Bitcoin bounces back as Grayscale ETF outflows hit new record low

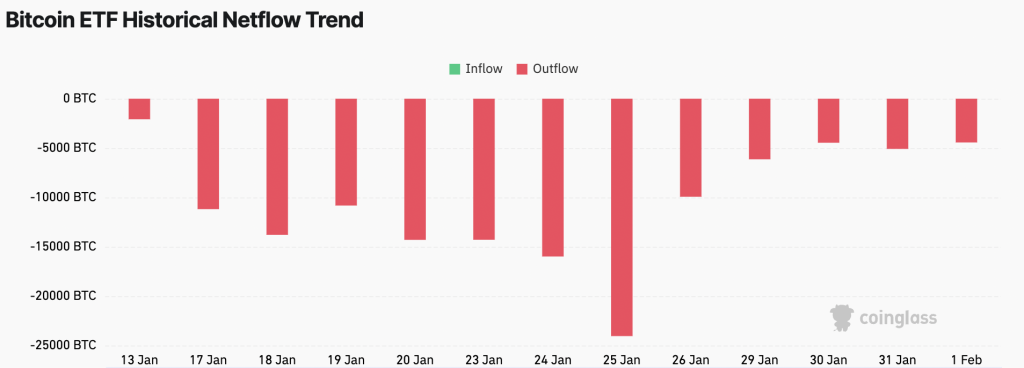

The GBTC outflows on April 10 were approximately 15 times less than the average daily GBTC outflows recorded over the past four months.

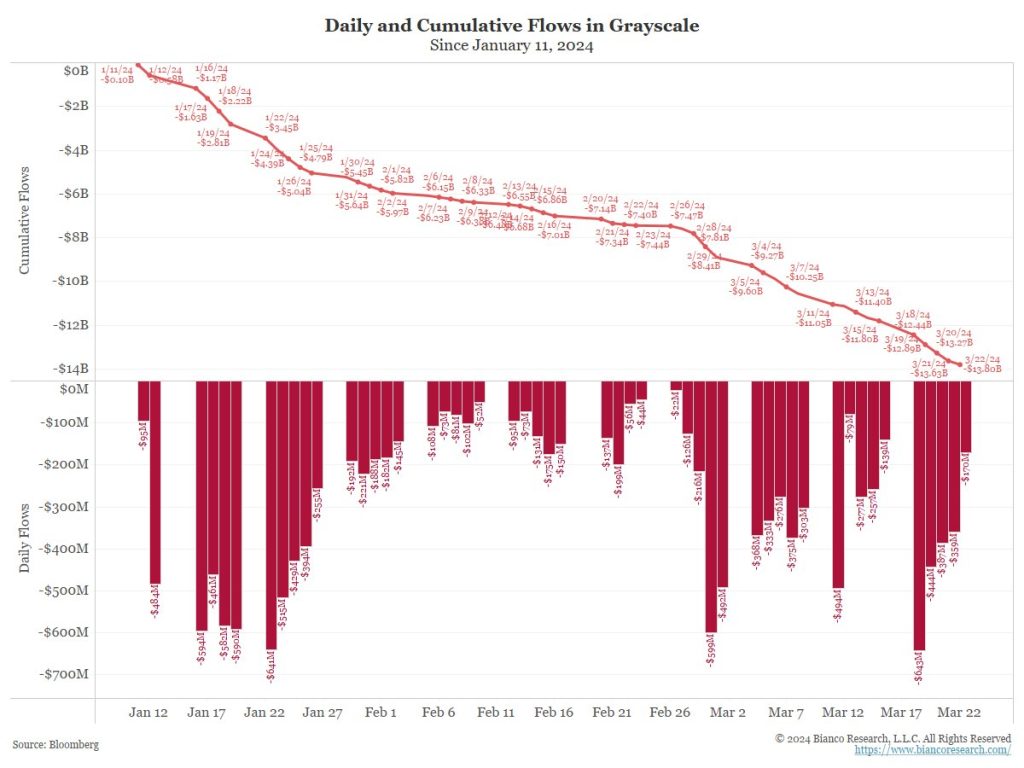

Outflows from the Grayscale Bitcoin Trust (GBTC) have hit a new record low, down almost 90% from the previous day, coinciding with a rebound in Bitcoin’(BTC) after new United States inflation data triggered volatility.

On April 10, GBTC saw outflows of $17.5 million, a significant decrease compared to the $154.9 million outflows recorded on April 9, as per Farside data.

