Bitcoin breaches $60K for the first time in over 2 years

The last time Bitcoin traded above $60,000 was in November 2021, shortly after it reached its all-time high. Is a “pre-halving retracement” imminent?

Bitcoin breached $60,000 for the first time in over two years after rising over 6% in the 24 hours leading up to 1:00 pm UTC, touching $60,001 on Binance at 1:11 pm.

The world’s first cryptocurrency is up over 13% on the weekly chart and 37% during the past month, according to CoinMarketCap data. The last time Bitcoin (BTC) traded above $60,000 was on Nov. 12, 2021, when Bitcoin started its reversal, falling over 67% to the macro low of $19,297 at the beginning of April 2022.

Bitcoin’s price performance can largely be attributed to the market anticipation surrounding the upcoming halving event, which historically leads to increased buying activity, according to Bryan Legend, investor and CEO of Hectic Labs. He told Cointelegraph:

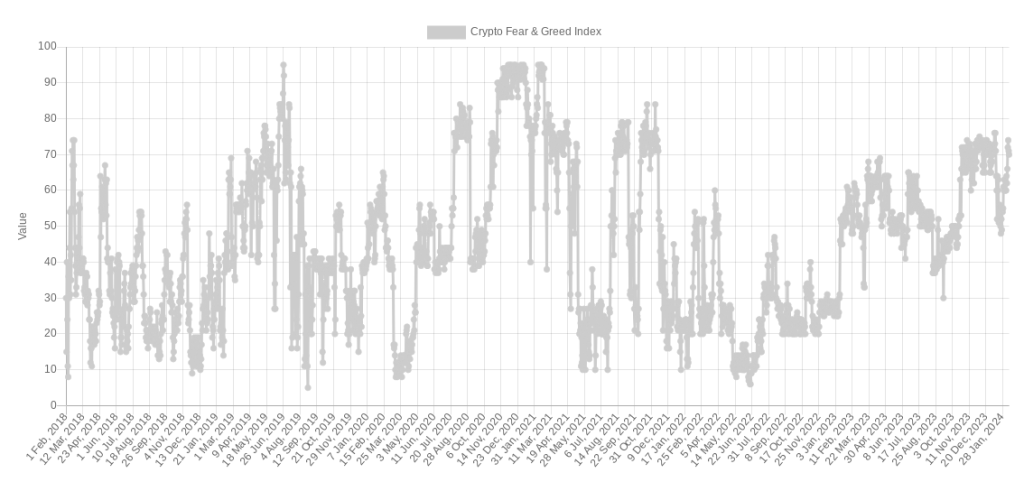

“Investors expect a reduction in supply to drive up prices. This is better known as the ‘Pre-Halving rally’ which contributes to a new bull market with a refreshed bullish sentiment. This is exactly what we are seeing today.”

Yet, according to pseudonymous crypto analyst Rekt Capital, a “pre-halving retracement” could still be on the table. The pseudonymous analyst added that the upcoming Bitcoin halving isn’t priced in by the market, based on historical market data that saw Bitcoin’s major movements occur after previous halvings, not before, Rekt Capital shared in a Feb. 28 X post.

Here’s Why the Bitcoin Halving Is NOT Priced In

If you enjoyed this 1-minute summary on #BTC

Checkout the full video here:https://t.co/jxduExhrTu

Enjoy and Subscribe!$BTC #Crypto #Bitcoin pic.twitter.com/UrWxbMA7iK

— Rekt Capital (@rektcapital) February 27, 2024

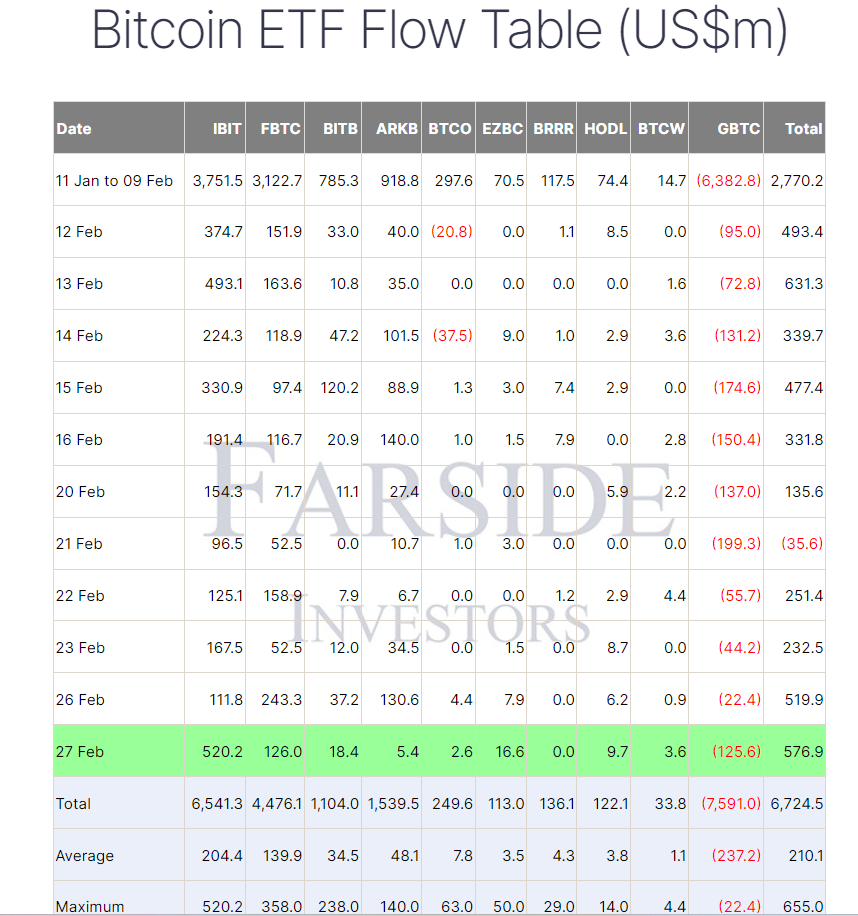

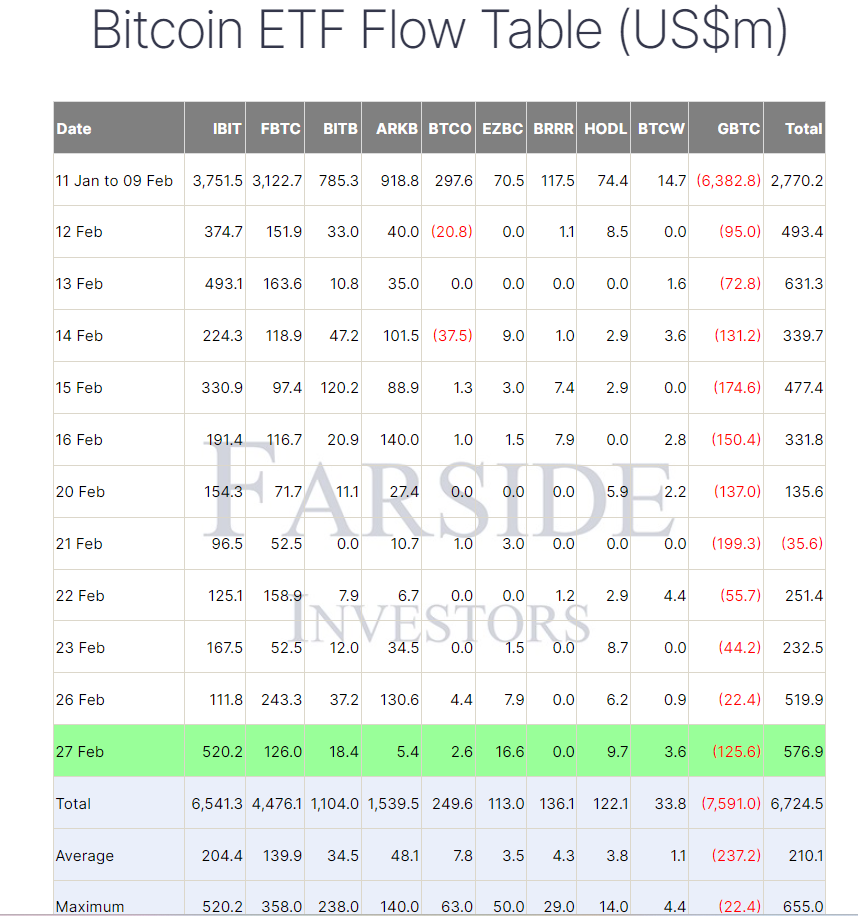

Bitcoin’s bullish momentum comes two days after the spot Bitcoin exchange-traded funds (ETFs) in the United States broke an all-time high of $2.4 billion in daily trading volume on Feb. 26, according to Eric Balchunas, senior ETF analyst at Bloomberg.

The new nine spot Bitcoin ETFs have recorded combined trading volumes of over $2 billion for the second consecutive day on Feb. 28.

BlackRock’s iShares Bitcoin Trust ETF recorded over 100,000 individual trades on Feb. 27, up from around 30,000 to 60,000 average daily trades, according to an X post by Balchunas.

Another intense volume day for the Nine with well over $2b traded. $IBIT broke its personal record again w/ $1.3b (for context that’s more than most large cap US stocks trade). I don’t know if this is a new normal or some kind of short-term algo/arb-related burst a la $HODL. pic.twitter.com/KkCkdQKe9r

— Eric Balchunas (@EricBalchunas) February 27, 2024

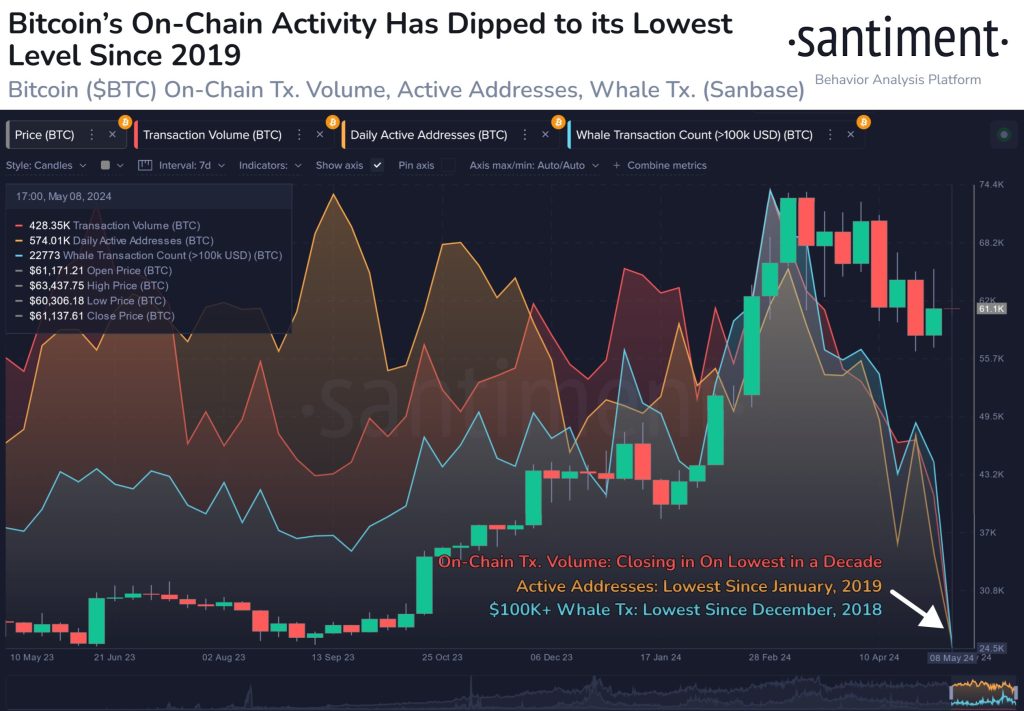

An estimated 75% of new Bitcoin investments came from the spot Bitcoin ETFs in the United States, according to a Feb. 14 report by on-chain data analytics firm CryptoQuant.

Related: MicroStrategy adds 3K BTC as Bitcoin ETFs are poised to surpass gold ETFs

Responses