Is Bitcoin’s on-chain bull run momentum over? Indicator flashes red

The indicator signals that behavior among Bitcoin OGs is quite different to previous Bitcoin halvings.

Bitcoin (BTC) OGs appear to be gearing up to cash in on their gains ahead of the Bitcoin halving, according to a leading indicator popular among crypto traders.

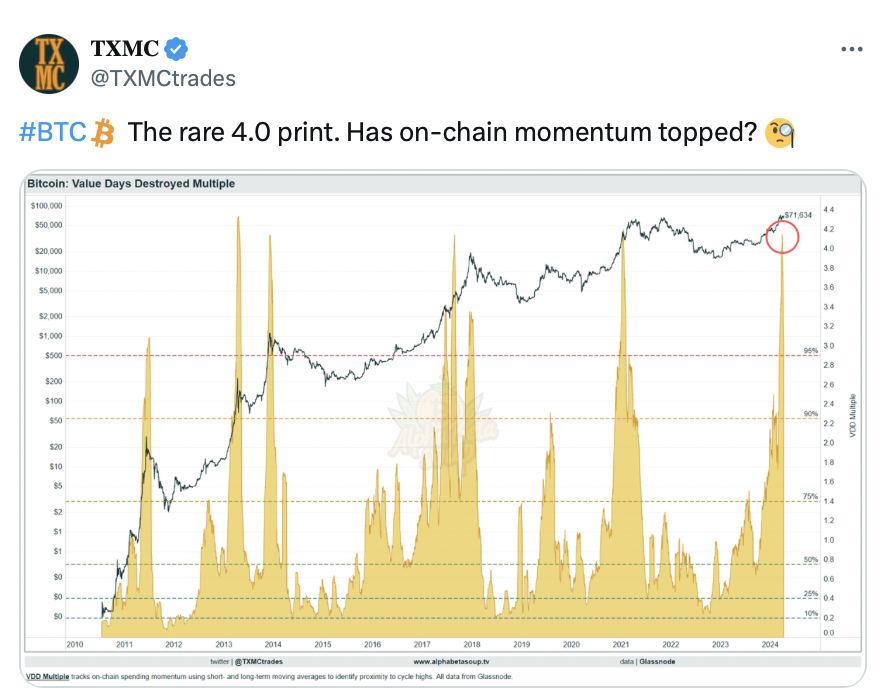

An indicator called the Value Days Destroyed (VDD) Multiple recently spiked above 4.0, leading crypto commentators to speculate that the wider market could be nearing the end of the bull run.

“Has on-chain momentum topped?” pseudonymous trader TXMC Trades asked their 83,200 X followers in an April 10 post.

The VDD Multiple is intended to highlight instances where the price of Bitcoin could be showing signs of overheating and nearing its peak during major market cycles.

A higher VDD Multiple reading indicates a larger amount of Bitcoin quickly entering the market, likely to be sold.

It is measured by multiplying the existing Coin Days Destroyed metric by the current price of Bitcoin to compare spending velocity over time.

Currently, it stands at 3.03, having briefly surged to 4.21 on March 28. It has doubled since the beginning of this year when the VDD multiple hovered around 2.04 on Jan. 1, as per GlassNode data.

The last time the VDD multiple went above 4 was in January 2021, when Bitcoin was $40,257.

However, the brief peak before the cooldown didn’t result in a market downturn, as Bitcoin’s price promptly surged. Just two months later, Bitcoin’s price soared by 52.2% to $61,283 in March 2021, as per CoinMarketCap data.

It is now just nine days to the Bitcoin halving, and it has surpassed the levels observed before past halving events.

During the same timeframe preceding the last halving on July 9, 2016, the VDD multiple stood at 0.419, while it reached 1.606 10 days before the 2020 Bitcoin halving.

Related: Bitcoin analysis eyes CPI as whales ‘pressure’ BTC price below $69K

A senior researcher at Glassnode, who goes by the name CryptoVizArt on X, attributed the soaring VDD Multiple levels to the substantial outflows from Grayscale’s Bitcoin Trust (GBTC).

“Volume and age of Grayscale coins moving since 10th of January, push VDD to new highs,” he stated in an April 10 post on X.

On Jan. 10, the United States Securities and Exchange Commission approved spot Bitcoin exchange-traded funds (ETFs) for trading. Since their approval, GBTC has shed a total of $15.96 billion in assets, as per Farside data.

The fund’s high fees relative to the other Bitcoin ETFs were also noted as a reason for the elevated outflows.

Bitcoin has surged by 56% since Jan. 1 this year, climbing from $44,172 to its current price of $69,260 at the time of publication.

Magazine: Nic Carter vs. the Bitcoin Maxis, ‘no regrets’ about losing $10M DOGE: X Hall of Flame

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses