Bitcoin ETFs could soften BTC price retracement before the halving

The 2024 Bitcoin halving may have all the conditions for an impressive bullish scenario where prices reach record all-time highs.

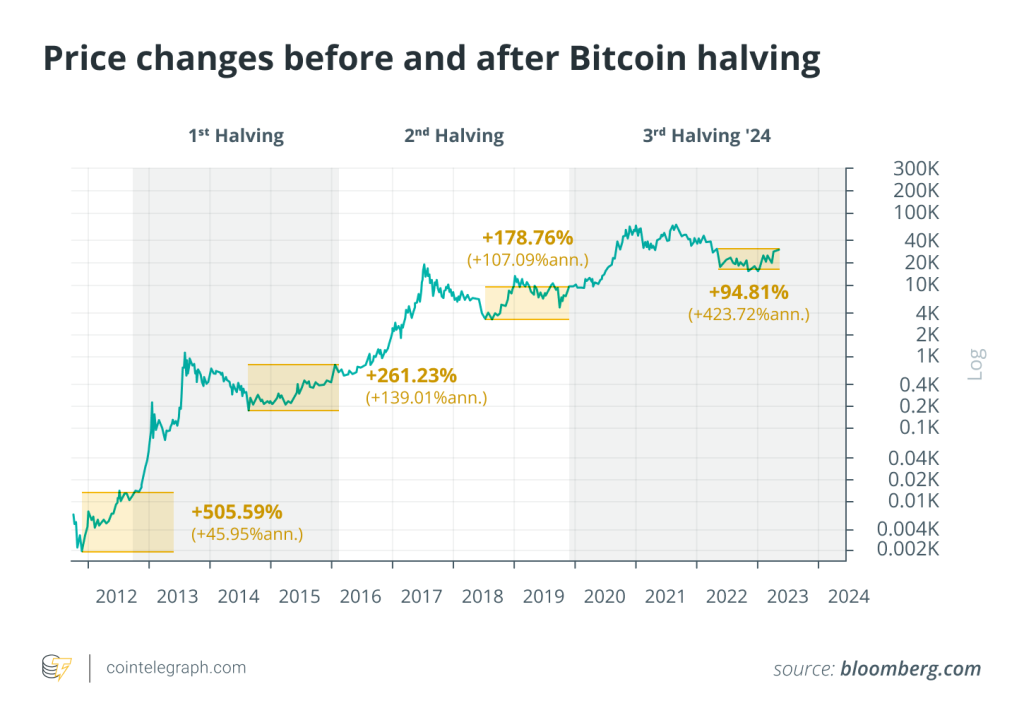

Bitcoin’s halving event — which happens every four years or 210,000 blocks — is historically accompanied by a price retracement.

This time, market observers are asking whether this part of the halving — which in previous years saw double-digit percentage losses — will be softened by the presence of spot Bitcoin (BTC) exchange-traded funds (ETFs), which have the potential to bring large amounts of institutional investment into BTC.

The 2024 Bitcoin halving is expected to take place in April and will be the fourth halving in Bitcoin’s history. Halvings decrease the supply of new BTC, ensuring its scarcity.

According to crypto analysis firm Rekt Capital, the first stage is called the pre-halving downside phase, which sees bearish price movements due to investors anticipating the event. The second stage — the pre-halving rally — records significant price increases due to moves by short-term investors who want to reap the benefits of the halving hype.

At the time of writing, many market observers believe Bitcoin has entered the third stage: a pre-halving retracement.

This phase records downward price movements mainly due to investors anticipating incoming sell pressure and exiting their positions — and this is where investors expect Bitcoin ETFs to play a crucial role.

The fourth stage, reaccumulation, starts after the halving takes place and may last up to five months. At this point, most hype is lost, and many investors exit their positions as they get bored due to stagnant price movements.

However, at the end of this reaccumulation phase comes the fifth stage of halving: the parabolic uptrend. This is where the Bitcoin price can recover from the third and fourth stages and hit a new all-time high (ATH).

ETFs’ impact on pre-halving retrace

In early January, the United States Securities and Exchange Commission (SEC) approved 11 Bitcoin ETFs to be listed and traded on registered traditional exchanges. This landmark decision allowed skeptical traditional investors to include Bitcoin among their assets, increasing demand for the flagship crypto.

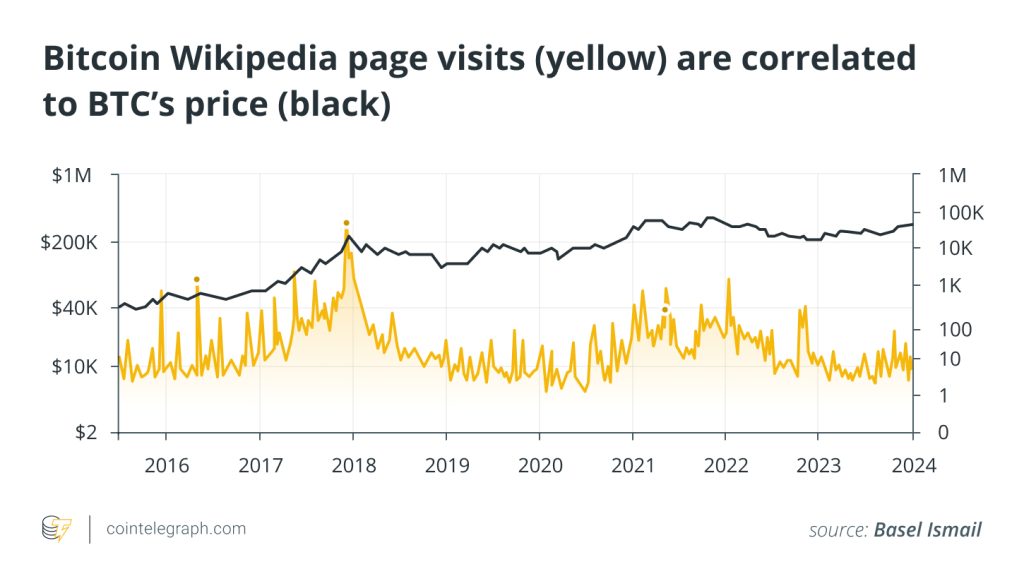

Recent data shows that the demand for Bitcoin ETFs is too substantial to be ignored. On March 4, global Bitcoin exchange-traded products (including Bitcoin ETFs) surpassed 1 million Bitcoin in assets under management.

