Bitcoin funding rates stay cool while BTC price coils beneath $71K

Bitcoin bulls escape a fresh inlation-induced burn as U.S. PPI figures drop faster than expected and BTC price action challenges $71,000.

Bitcoin (BTC) refused to give up $70,000 support into the April 11 Wall Street open as fresh United States macro data boosted the mood.

Bitcoin stays higher as U.S. PPI inflation drops

Data from Cointelegraph Markets Pro and TradingView showed seesawing BTC price action, with bulls holding gains from the day prior.

The March print of the Producer Price Index (PPI) delivered a boost to risk-asset sentiment, coming in below expectations at 0.2% month-on-month.

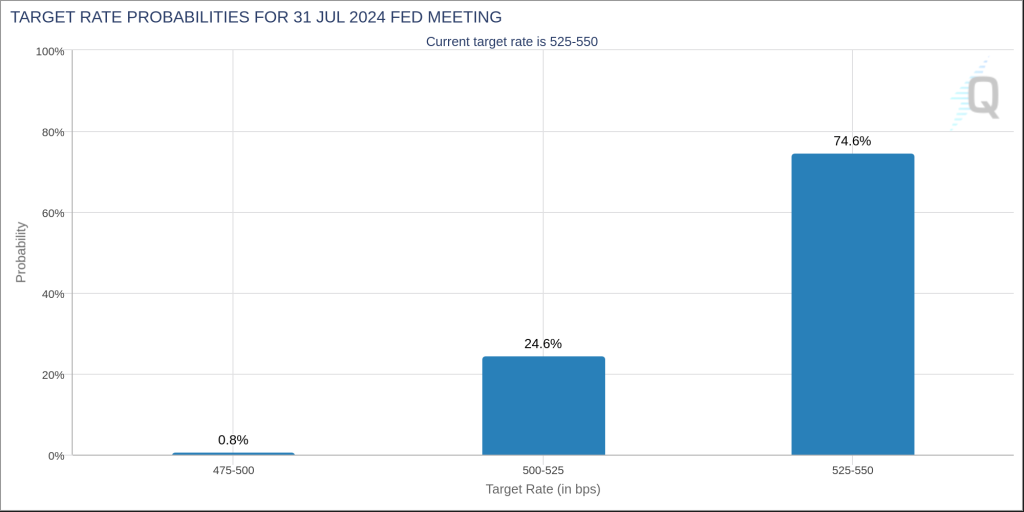

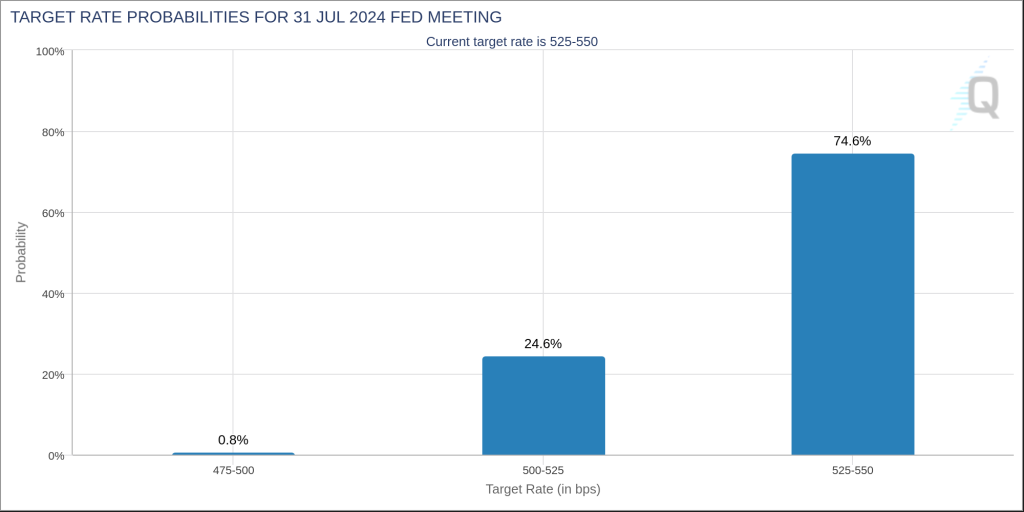

This served to partially counteract the previous Consumer Price Index (CPI) overshoot, ultimately providing a mixed picture of inflationary forces. Overall, however, markets were expecting to wait longer than previously thought for the Federal Reserve to lower interest rates.

