BlackRock's ETF could flip GBTC in Bitcoin holdings within 3 weeks

BlackRock’s spot Bitcoin ETF could soon surpass the Grayscale Bitcoin Trust (GBTC) in Bitcoin held within 14 trading days, based on current rates.

The amount of Bitcoin in BlackRock’s spot Bitcoin ETF could overtake crypto asset manager Grayscale’s GBTC within the next three weeks, assuming no drastic changes in current flows.

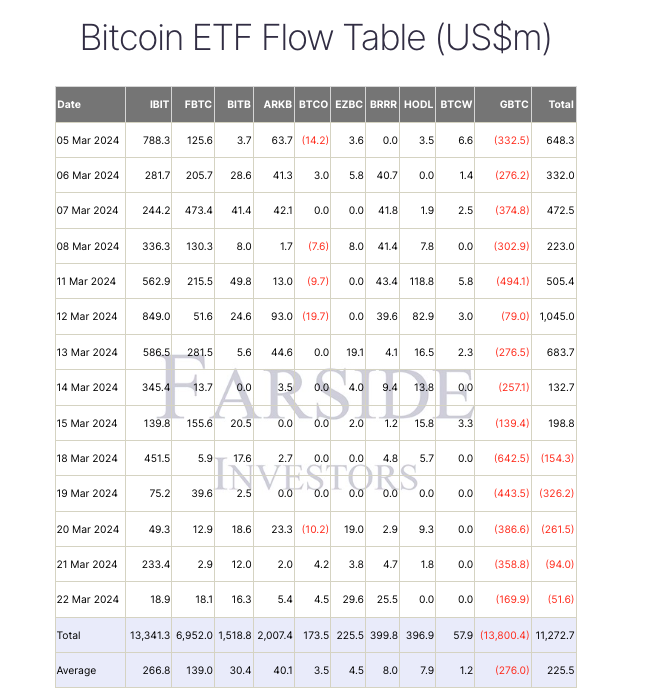

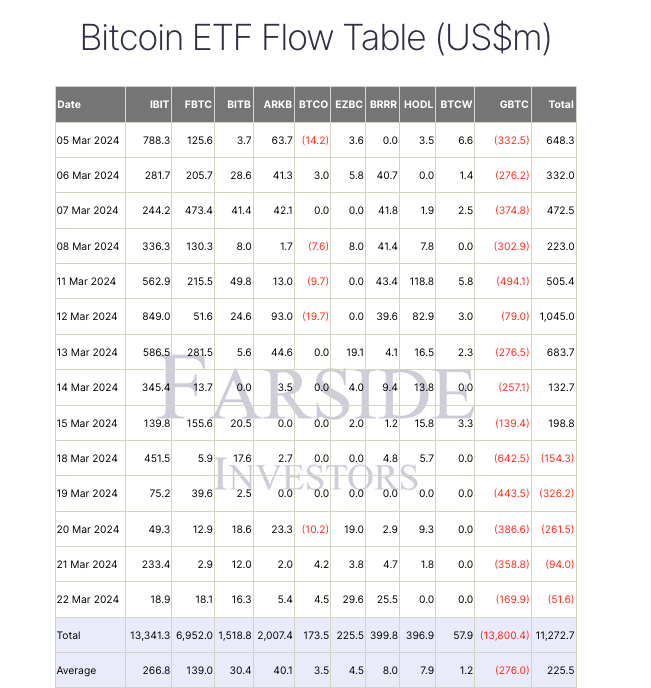

As of March 22, BlackRock’s Bitcoin ETF held 238,500 Bitcoin (BTC) on its books — worth $15.5 billion at current prices, but has touted an average daily inflow of approximately $274 million — roughly 4,120 in new Bitcoin entering the fund every day.

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) reports that it still holds an estimated 350,252 BTC — worth $23 billion at current prices. It has been experiencing an average daily outflow of roughly $277 million, or roughly 4,140 BTC daily, over the last fortnight.

Assuming no drastic changes in the rate of the inflows and outflows, BlackRock could overtake Grayscale in terms of total Bitcoin held by April 11.

This date could come even closer if BlackRock’s inflows were to return to the prior week’s daily average inflow of 7,200 Bitcoin, meaning the flip could occur in 10 days.

“BlackRock is going to flip Grayscale soon,” YouTuber George Tung said in a March 20 video on his CryptosRUs channel.

“I say within the next two weeks — it’s going to happen.”

If BlackRock surpasses Grayscale, it will officially become the largest institutional holder of Bitcoin in the world.

Related: Bitcoin price clear for new record high as GBTC outflows drop to $170M

On March 18, GBTC notched a staggering $643 million in net outflows, its largest day of bleeding on record.

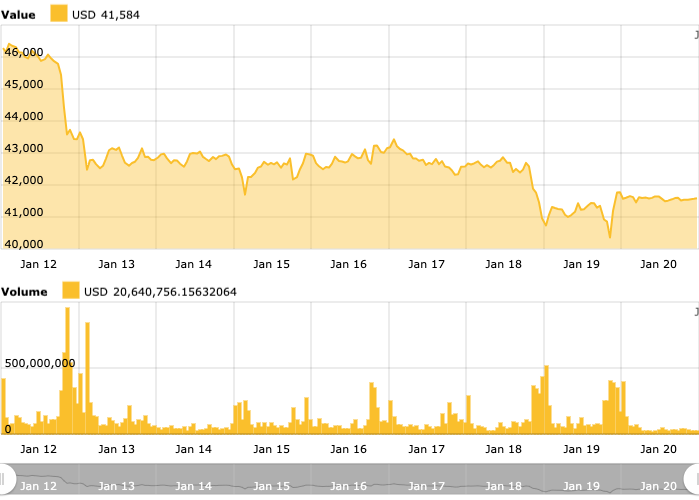

While the flows leaned up a little in the following days, the heightened volume of outflows saw several analysts warn of potential downward volatility in the price of Bitcoin.

Senior Bloomberg ETF analyst Eric Balchunas wasn’t too concerned by the GBTC-led outflows and predicted the exodus could be over almost entirely within the next few weeks.

Additionally, Blachunas speculated that the majority of last week’s outflows came from bankruptcies of crypto firms such as Genesis and Digital Currency Group due to their “size and consistency.”

On March 10, BlackRock’s spot Bitcoin ETF officially outpaced MicroStrategy’s holdings of the cryptocurrency. As of the time of publication, MicroStrategy holds 214,246 BTC on its books after purchasing an additional 9,000 BTC on March 19.

Responses