Bitcoin surge to $72K driven by macro factors, not just spot BTC ETF inflows

Bitcoin’s rally is likely influenced by persistent inflation, student debt forgiveness policies, and global trade restrictions.

Bitcoin’s (BTC) increase of 7.6% between April 6 and April 8, reached an intraday peak of $72,747 and sparked widespread speculation about the underlying causes.

While some may hastily point to the inflows from the spot Bitcoin exchange-traded funds (ETF) as the primary factor, this perspective overlooks the broader motivations for buyers to push the price higher. It is more plausible that a range of macroeconomic factors played a key role in Bitcoin’s recent price rally.

Is Ethena’s stablecoin behind Bitcoin’s surge to $72,000?

It seems misguided to assert that the surge in BTC’s value was solely due to the purchase of $500 million in Bitcoin by the Ethena stablecoin USDCe as collateral. For instance, MicroStrategy’s acquisition of 9,245 Bitcoin, valued at over $600 million on March 19, did not prevent a 13.7% drop in BTC price in the subsequent six days. Given Bitcoin’s daily spot volumes exceeding $10 billion, such inflows are relatively insignificant.

Investors’ expectations regarding the economy and the cost of capital should not be underestimated. Periods of increased liquidity and monetary policies aimed at stimulating consumption and growth usually benefit scarce assets, a trend that is magnified during times of persistent inflation when salaries and prices rise to match the increasing availability of money.

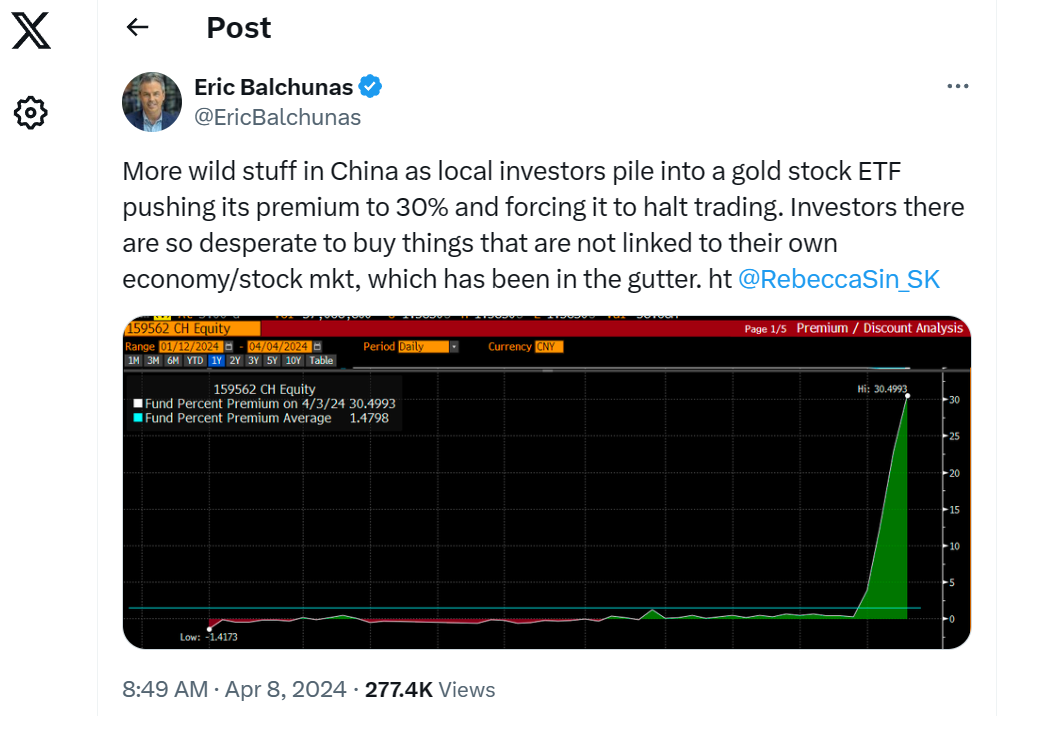

Jamie Dimon, CEO of JPMorgan Chase, recently indicated in a shareholder letter that the resilience of the U.S. economy could “lead to stickier inflation and higher rates than markets expect,” as reported by Yahoo Finance. This insight helps partially explain why gold ETF instruments are trading at a premium in China, as investors brace for inflationary pressures amid the U.S.’s precarious fiscal debt situation.