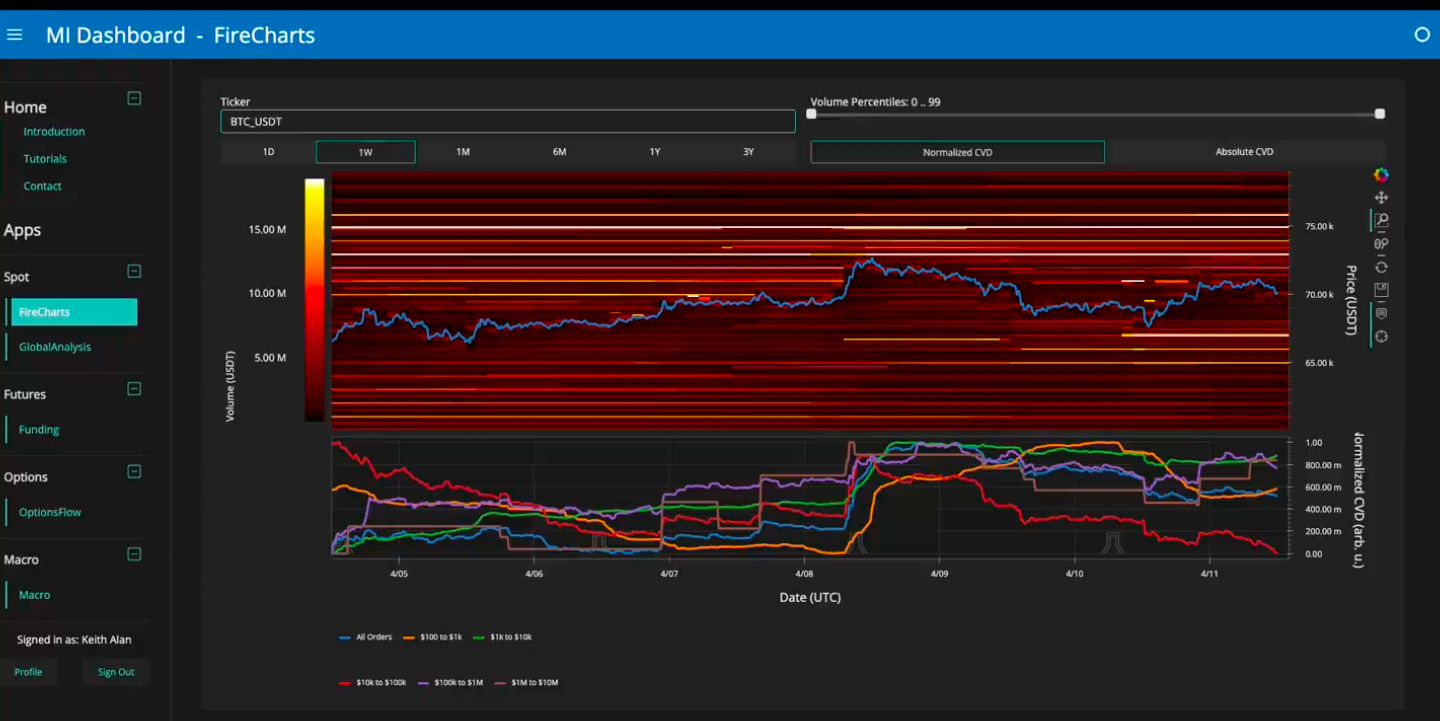

“After yesterday’s HOT inflation data, I’m honestly not sure how much today’s reports matter. Markets are baking in ‘high for longer,’” Keith Allen, co-founder of trading resource Material Indicators, wrote in part of a response on X (formerly Twitter).

