Bitcoin supply to run out on exchanges in 9 months: Bybit

Supply on exchanges will dry up in nine months with the upcoming Bitcoin halving and continued accumulation by Bitcoin ETFs.

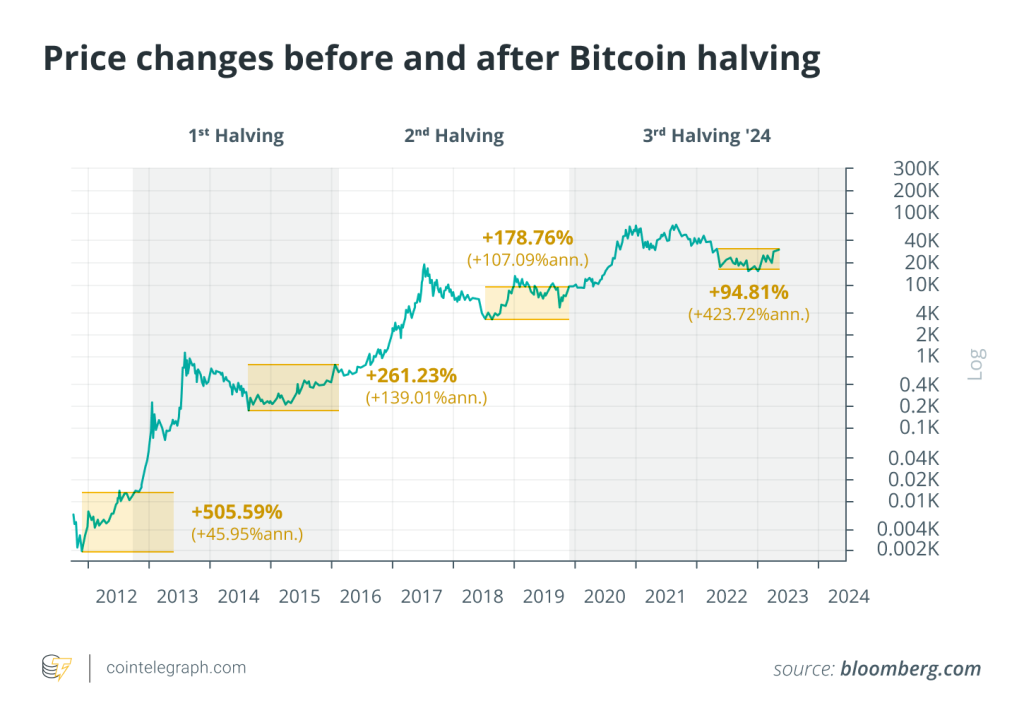

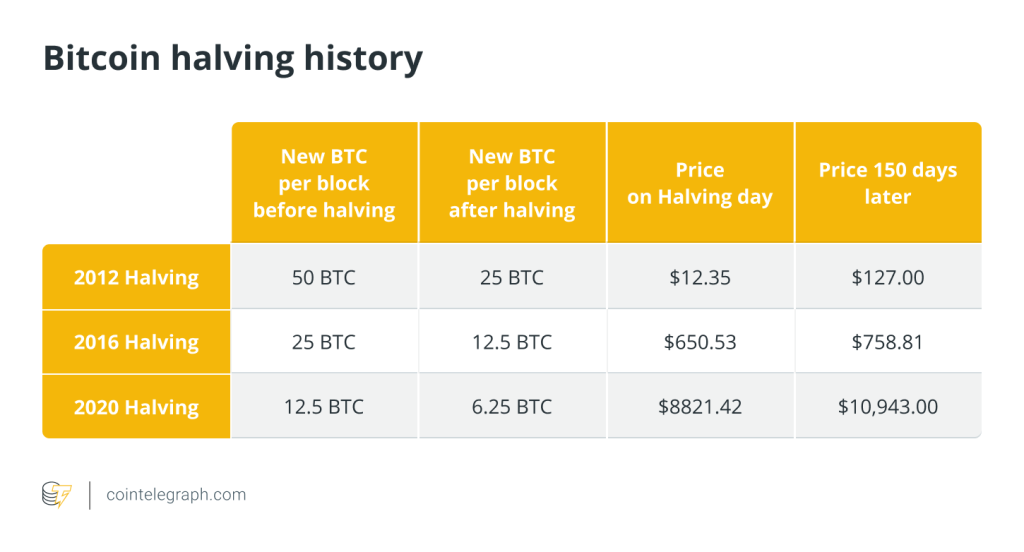

Bitcoin supply on cryptocurrency exchanges will dry up in nine months, thanks to the 50% supply issuance reduction of this week’s upcoming Bitcoin halving.

Provided that the inflows from the United States Bitcoin exchange-traded funds (ETFs) continue, Bitcoin’s post-halving supply dynamic will see exchange reserves run out of Bitcoin (BTC), according to an April 15 report by Bybit:

“Bitcoin reserves in all centralized exchanges have been depleting faster. With only 2 million Bitcoins left, if we assume a daily inflow of $500 million to Bitcoin Spot ETFs, the equivalent of around 7,142 bitcoins will leave exchange reserves daily, suggesting that it will only take nine months to consume all of the remaining reserves.”

Bitcoin reserves on centralized exchanges fell to a near three-year low of 1.94 million BTC on April 16, according to CryptoQuant data.

The report comes amid a wider market slump, that saw Bitcoin fall over 10% during the past week to $62,924, as of 1:36 pm UTC, according to CoinMarketCap.

Bybit, the world’s third-largest exchange, expects Bitcoin prices to start recovering from the current correction, according to the report:

“With this in mind, it’s unsurprising that Bitcoin’s price may continue to climb before the halving, or even afterward, as the supply squeeze propels the price to another new record.”

Related: Korean won becomes world’s most traded fiat for crypto traders: Report

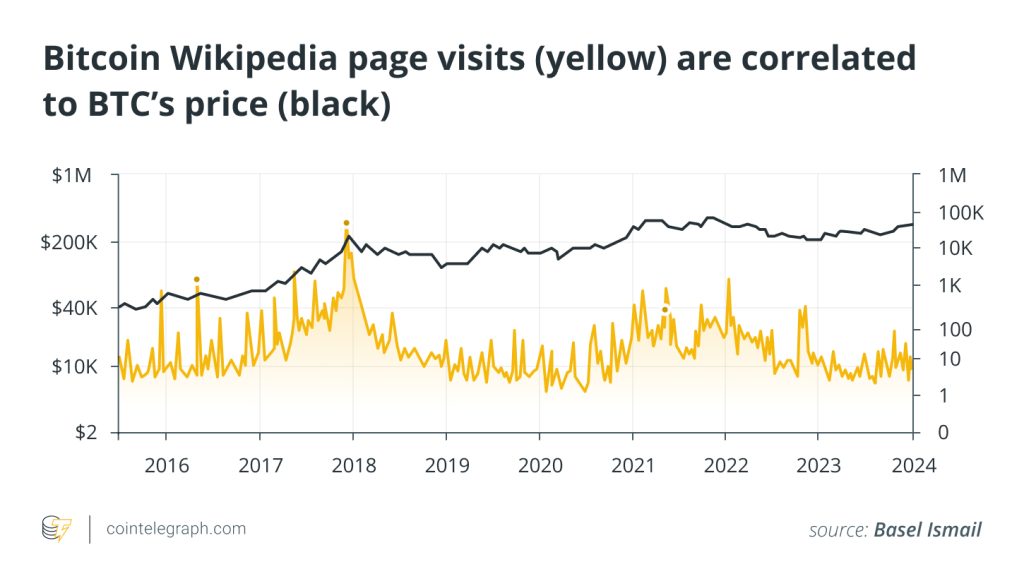

Institutional interest in Bitcoin is on the rise

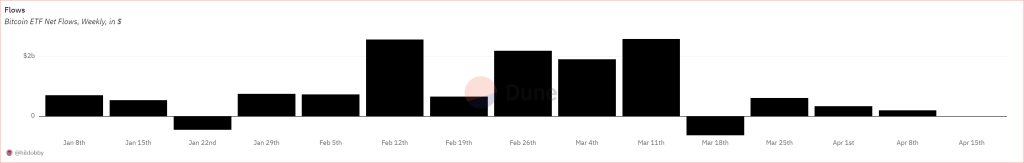

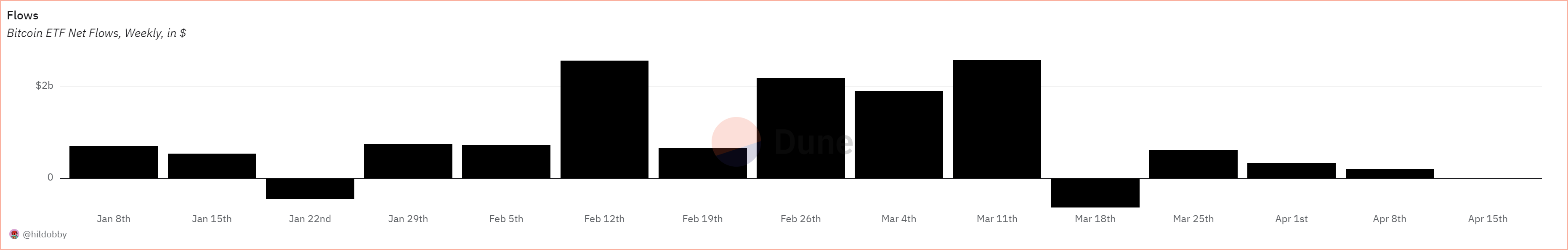

Weekly inflows into the spot Bitcoin ETFs have been slowing down since March. Last week saw over $199 million worth of net inflows into the ETFs, down from $2.58 billion in the week beginning March 11, according to Dune.

Despite the recent slump, the Bitcoin ETFs amassed over 841,000 BTC worth $52.9 billion, with over $12.7 billion net flows since launch, according to Dune.

Bitcoin investor allocation has risen since last September. Institutions are allocating an average of 40% of total assets to BTC, while retail investors average a Bitcoin allocation of 24%, according to Bybit’s asset allocation report from Feb. 24.

Bybit noted that both crypto-native firms and traditional institutions are gaining increasing exposure to Bitcoin via ETFs or proxy stocks such as MicroStrategy. The exchange expects more institutions to follow suit:

“We believe that not all institutions have been able to gain exposure since the approval of Bitcoin Spot ETFs in January 2024, as their investment mandates restrict them from investing in new products that have been in the market for only a few months.“

Related: Bitcoin halving will lead to more sustainable BTC mining: Report

Responses