Crypto derivatives’ daily trading volumes reach record highs

Deribit and Coinbase Institutional reported record highs for crypto derivatives activity and trading volumes this week.

Daily trading volumes for crypto derivatives such as options and futures have surged this week hitting record highs on a number of exchanges.

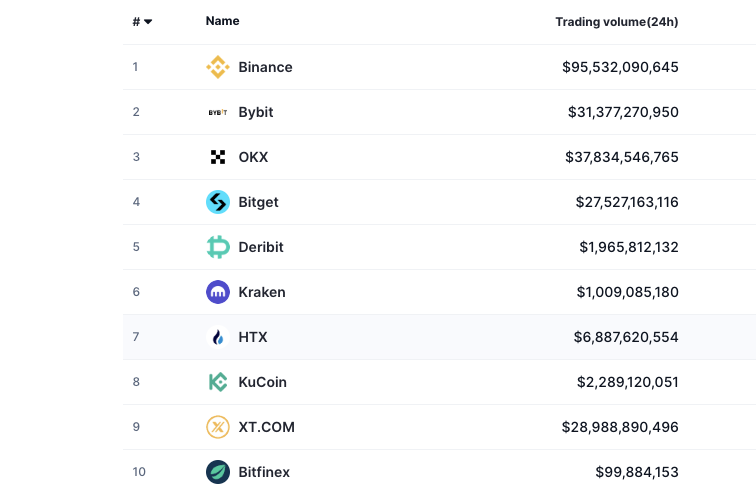

The crypto derivatives exchange Deribit said in a Feb. 29 X post that its 24-hour trading volume hit an all-time high of $12.4 billion on the day.

It added open interest, the number of derivatives contracts that have yet to be closed or settled on the platform, had passed $29 billion, another all-time high. Deribit’s third record was its client assets which reached $4 billion, it said.

On March 1, Coinbase Institutional said its United States-regulated futures exchange had its second-best-ever day of $380 million notional volume traded in Bitcoin (BTC) and Ether (ETH) contracts across a record 850 unique end-users on Feb. 29.

The Greeks Live professional options trader’s tooling platform also reported a historic 24-hour high options trading volume of $620 million.

On March 1, Greeks Live noted that U.S. spot Bitcoin exchange-traded funds (ETFs) were driving the spot bull market, which saw record volumes this week as Bitcoin’s price hit as high as $64,000.

However, options volume positions are rising modestly, it said. It added that “solid inflows are making for a very healthy market structure.”

Related: Bitcoin rallies to 2-year high, but derivatives traders not betting on further gains

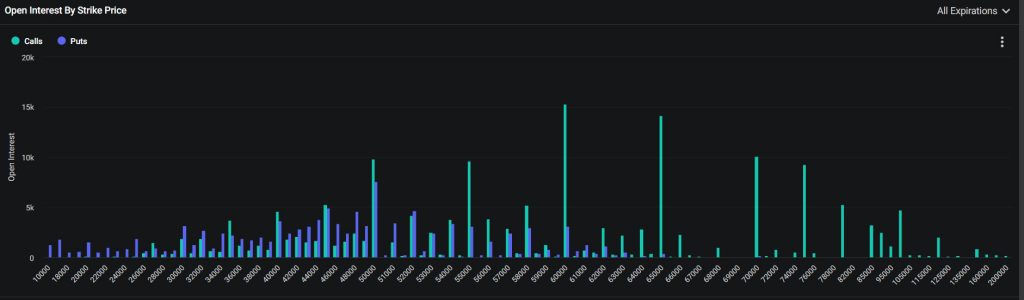

Every week on Friday is crypto options expiry day and Deribit reported there are around 32,000 BTC options with a notional value of $1.9 billion set to expire on March 1.

In addition, around 235,000 ETH options contracts are also expiring with a notional value of $793 million.

Spot Bitcoin ETFs also had a solid week with several record trading volume days of over $2 billion.

However, a near $600 million outflow from Grayscale’s ETF on Feb. 29 saw the net inflow for all ten ETFs drop to $93.8 million — the lowest level since Feb. 6, according to preliminary data from Farside Investors.

Net inflows to BlackRock’s Bitcoin fund on Feb. 29 hit $604 million, exceeding Grayscale’s net outflows and netting more inflows for the day than all the other ETFs combined.

Big Questions: How can Bitcoin payments stage a comeback?

Responses