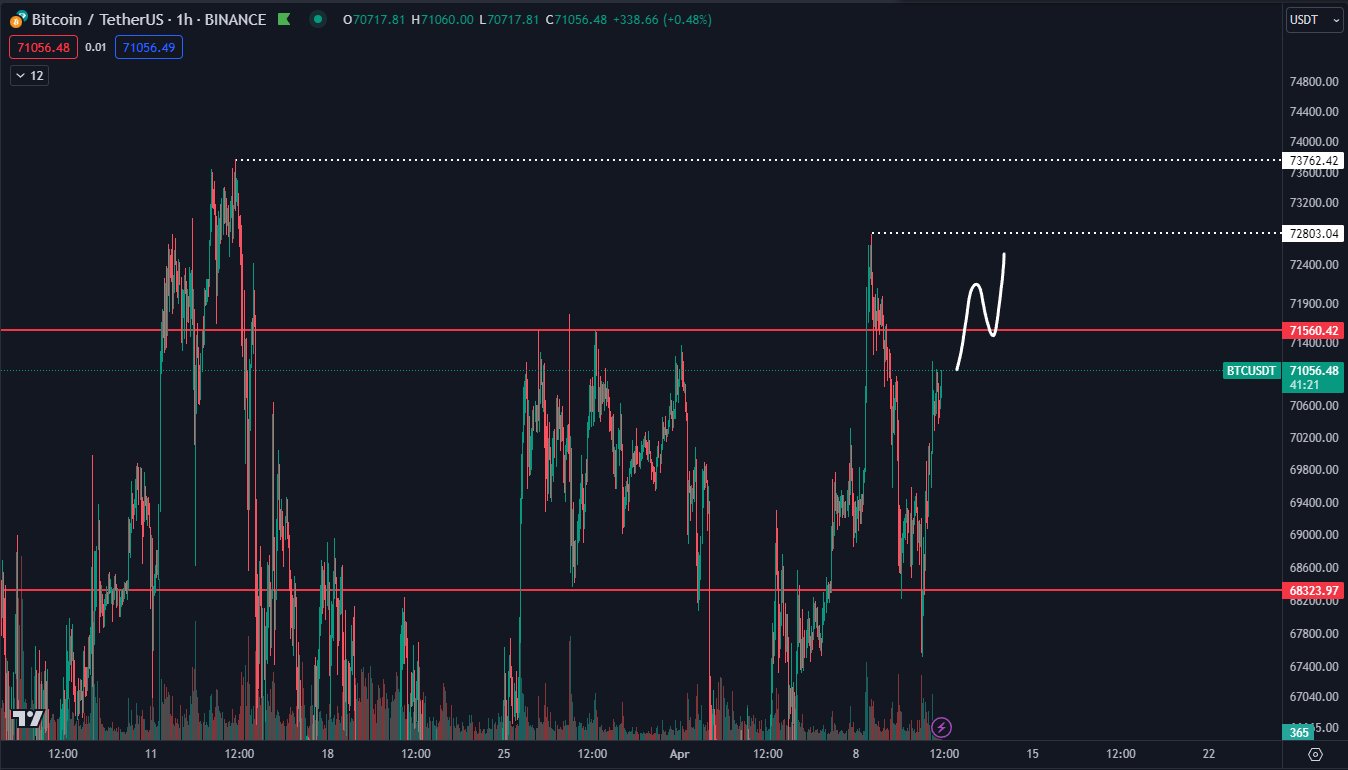

Alan, as well as others, focused on the upcoming block subsidy halving and current BTC price structures as more important focuses going forward.

“The bullish case for BTC is building around a series of higher lows. The bearish case is centered around the fact that bulls haven’t been able to validate and R/S flip at the trend line, $69k or the 21-Day Moving Average,” he explained.

Alan added that $69,000 remained the “most critical” level to watch.

An accompanying video included a chart of BTC/USDT order book liquidity on largest global exchange Binance. This showed sellers in wait near $73,000, along with strengthening bid support near $67,000.

BTC longs “hesistant” near $71,000

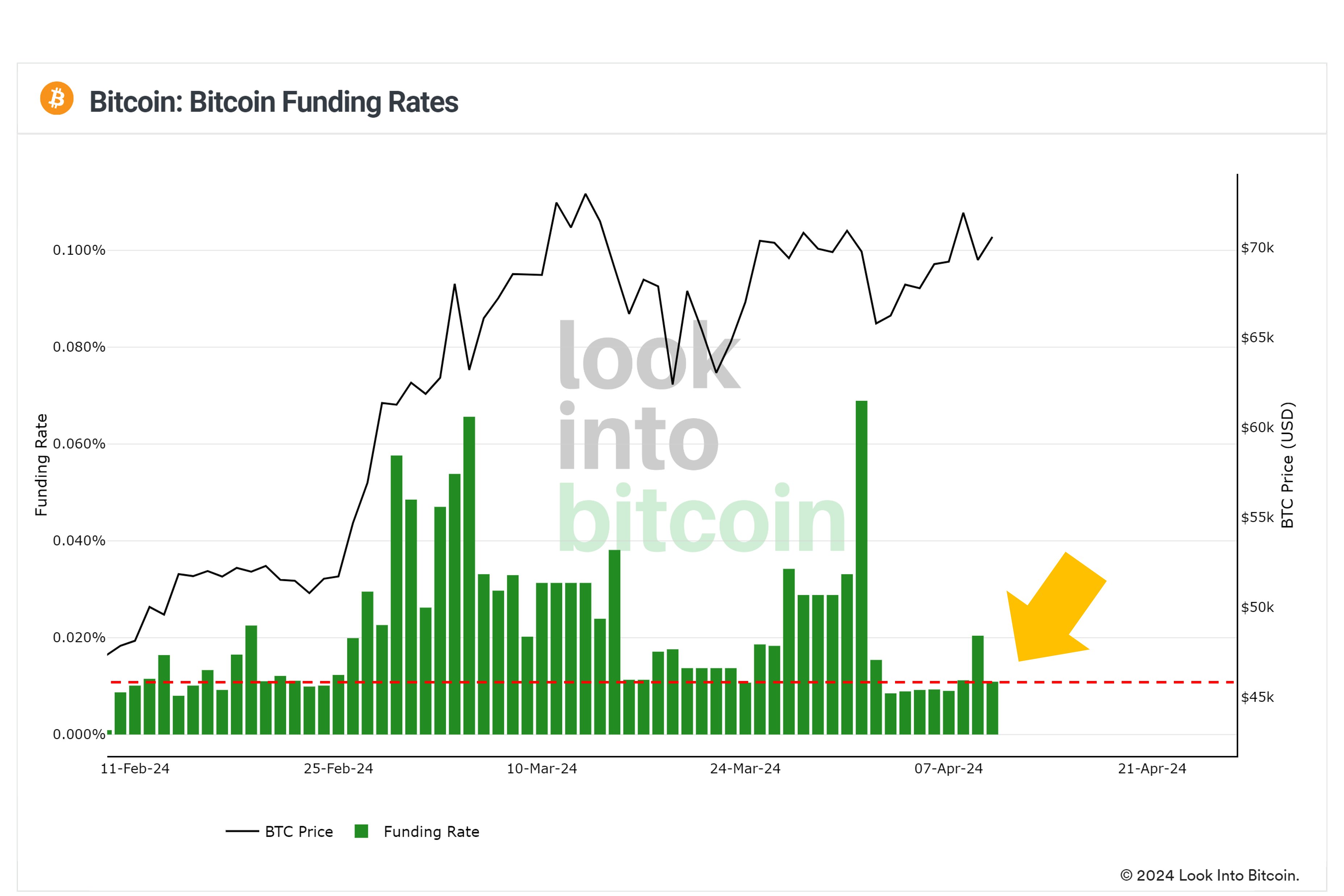

Market observers meanwhile drew optimism from the landscape on exchanges, with funding rates staying low despite recent price upside.

Related: Bitcoin RSI points to short-term gains as metric signals BTC price top

“Bitcoin funding rates finally look healthy for the first time since $BTC climbed above $70,000,” Philip Swift, co-founder of statistics platform Look Into Bitcoin, concluded.

“Bitcoin needed this choppy consolidation to clear out the degens trying to go leverage long. Encouraging sign for bulls.”

Popular trader Daan Crypto Trades suggested that traders were now “hesitant” to long BTC due to successive rejections near all-time highs.

“$71.5K important to break and hold above. Then those all time highs should be a matter of time,” he summarized.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses