Base and SOL memecoin market caps plummet 19% and 12% in 24 hours

Mati Greenspan suggests the memecoin market is crashing because the joke is over, while Charles Edwards points to memecoins suffering heavier losses than Bitcoin during sharp downturns.

The total market capitalizations of memecoins on Solana and Coinbase’s Ethereum layer-2 Base have witnessed a significant drop in the last 24 hours, plunging 12% and 19% respectively across the two networks.

The memecoin sell-off arrived around the same time as a sharp decline in the price of Bitcoin (BTC), with the cryptocurrency falling 4.94% in the last 24 hours, per CoinMarketCap data.

One crypto analyst said it’s common for memecoins to plummet when the price of BTC falters, however, another analyst linked the bearish trend to the humor simply running its course.

“I guess it stopped being funny,” crypto analyst and founder of Quantum Economics Mati Greenspan told Cointelegraph.

“Pretty fitting that the top came in on April Fool’s day,” he added. “There is too much value on memecoins, it’s gotta end at some point, it can’t keep going forever.”

Solana’s memecoin market cap stands at $8.29 billion, marking a 12% decrease within the last 24 hours, according to CoinGecko.

The leading Solana-based meme token by total value — dogwifhat (WIF) — saw a 9% market cap decline on the day, amounting to a loss of $3.9 billion. Notably, WIF still accounts for nearly half of the total memecoin market share on Solana.

