BTC price corrects 7% after Bitcoin sets first-ever pre-halving all-time high

Bitcoin is making history — but this is not stopping a post-high BTC price comedown.

Bitcoin (BTC) fell $5,000 on March 5 after a unique BTC price all-time high sparked mass volatility.

Bitcoin sellers put brakes on price discovery

Data from Cointelegraph Markets Pro and TradingView tracked snap losses for BTC/USD as the pair shed 6.7% in just over an hour.

The reaction followed new all-time highs for Bitcoin, with bulls waiting since November 2021 for BTC price discovery.

With volatility still rampant at the time of writing, market observers sought to take a balanced perspective on current market performance.

“It’s perfectly normal for Bitcoin to pull back from the all time high (this happens every cycle),” crypto author and educator Vijay Boyapati argued on X.

“Large sellers use the anticipation of the moment to dump into a high liquidity moment. Importantly the psychological wall is broken and true price discovery will eventually begin.”

The latest data from monitoring resource CoinGlass estimates that liquidations totaled nearly $150 million during the correction from the new highs of $69,210 on Bitstamp.

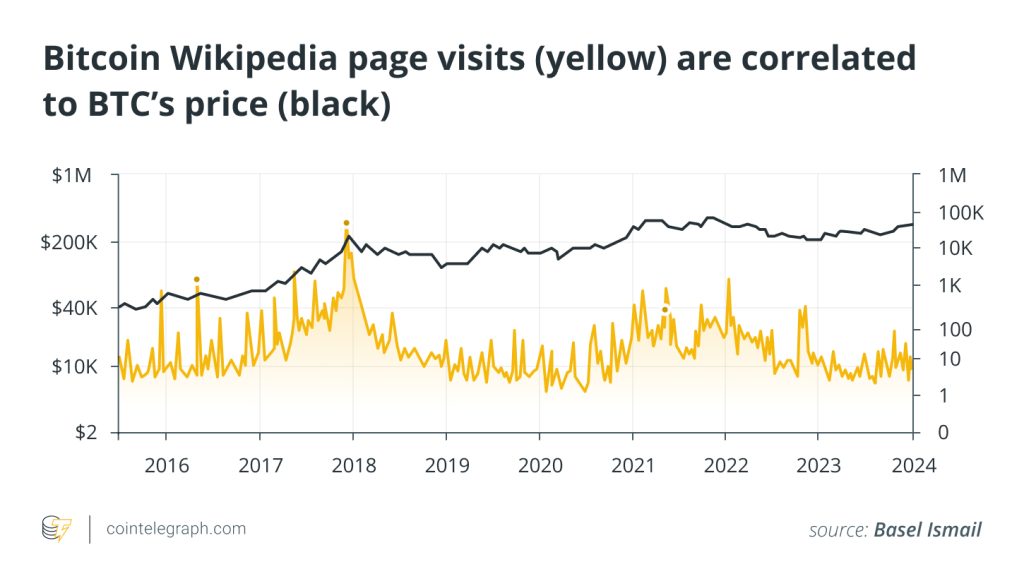

As Bitcoin returned to the mainstream spotlight, longtime hodlers were celebrating the highs for a different reason.

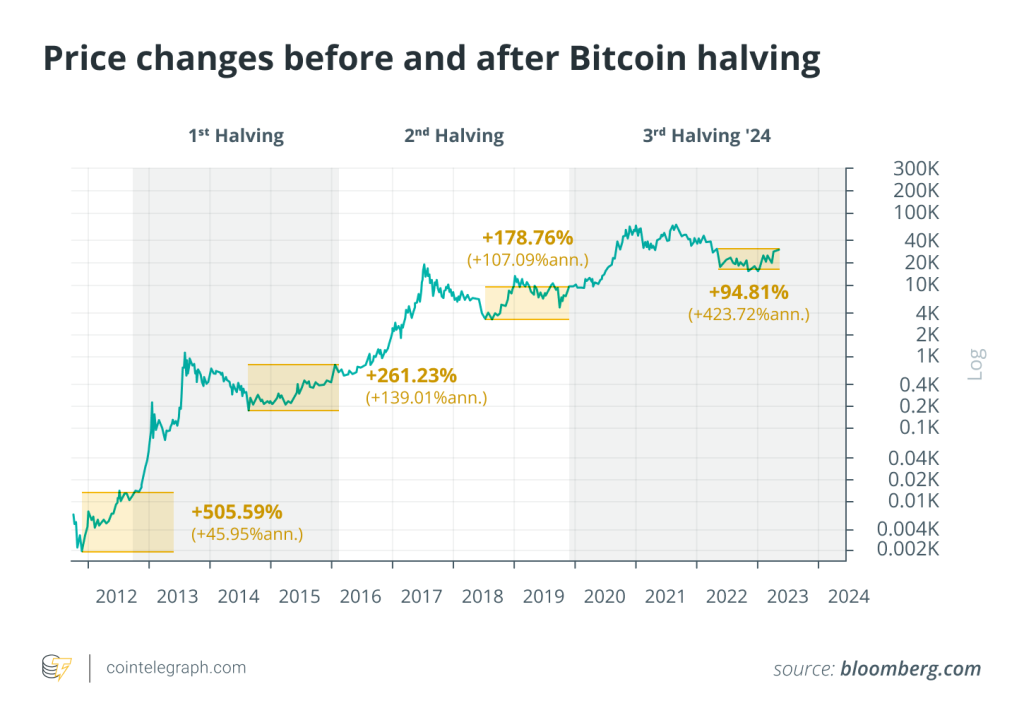

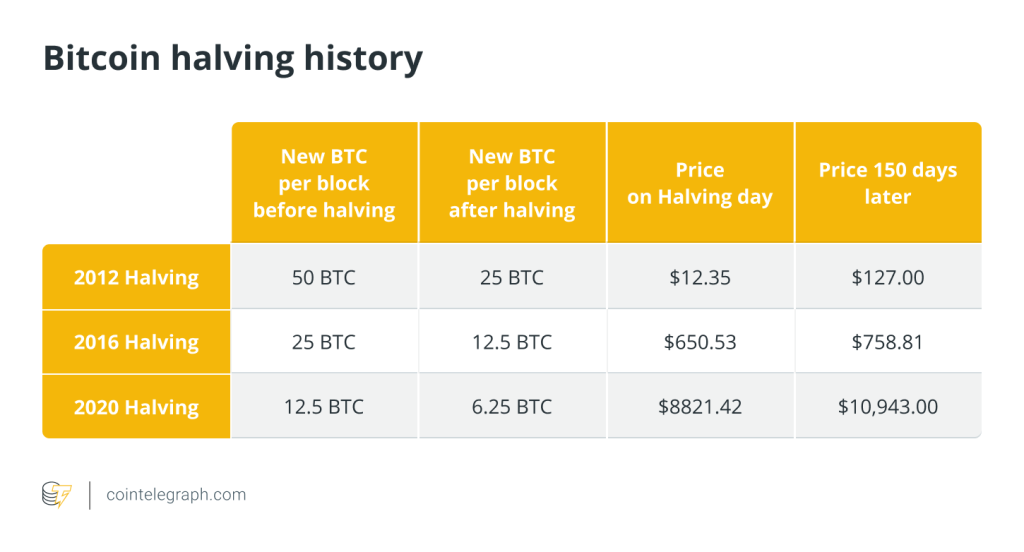

As many noted, 2024 marks the first time that BTC/USD has hit new record levels before a block subsidy halving event.

Boyapati called the achievement “unprecedented.”

“Bitcoin has passed $0.069M before the halving,” Samson Mow, CEO of Bitcoin adoption startup Jan3, continued.

“All your cycles are destroyed.”

BTC price action enters “new era”

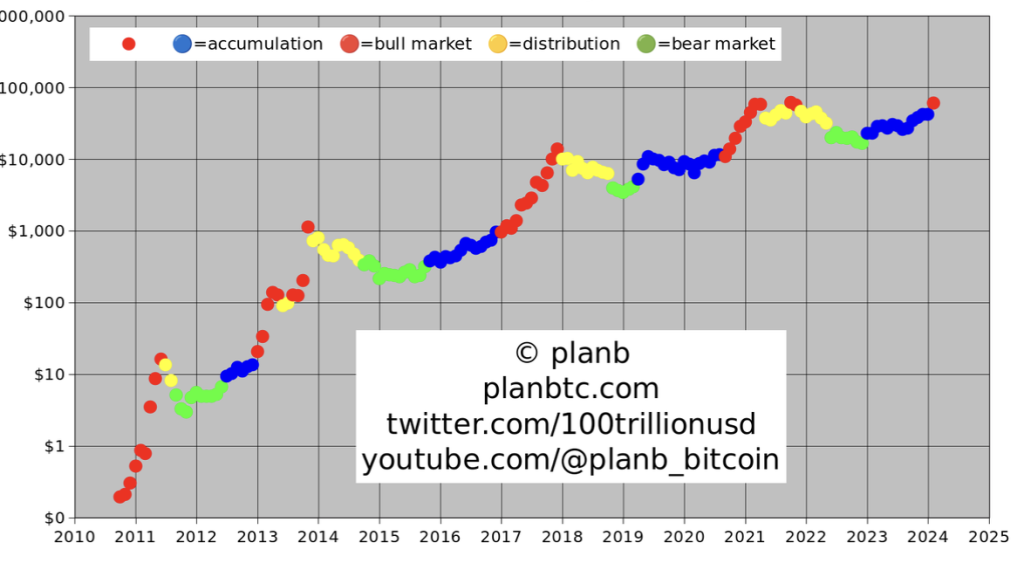

In his latest YouTube update, meanwhile, popular trader and analyst Rekt Capital considered whether the current price cycle had “accelerated” thanks to the pre-halving move.

Related: Why are BTC traders bearish above $64K? 5 things to know in Bitcoin this week

In previous cycles, he noted, BTC/USD took around 500 days to hit new all-time highs after a halving, meaning that this time around, progress might be “ahead of schedule.”

“Something to consider as we enter a new era for Bitcoin’s price action — we’ve never really seen price action like this before,” he acknowledged, listing various unique aspects of the market this year.

How Bitcoin goes forward to treat the all-time high region, he said, was key.

Fellow trader Mikybull Crypto added that in 2020, BTC/USD tracked sideways below new all-time highs for two weeks before finally seeing upside continuation.

“Bitcoin on a critical decision point right now. In 2020, it wicked through to break an all-time high and retraced back into the box for two weeks before closing above the previous ATH,” he wrote on X alongside an illustrative chart.

“Will this time be different due to ETFs inflows?”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses