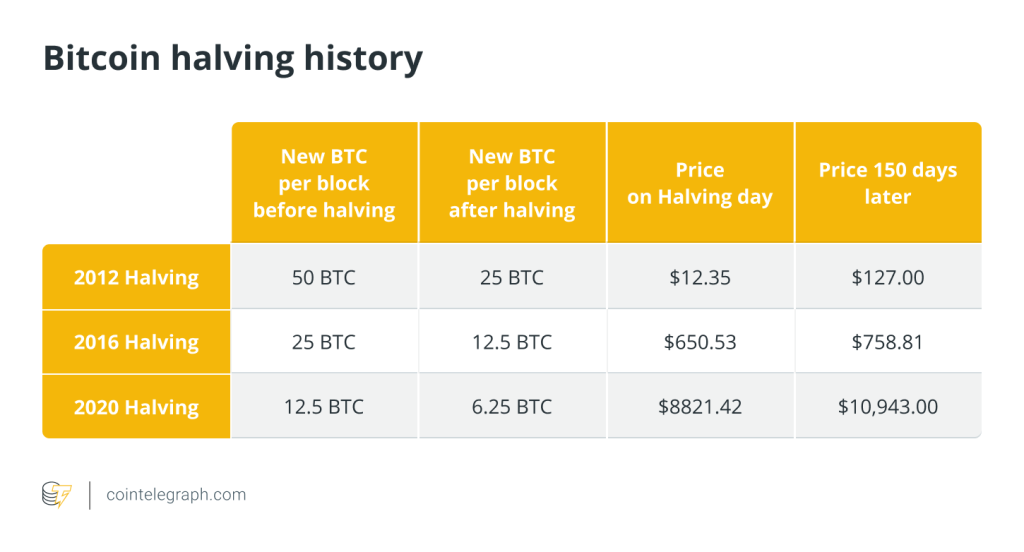

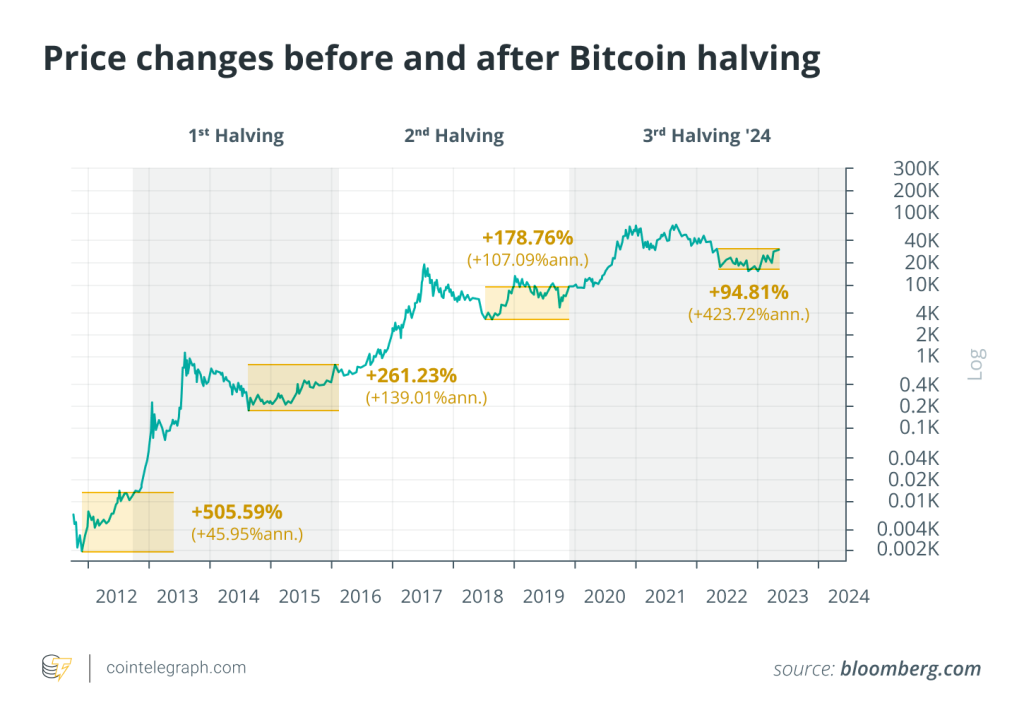

On April 19, the halving — the fourth in the blockchain’s history, with the third occurring in May 2020 — the block reward for miners will be cut from 6.25 BTC to 3.125 BTC. The event will effectively cut Bitcoin’s inflation rate in half from roughly 1.7% to 0.85%, decreasing the new supply of the cryptocurrency and potentially causing its price to rise if demand remains constant or increases.

Related: Is the Bitcoin halving priced in? Analysts compare BTC price targets vs previous halvings

Historically, all BTC halving events have eventually resulted in price increases. Many users in the U.S. already use the cryptocurrency as a hedge against the dollar’s inflation, while more users in countries with hyperinflation, like Argentina, could also turn to Bitcoin.

“It’s becoming increasingly clear that Bitcoin and digital assets offer more than simply ‘paying with crypto’ for users,” said Gnosis Pay CEO Marcos Nunes. “Rather, these assets serve as a lifeline for millions across the globe who live in countries with economic turmoil and hyperinflation.”

How countries choose to adopt or handle Bitcoin through regulation can impact the cryptocurrency’s price. Many analysts closely monitor the United States’ approach to regulation at both the state and federal levels, as the country is responsible for roughly a third of all mining.

Winning against gold?

Greater scarcity following the halving will likely make Bitcoin’s store of value proposition more appealing to crypto users. Many are also considering how the cryptocurrency will compare to gold after the event. The precious metal has been touted as a more traditional store of value to traders who are not necessarily interested in crypto, but that dynamic could change.

Bitcoin’s price volatility after the halving likely will not change anytime soon. Still, its inflation rate is expected to drop below gold’s again — miners will increase the percentage of the gold supply at a greater rate than crypto miners will increase the percentage of the Bitcoin supply. Gold bug Peter Schiff hasn’t seemed to have directly addressed this issue on social media, focusing his recent posts on the price of Bitcoin.

The upcoming halving and historical data suggest that the last BTC block reward could come in 2140, or more than 100 years from now. At that point, according to the Bitcoin white paper, the incentive for miners “can transition entirely to transaction fees” with all 21 million coins mined.

Responses