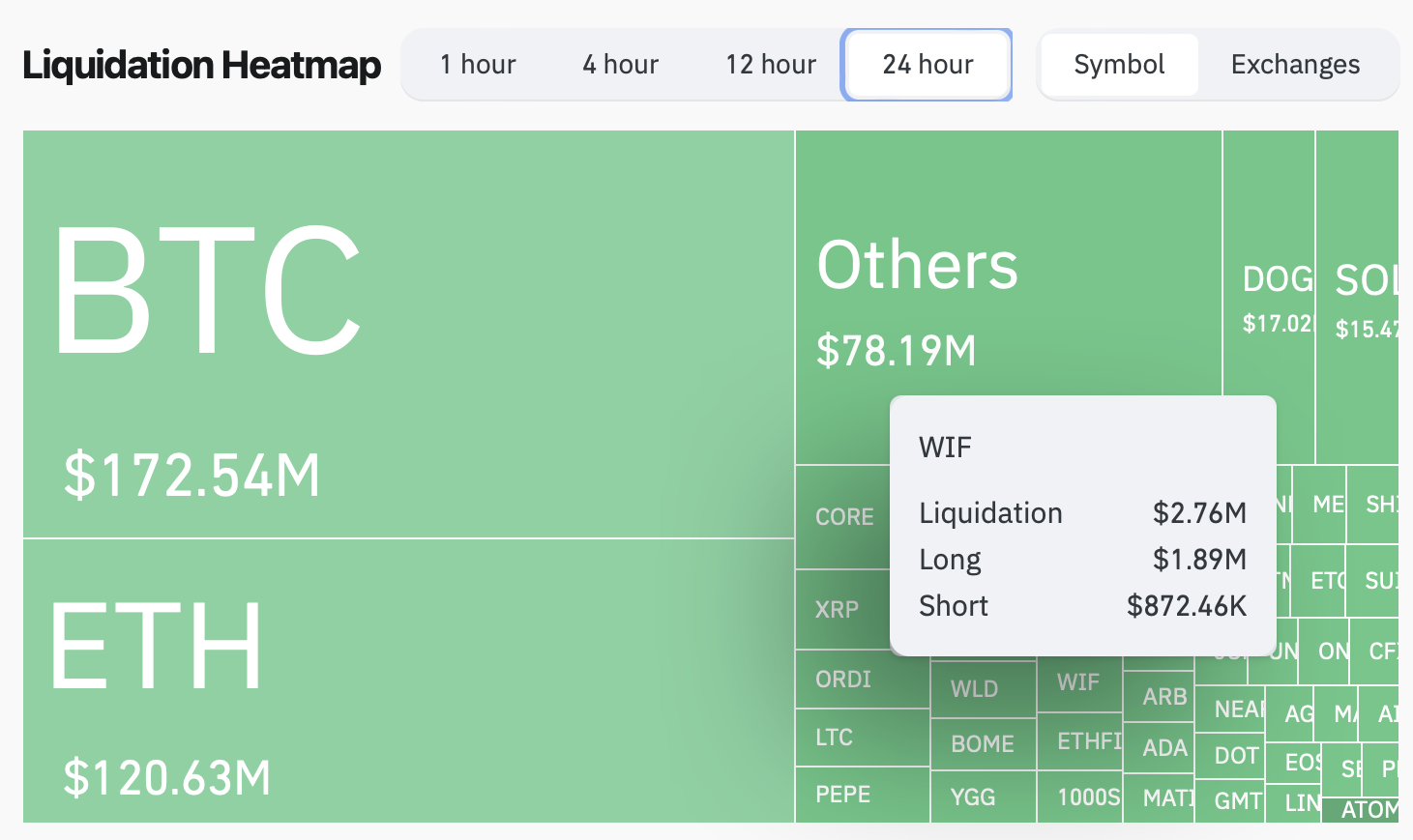

Across eight major crypto exchanges, WIF currently touts a total of $484 million in open interest (OI). However, $2.76 million in leveraged positions have been liquidated over the last 24 hours, including $1.89 million in short positions and $872,460 in long positions, per CoinGlass data.

Base’s total market cap dropped 19% over 24 hours to $1.47 billion. The native token of a new Layer 3 network dubbed “Degen” (DEGEN) on Base, suffered the most, witnessing a 26.14% drop in market cap to $436.5 million.

The total crypto market cap — the value of all assets across the entire crypto sector — has also taken a 6.14% hit over the past 24 hours, currently standing at $2.45 trillion, per CoinMarketCap data.

Greenspan suggested that while Bitcoin is finding strong support levels, memecoins are seeing fluctuations beyond critical key price points.

“Bitcoin retracement is minuscule at the moment, memecoins are getting slaughtered,” Greenspan added.

Bitcoin dropped 4.94% over the past day to trade at $65,910. Meanwhile, WIF’s price has dropped 10.3% to $3.67.

Related: Base TVL doubles in a month as pundits tip memecoins to drive adoption

Greenspan attributes this to the leading correlation that Bitcoin commands over other cryptocurrencies in the wider crypto market.

“It has directional correlation, when Bitcoin is up, they go up more, and when Bitcoin is down, they go down more than Bitcoin. This will hold up for a very long time,” Greenspan says.

