TradFi Wall Street firms pushing for Ether ETF approval, says former Binance Labs head

Wall Street firms want Ether ETFs more than crypto natives due to the ETF management fees, Bill Qian told Cointelegraph in an exclusive interview.

Wall Street firms and large financial institutions, not crypto natives, have the biggest interest in pushing for the approval of spot Ether (ETH) exchange-traded funds (ETFs), according to Bill Qian, chairman of Cypher Capital and former global head of fundraising at Binance Labs.

“Now it’s not crypto natives pushing the approval of ETFs but Wall Street firms trying their best to make it happen,” Qian told Cointelegraph in an interview.

“In the end, the key lobbyists would be the institutional asset management companies. It is in their best interest to launch the ETF and to get the ETF approved, because they are in a game of the AUM [assets under management], and to increase their AUM, they need to get approval for the ETFs.”

Companies vying for a spot Ether ETF include BlackRock, Grayscale, Fidelity, ARK 21Shares, Invesco Galaxy, VanEck, Hashdex and Franklin Templeton.

The United States Securities and Exchange Commission has pushed its decision on VanEck’s ETF application to May 23. It also postponed its decision on the Hashdex and ARK 21Shares spot Ether ETFs on March 19. Both ETF applications have a final deadline for a decision in late May.

While the approval of the Ether ETF would be a welcome sign for crypto natives, large issuers have a bigger vested interest due to generating ETF-related fees, according to Qian:

“It’s Wall Street firms who want to make this happen to generate an ETF management fee.”

Grayscale’s Bitcoin ETF is offering the highest fee at 1.5%, followed by BlackRock and Fidelity with 0.25% and 21Shares with 0.21%.

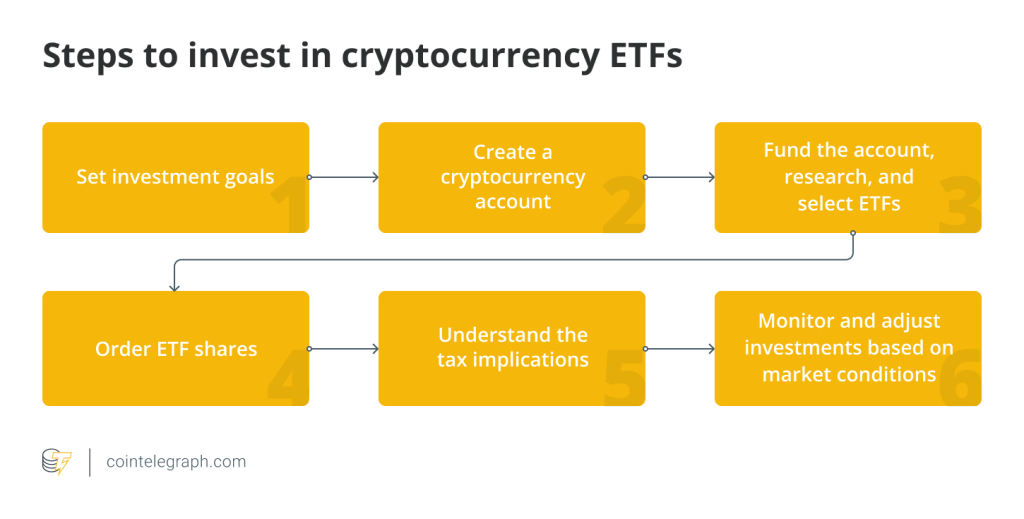

Before the approval of the spot Bitcoin ETFs, several applicants updated their S-1 filings multiple times to lower their ETF fees, in a race to offer the lowest management fees to clients.

Out of the 10 ETF issuers, Bitwise offers the lowest fees, offering ETFs with zero fees for the first six months and $1 billion in assets, followed by a 0.20% fee.

According to Qian, a spot Ether ETF is “highly likely” to be approved this year due to demand by BlackRock, the world’s largest asset manager, with trillions of dollars in capital.

Bloomberg ETF analyst James Seyffart expects the current Ether ETF approvals to be denied in late May, according to a March 19 X post.

Related: Ether ETFs may be delayed, as institutions are unprepared — Web3 exec

Responses