On March 5, Bitcoin ETF products broke a new record, reaching a cumulative $10 billion in trading volume, which marked the highest level since their inception in January.

Considering that these surges were recorded while gold and other ETF products recorded significant outflows, could this suggest a potential investment shift toward Bitcoin ETFs?

Recent: Ethereum Dencun upgrade lowers transaction fees for L2s

Such an increase in demand for Bitcoin from traditional investors is not something the market has witnessed before. According to bullish market observers, the inflows through Bitcoin ETFs will be a hedge against falling prices during the retracement.

MicroStrategy CEO Michael Saylor recently said, “The approval of spot ETFs is going to be a major catalyst that’s going to drive the demand shock, and then that will be followed in April with a supply shock.”

Connecting the dots

The connection between Bitcoin ETFs and the Bitcoin halving will appear in the third and fourth stages of the halving process.

The third and fourth stages of the halving usually record falling Bitcoin prices, as mentioned above. This happens as the investors who opened shorts to ride the halving hype exit their positions.

Miners who anticipate this retreat also sell their Bitcoin holdings before their rewards are cut in half to maintain some liquidity.

After these players leave the market, new investors who bought in for the hype get disappointed and leave their positions. All these factors mean one thing only: falling demand.

However, the halving phases are not the only things that can trigger a price dump. During the first week of March, the Bitcoin price fell after a whale sold 1,000 Bitcoin all at once. Data showed that this wallet had been holding Bitcoin since 2010, and the sudden exit triggered an overall decline in Bitcoin prices.

Institutional activity, particularly within Bitcoin ETFs, played a significant role in shaping market dynamics. Accounting for billions of dollars in trading volume, the ETFs successfully influenced the market sentiment toward a positive trajectory.

Assuming that the exponential growth of Bitcoin ETFs continues, data reported by Blockworks suggests that by the time the third and fourth stages of the halving arrive, the inflows through Bitcoin ETFs could create enough force to combat the falling prices, which, in turn, would provide a stronger base for the parabolic uptrend and result in even higher ATHs at the fifth stage.

Mario Nawfal, the host of The Roundtable Show on X, told Cointelegraph, “The expected halving retracement is becoming a very consensus view, no different to the ‘sell on the news’ consensus we experienced when the ETFs were first approved by the SEC. Thus, when we got the news and correction, as the thesis was so consensus, the dip was shallow and short-lived.”

“The real story going forward is actually the huge imbalance we see between the supply of BTC and structural inflows that our sources indicate are being planned, with institutions, family offices, and endowments and foundations having not yet concluded their rebalancings and asset allocation into BTC or crypto assets generally. The real story will be the lack of supply to handle the inflows and the disruption that comes with it,” he said.

Bitcoin EFTs and halving is just speculation

On the other hand, some experts are not confident that the inflows through Bitcoin ETFs can provide the aforementioned once-in-a-lifetime opportunity during the 2024 halving.

Nicholas Sciberras, a senior analyst from Collective Shift, argues that while Bitcoin EFTs could pull in enough inflow to hedge against the selling pressure, they could also contribute to the selling pressure if the demand for Bitcoin ETFs doesn’t continue as positively as it is today. Therefore, instead of balancing out the decreases expected in the third and fourth stages of halving, they can amplify it.

JPMorgan’s prediction for the bearish scenario also argues that Bitcoin could fall as low as $42,000 after the halving. The bank expects the prices to follow the usual halving sequences and critically fall after the halving hype is over.

For instance, since its launch in January, Grayscale Investments has been experiencing considerable outflows from its Grayscale Bitcoin Trust ETF. The sell-offs amounted to billions of dollars in January alone. This could point to investors’ decreasing interest in Bitcoin ETFs, or it could simply be associated with Grayscale’s Bitcoin ETF, showing that it might not meet the expectations or needs of investors.

Recent: Greens’ push to end German cryptocurrency tax exemption sparks debate

If it’s the former, then by the time the third and fourth stages of the halving arrive, inflows to spot BTC ETFs might decrease, thereby not affecting the expected price drops of the halving.

Senior Bloomberg ETF analyst Eric Balchunas told Cointelegraph, “You may argue that the ETF buyers aren’t even that into the mission of Bitcoin. But, as I’ve told many people, don’t underestimate their ability to hold on because most of them are going to have a 60/40 core and guardian, kinda low-cost indexing. Plus, because they’ve got all the serious stuff covered there, they’re going to have more tolerance for the hot sauce. So, no matter how high or low it goes, I just don’t think they’ll do that much. I think the ETF holders will be stronger than people think.”

Most would say that it’s not possible to be 100% certain about something in the crypto market. While Sciberras’s scenario is possible, there is less than a month to the halving, and judging by the performance of the Bitcoin ETFs, the bearish scenario seems unlikely. Nevertheless, while most of the community expects Bitcoin ETFs to benefit from some of the halving stages, only time will tell to what extent it will affect them, if at all.

Responses