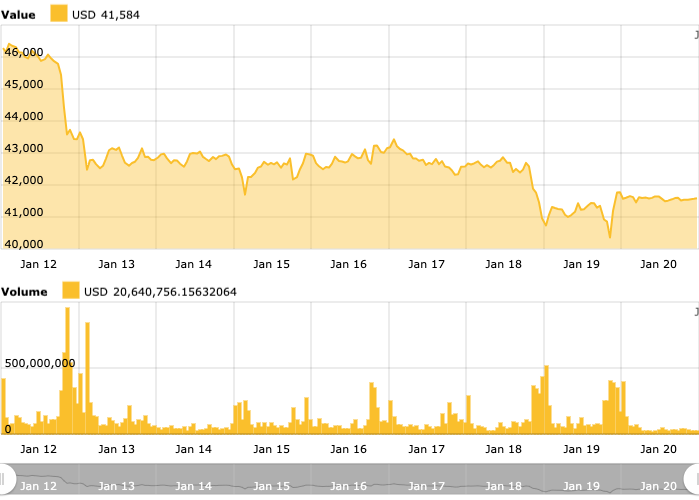

Alongside this, Bitcoin’s price has increased 2.08% over the past 24 hours, currently standing at $70,474, as per CoinMarketCap data.

Within the same time-frame, it briefly hit local lows of $67,482 following the release of the U.S. Consumer Price Index (CPI) for March, which came in at 3.5% year-on-year. This led to worries that the Federal Reserve might further delay interest rate cuts.

Some crypto commentators are again sharing hope it could be the start of the slowdown in GBTC outflows, which have amounted to $16 billion in outflows since GBTC was converted to a spot Bitcoin ETF in January.

