Bitcoin maximalism is misguided — Satoshi Nakamoto was a 'Maxi Plus'

Bitcoin Maximalism is often toxic and off-putting to cryptocurrency newcomers — along with everyone else. But “Bitcoin Maxi Plus” offers a nuanced alternative.

“Bitcoin is all that matters, but so does everything else,” is a statement I have made to clients and students alike for years now. In an attempt to stress how important Bitcoin (BTC) is, it can be easy to take a hard-line “Bitcoin Maxi” stance. Bitcoin maximalism is the idea that Bitcoin is the only legitimate cryptocurrency protocol, and that all other protocols have no use cases or utility — and are simply scams.

The other side of the coin is being too lenient with every protocol someone dreams up. Founders always tout some coin or token with some kind of shiny buzzword attached to it to make it sound like a technological revolution. Or a memecoin that will fly to the moon.

Having extensive experience as an emerging technology engineer, along with my experience with Bitcoin, Web3, and cryptocurrencies, I can’t throw the baby of newer protocols out with the proverbial bathwater of being a Bitcoin maxi. Seeing the innovations and applications of newer protocols served as the inspiration for my idea of being a “Bitcoin Maxi Plus.”

Related: Bitcoin just hit a record in open interest — expect imminent volatility

The Bitcoin Maxi Plus perspective offers a fresh take on the traditional Bitcoin Maximalist stance. It recognizes Bitcoin’s paramount importance and values other cryptocurrencies’ contributions to advancing blockchain technology and its applications. This perspective is a blend of unwavering faith in Bitcoin’s superiority and its role as the ultimate digital asset, along with an understanding that the broader cryptocurrency ecosystem is crucial in fostering innovation and experimentation.

