Hong Kong approves first Bitcoin and Ether ETFs

Hong Kong’s securities regulator reportedly approved the in-kind creation model for Bitcoin and Ether ETFs, as opposed to the cash-created in the United States.

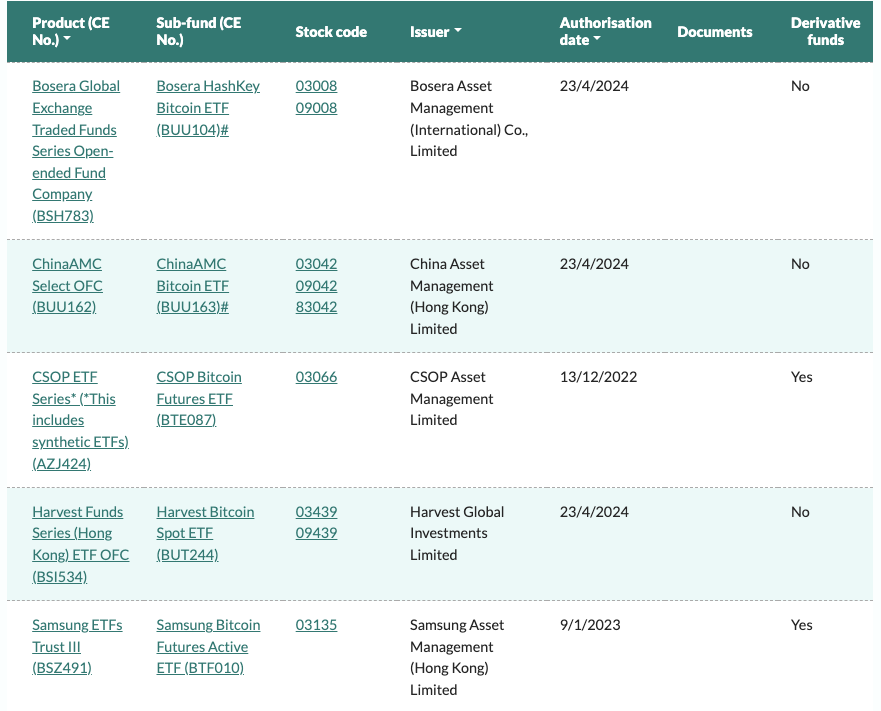

Hong Kong is inching closer to introducing spot exchange-traded funds (ETF) for Bitcoin (BTC) and Ether (ETH), with local regulators issuing approvals to at least three local issuers.

The Hong Kong Securities and Futures Commission (SFC) conditionally approved its first spot BTC and ETH ETFs on April 15, Reuters reported.

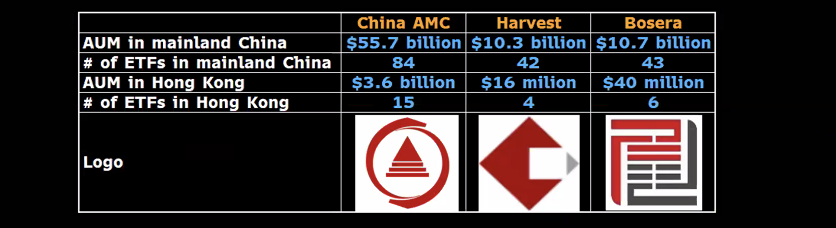

At least three offshore Chinese asset managers, including Hong Kong units of Harvest Fund Management, Bosera Asset Management and China Asset Management, will launch their spot Bitcoin and Ether ETFs soon.

According to the report, Hong Kong’s Harvest and Bosera received conditional approvals from the SFC, allowing them to launch the ETFs.

On the other hand, the Hong Kong unit of China Asset Management, or ChinaAMC, said it received regulatory approval to provide virtual asset management services and was developing spot ETFs of BTC and ETH.

Hong Kong’s securities regulator issues a conditional authorization letter to an ETF application if it generally satisfies its requirements, subject to various conditions, including fee payments, filing of documents and the Hong Kong Stock Exchange’s (HKEX) listing approval.

Issued in partnership with Hong Kong-based HashKey Capital, Bosera’s Bitcoin and Ether ETFs will be launched as in-kind ETFs, meaning that new ETF shares can be issued using BTC and ETH.

The in-kind creation model is opposed to the cash-create redemption model, which allows issuers to create new ETF shares only with cash. Spot Bitcoin ETFs currently use the cash-create model in the United States as local securities regulators opted for this redemption method.

Related: Hong Kong regulator fast-tracks Bitcoin spot ETF approvals

“The introduction of the virtual asset spot ETFs not only provides investors with new asset allocation opportunities but also reinforces Hong Kong’s status as an international financial center and a hub for virtual assets,” Bosera reportedly said.

Other issuers like ChinaAMC will be launching spot Bitcoin and Ether ETFs in partnership with OSL Digital Securities, a major local digital asset platform.

Cointelegraph approached Bosera and Harvest for a comment regarding the ETF approval in Hong Kong but did not receive a response at the time of publication.

Responses