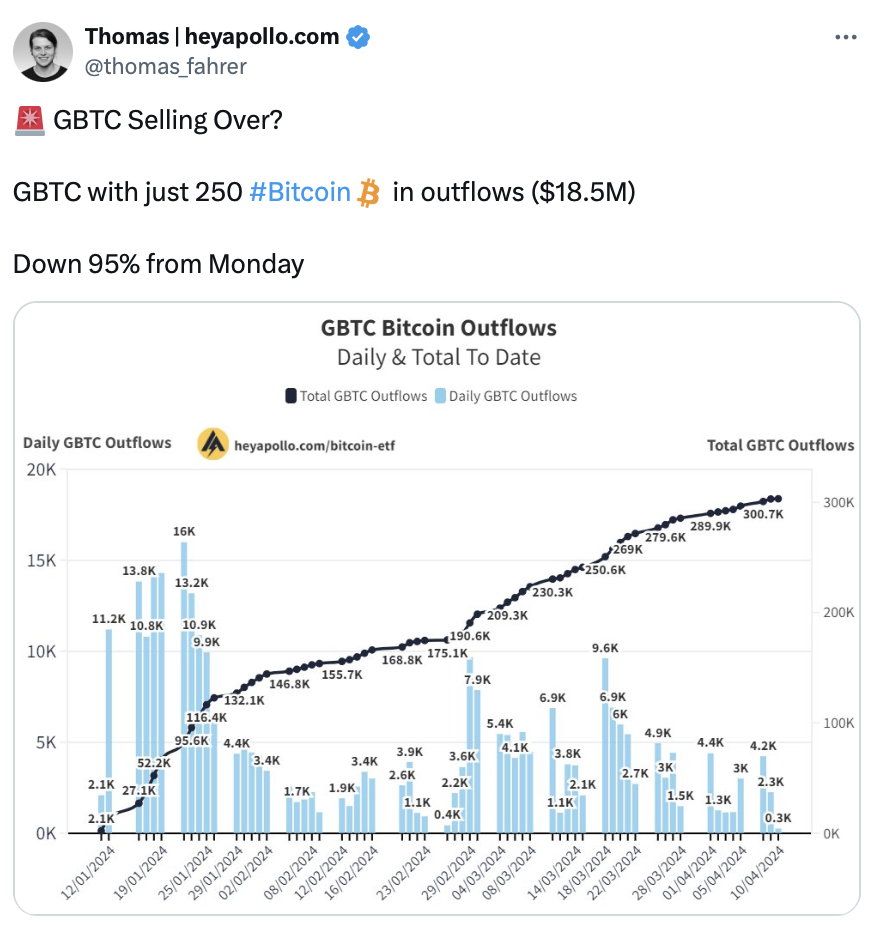

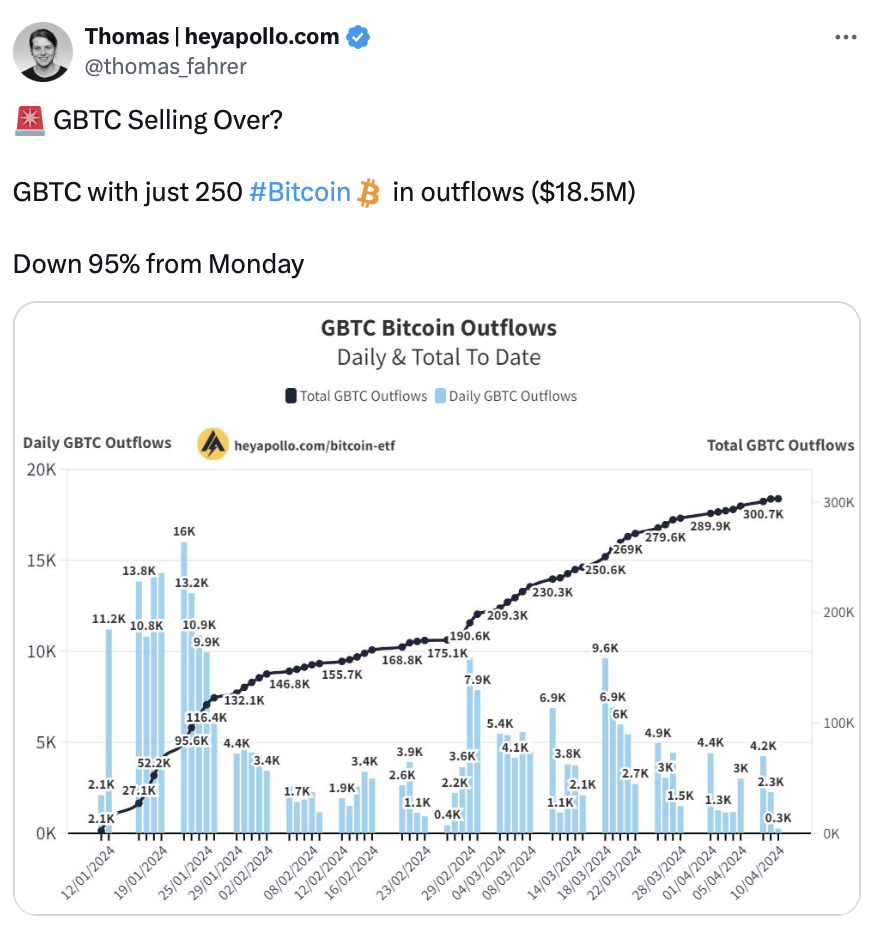

“GBTC selling over?” CEO of crypto-focused reviews portal Apollo Thomas Fahrer asked his 41,500 X followers in an April 11 post.

Fahrer further pointed out that the April 10 outflows are equivalent to roughly 250 Bitcoin, almost a 95% decrease in outflows from the start of the week.

Only days ago, on April 8, Grayscale witnessed outflows equivalent to 4,288 Bitcoin at a total of $303 million.

The previous low was on Feb. 26 when GBTC outflowed $22.4 million. The daily GBTC outflows average across the four months is $257.8 million.

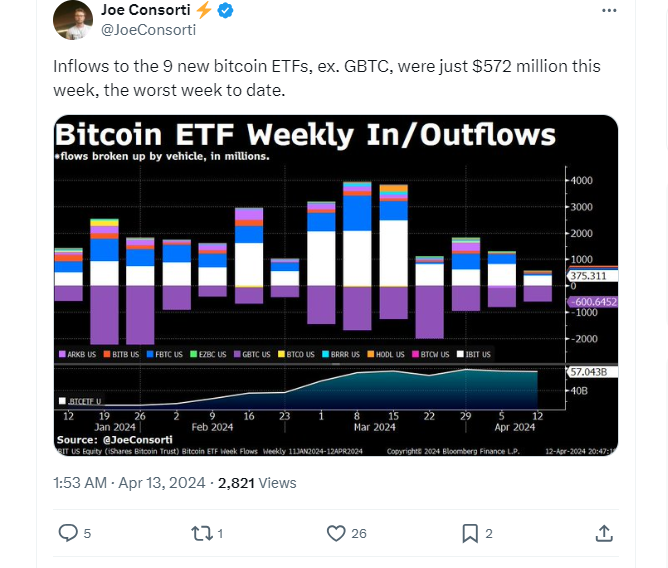

Fidelity Wise Origin Bitcoin Fund (FBTC) recorded $76.3 million in inflows, iShares Bitcoin Trust (IBIT) saw $33.3 million, Bitwise Bitcoin ETF (BITB) saw $24.3 million, and ARK 21Shares Bitcoin ETF (ARKB) experienced inflows of $7.3 million.

Recently, bankrupt crypto lending firm Genesis offloaded approximately 36 million GBTC shares to acquire 32,041 Bitcoin.

Responses