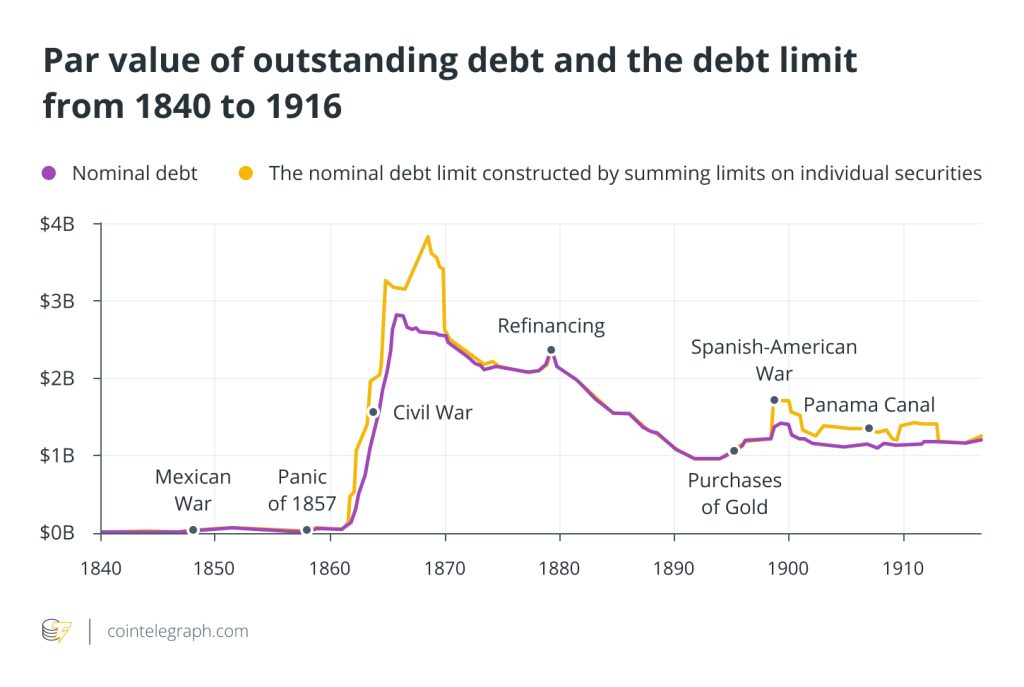

Eric Balcunhas, a senior ETF analyst at Bloomberg, noted that Chinese investors are “desperate to buy assets unlinked to their own economy/stock market,” which has led to gold ETFs trading at 30% above their fair value in China. The U.S. government’s deficit is further strained by a $1.2 trillion spending package approved on March 23 and President Joe Biden’s proposal to forgive up to $20,000 of student debt for 23 million borrowers, regardless of income, thereby exacerbating concerns over fiscal sustainability.

Should Bitcoin react positively to a potential economic downturn?

One might contend that the aforementioned dynamics do not inherently favor Bitcoin, as heightened inflation diminishes the populace’s disposable income, and the inexorable escalation of U.S. debt is likely to precipitate an economic downturn. Nonetheless, predicting how investors will react to such occurrences remains challenging, given Bitcoin’s fluctuating correlation with traditional assets like stocks and gold.

Moreover, escalating trade tensions between the U.S. and China could have spurred the increased interest in both gold and Bitcoin. Intriguingly, gold prices soared to a record high of $2,354 on April 8, a development that coincided with the U.S. Treasury 2-year yield reaching its highest level in over four months at 4.79%. Conventionally, gold’s value tends to wane when investors favor the yields from fixed-income investments; however, this trend was conspicuously absent in the recent surge.

Related: Bitcoin ‘pretty unlikely’ to revisit $50K price level, says analyst

On April 8, U.S. Treasury Secretary Janet Yellen disclosed that the administration is contemplating potential tariffs on subsidized Chinese energy products, including solar panels, lithium-ion batteries, and electric vehicles. Yellen also noted that other nations might consider implementing trade restrictions against China, as reported by CNBC.

Within this context, the surge in Bitcoin’s value to $72,000 on April 8 may be attributed to investors seeking a hedge against the deteriorating state of global economic relations and the ramifications of U.S. government stimulus initiatives, rather than being driven by sporadic and unpredictable Bitcoin inflows from specific investors.

Responses