Bitcoin halving meets unprecedented institutional demand

Thanks to the quadrennial halving, the supply of Bitcoin is a constant, reliable and predictable side of the equation. The demand side has now really started to come into play.

If Bitcoin (BTC) is the unstoppable force of continuously reducing new supply to the market, retail and institutional adoption may have become an immovable object driving up demand for the largest cryptocurrency.

With the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States (the largest global equity market) — and the ETFs breaking records since their launch — the demand side (immovable object) may be in play, which could be pushed into overdrive with the upcoming Bitcoin halving.

Some things are certain in life, and some are just on a spectrum of possibilities. All the current speculation in the cryptoverse is around the vast spectrum of potential new highs or the fear of potential new lows.

What narrative is hot in this cycle? What regulations or macro factors will increase or hamper the growth of the blockchain and decentralized finance industry? One thing remains constant through all the possibilities and probabilities, stacking block after block, following the plan silently in the background: Bitcoin.

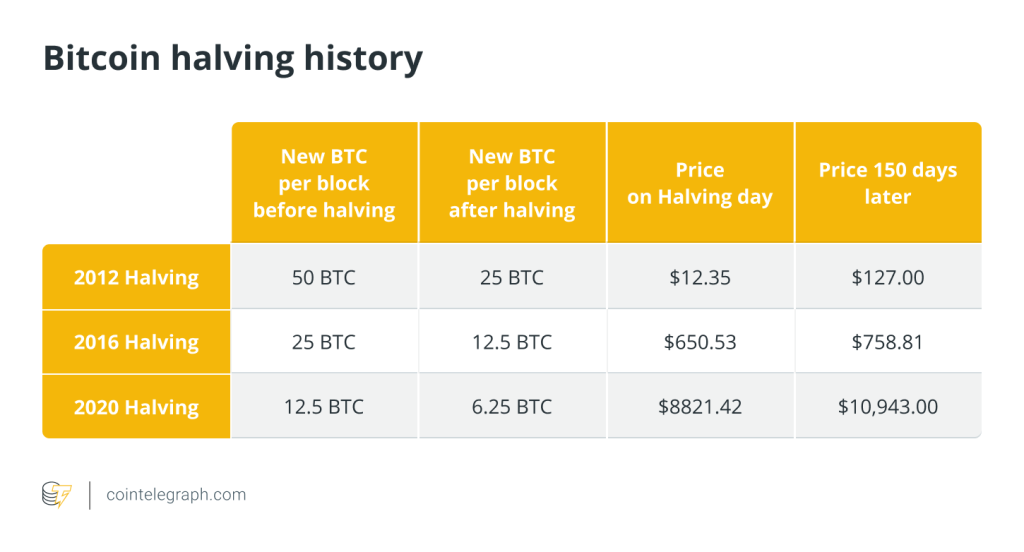

Bitcoin continues to trundle along steadily, with its halving event occurring every 210,000 blocks. With a block added to the blockchain every 10 minutes, a halving happens around every four years. This programmatic event reduces Bitcoin miners’ rewards by half, meaning miners will need to do roughly the same amount of work for half the BTC reward.

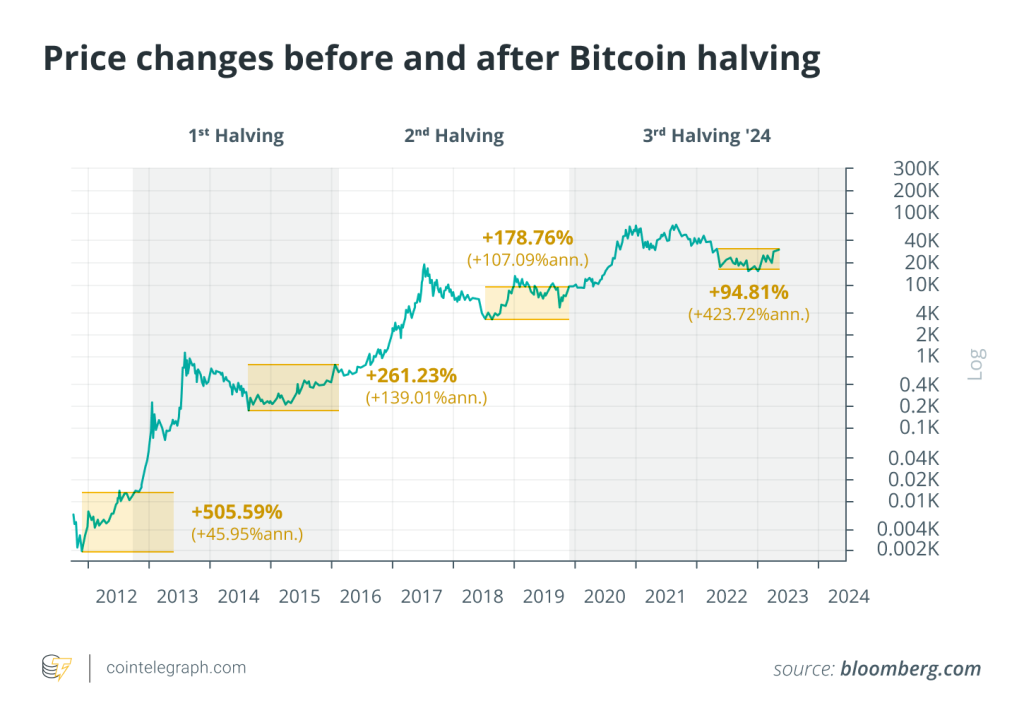

The predictability of the halving can give comfort to those in the cryptoverse who have been through — and hardened by — previous Bitcoin cycles. Newer Bitcoiners have recognized those who have been through previous cycles as “veterans,” as though this is a war where each “survivor” went through tours of duty on the Bitcoin price discovery battlefield.

Is “number go up” programmed into the halving?

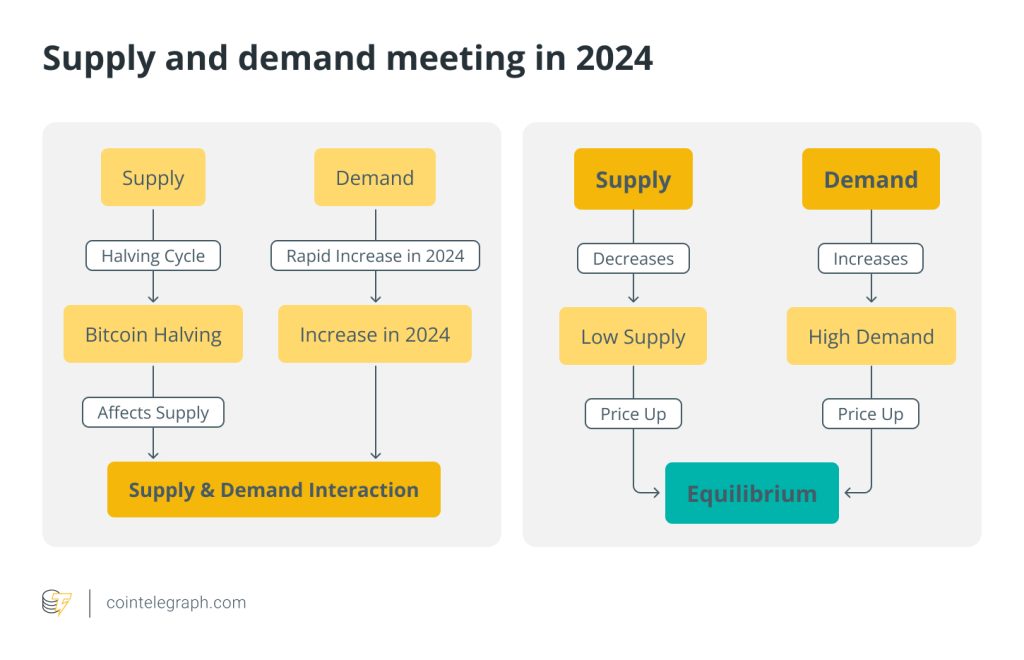

The oldest law in economics is supply and demand. To increase the price of something, decrease supply and increase demand. To decrease the price of something, increase supply and decrease demand.

If we study Bitcoin’s tokenomics, it has a deflationary issuance schedule marked by the halving of new supply every four years. While the halving continues technically like Zeno’s paradox (halving forever and never actually reaching zero), it becomes infinitesimal around the year 2140.

On the supply side of the economic scale, Satoshi Nakamoto took care of the “less supply” portion of the law of supply and demand. Nothing was guaranteed on the demand side, however.

Satoshi was acutely aware of this, having talked about these issues on the Cryptography Mailing List and in the recently released emails with Marti Miami. Satoshi was well aware of economics, including the Austrian School of economic theories of Ludwig von Mises and Murray Rothbard. Satoshi and the early Bitcoiners let the free market decide the fate of the demand portion of the equation.

Recent: How much does it cost to build a crypto mining rig at home?

Since the genesis block on Jan. 3, 2009, the fiat currency price of Bitcoin has continuously seen price discovery and retracement. One of the macroeconomic factors that has helped speculative assets like Bitcoin since the Great Recession of 2008–2009 has been low interest rates across much of the developed world. This access to cheap money encourages more speculation on riskier assets, such as in the emerging technology sector. However, in March 2022, the U.S. Federal Reserve began raising interest rates from 0.25% to 5.5% as of the first quarter of 2024.

Bitcoin’s price action during this time saw positive and negative shocks on the news of rate hikes. In July 2022, Bitcoin’s price shot up when the Fed announced a 75 basis points rate hike; it had some instant upside volatility in November 2022 upon another 75-point rate hike and continued to climb steadily in 2023 as the Federal Reserve hiked rates to 22-year highs.

While it cannot be dismissed that Bitcoin may be susceptible to interest rate changes by the Fed, the trend shows BTC’s declining value in fiat terms during periods of sustained rate hikes by the Fed.

However, interest rates are higher now than at any point in Bitcoin’s existence, and Bitcoin’s price hovers around $63,000 at the time of writing, meaning other factors are trumping the impact of interest rates on BTC’s price. One of the factors resulting from the halving event is the idea that Bitcoin is a hedge against inflation and a store of value.

These narratives are fueled by the deflationary aspect of regular Bitcoin halvings and promoted by investment experts like Greg Foss, executive director of strategic initiatives at Validus Power Corp.

The Bitcoin halving does not necessarily answer the question of demand. The fiat value of Bitcoin should rise if the demand for Bitcoin stays the same and the supply decreases.

So, what would happen if major institutions started buying Bitcoin? Enter the ETFs.

The demand for Bitcoin

While there has always been what is considered retail trading of BTC, recent years have seen increased interest in Bitcoin from traditional financial institutions.

Dan Held, general partner at Asymmetric Financial, wrote of a “Bitcoin Supercycle” that would occur once traditional institutions started buying and adopting Bitcoin. The idea was that volatility in the market would not happen in line with other four-year cycles, and the cost would continuously rise due to the increased demand.

Not everyone feels this way despite the U.S.-based spot Bitcoin ETFs from major traditional and crypto native institutional investors driving up demand for BTC since their launch in January 2024. By some estimates, global crypto adoption just passed over half a billion users, and others predict it could reach the one billion mark by the end of 2024, with the adoption of crypto by the masses — not institutions — being the primary force driving utility and stability.

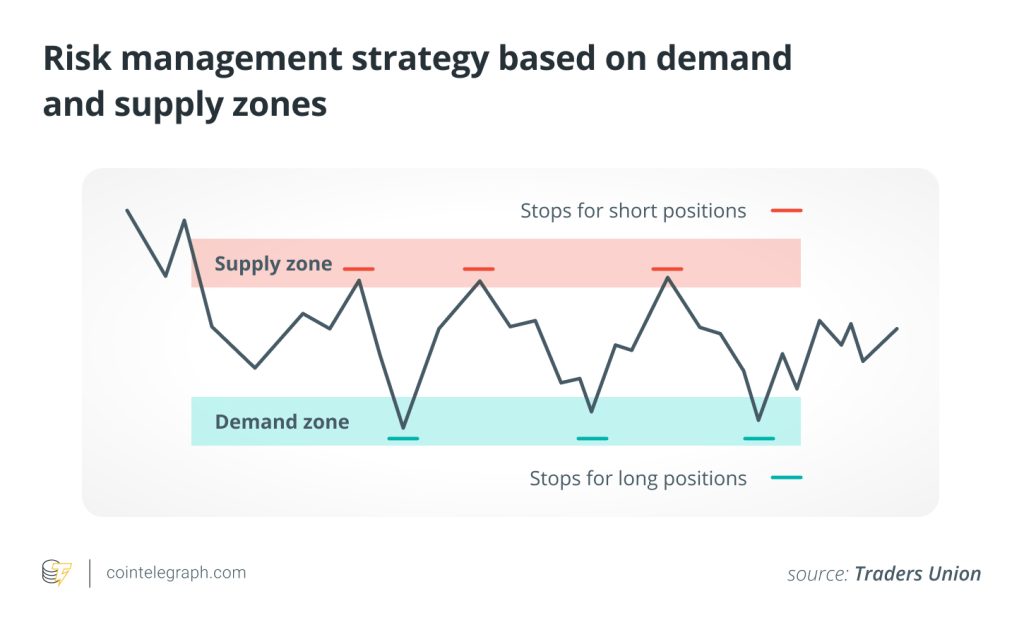

Equilibrium is never settled

In economics, there is a lot of talk about equilibrium. Equilibrium refers to a moment when there are just the right circumstances for an individual to trade one thing for another in a balance between supply and demand. In reality, this equilibrium is in constant motion, as anyone who has followed the price action of Bitcoin can attest to.

Bitcoin’s halving cycle provides a predictable slashing of new supply, making Bitcoin a deflationary asset. The narrative for demand is the variable in the equation — be it the cypherpunk ethos of peer-to-peer electronic cash, Bitcoin as a store of value or Bitcoin as simple “number go up” technology. As long as demand stays the same, Bitcoin’s fiat value equilibrium will likely see pressure to climb as the cycles move forward.

Recent: Moon or doom: Why do so many crypto startups fail?

On March 13, Bitcoin entered uncharted territory and broke all previous cycles by hitting a new all-time high (ATH) of $73,900 before the halving event in April, leaving analysts scratching their heads about what this means for the future price of BTC as the halving draws closer.

However, factoring in inflation since Bitcoin’s previous ATH in November 2021, the ATH is actually around $79,000 today, as measured in fiat terms, and does not factor in the overall purchasing power of the asset.

Speculation surrounds the institutional adoption of Bitcoin and whether this will bring stability to the asset in terms of its purchasing power. As powerful and prominent as the institutions are, without usage and utility by the masses, price discovery will likely continue through this cycle as it has in the past, but that is the demand side. Nothing is certain — except the Bitcoin halving.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses