Bitcoin halving will spur ‘surge’ in NFT volume

Mintable founder Zach Burks said that if the halving boosts user engagement, there would be an uptrend in NFT prices.

As the much-anticipated Bitcoin halving looms closer, professionals working in the nonfungible token (NFT) space anticipate that the crypto milestone will not only affect crypto tokens but may also positively impact the NFT ecosystem.

Oscar Franklin Tan, the chief financial officer of Atlas Development, a core contributor to the NFT platform Enjin, believes that NFT prices will “surge after the halving.” The executive argued that this is part of a known cycle where interest in Bitcoin (BTC) spills over other ecosystems like NFTs. Tan said:

“Prices and volumes should eventually surge after the halving as part of the known cycle. Because NFTs are established segments of ecosystems, interest from Bitcoin will spill over into NFTs together with altcoins.”

Tan told Cointelegraph that this is especially true for NFTs integrated within altcoin ecosystems, which are different from profile picture (PFP) projects. The executive explained that these NFTs receive token airdrops or digital collectibles used in token-gated networks.

Zach Burks, the founder of NFT marketplace Mintable, said that while accurately predicting the future growth or adoption of technology is almost impossible, the community can expect an increase in trading volume for NFTs as Bitcoin’s price rises. “If the halving also boosts user engagement, it is reasonable to expect an uptrend in NFT prices.”

Bitcoin Ordinals to be ‘directly impacted’

Burks also shared his belief that Bitcoin Ordinals “will be directly impacted” by upward BTC price movements. Burks believes that there are Bitcoin holders who haven’t been able to use their BTC for any significant participation in the Bitcoin ecosystem for years.

“This means there are a lot of people who have disposable income in Bitcoin to spend or use that haven’t had anything to use it on until now. This multiplies as the price increases, once we break $70,000, every user who has ever bought Bitcoin will be in the green, and this means there is more money to play with.”

Tan echoed the sentiment and described Bitcoin Ordinals as an “obvious beneficiary” of the Bitcoin exchange-traded fund (ETF) narrative. “If the ETF establishes Bitcoin as digital gold, then Ordinals are established as digital gold carvings immutable on the mother chain.”

Meanwhile, BNB Chain senior solution architect Jimmy Zhao explained that the halving could highlight how Ordinals can help miners generate revenue after BTC rewards dwindle. With Ordinals generating over $200 million in transaction fees for miners, Zhao said that the Ordinals are likely to get a boost as the upcoming halving will influence fees and miner revenue.

Related: NFTs eye comeback following spot Bitcoin ETF approval

NFT adoption amid the Bitcoin halving

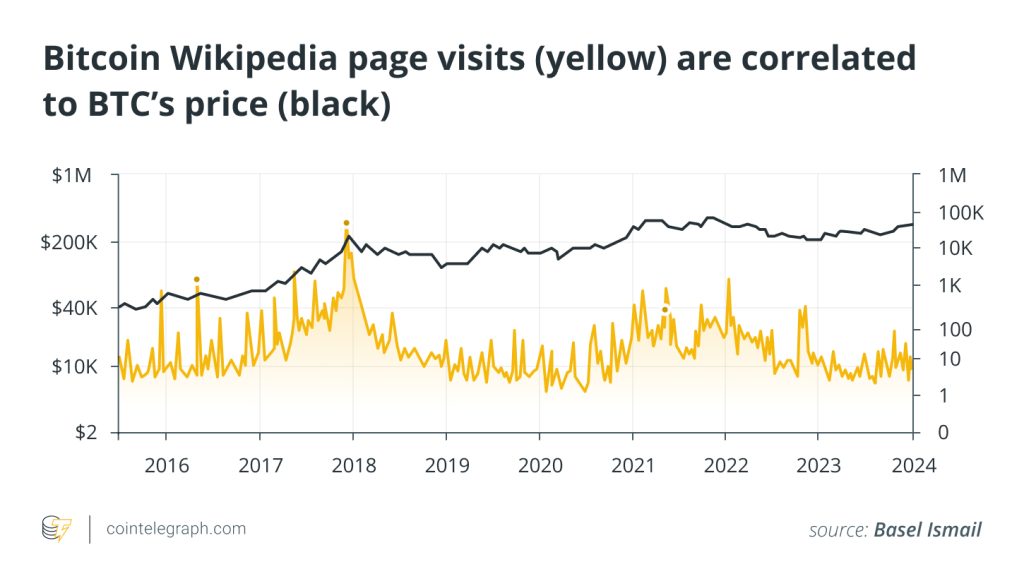

Zhao also believes that the halving could have an impact on NFT adoption on a broader scale. The executive said that the halving could trigger a domino effect when it gets recognized in the mainstream media because of the halving. Zhao believes that with this, more people will be exposed to NFT utility and understand its use cases.

Burks expressed similar beliefs. The Mintable founder said that the halving may act as “free marketing” for the broader crypto sector and attract new individuals. He explained:

“As these newcomers integrate into the crypto ecosystem, we will likely see them expand beyond merely purchasing BTC on exchanges. Instead, they’ll start engaging with the wider crypto and Web3 ecosystem, including NFTs, DeFi, and other applications beyond trading.”

Meanwhile, Tan believes the halving will impact NFT adoption as new NFTs or marketplaces focusing on digital collectibles may emerge. With Bitcoin being “increasingly intertwined” with NFTs, the adoption of NFTs would also closely follow when Bitcoin stands in the limelight.

Responses