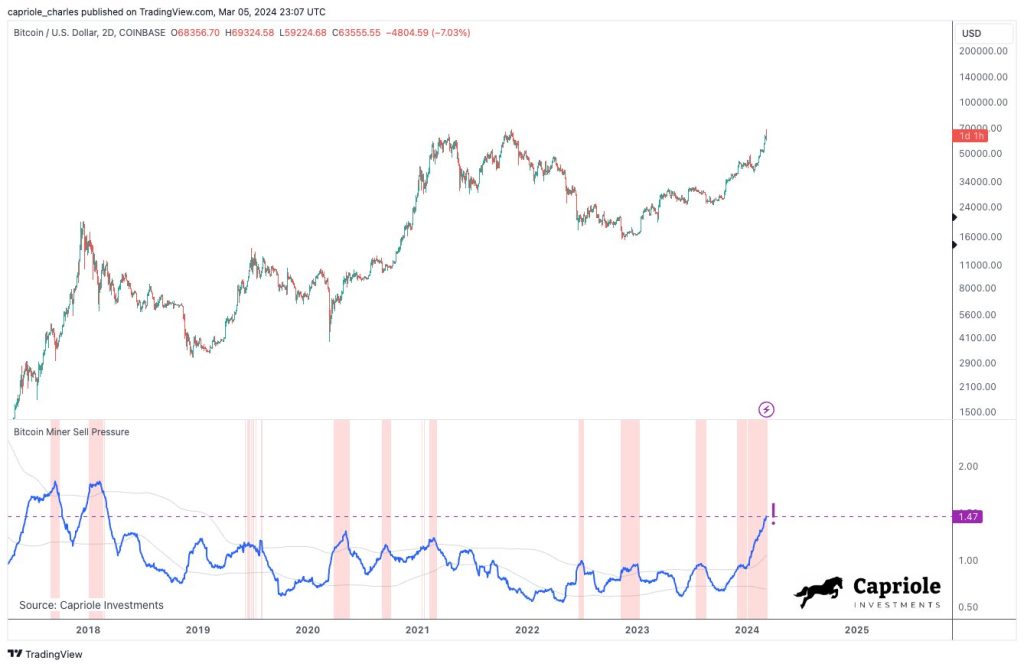

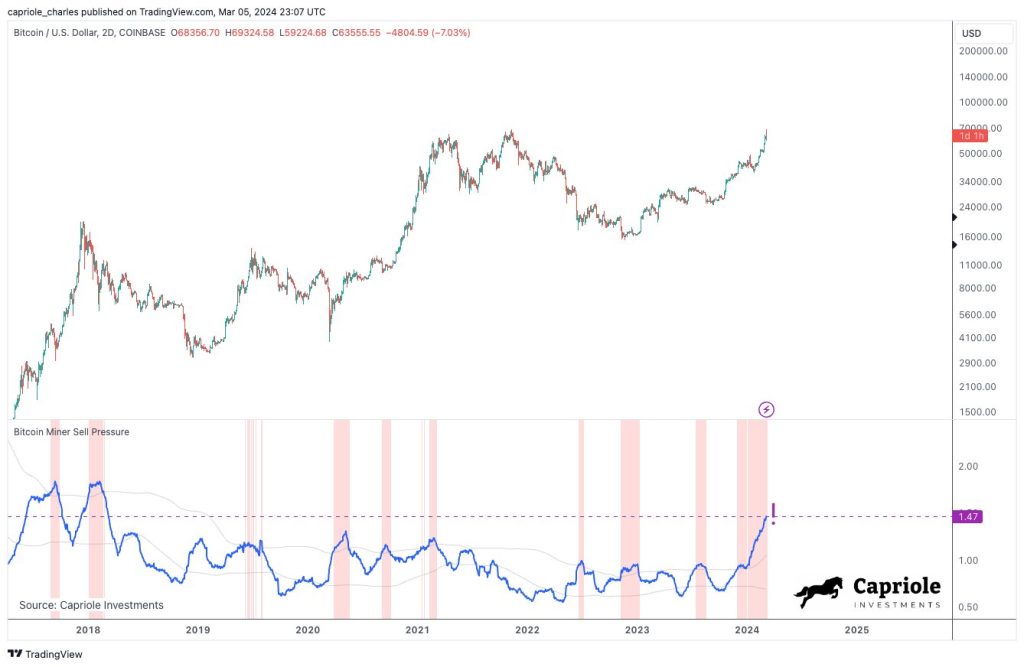

Charles Edwards, the founder of quantitative Bitcoin and digital asset fund Capriole shared a similar sentiment, telling Cointelegraph that it’s typical for memecoins of this nature to experience up to double the impact of Bitcoin’s downturns.

“Altcoins like this are high beta on Bitcoin, so if Bitcoin drops 7-10% as it has over the last day or two, expect coins like this to drop at least 1.5 -2x more,” Edwards told Cointelegraph, adding that excitement has been driving much of the prices for Solana and Base in recent times:

“There’s just generally been a lot of hype for SOL and Base ecosystems, but I would argue that they have a lot less tangible value than BTC and Ethereum.”

Crypto analyst and Crypto Banter podcast host Ran Neuner said in an April 2 X post that the memecoin market is nearing an oversaturation point.

Responses