Bitcoin ETF demand could rise as prices drop, crypto analyst suggests

Young Ju noted that new BTC whales have an on-chain cost basis of around $56,000 and expects substantial capital influxes into the spot Bitcoin ETF market if BTC reaches this price level.

Amid Bitcoin’s price decline, the spot Bitcoin ETF market has been gloomy recently. Despite these persistent declining net flows, Ki Young Ju, a prominent analyst and CEO at CryptoQuant, has predicted a possible resurgence in the spot Bitcoin ETF market.

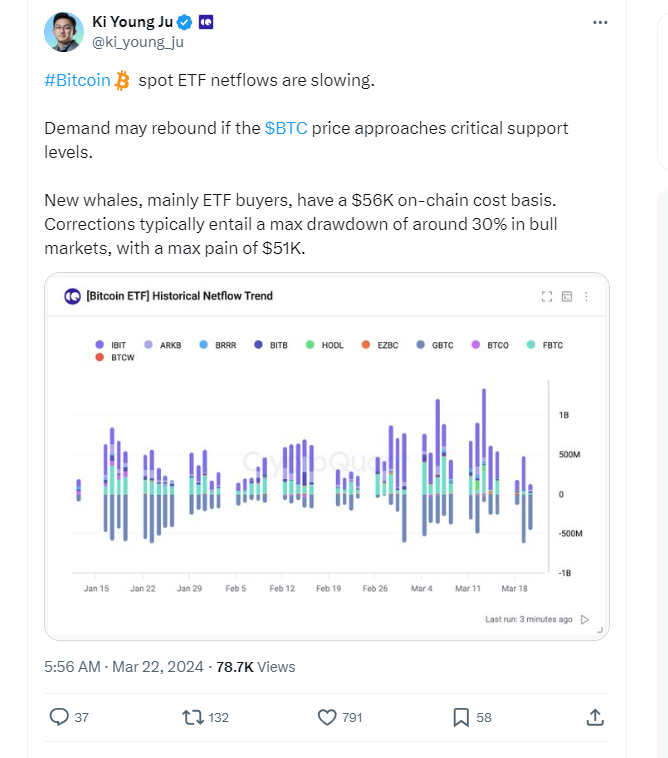

In a post on X on March 22, Ki Young Ju shared that spot Bitcoin ETF netflows could rise even as the BTC price decline continues. Using data from the historical netflow trends, the analyst noted that demand for Bitcoin ETFs usually kicks in when the cryptocurrency traces to certain support levels.

According to data from analytics firm BitMEX Research, these BTC ETFs have recorded a negative flow for the last four trading sessions. This situation has been marked by significant levels of Grayscale’s GBTC outflows and the record low inflows for the other ETFs, mainly the market leaders BlackRock’s IBIT and Fidelity’s FBTC.

Young Ju noted that new BTC whales, especially ETF buyers, have an on-chain cost basis of around $56,000. This indicates that significant Bitcoin holders, particularly ETF investors, typically acquired Bitcoin at an average price of $56,000.

In line with this pattern, the cryptocurrency quantitative expert anticipates significant inflows into the spot Bitcoin ETF market should BTC attain the mentioned price threshold.

According to data from Cointelegraph Markets Pro, Bitcoin’s (BTC) price has fluctuated between $62,000 to $68,000 over the past week. However, Young Ju suggests that such a decline is plausible, given that corrections typically see a maximum drop of 30%. With BTC’s recent peak at $73,750, the analyst forecasts that the asset’s price could drop as low as $51,000.

Related: Bitcoin demand in Argentina reaches highest point in nearly two years

However, over the past 48 hours, BTC’s price dropped 13% from its new all-time high of $73,835 to briefly trade near $60,000. The correction was caused by overheated market conditions in what analysts have christened a “pre-halving retrace” ahead of the Bitcoin halving event that is roughly 30 days away.

A report by CryptoQuant shows that the Bitcoin bull cycle is not over, given the relatively low level of investment flows from new investors and price valuation metrics still below levels seen in past market tops.

Meanwhile, the upcoming Bitcoin halving event is a significant driver expected to bolster BTC price, ushering in a parabolic uptrend. According to CoinMarketCap’s halving countdown, Bitcoin’s next halving event is less than 31 days away.

Responses