FOMC meets halving 'danger zone' — 5 things to know in Bitcoin this week

Bitcoin attempts to recover from significant weekend downside with old all-time highs back in place as BTC price resistance.

Bitcoin (BTC) starts a new week in recovery mode after an unusually volatile weekend sparked heavy losses.

BTC price action is struggling to reclaim old all-time highs after days of sustained selling pressure — can bulls turn the tide?

A key macroeconomic week ensures that unpredictable trading conditions will continue as both crypto and risk assets await cues from the United States Federal Reserve. The battle against inflation rages on, and more recent data suggests that inflationary forces are not giving up without a fight.

With BTC/USD acting within a critical zone that must be reclaimed for price discovery to continue, there is everything to play for this week.

Bitcoin is now just one month away from its next block subsidy halving and could be repeating history with a classic pre-halving retracement.

Cointelegraph takes a closer look at these issues and others at hand in the weekly rundown of what could impact BTC price action in the coming days and beyond.

BTC price “defensive” below key resistance

A brutal weekend for bulls hoping for a break soon placed Bitcoin at its lowest levels since March 6.

Bouncing near $64,500, BTC/USD then produced a solid recovery, almost reaching the $69,000 mark before encountering fresh losses at the weekly close.

At the time of writing, the pair circled $68,000, per data from Cointelegraph Markets Pro and TradingView, still unable to crack the area well known as the site of its old all-time highs from 2021.

Analyzing the current setup, [popular trader Skew flagged the 21-period exponential moving average (EMA) on the 4-hour chart as a line to reclaim next. Bitcoin’s relative strength index (RSI) readings on 4-hour timeframes, currently at 48.2, should also return above 50.

“Still need a strong close above 4H 21EMA & RSI above 50 In confluence with reclaim of $69K – $70K,” part of his latest post on X (formerly Twitter) read.

“Those are the crucial confirmations for higher, till then a bit defensive.”

Bitcoin selling pressure was nonetheless unusually intense for a weekend with the absence of institutional trading.

One theory circulating online put the trend down to a single hedge fund’s position unwinding. Here, the entity may have been long BTC while simultaneously shorting the stock of tech firm MicroStrategy (MSTR). When this was liquidated, the fund had no choice but to sell around $1 billion in BTC to cover the losses.

“Also all week shrimp crabs and fish selling,” investor Fred Krueger added in part of an explanation on X, referring to additional offloading by smaller BTC holders.

Despite the setback, Bitcoin nonetheless managed its second-highest weekly close ever. At just below $68,400, the largest cryptocurrency finished the week down a mere $600 versus its previous close.

“New week, with Bitcoin above the highest resistance level on the chart,” popular trader Jelle wrote in an optimistic post.

“Don’t get shaken out.”

Liquidity flush and funding reset

Some of the latest market data captures the extent of the “flush” which occurred across exchanges in the wake of near two-week lows.

Numbers from monitoring resource CoinGlass show days of long liquidations totaling more than $300 million.

On largest global exchange Binance, perpetual swaps now have little liquidity around price, with a wall of bid support only in place at $66,266. Sellers lie in wait above $69,000.

A side effect of the weekend came in the form of a reset in both open interest and funding rates, the latter still overly positive but a fraction of the recent peaks.

“Too much bearish sentiment on my timeline. Bitcoin is trading $5k below its ATH,” James Van Straten, research and data analyst at crypto insights firm CryptoSlate, responded.

“Each flush out is necessary for our next leg higher.”

Van Straten noted that funding rates had not been negative since September last year, and he “highly doubted” that those would return.

“We have been and are in a bullish structure since October, so positive funding continues, with occasional resets when we get too frothy,” he commented.

Classic timing for a “pre-halving retrace”

Bitcoin miners are on course to enjoy its final month of 6.25 BTC block subsidies before April’s halving.

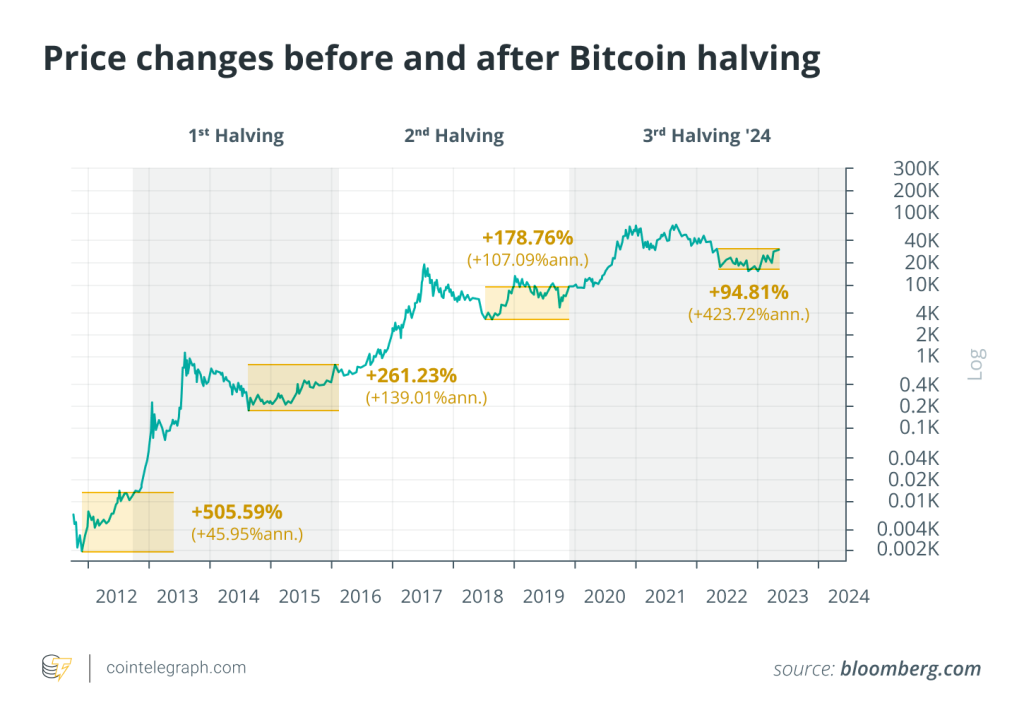

The debate around how the event will impact BTC price behavior continues — a new all-time high, after all, has never preceded a halving but instead came months after it.

As Cointelegraph reported, some thus believe that the current journey to all-time highs could be completed sooner than during other price cycles. Around the halving itself, however, Bitcoin may still stick to the classic playbook — lower, then higher.

In recent content on the topic, popular trader and analyst Rekt Capital spelled out the risks for hodlers going forward.

“In 2 days, Bitcoin will officially enter the ‘Danger Zone’ (orange) where historical Pre-Halving Retraces have begun,” he warned on March 17 alongside an illustrative chart.

“Historically, Bitcoin has performed Pre-Halving Retraces 14-28 days before the Halving.”

In halving years gone by, this “danger zone” produced corrections of up to 40% — far beyond the current maximum drawdown from recent all-time highs of around $73,700.

“Bitcoin is slowly transitioning away from its ‘Pre-Halving Rally’ phase and into its ‘Pre-Halving Retrace’ phase,” Rekt Capital added.

He further noted that despite consistent buying by the U.S. spot Bitcoin exchange-traded funds (ETFs), standard cycle phenomena are still playing out.

Focus on Fed’s Powell after FOMC

A crunch week for risk assets centers around the Fed’s next decision on interest rates and accompanying commentary from Chair Jerome Powell.

The next meeting of the Federal Open Market Committee (FOMC) will conclude on March 20, and forms a classic risk-asset volatility catalyst.

That said, markets are expecting few surprises this time — persistent inflation has removed the chance of a rate cut, and even subsequent FOMC gatherings are not thought to be apt to buck the trend.

The latest estimates from CME Group’s FedWatch Tool put the chances of a cut at the FOMC meeting, for instance, at just 8%.

“It’s official: For the first time this year, markets now only see 3 interest rate cuts in 2024,” trading resource The Kobeissi Letter wrote in analysis of broader FedWatch data.

“This also happens to be the first time that markets align with the latest Fed guidance.”

Powell will make two speaking appearances this week, with the second on March 22. Market observers will closely watch the language used as cues for future policy moves.

“All eyes are on Fed guidance at this week’s Fed meeting. With 2 months of rising CPI inflation, the Fed has to be concerned,” Kobeissi continued.

“Rate cuts are all but certain in 2024 as the battle against inflation continues.”

Bitcoin diamond hands leverage all-time highs

While sentiment remains in the “extreme greed” zone, per market sentiment gauge, the Crypto Fear & Greed Index, some hodlers are voting with their wallets.

Related: How low can BTC price go? Bitcoin analysis points to $45K

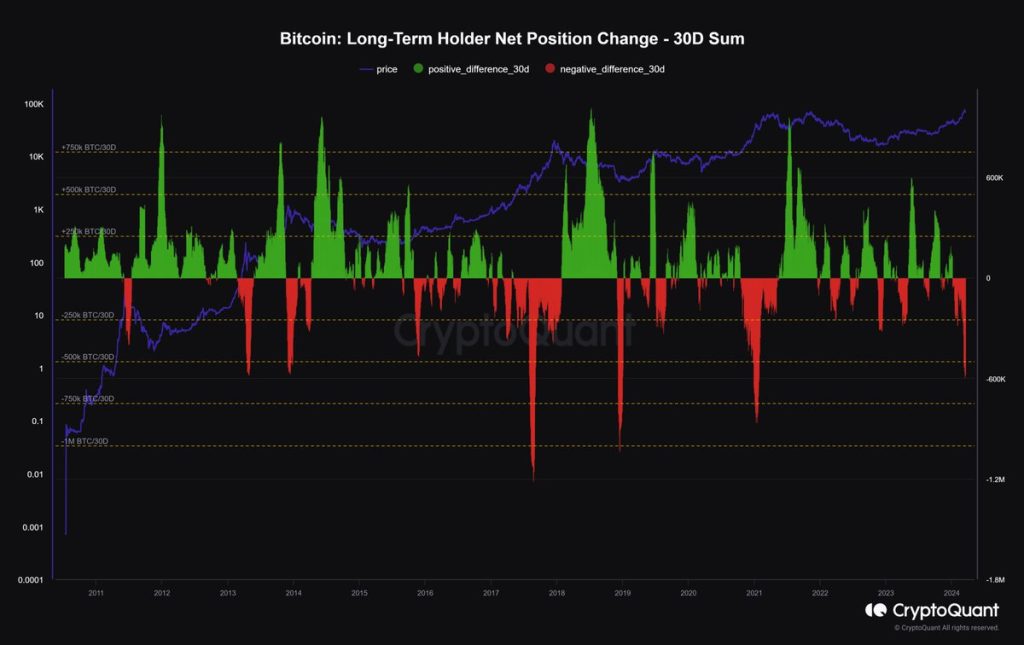

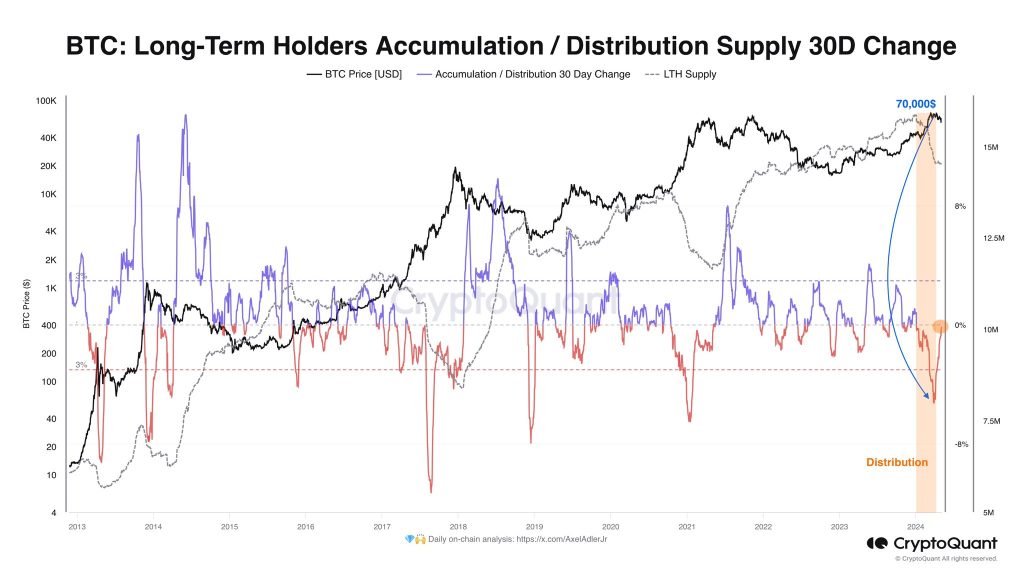

Profit-taking on long-held coins has spiked significantly, the latest data from on-chain analytics platform CryptoQuant confirms.

Long-term holders (LTHs) — entities hodling coins for at least 155 days — have distributed nearly 600,000 BTC, or around $40B, over the past month.

Discussing the phenomenon on X, CryptoQuant contributors attributed a portion of the selling to the Grayscale Bitcoin Trust (GBTC).

As Cointelegraph reported, Bitcoin miners have also stepped up selling this year.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses