Hut 8 stock crash attracts multiple lawsuits

While some lawsuits cater to individuals who suffered losses, others claim that all shareholders who purchased stocks during the timeframe are entitled to compensation.

A number of law firms have offered to represent Hut 8 investors who recently incurred losses on the Nasdaq amid short-selling accusations.

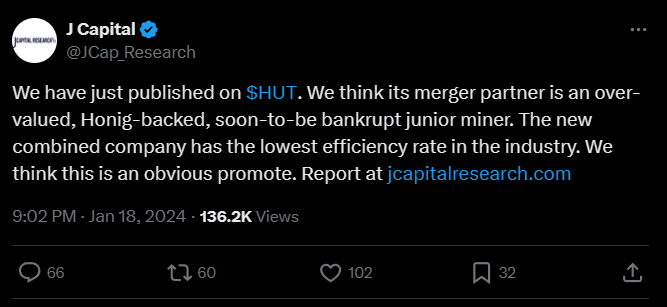

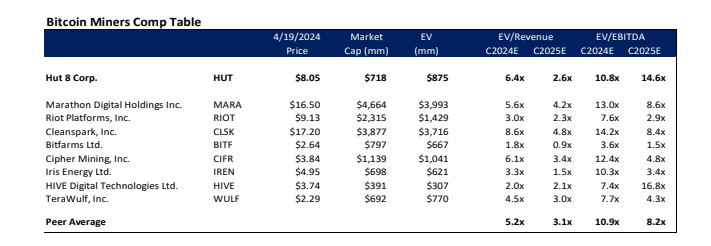

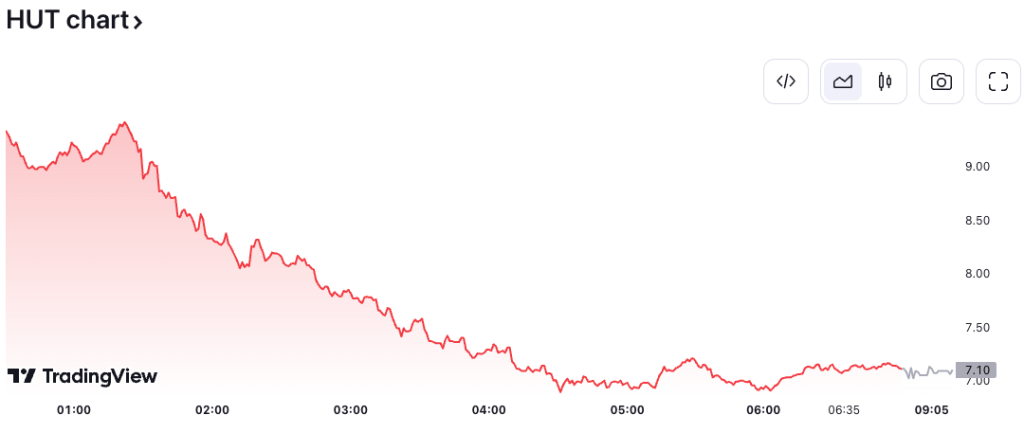

On Jan. 19, the share prices of Bitcoin (BTC) mining firm Hut 8 tanked 23% — from $7.12 to $2.16 — after the release of an unverified J Capital report alleging insiders were preparing to dump Hut 8 stock. Hut 8 reviewed the report and, on Jan. 24, dismissed all allegations of short-selling. The company stated:

“The report appears to represent a deliberate attempt to spread misinformation about Hut 8, its operations, finances, management practices, and key executives. The statements made by the short seller expose an inadequate, distorted understanding of the Company, its operations, and its key executives.”

The J Capital report accuses Hut 8’s partner, USBTC, of a history of legal trouble in a $725 million merger deal. Jaime Leverton resigned as the CEO of Hut 8, and was later replaced by Asher Genoot, the president and a member of the company’s board of directors.

Investors who purchased Hut 8 stocks between Nov. 9, 2023, and Jan. 18, 2024, are urged by all supporting law firms to join their efforts in claiming a settlement for the losses incurred during the time frame. Hut 8 shareholders who incurred losses during the time frame and wish to serve as a lead plaintiff are asked to reach out to the law firm of their choice by April 8, 2024.

According to one of the law firms, Kuznicki Law, Hut 8 and its executives violated federal securities laws by misstating certain finances, eventually negatively impacting the share price.

While some lawsuits cater to individuals who suffered losses, others claim that all shareholders who purchased stocks during the time frame are entitled to compensation. Moreover, a contingency fee arrangement will ensure that participating shareholders are not liable for court fees.

Related: Hut 8 begins construction on 63MW crypto mining site in Texas

On March 6, Hut 8 announced the closure of its mining site in Drumheller, Alberta, Canada, citing power disruptions and surging energy costs.

“Following a comprehensive analysis, we have determined that the profitability of Drumheller has been impacted significantly by various factors, including elevated energy costs and underlying voltage issues,” the newly appointed CEO Genoot said in a statement.

Responses