El Salvador’s newest Hilton hotel to tap into tokenized debt on Bitcoin

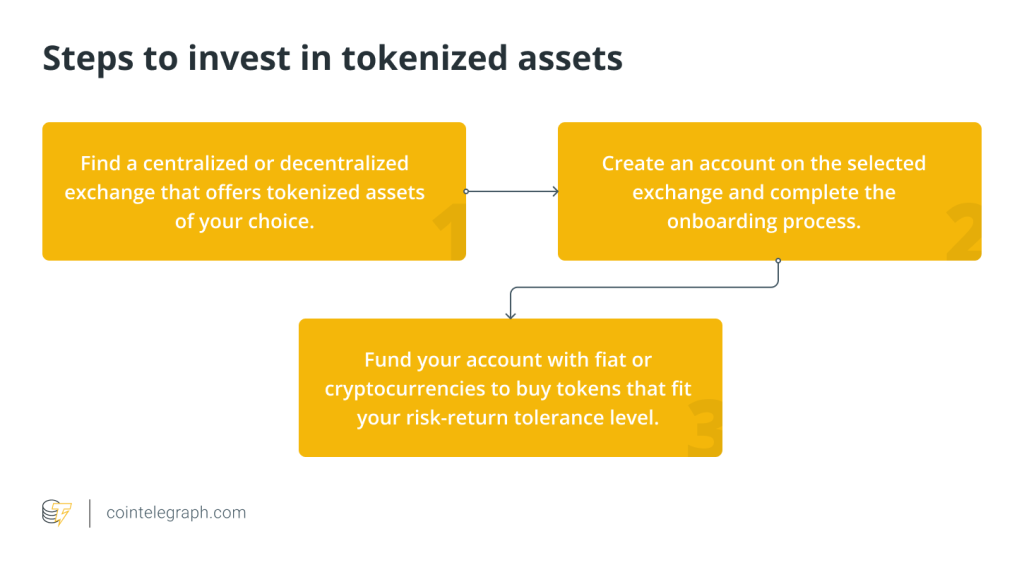

Investors will need to make a minimum $1,000 investment to purchase the token, which will be issued on the Bitcoin layer 2 “Liquid Network” under the ticker HILSV.

Investors will soon be able to own a slice of a new, 4,500 square-foot Hampton by Hilton hotel in El Salvador by buying tokenized shares issued on the Bitcoin layer 2 Liquid Network.

The country’s first ever tokenized asset raise will be facilitated by Bitfinex Securities — the first licensed and registered digital asset provider in El Salvador — while the debt issued from Inversiones Laguardia S.A. de C.V.

The hotel will be constructed at El Salvador’s international airport, with Inversiones Laguardia looking to raise $6.25 million from crowdfunders in exchange for a 10% coupon over a 5 year term.

“[This] represents an important step forward in developing its nascent capital market as well as introducing a major new asset class into the market,” said Paolo Ardoino, chief technology officer of Bitfinex Securities in an April 11 statement.

“For the first time, investors who do not usually have the opportunity to invest in such assets have the opportunity to do so, while issuers in markets which have less access to capital, are able to tap into a new asset class to raise finance.”

Investors will need to make a minimum $1,000 investment to purchase the token under the ticker HILSV on the Liquid Network. Liquid was built by Blockstream in 2018, a Bitcoin-focused infrastructure firm led by long-time cypherpunk Adam Back.

Related: El Salvador’s Bitcoin treasury is now $85M in profit amid BTC rally

The hotel project will have five levels, 80 rooms, five commercial spaces, and other hotel amenities, including swimming pool, restaurants, gym, gardens, and multipurpose rooms, Bitfinex noted.

HILSV token holders will also be offered some free nights accommodation at the hotel based on the size of their investment.

El Salvador, widely known for its Bitcoin investment and adoption strategy, decided to expand into the real-world asset tokenization space in April 2023 when it granted Bitfinex a digital asset service provider license.

Prior to Bitcoin, many locals in El Salvador were stuck between no investments and buying an entire house, said Jamie Robinson, chief strategy officer of The Bitcoin Hardware Store in a recent interview with Cointelegraph.

But Bitfinex’s expansion marks a “new era of capital markets” on Bitcoin in El Salvador, noted Bitcoin commentator Stacy Herbet, which will offer the local population a new way to access financial markets.

“This capital raise not only marks our first venture in El Salvador but also stands as a testament to the transformative power of Bitcoin-based capital markets,” said Jesse Knutson, head of operations at Bitfinex Securities.

Responses