Digital asset inflows recover, but ETF activity is slowing down

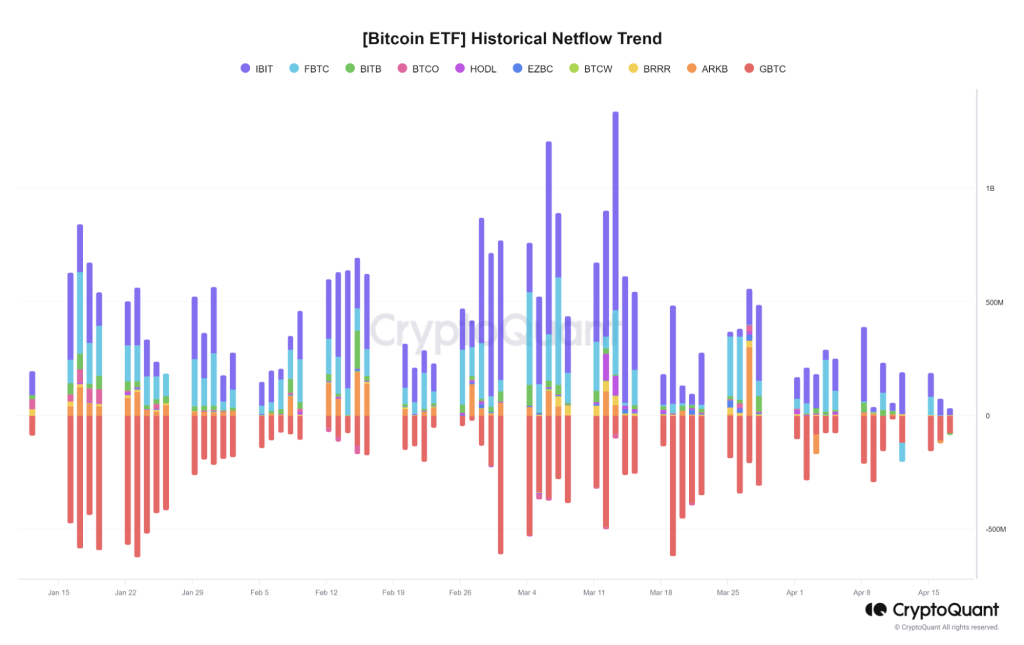

Despite a net positive flow into the crypto market, the ETF demand seems to have slowed down compared to its peak in the first week of March.

Digital asset inflows into crypto investment products turned positive over the past week, with net inflows of $862 million compared to net outflows of $931 million a week prior.

However, the popularity of spot Bitcoin exchange-traded funds seems to be cooling down. The daily trading volume of exchange-traded funds (ETFs) has dropped to $5.4 billion, 36% less than its peak of $9.5 billion recorded in the first week of March.

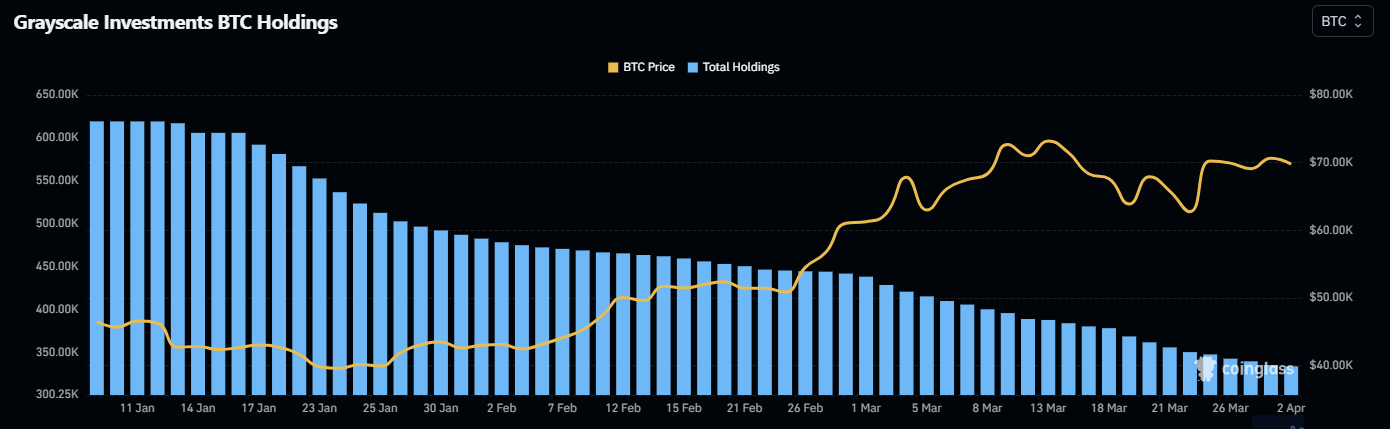

Bitcoin (BTC) topped the digital asset flows with $863 million in inflows aided by the ETF demand, with spot BTC ETFs recording $1.8 billion in inflows compared to $965 million in outflows by Grayscale.

Grayscale continues to see massive outflows nearly two months after the trading for 11 spot Bitcoin ETFs in the United States began on Jan. 11.

The continuous outflow from the Grayscale Bitcoin Trust (GBTC) has put significant selling pressure on BTC price over the past three weeks.

Market pundits had predicted that over time, the outflows from GBTC would slow down and dry up, leading to unprecedented demand for ETFs.

However, the current investor trends indicate that the GBTC outflows are far from over, with GBTC dominating the ETF flow over the past three weeks.

The selling pressure from ETFs is visible on the BTC price as the world’s top cryptocurrency dropped by $4,000 over the past 24 hours, trading just above $66,000.

Many market analysts have called it a routine correction before the Bitcoin halving event scheduled for April 20.

The BTC price correction saw nearly $500 million in liquidation while the options market heated up with heavy put calls, suggesting a bearish trader sentiment.

Related: Bitcoin exchanges’ BTC balances have dropped almost $10B in 2024

Ethereum (ETH) recorded its fourth consecutive week of outflows, with $19 million this past week. The altcoin market recorded a net inflow of $18.3 million last week, with Solana (SOL) leading the charge with $6.1 million in inflows.

The U.S. recorded the largest outflow region-wise this past week with $897 million, while Europe and Canada combined saw $49 million in outflows.

Responses