Core components of the Bitcoin Maxi Plus perspective

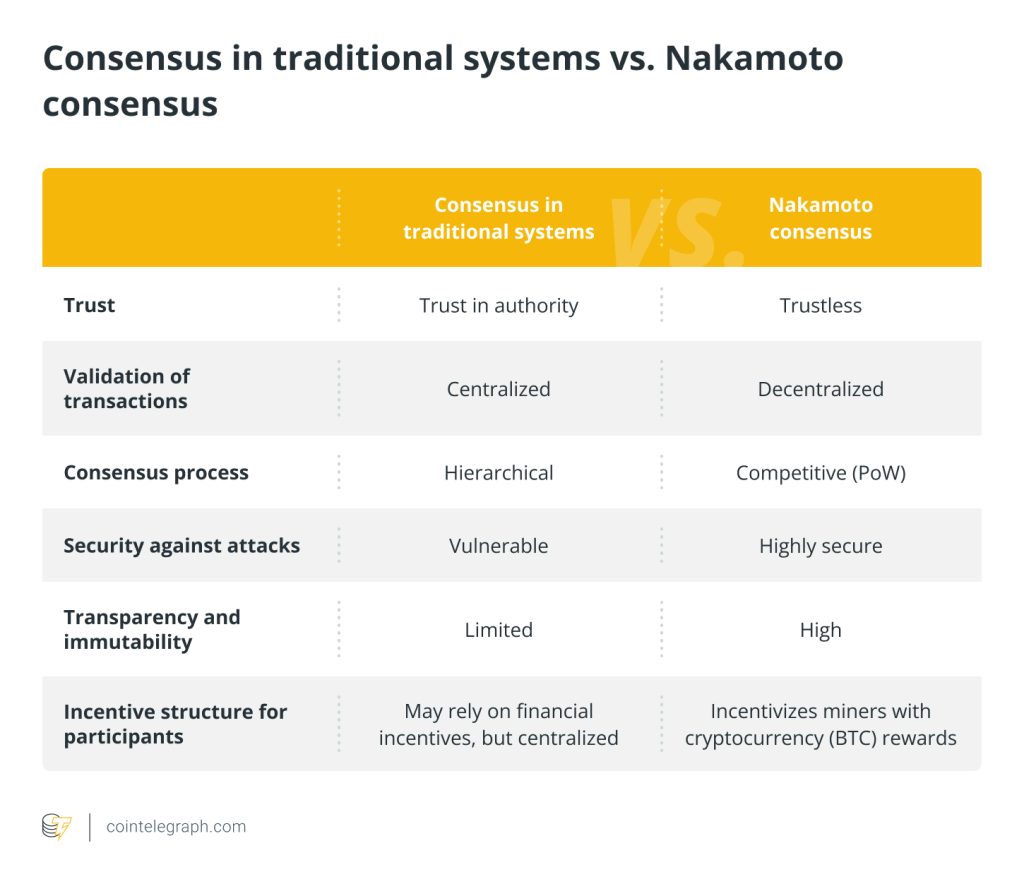

The belief that Bitcoin is the primary digital asset is at the heart of a Bitcoin Maxi Plus. This conviction is rooted in Bitcoin’s unmatched security, decentralization, network effect, and proven track record as a store of value and medium of exchange. It is important to note that this perspective does not diminish the value of other cryptocurrencies but rather highlights Bitcoin’s unique position in the cryptocurrency landscape.

Unlike traditional Bitcoin maximalists who may dismiss the utility and innovation within other cryptocurrency projects, a Bitcoin Maxi Plus appreciates the experimentation and development happening across the broader blockchain space. This includes advances in smart contracts, decentralized finance (DeFi), nonfungible tokens (NFTs), and scalability solutions.

Keeping an eye on experimentation and potential adoption is in keeping with Satoshi Nakamoto’s own stance as well. Satoshi himself said in reference to zero-knowledge (ZK) proofs being added to Bitcoin that “If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.” In the event of an SHA-256 meltdown, Satoshi suggested a transition to something stronger. In 2011, Satoshi responded to Mike Hearn’s email by pointing out “other chains to not follow Bitcoin’s rules,” suggesting he knew about the experimentation of others.

Was Satoshi Nakamoto the first Bitcoin Maxi Plus?

Satoshi and others from the Bitcoin OG era share the Bitcoin Maxi Plus recognition that Bitcoin can potentially integrate technological advancements, which has been proven in other cryptocurrency projects, such as implementing the Lightning Network for scalability. A Bitcoin Maxi Plus might support or advocate adopting successful innovations into the Bitcoin ecosystem to enhance its functionality.

Related: Why Solana will prevail despite Ethereum ETFs

By understanding the value of a diverse blockchain ecosystem, a Bitcoin Maxi Plus supports the growth and development of other cryptocurrencies, not as competitors but as complementary technologies that push the boundaries of what is possible with blockchain. This perspective sees the crypto ecosystem as a testing ground for innovations that could benefit Bitcoin directly or indirectly.

A Bitcoin Maxi Plus approaches other cryptocurrencies with a crucial but open-minded attitude, recognizing that while many projects may fail or prove unnecessary, the innovation process is valuable. This stance allows for a more inclusive view of cryptocurrency while firmly believing in Bitcoin’s leading role.

Bitcoin is the first generation, but not the last

The journey of cryptocurrency has unfolded through various phases, each distinguished by breakthroughs in technology and an expansion of applications. Bitcoin heralded the first generation. Ethereum (ETH) represented the second generation. Layer-2 protocols including Solana (SOL), Near (NEAR), and Avalanche (AVAX) ushered in the third generation. The fourth included projects such as Polkadot (DOT) and Cosmos (ATOM).

With each generation building on the achievements of its predecessors, the cryptocurrency domain continues to evolve, exploring new frontiers. The sector is abuzz with research into fifth-generation cryptocurrencies, which aim to further bolster security, diminish energy consumption, and facilitate blockchain technology’s integration across diverse economic sectors.

Bitcoin is all that matters — and so does everything else

The Bitcoin Maxi Plus concept represents a mature and nuanced understanding of cryptocurrency. It bridges steadfast support for Bitcoin and the recognition that a diverse and innovative cryptocurrency ecosystem can significantly contribute to the technology’s evolution and adoption. This perspective not only enriches the discourse within the cryptocurrency community but also advocates for a more collaborative and exploratory approach to the future of blockchain technology.

Dr. Michael Tabone is a senior economist for Cointelegraph and a professor at the University of the Cumberlands in the Global Business with Blockchain Technology program. His Ph.D. dissertation focused on DAOs and their practical applications in business.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses