Weekend Bitcoin trading drops due to TradFi institutions and spot ETFs

The share of weekend Bitcoin trading volume has been in decline since 2018 but has dropped considerably since the U.S. launch of spot Bitcoin ETFs in early January.

Bitcoin (BTC) trading volume on Saturdays and Sundays has continued to fall this year as institutional participation in Bitcoin increased, leading to poor weekend market liquidity, says crypto research firm Kaiko.

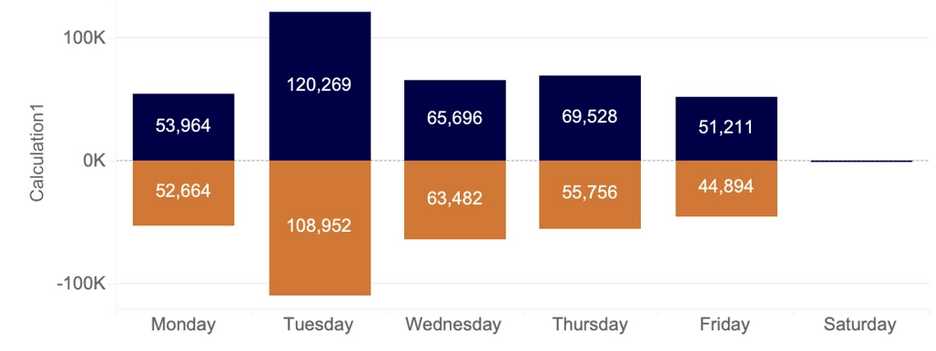

Between 2018 and 2021, around a quarter of Bitcoin trading volume took place on the weekend, which has since seen a steady decline and so far in 2024 has fallen to 13% , Kaiko noted on Feb. 26.

“The decline suggests worsening liquidity conditions during weekends and could be explained by both increased institutional participation and worsening market infrastructure,” it wrote.

Kaiko said managing liquidity on weekends has been a longstanding challenge for exchanges as the 24/7 crypto trading area creates a “mismatch between the operating hours of traditional financial institutions and the needs of large crypto traders and market makers.”

This was evidenced firsthand when several crypto-friendly banks in the United States closed down, Kaiko noted.

Kaiko observed that the fall in weekend trading occurred in both the United States and offshore exchanges.

However, weekend trading remained slightly higher on offshore exchanges such as Binance, HTX, OKX, Bybit and Upbit. Offshore exchange weekend trades had 15% of the volume compared to 11% for U.S. exchanges like Coinbase, Kraken and Bitstamp.

Kaiko said it observed “poorer liquidity conditions” on the U.S.-based Coinbase over weekends as compared to Binance.

Related: Australia’s Bitcoin sentiment jumps after US spot Bitcoin ETF approvals

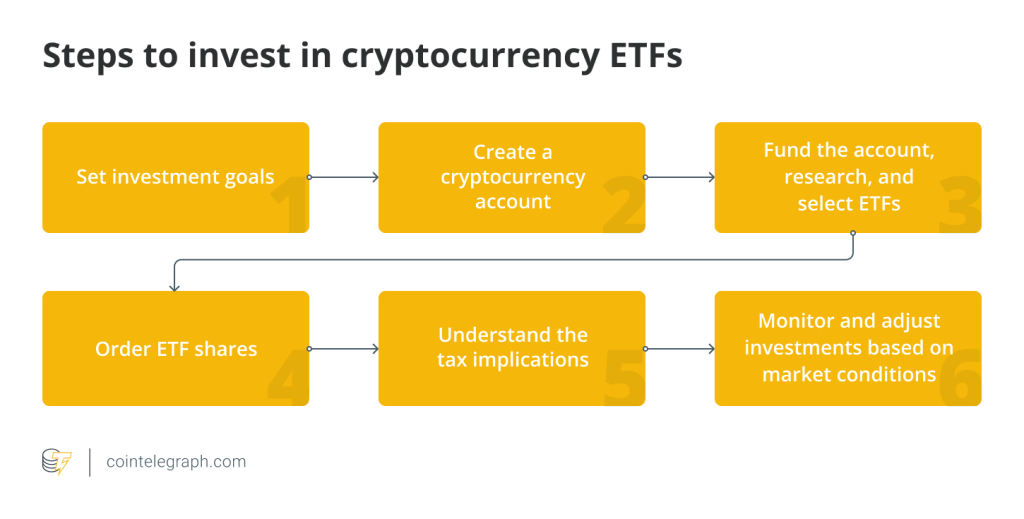

The research firm noted that Bitcoin liquidity has rebounded strongly since spot Bitcoin exchange-traded funds (ETFs) were launched in the U.S.

However, few transfers have been made between the spot Bitcoin ETF issuers and exchanges over the weekends, Kaiko sai.

It concluded this gap may increase as ETF issuers continue increasing their Bitcoin holdings.

Responses