Bitcoin miner reserves held steady in February, despite $40B flows to exchanges

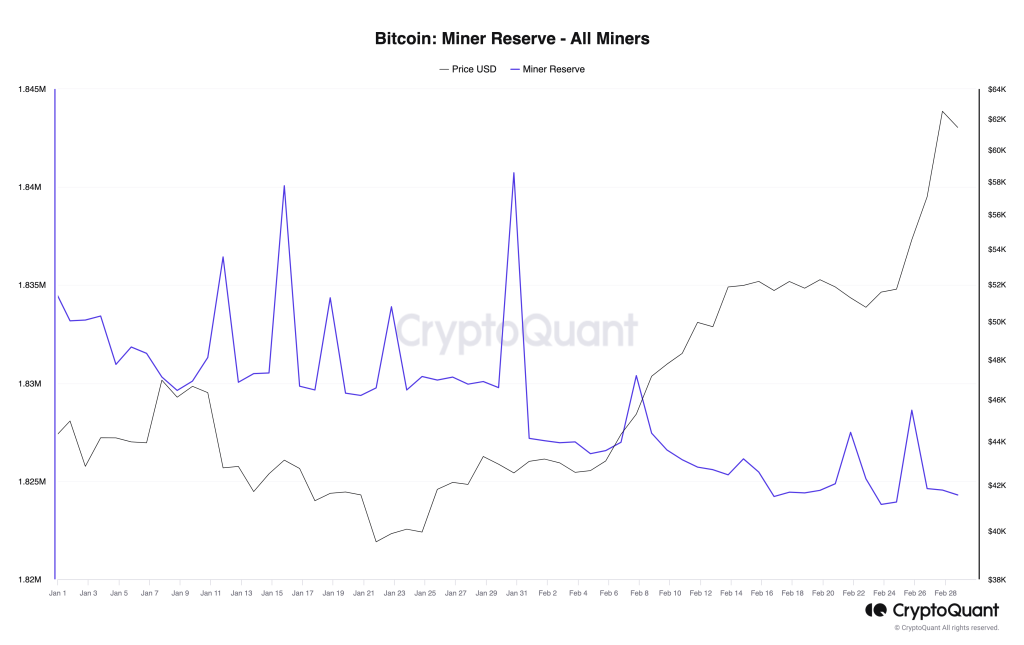

Bitcoin miners’ holdings remained stable in February at around 1.82 million BTC despite miners’ sales ahead of the halving.

Bitcoin miners’ reserves remained stable in February, despite $40 billion in flows from mining pools to crypto exchanges, according to data from CryptoQuant.

On Feb. 28, miners’ wallet reserves had 1.828 million in Bitcoin (BTC) holdings, a marginal difference from Feb. 1, when their reserves stood at 1.827 million.

Despite maintaining holding levels, recent fluctuations in BTC price triggered significant sales from miners over the week, with at least 40,000 BTC sold on Feb. 26 as the cryptocurrency’s price broke above $52,000, revealed CryptoQuant.

According to data from Cointelegraph Markets, Bitcoin’s price has increased by 22% in the past seven days, supported by inflows from exchange-traded funds (ETFs) and market anticipation of the next halving.

The majority of miners’ sales ahead of the halving happened in January, with total reserves ranging from 1.840 million BTC at the peak to 1.827 million BTC at the end of the month.

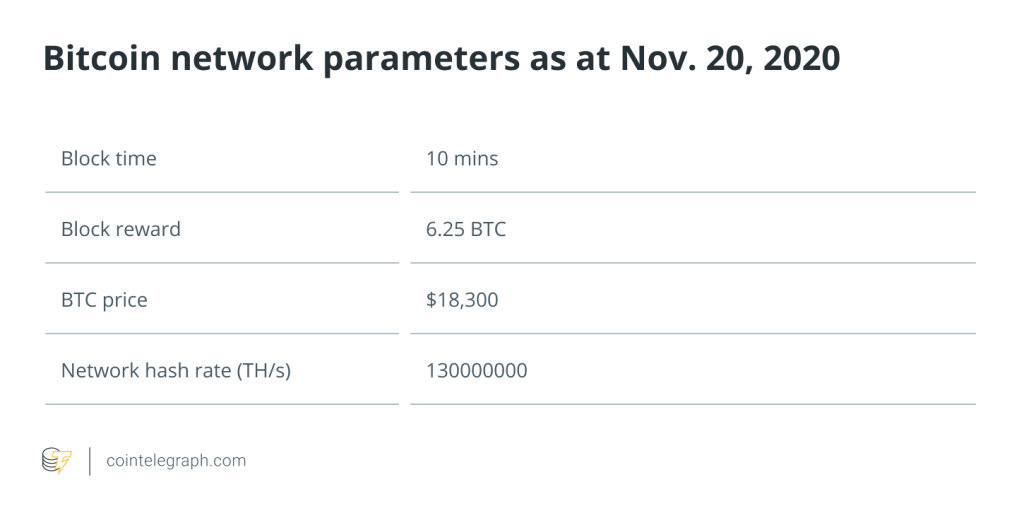

Historically, miners sell more of their BTC reserves ahead of the halving to maximize profits before the block reward decreases. The halving is part of Bitcoin’s deflationary mechanism and cuts the rate at which new BTC is generated, reducing the block reward miners receive for verifying transactions.

The event takes place every four years, with the next Bitcoin halving expected to occur around April 19, 2024, reducing block rewards from 6.25 BTC to 3.125 BTC. Mining costs, however, remain the same or may even increase as miners expand operations to remain profitable.

Miners brace for rewards slash

Crypto miners are revamping strategies and trying to capitalize ahead of April. CleanSpark, for instance, recently announced plans for an in-house trading desk, meaning it will manage and trade its large Bitcoin holdings without relying on external brokers. The approach could reduce the costs associated with trading.

CleanSpark is one of the best-positioned companies to handle the cut in revenue, according to an analysis from asset manager CoinShares. Riot and TeraWulf should also be ready to cope with the halving:

“We think Riot, TeraWulf and Cleanspark are best positioned going into the halving. One of the main problems miners have is large SG&A [selling, general, and administrative expenses] costs. For miners to break even, the halving will likely force them to cut SG&A costs, otherwise they could continue to run at an operating loss and having to resort to liquidating their HODL balances and other current assets.”

CoinShares anticipates the average cost of production post-halving for crypto miners to be at $37,856.

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in

Responses